Market By Type, End-users, Technology And Geography | Forecast 2019-2027

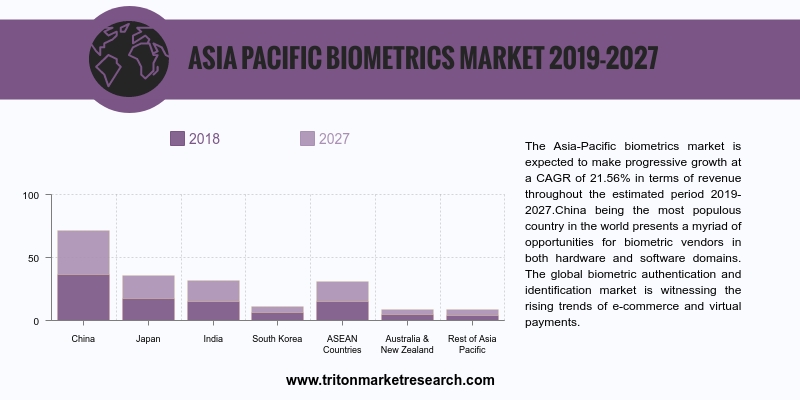

The Asia-Pacific biometrics market is expected to make progressive growth at a CAGR of 21.56% in terms of revenue throughout the estimated period 2019-2027.

The countries studied in the Asia-Pacific market for biometrics are:

• China

• Japan

• India

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of Asia-Pacific

China being the most populous country in the world presents a myriad of opportunities for biometric vendors in both hardware and software domains. The global biometric authentication and identification market is witnessing the rising trends of e-commerce and virtual payments. With the launch of virtual payment systems such as Google Wallet and Apple Pay from market giants such as Google and Apple, China will eventually experience an influx of a voluminous number of online payment accommodations and solutions. Moreover, the issuing of e-passports in the country commenced in 2012, and it is one of the major drivers for the magnification of Chinese biometric authentication and identification market.

One of the major shares of revenue in the Chinese biometric market is contributed by the financial sector. Among the multifarious biometric modalities available, voice biometric readers are increasingly being adopted for telebanking; whereas, solutions such as fingerprint recognition and hand geometry are being employed by ATMs. Other application areas such as healthcare and gaming are also gaining traction in the market and are rapidly adopting different biometric modalities to enable advanced security. Hospitals are aiming to incorporate fingerprint scanning to identify blood donors, biometric patient check-ins through palm vein scanning and biometrics USB drives to store patient records. Increasing demand for fingerprint sensors from various smartphones and tablets are becoming a major trend in the Chinese market.

Fujitsu Limited is a Japanese information and communication technology (ICT) company. It offers a wide range of technology products, services and solutions. The company’s main products include software, network, electronics devices, IT products & systems and other products; whereas, its main services include management infrastructure services, business & application services, hybrid IT & cloud services and product support services. Besides that, the company offers key solutions such as infrastructure solutions, industry solutions and business & technology solutions. Fujitsu is headquartered in Tokyo, Japan.

1.

ASIA-PACIFIC

BIOMETRICS MARKET - SUMMARY

2.

INDUSTRY

OUTLOOK

2.1. MARKET DEFINITION

2.2. COMPONENTS OF A BIOMETRIC ACCESS CONTROL SYSTEM

2.2.1.

INPUT

EXTRACTION

2.2.2.

TRANSMISSION

& SIGNAL PROCESSING

2.2.3.

QUALITY

ASSESSMENT

2.2.4.

DATA STORAGE

2.3. KEY INSIGHTS

2.3.1.

FAVORABLE

GOVERNMENT INITIATIVES

2.3.2.

INTRODUCTION

OF MULTIMODAL BIOMETRIC TECHNOLOGY

2.3.3.

RAPID ADOPTION

BY BANKING & FINANCIAL SERVICE INDUSTRIES

2.4. PORTER’S FIVE FORCE ANALYSIS

2.4.1.

