Market By Type, Application, Technology And Geography | Forecast 2019-2027

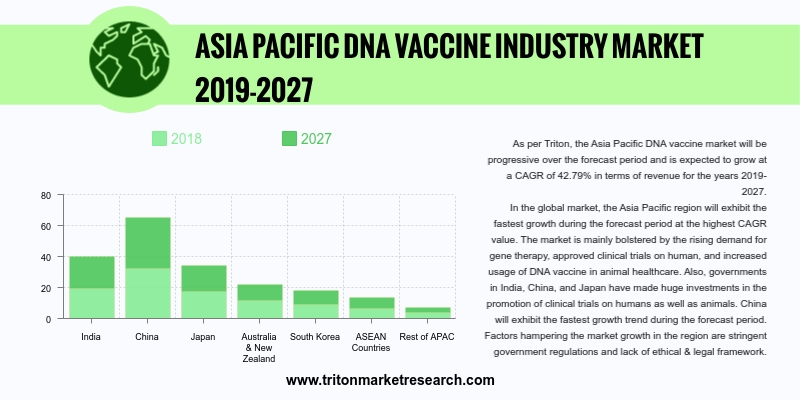

Triton’s report on the Asia Pacific DNA vaccines market proclaims that the market is progressing rapidly and is expected to grow at a CAGR of 42.79% over the forecast period 2019-2027.

The countries that have been studied in the Asia-Pacific DNA vaccines market are:

• China

• India

• Japan

• South Korea

• Australia & New Zealand

• ASEAN countries

• Rest of Asia-Pacific

The Asia-Pacific DNA vaccines market is primarily driven by a number of key drivers, including the rising investments in DNA vaccine research & development, particularly in third-generation vaccination technology, as well as the increasing number of clinical trials, extensive government support, well-established healthcare facilities and healthcare infrastructure. Some other major DNA vaccines market drivers for this region include, the growing target population base with significant unmet clinical requirements, increasing disposable income and the increasing awareness related to the merits of vaccination in developing countries. Some of the primary clinical applications of DNA vaccine include the use of DNA vaccine for treatment trial of human immunodeficiency virus type 1 (HIV-1), DNA vaccination trials for the treatment of hepatitis, human papillomavirus (HPV), influenza, other HIV-1 antigens, and malaria.

We provide additional customization based on your specific requirements. Request For Customization

The support of the Japanese government for conducting clinical trials for the development of DNA vaccines is primarily boosting the DNA vaccines market growth in the country. The per capita healthcare expenditure in Japan grew from nearly $3,861 in 2015 to about $4,356 in 2016. The growing healthcare expenditure in the country, coupled with government initiatives to boost the DNA vaccine clinical trials in the country are expected to drive the Japan DNA vaccines market growth. On November 8, 2016, GlaxoSmithKline sponsored the development of Herpes zoster vaccine coded GSK1437173A. It is a DNA vaccine to treat the Herpes Zoster condition. Therefore, it is safe to say that extensive clinical trials performed for DNA vaccines are expected to boost the Japan DNA vaccines market growth.

Astellas Pharma, Inc. is a Japanese pharmaceutical company, headquartered in Tokyo. The company is mainly engaged in the manufacture and worldwide imports/exports of pharmaceutical products. It generally focuses on oncology, urology, neuroscience, nephrology and immunology as arranged therapeutic areas through its discovery research that is leveraging new technologies/modalities and advancing novel therapeutic areas. Astellas Pharma generated a revenue of $12.61 billion in 2016. The company also has a global presence in more than 50 countries across the globe.

1.

ASIA-PACIFIC DNA VACCINES MARKET -

SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREATS OF SUBSTITUTE PRODUCT

2.2.3.

BARGAINING POWER OF BUYER

2.2.4.

BARGAINING POWER OF SUPPLIER

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. VALUE CHAIN OUTLOOK

2.5. KEY INSIGHTS

2.6. REGULATORY FRAMEWORK

2.7. KEY BUYING OUTLOOK

2.8. MARKET DRIVERS

2.8.1.

SURGE IN NEW VACCINE DEVELOPMENT

2.8.2.

RISE IN THE USAGE OF DNA VACCINES FOR ANIMAL HEALTHCARE

2.8.3.

RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES

2.9. MARKET RESTRAINTS

2.9.1.

LACK OF LEGAL AND ETHICAL FRAMEWORK

2.9.2.

STRINGENT GOVERNMENT REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

GROWING DEMAND FOR GENE THERAPY

2.10.2.

STEADY VACCINES ARE EASY TO STORE

AND TRANSPORT

2.10.3.

INCREASING NUMBER OF CLINICAL TRIALS ON HUMANS

2.11.

