Market By Devices, End-users And Geography | Forecast 2019-2027

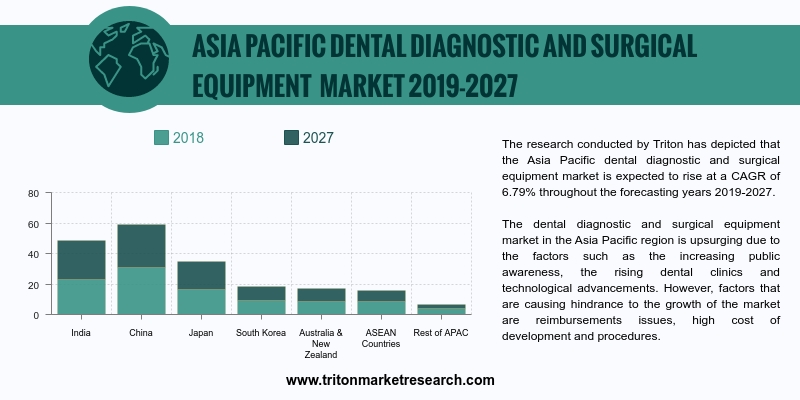

Research conducted by Triton has depicted that the Asia-Pacific dental diagnostic and surgical equipment market is expected to rise at a CAGR of 6.79% throughout the forecasting years 2019-2027. The Asia-Pacific dental diagnostic and surgical equipment market is anticipated to account for the highest CAGR by the end of the forecasting period. China dominates the dental diagnostic and surgical equipment market in the Asia-Pacific region.

The Asia-Pacific region has covered countries in the dental diagnostic and surgical equipment market report, which include:

• China

• Japan

• India

• South Korea

• ASEAN countries

• Australia &New Zealand

• Rest of Asia-Pacific

Report scope can be customized per your requirements. Request For Customization

China is one of the major economies in the world and is recognized for its infrastructure and technology across the globe. It is the most populated country in the world, and is also the prime consumer market in the world. Across the globe, China is seen as a significant dental diagnostics and surgical equipment manufacturer. However, the country has the largest tobacco and cigarette consumer across the globe. The prevalence of oral cancer and other oral problems is high in the region as compared to other countries across the globe. Around 350 million people in China smoke and around 45% of cigarette production takes place in China alone. Thus, the rising trend of smoking in the Chinese region is increasing the scope of the dental diagnostics and surgical equipment market due to the growing prevalence of chronic dental diseases.

South Korea is one of the major contributors to the growth of the Asia-Pacific dental diagnostic and surgical equipment market. The South Korea dental diagnostic and surgical equipment market is growing due to a number of factors such as the development of virtual reality in dentistry and an increase in diagnostics across the country.

The report comprises a detailed analysis of the market trends, key insights, key buying outlook, Porter’s five force analysis, the value chain outlook and patents outlook.

The players dominating the dental diagnostic and surgical equipment market are ProMED, Inc., Surgismith, Hu-Friedy Mfg. Co., DentalEZ, Inc., 3M Company, Henry Schein, Inc., BIOLASE Technology, Inc., A-dec, GE Healthcare, Qioptiq (acquired by Excelitas Technologies Corp.), 3Shape, Danaher Corporation, Midmark Corporation, Dentsply International, DCI and Carestream Health, Inc.

1.

DENTAL DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES MODEL

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE PRODUCTS OR SERVICES

2.2.3.

BARGAINING POWER OF BUYER

2.2.4.

BARGAINING POWER OF SUPPLIER

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. MARKET TRENDS

2.4. KEY INSIGHTS

2.5. VALUE CHAIN OUTLOOK

2.6. PATENTS OUTLOOK

2.7. KEY BUYING OUTLOOK

2.8. MARKET DRIVERS

2.8.1.

SIGNIFICANT RISE IN DENTAL CLINICS

2.8.2.

TECHNOLOGICAL ADVANCEMENTS

2.8.3.

RISE IN THE AWARENESS

2.8.4.

RISE IN THE MEDICAL AND DENTAL TOURISM

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COST OF DEVELOPMENT

2.10.

MARKET CHALLENGES

2.10.1.

HIGH COST OF DENTAL PROCEDURES

2.10.2.

COST OF EQUIPMENT IS HIGH

2.11.

