Market By Blood Type, Application, End-users And Geography | Forecast 2019-2027

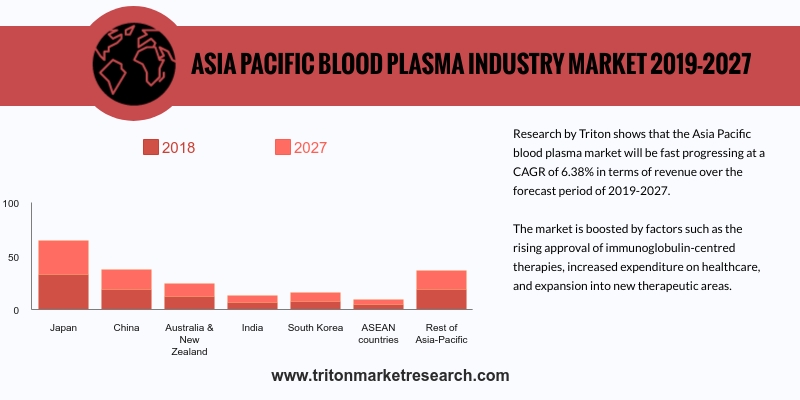

Research by Triton shows that the Asia-Pacific blood plasma market will be fast progressing at a CAGR of 6.38% in terms of revenue over the forecast period of 2019-2027.

The countries that have been studied in the Asia-Pacific blood plasma market are:

• China

• India

• Japan

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of Asia-Pacific

China has made major contributions to the growth of the blood plasma market in the Asia-Pacific region and the use of plasma in many therapeutic treatments is now widely accepted. In 2012, China accounted for 25 fractionation facilities, the highest number in the region. Japan has constructed only four plasma fractionation plants, while other countries such as Australia and India have only one each. China offers profitable opportunities ahead in the production of novel plasma therapies. Coagulation factors, intravenous immunoglobulin, albumin, normal immunoglobulins and other plasma products are already manufactured in the country.

The demand for intravenous immunoglobulins (IVIg) has increased in Australia, as they are reportedly used in over 70 clinical indications in addition to the treatment of idiopathic thrombocytopenic purpura (ITP), primary immune deficiency (PID), lymphoproliferative disorders (LPDs) and Kawasaki disease. Before 2005, plasma fractionation targeted the production of immunoglobulins and factor VIII, while a small proportion of total fractionated plasma was used in the manufacture of other products, such as albumin and other clotting factors. Regional market players such as CSL Bioplasma assisted in increasing the yield of intravenous immunoglobulins from 2000 to 2006. However, a shortage in this region persists due to limited accessibility to domestic plasma and the growing demand. Such factors are responsible for restraining the growth of the blood plasma market in Australia.

CSL Ltd. is an international company that specializes in manufacturing biotherapeutic products. The company manufactures and supplies innovative biotherapeutic products that offer safe treatments to people suffering from chronic medical conditions. CSL operates in over 30 countries and has a major geographical presence in Australia, Germany, Switzerland, the UK and the US. The company has achieved expertise in R&D, plasma products, vaccines and pharmaceuticals. CSL is an innovation-driven company that has a strong R&D foothold in new biotherapy development. The company focuses on R&D investments, as well as manufacturing of immunoglobulins, hemophilia products and breakthrough medicines. The company strives to develop innovative plasma therapies that improve patient care.

1.

ASIA-PACIFIC BLOOD PLASMA MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTES

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF RIVALRY

2.3. VENDOR SCORECARD

2.4. CLINICAL GUIDELINES

2.5. REGULATION IN THE PLASMA THERAPEUTICS

2.6. KEY INSIGHTS

2.7. REGULATORY OUTLOOK

2.8. MARKET TRENDS

2.9. PATENT OUTLOOK

2.10.

MARKET DRIVERS

2.10.1.

EXPANSION IN INDICATION FOR NEW THERAPEUTIC AREAS

2.10.2.

APPROVAL OF IMMUNOGLOBULIN-CENTERED THERAPIES

2.10.3.

SURGE IN THE HEMOPHILIA TREATMENT

2.11.

MARKET RESTRAINTS

2.11.1.

HIGH COSTS OF BLOOD PLASMA TREATMENTS

2.11.2.

EASY AVAILABILITY OF RECOMBINANT PLASMA

2.12.

MARKET OPPORTUNITIES

2.12.1.

INCREASING PUBLIC COGNIZANCE

2.12.2.

RISE IN THE PLASMA-DERIVED PRODUCTS OPPORTUNITIES

2.12.3.

INCREASING OCCURRENCE OF HEMOPHILIA

2.13.

MARKET CHALLENGES

2.13.1.

SPREAD OF PATHOGENIC CONTAMINANTS

2.13.2.

HIGH REGULATIONS IN THE MARKET

2.14.

BLOOD PLASMA INDUSTRY BY MODE OF DELIVERY

2.14.1.

INFUSION SOLUTIONS

2.14.2.

GELS

2.14.3.

SPRAYS

2.14.4.

BIOMEDICAL SEALANTS

3.

BLOOD PLASMA MARKET OUTLOOK - BY BLOOD TYPE

3.1. ALBUMIN

3.2. IMMUNOGLOBULIN

3.2.1.

INTRAVENOUS IMMUNOGLOBULIN

3.2.2.

SUBCUTANEOUS IMMUNOGLOBULIN

3.2.3.

OTHER IMMUNOGLOBULIN TYPE

3.3. COAGULATION FACTOR CONCENTRATES

3.4. HYPERIMMUNE

3.5. OTHER PLASMA FRACTIONATION PRODUCTS

4.

