Market By Products, Application And Geography | Forecast 2019-2027

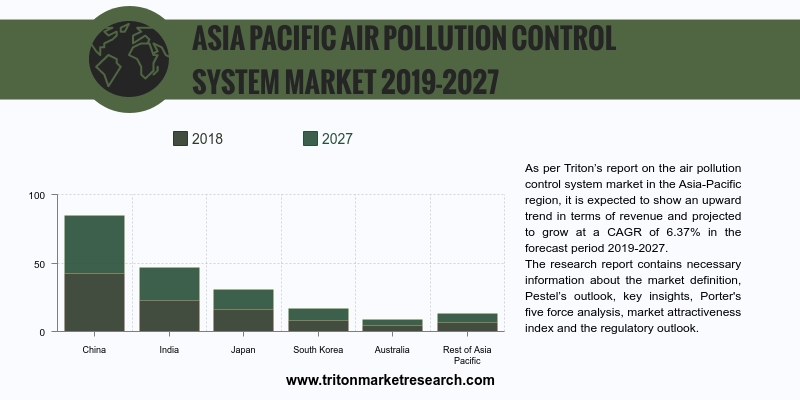

As per Triton’s report on the air pollution control system market in the Asia-Pacific region, it is expected to show an upward trend in terms of revenue and projected to grow at a CAGR of 6.37% in the forecast period 2019-2027.

The countries that have been studied in this report on the Asia-Pacific market are:

O India

O China

O Japan

O South Korea

O Australia

O New Zealand

O ASEAN countries

O Rest of Asia Pacific

Report scope can be customized per your requirements. Request For Customization

The key factor responsible for the growth of this market is the rising population in this region. Rapid urbanization has led to crowding in cities, and thus the quality of air in these places has also deteriorated. Operational processes in industries emit gaseous particulates that severely adulterate air quality. Several gases such as SO2, CO, CO2, N2O, particulates, ozone, volatile organic compounds, CFCs, unburned hydrocarbons, lead, heavy metals, etc., heavily contribute to air pollution.

India is one of the most polluted countries in this region, with six of its cities being listed in the world’s most polluted cities list. Due to deteriorating air quality, alternative solutions are now being explored along with several other cleanliness initiatives. In an effort to improve the quality of air, the government is offering financially viable options to service providers and investors so that they can comply with environmental regulations.

Over the last few years, the amount of electricity generated from coal has declined globally; in spite of this, the energy companies in emerging countries in the APAC region continued to build new coal-fired power plants. The reason for this being, a large number of areas in these countries having no access to electricity and the high coal production in this region. Air pollution from coal is responsible for premature deaths, and the number is only expected to rise. Installing emission control systems becomes imperative for these regions to keep air pollution in check and this increase in the newly installed coal power plants presents an opportunity for the growth of the air pollution control system market.

It is the responsibility of the owner to ensure the safety of its workers, employees and surroundings. Government laws bind them to install safety systems in the industry. However, high capital costs, requirement of skilled labor and the need for periodic maintenance along with the risks associated with these safety systems and the stringent regulations by the government have made the end users skeptical about adopting air pollution control systems.

This report provides a detailed study of the market definition, key industrial insights, regulatory components, market opportunities insights, vendor scorecard, Porter’s five force analysis and the key impact analysis.

Companies such as FLSmidth & Co., A/S, Zhejiang Feida Environmental Science & Technology Co., Ltd., Siemens AG, John Wood Group PLC, Babcock & Wilcox Enterprises, Inc., Mutares AG, Southern Erectors, Inc., Beltran Technologies, Inc., Elex AG, Thermax Asia-Pacific, S.A. Hamon, Mitsubishi Hitachi Power Systems, Ltd., KC Cottrell Co., Ltd. and Fujian Longking Co., Ltd. are well-known in the air pollution control systems market.