MARKET OPPORTUNITIES

2.11.1.

RISING DEMAND FOR COSMETIC DENTISTRY

2.11.2.

INCREASE IN THE INNOVATION OF NEW TECHNOLOGIES

3.

DENTAL DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET OUTLOOK - BY DEVICE

3.1. INSTRUMENT DELIVERY SYSTEM

3.2. CAD/CAM SYSTEMS

3.2.1.

FULL IN-LAB SYSTEMS

3.2.2.

STAND-ALONE SCANNERS

3.2.3.

CHAIRSIDE SYSTEMS

3.3. DENTAL CHAIRS

3.4. DENTAL RADIOLOGY EQUIPMENT

3.4.1.

EXTRAORAL RADIOLOGY EQUIPMENT

3.4.2.

INTRAORAL RADIOLOGY EQUIPMENT

3.4.3.

CONE BEAM COMPUTED TOMOGRAPHY SCANNERS

3.5. SCALING UNIT MARKET

3.6. LIGHT CURE EQUIPMENT

3.7. DENTAL LASERS

3.7.1.

SOFT TISSUE LASERS

3.7.2.

HARD/SOFT TISSUE LASER

3.8. HANDPIECES

4.

DENTAL DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET OUTLOOK - BY END-USERS

4.1. HOSPITALS

4.2. DENTAL CLINICS

4.3. DIAGNOSTIC CENTERS

4.4. OTHER END-USERS

5.

DENTAL DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET - REGIONAL OUTLOOK

5.1. ASIA-PACIFIC

5.1.1.

COUNTRY ANALYSIS

5.1.1.1.

INDIA

5.1.1.2.

CHINA

5.1.1.3.

JAPAN

5.1.1.4.

SOUTH KOREA

5.1.1.5.

AUSTRALIA & NEW ZEALAND

5.1.1.6.

ASEAN COUNTRIES

5.1.1.7.

REST OF APAC

6.

COMPETITIVE LANDSCAPE

6.1. A-DEC

6.2. BIOLASE TECHNOLOGY, INC.

6.3. GE HEALTHCARE

6.4. MIDMARK CORPORATION

6.5. PROMED, INC.

6.6. CARESTREAM HEALTH, INC.

6.7. DANAHER CORPORATION

6.8. DCI

6.9. HU-FRIEDY MFG. CO.

6.10.

SURGISMITH

6.11.

QIOPTIQ (ACQUIRED BY EXCELITAS TECHNOLOGIES CORP.)

6.12.

DENTALEZ, INC.

6.13.

3SHAPE

6.14.

DENTSPLY INTERNATIONAL

6.15.

HENRY SCHEIN, INC.

6.16.

3M COMPANY

7.

METHODOLOGY & SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET 2019-2027 ($ MILLION)

TABLE 2 PATENTS FOR DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT

TABLE 3 AVERAGE COSTS OF

DENTAL TREATMENTS ($)

TABLE 4 COST OF DENTAL

SURGERY DEVICES ($)

TABLE 5 POPULATION

PROJECTION

TABLE 6 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET BY DEVICE 2019-2027 ($ MILLION)

TABLE 7 MERITS OF DELIVERY

SYSTEMS

TABLE 8 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET IN CAD/CAM SYSTEM BY TYPE 2019-2027 ($

MILLION)

TABLE 9 ADVANTAGES AND

DISADVANTAGES OF CHAIRSIDE CAD/CAM SYSTEM

TABLE 10 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET IN DENTAL RADIOLOGY EQUIPMENT BY TYPE

2019-2027 ($ MILLION)

TABLE 11 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET IN DENTAL SCALING UNIT MARKET

2019-2027 ($ MILLION)

TABLE 12 CHOOSING THE RIGHT

LIGHT SOURCE

TABLE 13 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET IN DENTAL LASERS BY TYPE 2019-2027 ($

MILLION)

TABLE 14 USAGE OF LASERS IN

SOFT TISSUE SURGERY

TABLE 15 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET 2019-2027 ($ MILLION)

