Market By Vehicle Type, Power Source, Technology And Geography | Forecasts 2019-2027

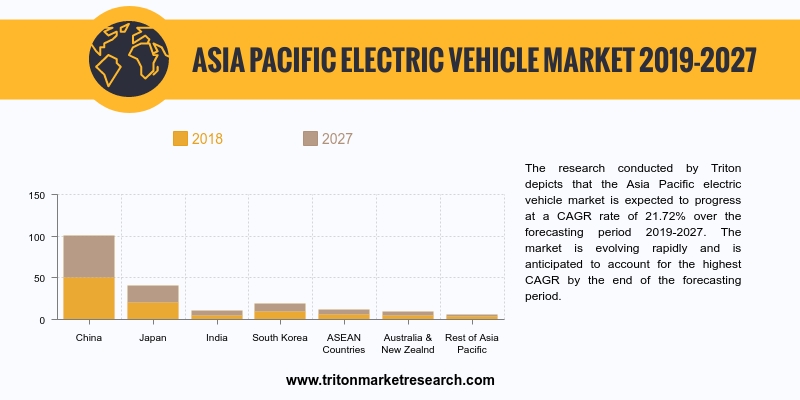

The research conducted by Triton depicts that the Asia Pacific electric vehicle market is expected to progress at a CAGR rate of 21.71% over the forecasting period 2019-2027. The market is evolving rapidly and is anticipated to account for the highest CAGR by the end of the forecasting period.

The economies studied in the Asia Pacific electric vehicle market are:

• China

• Japan

• India

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of Asia Pacific

Report scope can be customized per your requirements. Request For Customization

The market of electric vehicle report is divided into vehicle type, power source and technology. India, China and South Korea are the key countries dominating the electric vehicle market in the Asia Pacific region. Amongst, China reigns the electric vehicle market in the Asia Pacific region and has the largest market share in terms of revenue. China leads the electric vehicle market in the Asia Pacific region due to increasing adoption rates of smart mobility services, the increasing government initiatives and increasing fuel rates.

The electric vehicle market report from Triton provides detailed information about the market sizing and forecasting of electric vehicle market in the Asia Pacific region. This report also provides the necessary information about the market definition, key insights, introduction, evolution & transition of electric vehicle, Porter's five force analysis, market attractiveness matrix, industry components, regulatory framework, key impact analysis, market opportunity insights, industry player positioning, key market strategies and vendor scorecard.

Electric vehicle market in Asia Pacific region is driven by factors such as proactive government policies, the cost-effectiveness of the electric vehicle as compared to their gas-powered counterparts and increasing per capita income. However, the factors causing an obstacle to the growth of the electric vehicle market are the high cost and the scarcity of charging stations for electric vehicles.

1. ASIA

PACIFIC ELECTRIC VEHICLE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. INTRODUCTION:

ELECTRIC VEHICLES

2.4. EVOLUTION

& TRANSITION OF ELECTRIC VEHICLE

2.5. PORTER'S

FIVE FORCE ANALYSIS

2.6. MARKET

ATTRACTIVENESS MATRIX

2.7. INDUSTRY

COMPONENTS

2.8. REGULATORY

FRAMEWORK

2.9. VENDOR

SCORECARD

2.10.

KEY IMPACT ANALYSIS

2.11.

MARKET OPPORTUNITY INSIGHTS

2.12.

INDUSTRY PLAYER POSITIONING

2.13.

KEY MARKET STRATEGIES

2.14.

MARKET DRIVERS

2.14.1.

PROACTIVE GOVERNMENT POLICIES

TO PROMOTE THE USE OF ELECTRIC VEHICLES

2.14.2.

COST-EFFECTIVENESS

OF ELECTRIC VEHICLES OVER THEIR GAS POWERED COUNTERPARTS

2.14.3.

TRANSPORT CONTRIBUTING TO THE GREENHOUSE

GAS (GHG) EMISSIONS, AIR POLLUTION & ENERGY CONSUMPTION

2.14.4.

INCREASING PER CAPITA INCOME

2.15.

MARKET RESTRAINTS

2.15.1.

LACK OF ELECTRIC VEHICLES

CHARGING STATIONS

2.15.2.

HIGH COST OF ELECTRIC VEHICLES

2.16.

MARKET OPPORTUNITIES

2.16.1.

RISE IN LITHIUM-ION BATTERY

PRODUCTION CAPACITIES

2.16.2.

GOVERNMENT INITIATIVES TO

LIMIT GREENHOUSE GASES

2.16.3.

INCREASED RESEARCH &

DEVELOPMENT EXPENDITURE TOWARDS DEVELOPMENT OF EV’S

2.17.

MARKET CHALLENGES

2.17.1.

LACK OF PUBLIC AWARENESS

2.17.2.

