Market By Type, Application, End-users, And Geography | Forecasts 2019-2027

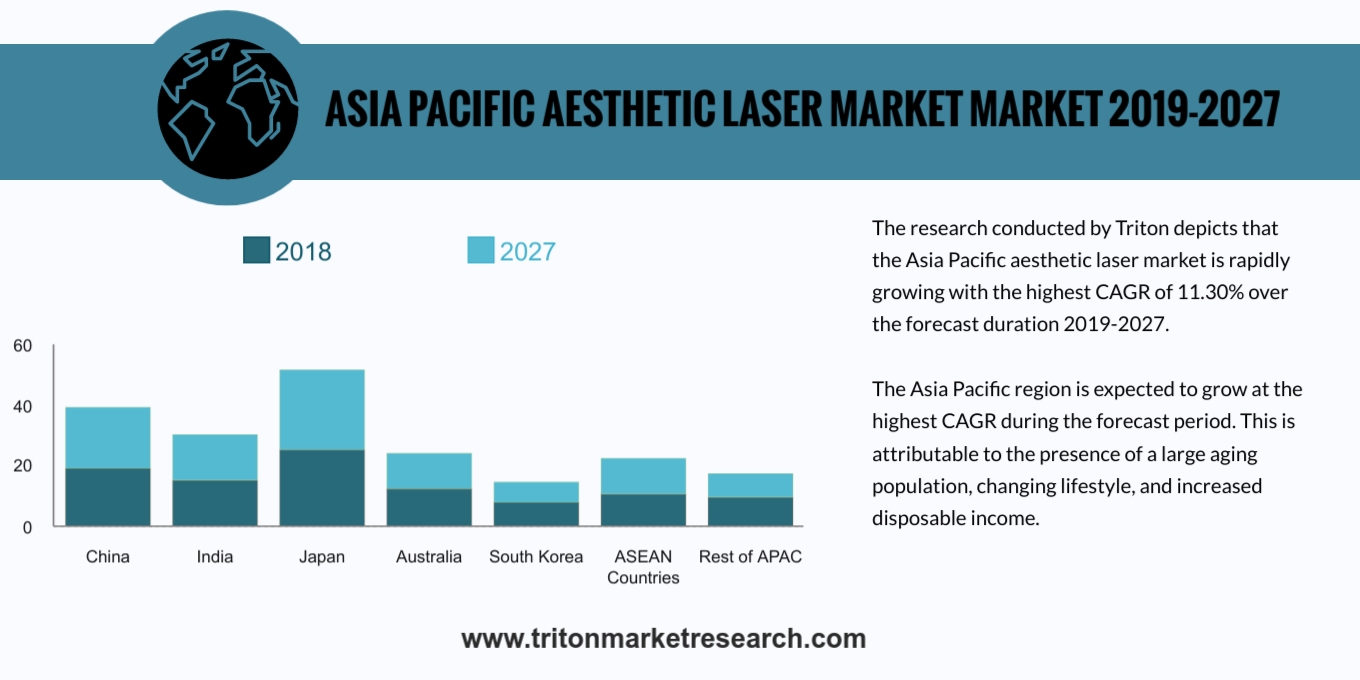

The research conducted by Triton depicts that the Asia Pacific aesthetic laser market is rapidly growing with the highest CAGR of 11.79% over the forecast duration 2019-2027.

The studied economies for the Asia Pacific aesthetic laser market include:

• China

• India

• Japan

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of Asia Pacific

We provide additional customization based on your specific requirements. Request For Customization

The aesthetic laser treatment came into existence during the 1960s but captured attention in the 1990s after rigorous experimentation on living tissues by researchers and dermatologists. The aesthetic laser is used in multiple treatment conditions such as wrinkles, scars, moles, excess fat, and skin laxity, etc. Aesthetics medicine contains plastic surgery, reconstructive surgery, and dermatology, which includes both non-surgical and surgical procedures. Nowadays, aesthetic laser technology has improved and is clinically proven to be effective and also decreases the recovery time.