1. AIR

POLLUTION CONTROL SYSTEM MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. HEALTH

PROBLEMS DUE TO AIR POLLUTION

2.2.2. REGULATIONS

ON MERCURY AND AIR TOXIC STANDARDS

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTES

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. COST

2.4.2. REGULATORY

STANDARDS

2.4.3. COST

BENEFIT RATIO

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

COMPONENTS

2.8. REGULATORY

FRAMEWORK

2.9. MARKET

DRIVERS

2.9.1. GOVERNMENT

REGULATIONS

2.9.2. POPULATION

GROWTH

2.9.3. INCREASING

AIR POLLUTION

2.10. MARKET RESTRAINTS

2.10.1. DECREASING INVESTMENTS IN COAL

POWER PLANTS BY DEVELOPED REGIONS

2.10.2. DEVELOPMENTS IN RENEWABLE

ENERGY MARKET

2.11. MARKET OPPORTUNITIES

2.11.1. NEW THERMAL POWER PLANTS

INSTALLATION IN CHINA AND INDIA

2.11.2. OPPORTUNITIES FROM INDUSTRIAL

SECTOR OF EMERGING COUNTRIES

2.11.3. GROWING NEED FROM CEMENT

INDUSTRIES

2.12. MARKET CHALLENGES

2.12.1. LOW INVESTMENT IN SAFETY

SYSTEM

2.12.2. COST INVOLVED IN INSTALLATION

AND MAINTENANCE OF SYSTEM

3. AIR

POLLUTION CONTROL SYSTEM MARKET OUTLOOK - BY PRODUCTS

3.1. SCRUBBERS

3.2. THERMAL

OXIDIZERS

3.3. CATALYTIC

CONVERTORS

3.4. ELECTROSTATIC

PRECIPITATORS

3.5. OTHERS

4. AIR

POLLUTION CONTROL SYSTEM MARKET OUTLOOK - BY APPLICATION

4.1. CEMENT

4.2. IRON

& STEEL

4.3. CHEMICAL

4.4. POWER

GENERATION

4.5. OTHERS

5. AIR

POLLUTION CONTROL SYSTEM MARKET - REGIONAL OUTLOOK

5.1. ASIA-PACIFIC

5.1.1. MARKET

BY PRODUCTS

5.1.2. MARKET

BY APPLICATION

5.1.3. COUNTRY

ANALYSIS

6. COMPETITIVE

LANDSCAPE

6.1. BABCOCK

& WILCOX ENTERPRISES, INC

6.2. MUTARES

AG

6.3. ELEX

AG

6.4. FLSMIDTH

& CO. A/S

6.5. ZHEJIANG

FEIDA ENVIRONMENTAL SCIENCE & TECHNOLOGY CO., LTD.

6.6. KC

COTTRELL CO., LTD

6.7. S.A.

HAMON

6.8. BELTRAN

TECHNOLOGIES, INC.

6.9. JOHN

WOOD GROUP PLC

6.10. SOUTHERN ERECTORS, INC.

6.11. MITSUBISHI HITACHI POWER

SYSTEMS, LTD.

6.12. FUJIAN LONGKING CO., LTD.

6.13. SIEMENS AG

6.14. HERMAX ASIA-PACIFIC

7. METHODOLOGY

& SCOPE

7.1. RESEARCH

SCOPE

7.2. SOURCES

OF DATA

7.3. RESEARCH

METHODOLOGY

TABLE 1: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: REGULATORY FRAMEWORK

TABLE 5: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY PRODUCTS, 2019-2027 (IN $ MILLION)

TABLE 7: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

FIGURE 1: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY PRODUCTS, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: KEY BUYING IMPACT ANALYSIS

FIGURE 4: INDUSTRY COMPONENTS

FIGURE 5: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY SCRUBBERS, 2019-2027 (IN $ MILLION)

FIGURE 6: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY THERMAL OXIDIZERS, 2019-2027 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY CATALYTIC CONVERTORS, 2019-2027 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY ELECTROSTATIC PRECIPITATORS, 2019-2027 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY CEMENT, 2019-2027 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM MARKET,

BY IRON & STEEL, 2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY CHEMICAL, 2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY POWER GENERATION, 2019-2027 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC AIR POLLUTION CONTROL SYSTEM

MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 16: CHINA AIR POLLUTION CONTROL SYSTEM MARKET,

2019-2027 (IN $ MILLION)

FIGURE 17: JAPAN AIR POLLUTION CONTROL SYSTEM MARKET,

2019-2027 (IN $ MILLION)

FIGURE 18: INDIA AIR POLLUTION CONTROL SYSTEM MARKET,

2019-2027 (IN $ MILLION)

FIGURE 19: SOUTH KOREA AIR POLLUTION CONTROL SYSTEM

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: ASEAN COUNTRIES AIR POLLUTION CONTROL SYSTEM

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: AUSTRALIA & NEW ZEALAND AIR POLLUTION

CONTROL SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: REST OF ASIA-PACIFIC AIR POLLUTION CONTROL

SYSTEM MARKET, 2019-2027 (IN $ MILLION)