PERFORMANCE ISSUES

3. ELECTRIC

VEHICLE INDUSTRY OUTLOOK - BY VEHICLE TYPE

3.1. COMMERCIAL

VEHICLES

3.2. PASSENGER

CARS

3.3. TWO

WHEELERS

3.4. OTHER

VEHICLES

4. ELECTRIC

VEHICLE INDUSTRY OUTLOOK - BY POWER SOURCE

4.1. STORED

ELECTRICITY

4.2. ON

BOARD ELECTRICITY GENERATOR

5. ELECTRIC

VEHICLE INDUSTRY OUTLOOK - BY TECHNOLOGY

5.1. HYBRID

ELECTRIC VEHICLE

5.2. BATTERY

ELECTRICAL VEHICLES

5.3. PLUG-IN

HYBRID ELECTRICAL VEHICLE

6. ELECTRIC

VEHICLE INDUSTRY - ASIA PACIFIC

6.1. CHINA

6.2. JAPAN

6.3. INDIA

6.4. SOUTH

KOREA

6.5. ASEAN

COUNTRIES

6.6. AUSTRALIA

AND NEW ZEALAND

6.7. REST

OF ASIA PACIFIC

7. COMPETITIVE

LANDSCAPE

7.1. BAYERISCHE

MOTOREN WERKE AG

7.2. BYD

COMPANY LTD

7.3. DAIMLER

AG

7.4. FIAT

CHRYSLER AUTOMOBILES N.V

7.5. FORD

MOTOR COMPANY

7.6. GENERAL

MOTORS COMPANY

7.7. GROUPE

PSA

7.8. HONDA

MOTOR COMPANY

7.9. HYUNDAI

MOTOR

7.10.

MITSUBISHI

7.11.

NISSAN MOTOR CO., LTD.

7.12.

TESLA MOTORS, INC.

7.13.

TOYOTA INDUSTRIES CORPORATION

7.14.

VOLKSWAGEN AG

7.15.

ZHEJIANG GEELY HOLDING GROUP

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1. MARKET

ATTRACTIVENESS MATRIX FOR ELECTRIC VEHICLE MARKET

TABLE 2. VENDOR

SCORECARD OF ELECTRIC VEHICLE MARKET

TABLE 3. REGULATORY

FRAMEWORK OF ELECTRIC VEHICLE MARKET

TABLE 4. KEY STRATEGIC

DEVELOPMENTS IN ELECTRIC VEHICLE MARKET

TABLE 5. BENEFITS &

LIMITATIONS OF ELECTRIC VEHICLES

TABLE 6. WORLDWIDE

LITHIUM-ION BATTERY PRODUCTION CAPACITY (GWH)

TABLE 7. COST

COMPARISON OF EV’S TO THEIR GAS-POWERED COUNTERPART

TABLE 8. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 9. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2019-2027 (IN $ MILLION)

TABLE 10. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY POWER SOURCE, 2019-2027 (IN $ MILLION)

TABLE 11. ASIA

PACIFIC ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2019-2027 (IN $ MILLION)

FIGURE 1. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 2. PORTER’S FIVE

FORCE ANALYSIS OF ELECTRIC VEHICLE MARKET

FIGURE 3. KEY IMPACT

ANALYSIS

FIGURE 4. TIMELINE OF

ELECTRIC VEHICLE

FIGURE 5. MARKET

OPPORTUNITY INSIGHTS, BY VEHICLE TYPE, 2018

FIGURE 6. INDUSTRY

COMPONENTS OF ELECTRIC VEHICLE MARKET

FIGURE 7. KEY PLAYER

POSITIONING IN 2018 (%)

FIGURE 8. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY COMMERCIAL VEHICLES, 2019-2027 (IN $ MILLION)

FIGURE 9. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY PASSENGER CARS, 2019-2027 (IN $ MILLION)

FIGURE 10. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY TWO WHEELERS, 2019-2027 (IN $ MILLION)

FIGURE 11. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY OTHER VEHICLES, 2019-2027 (IN $ MILLION)

FIGURE 12. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY POWER SOURCE, 2018 & 2027 (IN %)

FIGURE 13. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY STORED ELECTRICITY, 2019-2027 (IN $ MILLION)

FIGURE 14. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY ON BOARD ELECTRICITY GENERATOR, 2019-2027 (IN $

MILLION)

FIGURE 15. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY TECHNOLOGY, 2018 & 2027 (IN %)

FIGURE 16. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY HYBRID ELECTRIC VEHICLE, 2019-2027 (IN $ MILLION)

FIGURE 17. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY BATTERY ELECTRICAL VEHICLES, 2019-2027 (IN $

MILLION)

FIGURE 18. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, BY PLUG-IN HYBRID ELECTRICAL VEHICLE, 2019-2027 (IN $

MILLION)

FIGURE 19. ASIA PACIFIC

ELECTRIC VEHICLE MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 20. CHINA

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21. JAPAN

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22. INDIA

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23. SOUTH KOREA

ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24. ASEAN

COUNTRIES ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25. AUSTRALIA

& NEW ZEALAND ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26. REST OF

ASIA-PACIFIC ELECTRIC VEHICLE MARKET, 2019-2027 (IN $ MILLION)