Triton has discussed in detail, the market definition, aesthetic evolution, Porter’s five force analysis, key insights and regulations for the aesthetic laser market.

The Asia Pacific region is expected to grow at the highest CAGR in the global aesthetic laser market during the forecast period. This is attributable to the presence of a large aging population, changing lifestyle and increased disposable income. The prime countries like China, India, Japan, and South Korea is contributing major revenue in the region.

Japan has sanctioned some relaxations in the application of laser for medical applications. Also, the presence of Bollywood industry in India has majorly driven the cosmetic surgery segment, which is augmenting the growth of the overall aesthetic laser market. However, delusions pertaining to cosmetic surgery and stringent government regulations over the controlled application of laser are slowing the market growth in the region.

1. AESTHETIC

LASER MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTERS

FIVE FORCES MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE PRODUCTS

2.2.3. BARGAINING

POWER OF SUPPLIER

2.2.4. BARGAINING

POWER OF BUYER

2.2.5. INTENSITY

OF COMPETITIVE RIVALRY

2.3. VENDOR

SCORECARD

2.4. AESTHETIC

LASER EVOLUTION

2.5. KEY

BUYING OUTLOOK

2.6. REGULATIONS

2.7. SUPPLY

CHAIN OUTLOOK

2.8. KEY

INSIGHTS

2.9. MARKET

DRIVERS

2.9.1. CHANGING

LIFESTYLE AND INCREASING DISPOSABLE INCOME

2.9.2. RISING

MEDICAL TOURISM

2.9.3. SURGING

ADOPTION OF NON-INVASIVE AND MINIMALLY INVASIVE AESTHETIC PROCEDURES

2.10.

MARKET RESTRAINT

2.10.1.

LIMITATIONS IN LASER SYSTEMS

DEMONSTRATION

2.10.2.

DELUSION RELATED TO THE

COSMETIC SURGERIES

2.10.3.

STRICT GOVERNMENT GUIDELINES

2.11.

MARKET OPPORTUNITIES

2.11.1.

ADVANCEMENTS IN TECHNOLOGY

2.11.2.

LESS PRONE TO HUMAN ERRORS

DURING LASER SURGERIES BY THE SENSORS

USAGE

2.12.

MARKET CHALLENGES

2.12.1.

LARGE MARKET COMPETITION

3. AESTHETIC

LASER INDUSTRY OUTLOOK - BY TYPES

3.1.1. STANDALONE

LASERS

3.1.2. MULTIPLATFORM

LASERS

4. AESTHETIC

LASER INDUSTRY OUTLOOK - BY APPLICATION

4.1.1. HAIR

REMOVAL

4.1.2. SKIN

REJUVENATION

4.1.3. VASCULAR

LESIONS

4.1.4. PIGMENTED

LESION & TATTOO REMOVAL

4.1.5. OTHER

APPLICATIONS

5. AESTHETIC

LASER INDUSTRY OUTLOOK - BY END-USERS

5.1.1. PRIVATE

CLINICS

5.1.2. HOSPITALS

5.1.3. MEDICAL

SPAS

5.1.4. OTHER

END USERS

6. AESTHETIC

LASER INDUSTRY – REGIONAL OUTLOOK

6.1. ASIA

PACIFIC

6.1.1. COUNTRY

ANALYSIS

6.1.1.1. CHINA

6.1.1.2. INDIA

6.1.1.3. JAPAN

6.1.1.4. AUSTRALIA

& NEW ZEALAND

6.1.1.5. SOUTH

KOREA

6.1.1.6. ASEAN

COUNTRIES

6.1.1.7. REST

OF APAC

7. COMPETITIVE

LANDSCAPE

7.1. AEROLASE

7.2. CUTERA

INC.

7.3. ALLTEC

GMBH

7.4. ALMA

LASER INC.

7.5. FOTONA

7.6. INMODE

AESTHETIC SOLUTIONS

7.7. CYNOSURE

(ACQUIRED BY HOLOGIC)

7.8. LYNTON

LASERS LTD

7.9. LUMENIS

LTD. (ACQUIRED BY XIO)

7.10.

