Market By Type, Cable Type, Material, Application And Geography | Forecast 2019-2027

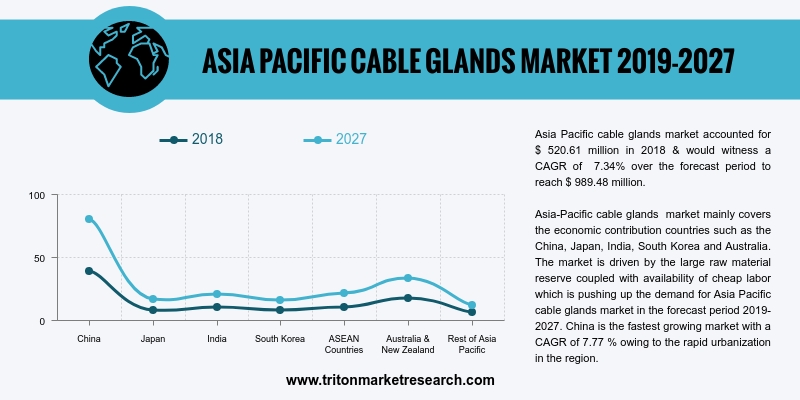

As per a Triton Market Research report, the market for cable glands in the Asia-Pacific is expected to show growth in revenue at a CAGR of 7.34% during the forecast period of 2019 to 2027.

The countries studied in the report on the Asia-Pacific market for cable glands are:

• Japan

• China

• India

• Australia & New Zealand

• South Korea

• ASEAN countries

• Rest of APAC

Report Scope Can Be Customized Per Your Requirements. Request for Customization

The automotive industry in China contributes significantly to the cable glands market. China’s automotive industry produces more than 20 million vehicles per year, which is nearly twice the number of those produced by the United States. The total number of vehicles sold is expected to reach 26 million units the coming year, with a growth rate of around 7%. The automotive industry in China has thus emerged as the largest automotive industry in the world, and it is expected to maintain its position, by aiming for a double-digit growth rate over the coming years, contributing to the country’s cable glands market growth.

The rate of industrial production in the country has witnessed growth and is expected to grow further in the forecast duration. The country has thus witnessed an increase in the demand for cable glands owing to industrialization and China being a major global manufacturing hub. Additionally, large-scale infrastructural projects, at both domestic and international levels are being planned in the country, which would give a further push to businesses, thereby driving the growth of the Chinese cable glands market. The rapid rate of urbanization and the tremendous growth rate have thus led to the growth of China’s cable glands market. The growth in demand for energy resources, along with technological advancements are expected to further boost the cable glands market in China.

Emerson Electric Co. is a tech company offering engineering services, industrial automation and process management. It provides hardware & software solutions to infrastructure, thermal and power companies. Emerson caters to industrial, commercial as well as consumer markets. The company’s products and services have found applications in climate technologies, network power, process management and industrial automation. Emerson Electric has a business presence across the Asia-Pacific, the Middle East and Africa, the Americas and Europe. The developed R&D capabilities of Emerson are leading to the company’s growth.

1. ASIA-PACIFIC CABLE GLANDS MARKET – SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

ASIA-PACIFIC LEADS THE OVERALL MARKET

2.2.2.

RISING DEMAND FOR HAZARDOUS CABLE GLANDS

2.2.3.

SWELLING DEMAND FOR CABLE CONNECTORS IN THE AEROSPACE SECTOR

2.3. PORTER’S FIVE FORCES ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

COST

2.4.2.

SCALABILITY

2.4.3.

EASE OF USE

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

GOVERNMENT REGULATIONS FUEL THE DEMAND FOR CABLE GLANDS

2.7.2.

RESTORATION OF ELECTRICAL NETWORKS IN SEVERAL REGIONS

2.7.3.

RISE IN CONSTRUCTION UNDERTAKINGS IN DEVELOPING REGIONS

2.7.4.

WIDE ADOPTION OF AUTOMATION

2.8. MARKET RESTRAINTS

2.8.1.

VARIABILITY IN RAW MATERIAL PRICES

2.9. MARKET OPPORTUNITIES

2.9.1.

EMERGING GROWTH IN BUDDING MARKETS

2.9.2.

SURGE IN COUNT OF DATA CENTERS

2.10. MARKET CHALLENGES

2.10.1. SUSPENSION OF THE LOCAL MARKETS

3. ASIA-PACIFIC CABLE GLANDS MARKET OUTLOOK – BY

TYPE

3.1. INDUSTRIAL

3.2. HAZARDOUS

3.2.1.

INCREASED SAFETY

3.2.2.

FLAME-PROOF

3.2.3.

EMC CABLE GLANDS

3.2.4.