TABLE 16 ASIA-PACIFIC DENTAL

DIAGNOSTIC AND SURGICAL EQUIPMENT MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 17 DENTAL COSTS IN INDIA

FIGURE 1 ASIA-PACIFIC DENTAL DIAGNOSTIC AND

SURGICAL EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 2 ASIA-PACIFIC DENTAL DIAGNOSTIC AND

SURGICAL EQUIPMENT MARKET IN INSTRUMENT DELIVERY SYSTEM 2019-2027 ($ MILLION)

FIGURE 3 ASIA-PACIFIC DENTAL DIAGNOSTIC AND

SURGICAL EQUIPMENT MARKET IN CAD/CAM SYSTEMS 2019-2027 ($ MILLION)

FIGURE 4 ASIA-PACIFIC CAD/CAM SYSTEM MARKET IN FULL

IN-LAB SYSTEMS 2019-2027 ($ MILLION)

FIGURE 5 ASIA-PACIFIC CAD/CAM SYSTEM MARKET IN

STAND-ALONE SCANNERS 2019-2027 ($ MILLION)

FIGURE 6 ASIA-PACIFIC CAD/CAM SYSTEM MARKET IN

CHAIRSIDE SYSTEMS 2019-2027 ($ MILLION)

FIGURE 7 ASIA-PACIFIC DENTAL DIAGNOSTIC AND

SURGICAL EQUIPMENT MARKET IN DENTAL CHAIRS 2019-2027 ($ MILLION)

FIGURE 8 ASIA-PACIFIC DENTAL DIAGNOSTIC AND

SURGICAL EQUIPMENT MARKET IN DENTAL RADIOLOGY EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 9 EXTRAORAL RADIOLOGY EQUIPMENT BY TYPE IN

2018 (%)

FIGURE 10 ASIA-PACIFIC DENTAL RADIOLOGY EQUIPMENT IN

EXTRAORAL RADIOLOGY EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 11 INTRAORAL RADIOLOGY EQUIPMENT BY TYPE IN 2018

(%)

FIGURE 12 ASIA-PACIFIC DENTAL RADIOLOGY EQUIPMENT

MARKET IN INTRAORAL RADIOLOGY EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 13 ASIA-PACIFIC DENTAL RADIOLOGY EQUIPMENT

MARKET IN CONE BEAM COMPUTED TOMOGRAPHY SCANNERS 2019-2027 ($ MILLION)

FIGURE 14 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN SCALING UNIT 2019-2027 ($ MILLION)

FIGURE 15 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN LIGHT CURE EQUIPMENT 2019-2027 ($ MILLION)

FIGURE 16 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL LASERS 2019-2027 ($ MILLION)

FIGURE 17 ASIA-PACIFIC DENTAL LASERS MARKET IN SOFT

TISSUE LASERS 2019-2027 ($ MILLION)

FIGURE 18 CO2 LASER SOFT TISSUE APPLICATIONS

FIGURE 19 ASIA-PACIFIC DENTAL LASERS MARKET IN

HARD/SOFT TISSUE LASER 2019-2027 ($ MILLION)

FIGURE 20 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL HANDPIECES 2019-2027 ($ MILLION)

FIGURE 21 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN HOSPITALS 2019-2027 ($ MILLION)

FIGURE 22 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DENTAL CLINICS 2019-2027 ($ MILLION)

FIGURE 23 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN DIAGNOSTIC CENTERS 2019-2027 ($ MILLION)

FIGURE 24 ASIA-PACIFIC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET IN OTHER END-USERS 2019-2027 ($ MILLION)

FIGURE 25 AGING POPULATION IN ASIA-PACIFIC (%)

FIGURE 26 INDIA DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 27 CHINA DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 28 JAPAN POPULATION (MILLION) 2012-2016

FIGURE 29 JAPAN DENTAL DIAGNOSTIC AND SURGICAL EQUIPMENT

MARKET 2019-2027 ($ MILLION)

FIGURE 30 SOUTH KOREA DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 31 AUSTRALIA & NEW ZEALAND DENTAL DIAGNOSTIC

AND SURGICAL EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 32 ASEAN COUNTRIES DENTAL DIAGNOSTIC AND

SURGICAL EQUIPMENT MARKET 2019-2027 ($ MILLION)

FIGURE 33 REST OF APAC DENTAL DIAGNOSTIC AND SURGICAL

EQUIPMENT MARKET 2019-2027 ($ MILLION)