LUTRONIC CORPORATION

7.11.

SCITON INC.

7.12.

SOLTA MEDICAL (VALEANT PHARMACEUTICALS)

7.13.

SHARPLIGHT

TECHNOLOGIES INC.

7.14.

VIORA

7.15.

STRATA SKIN SCIENCES INC.

7.16.

SYNERON CANDELA

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1 ASIA PACIFIC AESTHETIC LASER MARKET

2019-2027 ($ MILLION)

TABLE 2 NEW REGULATIONS FOR MEDICAL DEVICE

TABLE 3 ASIA PACIFIC AESTHETIC LASER MARKET BY

TYPES 2019-2027 ($ MILLION)

TABLE 4 ASIA PACIFIC AESTHETIC LASER MARKET BY

APPLICATIONS 2019-2027 ($ MILLION)

TABLE 5 ASIA PACIFIC AESTHETIC LASER MARKET BY

END-USERS 2019-2027 ($ MILLION)

TABLE 6 ASIA PACIFIC AESTHETIC LASER MARKET BY

COUNTRIES 2019-2027 ($ MILLION)

FIGURE 1 ASIA PACIFIC AESTHETIC LASER MARKET 2019-2027

($ MILLION)

FIGURE 2 EVOLUTION OF AESTHETIC LASER

FIGURE 3 ASIA PACIFIC AESTHETIC LASER MARKET IN

STANDALONE LASERS 2019-2027 ($ MILLION)

FIGURE 4 ASIA PACIFIC AESTHETIC LASER MARKET IN

MULTIPLATFORM LASERS 2019-2027 ($ MILLION)

FIGURE 5 ASIA PACIFIC AESTHETIC LASER MARKET IN

HAIR REMOVAL 2019-2027 ($ MILLION)

FIGURE 6 ASIA PACIFIC AESTHETIC LASER MARKET IN

SKIN REJUVENATION 2019-2027 ($ MILLION)

FIGURE 7 ASIA PACIFIC AESTHETIC LASER MARKET IN

VASCULAR LESIONS 2019-2027 ($ MILLION)

FIGURE 8 ASIA PACIFIC AESTHETIC LASER MARKET IN

PIGMENTED LESION & TATTOO REMOVAL 2019-2027 ($ MILLION)

FIGURE 9 ASIA PACIFIC AESTHETIC LASER MARKET IN

OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 10 ASIA PACIFIC AESTHETIC LASER MARKET IN

PRIVATE CLINICS 2019-2027 ($ MILLION)

FIGURE 11 ASIA PACIFIC AESTHETIC LASER MARKET IN

HOSPITALS 2019-2027 ($ MILLION)

FIGURE 12 ASIA PACIFIC AESTHETIC LASER MARKET IN

MEDICAL SPAS 2019-2027 ($ MILLION)

FIGURE 13 ASIA PACIFIC AESTHETIC LASER MARKET IN OTHER

END-USERS 2019-2027 ($ MILLION)

FIGURE 14 ASIA PACIFIC AESTHETIC LASER MARKET 2019-2027

($ MILLION)

FIGURE 15 CHINA AESTHETIC LASER MARKET 2019-2027 ($

MILLION)

FIGURE 16 INDIA AESTHETIC LASER MARKET 2019-2027 ($

MILLION)

FIGURE 17 JAPAN AESTHETIC LASER MARKET 2019-2027 ($

MILLION)

FIGURE 18 AUSTRALIA AESTHETIC LASER MARKET 2019-2027 ($

MILLION)

FIGURE 19 SOUTH KOREA AESTHETIC LASER MARKET 2019-2027

($ MILLION)

FIGURE 20 ASEAN COUNTRIES AESTHETIC LASER MARKET 2019-2027

($ MILLION)

FIGURE 21 REST OF APAC AESTHETIC LASER MARKET 2019-2027

($ MILLION)