BARGAINING

POWER OF BUYERS

2.4.2.

BARGAINING

POWER OF SUPPLIERS

2.4.3.

THREAT OF NEW

ENTRANTS

2.4.4.

THREAT OF

SUBSTITUTE

2.4.5.

THREAT OF

COMPETITIVE RIVALRY

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. INDUSTRY COMPONENTS

2.7.1.

CORE

TECHNOLOGY

2.7.2.

PHYSICAL

COMPONENTS MANUFACTURER

2.7.3.

INTEGRATED

BIOMETRIC DEVICES

2.7.4.

MARKETING AND

DISTRIBUTION

2.7.5.

END-USERS

2.8. MARKET DRIVERS

2.8.1.

INCREASED

SAFETY & SECURITY CONCERNS

2.8.2.

RISE IN

IDENTITY THREATS & RELATED COSTS

2.8.3.

IMMENSE

PROLIFERATION OF SMARTPHONES & TABLETS WITH BIOMETRIC CAPABILITIES

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COST OF

TECHNOLOGY

2.9.2.

DIFFICULTIES

IN INTEGRATING BIOMETRICS INTO EXISTING SOFTWARE

2.10. MARKET OPPORTUNITIES

2.10.1.

THRIVING

E-COMMERCE INDUSTRY

2.10.2.

EMERGENCE OF

E-PASSPORT

2.11. MARKET CHALLENGES

2.11.1.

TECHNICAL

LIMITATIONS ASSOCIATED WITH BIOMETRIC TECHNOLOGY

2.11.2.

DATA SECURITY

& PRIVACY ISSUES

3.

ASIA-PACIFIC

BIOMETRICS MARKET OUTLOOK – BY TYPE

3.1. FIXED

3.2. MOBILE

4.

ASIA-PACIFIC

BIOMETRICS MARKET OUTLOOK – BY END-USERS

4.1. GOVERNMENT

4.2. TRANSPORTATION

4.3. BFSI

4.4. HEALTHCARE

4.5. IT & TELECOMMUNICATION

4.6. RETAIL

4.7. OTHER END-USERS

5.

ASIA-PACIFIC

BIOMETRICS MARKET OUTLOOK – BY TECHNOLOGY

5.1. FINGERPRINT RECOGNITION

5.2. IRIS RECOGNITION

5.3. FACIAL RECOGNITION

5.4. HAND GEOMETRY

5.5. VEIN ANALYSIS

5.6. VOICE RECOGNITION

5.7. DNA ANALYSIS

5.8. GAIT

5.9. EEG/ECG

5.10. OTHER TECHNOLOGIES

6.

ASIA-PACIFIC

BIOMETRICS MARKET – REGIONAL OUTLOOK

6.1. CHINA

6.2. JAPAN

6.3. INDIA

6.4. SOUTH KOREA

6.5. ASEAN COUNTRIES

6.6. AUSTRALIA & NEW ZEALAND

6.7. REST OF ASIA-PACIFIC

7.

COMPETITIVE

LANDSCAPE

7.1. AWARE, INC.

7.2. BIO-KEY INTERNATIONAL, INC.

7.3. CROSSMATCH TECHNOLOGIES, INC.

7.4. FINGERPRINT CARDS AB

7.5. FUJITSU LIMITED

7.6. FULCRUM BIOMETRICS LLC

7.7. GEMALTO N.V.

7.8. HID GLOBAL CORPORATION

7.9. IMAGEWARE SYSTEMS

7.10. IRIS ID SYSTEMS, INC.

7.11. M2SYS TECHNOLOGIES, INC.

7.12. NEC CORPORATION

7.13. NUANCE COMMUNICATIONS, INC.

7.14. IDEMIA FRANCE S.A.S. (SAFRAN IDENTITY & SECURITY S.A.S.)

7.15. PRECISE BIOMETRICS AB

7.16. SIEMENS AG

8.

RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: GOVERNMENT INITIATIVES & POLICIES RELATED TO BIOMETRICS

TABLE 3: VENDOR SCORECARD

TABLE 4: INSTANCES OF IDENTITY THEFTS IN KEY GEOGRAPHIES, 2017

TABLE 5: SOME OF THE PROMISING E-PASSPORT PROJECTS

TABLE 6: ASIA-PACIFIC BIOMETRICS MARKET, BY TYPE, 2019-2027 (IN $

MILLION)

TABLE 7: ASIA-PACIFIC BIOMETRICS MARKET, BY END-USERS, 2019-2027 (IN $

MILLION)

TABLE 8: ASIA-PACIFIC BIOMETRICS MARKET, BY TECHNOLOGY, 2019-2027 (IN $

MILLION)

TABLE 9: ASIA-PACIFIC BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: BASIC COMPONENTS OF BIOMETRIC AUTHENTICATION SYSTEMS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: INTERNAL PROCESS FOR IDENTIFICATION BY BIOMETRIC TECHNOLOGY

FIGURE 5: AVERAGE CYBERCRIME COST IN KEY GEOGRAPHIES, AUGUST 2017 (IN $

MILLION)

FIGURE 6: ASIA-PACIFIC BIOMETRICS MARKET, BY FIXED, 2019-2027 (IN $

MILLION)

FIGURE 7: ASIA-PACIFIC BIOMETRICS MARKET, BY MOBILE, 2019-2027 (IN $

MILLION)

FIGURE 8: ASIA-PACIFIC BIOMETRICS MARKET, BY GOVERNMENT, 2019-2027 (IN $

MILLION)

FIGURE 9: ASIA-PACIFIC BIOMETRICS MARKET, BY TRANSPORTATION, 2019-2027

(IN $ MILLION)

FIGURE 10: ASIA-PACIFIC BIOMETRICS MARKET, BY BFSI, 2019-2027 (IN $

MILLION)

FIGURE 11: ASIA-PACIFIC BIOMETRICS MARKET, BY HEALTHCARE, 2019-2027 (IN

$ MILLION)

FIGURE 12: ASIA-PACIFIC BIOMETRICS MARKET, BY IT &

TELECOMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC BIOMETRICS MARKET, BY RETAIL, 2019-2027 (IN $

MILLION)

FIGURE 14: ASIA-PACIFIC BIOMETRICS MARKET, BY OTHER END-USERS, 2019-2027

(IN $ MILLION)

FIGURE 15: ASIA-PACIFIC BIOMETRICS MARKET, BY FINGERPRINT RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC BIOMETRICS MARKET, BY IRIS RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC BIOMETRICS MARKET, BY FACIAL RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC BIOMETRICS MARKET, BY HAND GEOMETRY, 2019-2027

(IN $ MILLION)

FIGURE 19: ASIA-PACIFIC BIOMETRICS MARKET, BY VEIN ANALYSIS, 2019-2027

(IN $ MILLION)

FIGURE 20: ASIA-PACIFIC BIOMETRICS MARKET, BY VOICE RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC BIOMETRICS MARKET, BY DNA ANALYSIS, 2019-2027

(IN $ MILLION)

FIGURE 22: ASIA-PACIFIC BIOMETRICS MARKET, BY GAIT, 2019-2027 (IN $

MILLION)

FIGURE 23: ASIA-PACIFIC BIOMETRICS MARKET, BY EEG/ECG, 2019-2027 (IN $

MILLION)

FIGURE 24: ASIA-PACIFIC BIOMETRICS MARKET, BY OTHER TECHNOLOGIES,

2019-2027 (IN $ MILLION)

FIGURE 25: CHINA BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: JAPAN BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: INDIA BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: SOUTH KOREA BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: ASEAN COUNTRIES BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: AUSTRALIA & NEW ZEALAND BIOMETRICS MARKET, 2019-2027 (IN

$ MILLION)

FIGURE 31: REST OF ASIA-PACIFIC BIOMETRICS MARKET, 2019-2027 (IN $

MILLION)