MARKET CHALLENGES

2.11.1.

VARIATION IN THE REGULATORY PATHWAY AND THE POINTS OF CONSIDERATION

REGARDING ENVIRONMENTAL VALUATION

3.

DNA VACCINES MARKET OUTLOOK - BY TYPE

3.1. ANIMAL DNA VACCINE

3.2. HUMAN DNA VACCINE

4.

DNA VACCINES MARKET OUTLOOK - BY APPLICATION

4.1. HUMAN DISEASE

4.2. VETERINARY DISEASE

5.

DNA VACCINES MARKET OUTLOOK - BY TECHNOLOGY

5.1. PLASMID DNA VACCINES

5.2. PLASMID DNA DELIVERY

6.

DNA VACCINES MARKET OUTLOOK - BY REGION

6.1. ASIA-PACIFIC

6.1.1.

COUNTRY ANALYSIS

6.1.1.1.

INDIA

6.1.1.2.

CHINA

6.1.1.3.

JAPAN

6.1.1.4.

AUSTRALIA & NEW ZEALAND

6.1.1.5.

SOUTH KOREA

6.1.1.6.

ASEAN COUNTRIES

6.1.1.7.

REST OF ASIA-PACIFIC

7.

COMPETITIVE LANDSCAPE

7.1. ASTELLAS PHARMA, INC.

7.2. DENDREON CORPORATION (ACQUIRED BY SANPOWER

GROUP)

7.3. ELI LILLY AND COMPANY

7.4. EUROGENTEC S.A.

7.5. GLAXOSMITHKLINE, INC.

7.6. INOVIO PHARMACEUTICALS, INC.

7.7. MADISON VACCINES, INCORPORATED (MVI)

7.8. MERCK & CO.

7.9. MERIAL LIMITED (ACQUIRED BY BOEHRINGER

INGELHEIM)

7.10.

NOVARTIS AG

7.11.

SANOFI

7.12.

VGXI

7.13.

VICAL, INCORPORATED

7.14.

XENETIC BIOSCIENCES, INC.

7.15.

ZOETIS, INC.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 ASIA-PACIFIC DNA

VACCINES MARKET 2019-2027 ($ MILLION)

TABLE 2 INTERVENTION AND

PHASE OF SOME DISEASES/CONDITIONS

TABLE 3 REGULATIONS TO

FOLLOW BEFORE COMMERCIALIZATION

TABLE 4 TEMPERATURE

REQUIREMENT IN PRESERVATION FOR VARIOUS VACCINES

TABLE 5 APPROACHES BEING

TESTED TO ENHANCE THE LOW IMMUNOGENICITY

TABLE 6 CLINICAL TRIALS ON

HUMANS INVOLVING DNA VACCINES

TABLE 7 ASIA-PACIFIC DNA

VACCINES MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 8 ASIA-PACIFIC DNA

VACCINES MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 9 ASIA-PACIFIC DNA

VACCINES MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 10 ASIA-PACIFIC DNA

VACCINES MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 ASIA-PACIFIC DNA

VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 2 VALUE CHAIN ANALYSIS

FOR DNA VACCINE INDUSTRY

FIGURE 3 ASIA-PACIFIC DNA

VACCINES MARKET IN VETERINARY DISEASES 2019-2027 ($ MILLION)

FIGURE 4 CLINICAL TRIALS OF

GENE THERAPY

FIGURE 5 ASIA-PACIFIC DNA

VACCINES MARKET IN ANIMAL DNA VACCINES 2019-2027 ($ MILLION)

FIGURE 6 ASIA-PACIFIC DNA

VACCINES MARKET IN HUMAN DNA VACCINES 2019-2027 ($ MILLION)

FIGURE 7 ASIA-PACIFIC DNA

VACCINES MARKET SHARE BY APPLICATION 2018 & 2026 (%)

FIGURE 8 ASIA-PACIFIC DNA

VACCINES MARKET IN HUMAN DISEASES 2019-2027 ($ MILLION)

FIGURE 9 ASIA-PACIFIC DNA

VACCINES MARKET IN VETERINARY DISEASES 2019-2027 ($ MILLION)

FIGURE 10 ASIA-PACIFIC DNA

VACCINES MARKET IN PLASMID DNA VACCINES TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 11 ASIA-PACIFIC DNA

VACCINES MARKET IN PLASMID DNA DELIVERY TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 12 INDIA DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 13 CHINA DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 14 JAPAN DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 15 AUSTRALIA & NEW

ZEALAND DNA VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 16 SOUTH KOREA DNA

VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 17 ASEAN COUNTRIES DNA

VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 18 REST OF ASIA-PACIFIC

DNA VACCINES MARKET 2019-2027 ($ MILLION)