BLOOD PLASMA MARKET OUTLOOK - BY APPLICATION

4.1. ONCOLOGY

4.2. HEMATOLOGY

4.3. TRANSPLANTATION

4.4. RHEUMATOLOGY

4.5. NEUROLOGY

4.6. IMMUNOLOGY

4.7. PULMONOLOGY

4.8. OTHER APPLICATIONS

5.

BLOOD PLASMA MARKET OUTLOOK - BY END-USER

5.1. ACADEMIC INSTITUTIONS

5.2. RESEARCH LABORATORIES

5.3. HOSPITALS AND CLINICS

6.

BLOOD PLASMA MARKET - REGIONAL OUTLOOK

6.1. ASIA-PACIFIC

6.1.1.

COUNTRY ANALYSIS

6.1.1.1.

JAPAN

6.1.1.2.

CHINA

6.1.1.3.

AUSTRALIA & NEW ZEALAND

6.1.1.4.

INDIA

6.1.1.5.

SOUTH KOREA

6.1.1.6.

ASEAN COUNTRIES

6.1.1.7.

REST OF ASIA-PACIFIC

7.

COMPANY PROFILES

7.1. SHIRE PLC

7.2. ARTHREX

7.3. OCTAPHARMA AG

7.4. BAXTER INTERNATIONAL, INC.

7.5. GRIFOLS INTERNATIONAL S.A.

7.6. BIOTEST AG

7.7. CSL LTD.

7.8. ADMA BIOLOGICS, INC.

7.9. CHINA BIOLOGIC PRODUCTS, INC.

7.10.

GENERAL ELECTRIC, CO.

7.11.

CERUS CORP.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 ASIA-PACIFIC BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

TABLE 2 BLOOD PLASMA

COMPONENTS

TABLE 3 ASIA-PACIFIC BLOOD

PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 4 ASIA-PACIFIC BLOOD

PLASMA MARKET IN IMMUNOGLOBULIN BY TYPES 2019-2027 ($ MILLION)

TABLE 5 PROTEASE INHIBITORS

USED IN THE HIV INFECTION TREATMENT

TABLE 6 ASIA-PACIFIC BLOOD

PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 6 ASIA-PACIFIC BLOOD

PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 7 ASIA-PACIFIC BLOOD

PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 ASIA-PACIFIC BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 2 IMMUNOGLOBULIN

INFUSIONS SIDE-EFFECTS

FIGURE 3 ROLE OF FIBRIN

SEALANT IN COAGULATION CASCADE

FIGURE 4 ASIA-PACIFIC BLOOD

PLASMA MARKET IN ALBUMIN 2019-2027 ($ MILLION)

FIGURE 5 ASIA-PACIFIC BLOOD

PLASMA MARKET IN IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 6 ASIA-PACIFIC

IMMUNOGLOBULIN MARKET IN INTRAVENOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 7 ASIA-PACIFIC

IMMUNOGLOBULIN MARKET IN SUBCUTANEOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 8 ASIA-PACIFIC

IMMUNOGLOBULIN MARKET IN OTHER IMMUNOGLOBULIN TYPE 2019-2027 ($ MILLION)

FIGURE 9 ASIA-PACIFIC BLOOD

PLASMA MARKET IN COAGULATION FACTOR CONCENTRATES 2019-2027 ($ MILLION)

FIGURE 10 HYPERIMMUNES ISOLATION

PROCESS

FIGURE 11 ASIA-PACIFIC BLOOD

PLASMA MARKET IN HYPERIMMUNES 2019-2027 ($ MILLION)

FIGURE 12 ASIA-PACIFIC BLOOD

PLASMA MARKET IN OTHER PLASMA FRACTIONATION PRODUCTS 2019-2027 ($ MILLION)

FIGURE 13 ASIA-PACIFIC BLOOD

PLASMA MARKET IN ONCOLOGY 2019-2027 ($ MILLION)

FIGURE 14 ASIA-PACIFIC BLOOD

PLASMA MARKET IN HEMATOLOGY 2019-2027 ($ MILLION)

FIGURE 15 ASIA-PACIFIC BLOOD

PLASMA MARKET IN TRANSPLANTATION 2019-2027 ($ MILLION)

FIGURE 16 LUPUS INFECTION

SYMPTOMS

FIGURE 17 ASIA-PACIFIC BLOOD

PLASMA MARKET IN RHEUMATOLOGY 2019-2027 ($ MILLION)

FIGURE 18 ASIA-PACIFIC BLOOD

PLASMA MARKET IN NEUROLOGY 2019-2027 ($ MILLION)

FIGURE 19 ASIA-PACIFIC BLOOD

PLASMA MARKET IN PULMONOLOGY 2019-2027 ($ MILLION)

FIGURE 20 ASIA-PACIFIC BLOOD

PLASMA MARKET IN IMMUNOLOGY 2019-2027 ($ MILLION)

FIGURE 21 ASIA-PACIFIC BLOOD

PLASMA MARKET IN OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 22 ASIA-PACIFIC BLOOD

PLASMA MARKET IN ACADEMIC INSTITUTIONS 2019-2027 ($ MILLION)

FIGURE 23 ASIA-PACIFIC BLOOD

PLASMA MARKET IN RESEARCH LABORATORIES 2019-2027 ($ MILLION)

FIGURE 24 ASIA-PACIFIC BLOOD

PLASMA MARKET IN HOSPITALS AND CLINICS 2019-2027 ($ MILLION)

FIGURE 25 JAPAN BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 26 CHINA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 27 AUSTRALIA & NEW

ZEALAND BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 28 INDIA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 29 SOUTH KOREA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 30 ASEAN COUNTRIES BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 31 REST OF ASIA-PACIFIC

BLOOD PLASMA MARKET 2019-2027 ($ MILLION)