OTHERS

4. ASIA-PACIFIC CABLE GLANDS MARKET OUTLOOK – BY

CABLE TYPE

4.1. ARMORED

4.2. UNARMORED

5. ASIA-PACIFIC CABLE GLANDS MARKET OUTLOOK – BY

MATERIAL

5.1. BRASS

5.2. STAINLESS STEEL

5.3. PLASTIC/NYLON

5.4. OTHERS

6. ASIA-PACIFIC CABLE GLANDS MARKET OUTLOOK – BY

APPLICATION

6.1. OIL & GAS

6.2. MINING

6.3. AEROSPACE

6.4. MANUFACTURING & PROCESSING

6.5. CHEMICAL

6.6. OTHERS

7. ASIA-PACIFIC CABLE GLANDS MARKET – REGIONAL OUTLOOK

7.1. ASIA-PACIFIC

7.1.1.

CHINA

7.1.2.

JAPAN

7.1.3.

INDIA

7.1.4.

SOUTH KOREA

7.1.5.

ASEAN COUNTRIES

7.1.6.

AUSTRALIA & NEW ZEALAND

7.1.7.

REST OF ASIA-PACIFIC

8. COMPETITIVE LANDSCAPE

8.1. ABB LTD.

8.2. AMPHENOL CORPORATION

8.3. EATON CORPORATION

8.4. EMERSON ELECTRIC CO.

8.5. HUBBEL INCORPORATED

8.6. THOMAS & BETTS

8.7. CMP PRODUCTS LTD

8.8. CORTEM S.p.A

8.9. BARTEC

8.10. JACOB GMBH

8.11. SEALCON LLC

8.12. R. STAHL AG

9. METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE

9.2. SOURCES OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: ASIA-PACIFIC CABLE GLANDS MARKET, BY TYPE, 2019-2027 (IN $

MILLION)

TABLE 5: ASIA-PACIFIC CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN $

MILLION)

TABLE 6: ASIA-PACIFIC CABLE GLANDS MARKET, BY CABLE TYPE, 2019-2027 (IN

$ MILLION)

TABLE 7: ASIA-PACIFIC CABLE GLANDS MARKET, BY MATERIAL, 2019-2027 (IN $

MILLION)

TABLE 8: ASIA-PACIFIC CABLE GLANDS MARKET, BY APPLICATION, 2019-2027 (IN

$ MILLION)

TABLE 9: ASIA-PACIFIC CABLE GLANDS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: ASIA-PACIFIC CABLE GLANDS MARKET, BY TYPE, 2018 & 2027 (IN

%)

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: KEY BUYING IMPACT ANALYSIS

FIGURE 4: ASIA-PACIFIC CABLE GLANDS MARKET, BY INDUSTRIAL, 2019-2027 (IN

$ MILLION)

FIGURE 5: ASIA-PACIFIC CABLE GLANDS MARKET, BY HAZARDOUS, 2019-2027 (IN

$ MILLION)

FIGURE 6: ASIA-PACIFIC CABLE GLANDS MARKET, BY INCREASED SAFETY,

2019-2027 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC CABLE GLANDS MARKET, BY FLAME-PROOF, 2019-2027

(IN $ MILLION)

FIGURE 8: ASIA-PACIFIC CABLE GLANDS MARKET, BY EMC CABLE GLANDS,

2019-2027 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $

MILLION)

FIGURE 10: ASIA-PACIFIC CABLE GLANDS MARKET, BY ARMORED, 2019-2027 (IN $

MILLION)

FIGURE 11: ASIA-PACIFIC CABLE GLANDS MARKET, BY UNARMORED, 2019-2027 (IN

$ MILLION)

FIGURE 12: ASIA-PACIFIC CABLE GLANDS MARKET, BY BRASS, 2019-2027 (IN $

MILLION)

FIGURE 13: ASIA-PACIFIC CABLE GLANDS MARKET, BY STAINLESS STEEL,

2019-2027 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC CABLE GLANDS MARKET, BY PLASTIC/NYLON, 2019-2027

(IN $ MILLION)

FIGURE 15: ASIA-PACIFIC CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $

MILLION)

FIGURE 16: ASIA-PACIFIC CABLE GLANDS MARKET, BY OIL & GAS, 2019-2027

(IN $ MILLION)

FIGURE 17: ASIA-PACIFIC CABLE GLANDS MARKET, BY MINING, 2019-2027 (IN $

MILLION)

FIGURE 18: ASIA-PACIFIC CABLE GLANDS MARKET, BY AEROSPACE, 2019-2027 (IN

$ MILLION)

FIGURE 19: ASIA-PACIFIC CABLE GLANDS MARKET, BY MANUFACTURING &

PROCESSING, 2019-2027 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC CABLE GLANDS MARKET, BY CHEMICAL, 2019-2027 (IN

$ MILLION)

FIGURE 21: ASIA-PACIFIC CABLE GLANDS MARKET, BY OTHERS, 2019-2027 (IN $

MILLION)

FIGURE 22: ASIA-PACIFIC CABLE GLANDS MARKET, REGIONAL OUTLOOK, 2018

& 2027 (IN %)

FIGURE 23: CHINA CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: JAPAN CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: INDIA CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: SOUTH KOREA CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: ASEAN COUNTRIES CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: AUSTRALIA & NEW ZEALAND CABLE GLANDS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 29: REST OF ASIA-PACIFIC CABLE GLANDS MARKET, 2019-2027 (IN $ MILLION)