Market By Delivery Model, End User, Solutions And Geography | Forecast 2019-2027

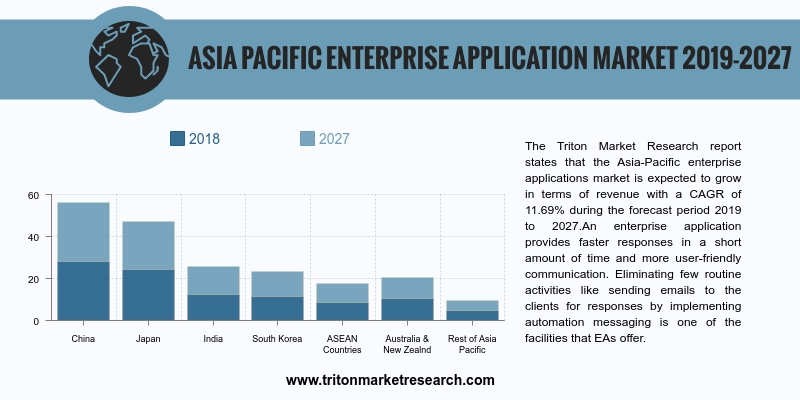

The Triton Market Research report states that the Asia-Pacific enterprise applications market is expected to grow in terms of revenue with a CAGR of 11.69% during the forecast period 2019 to 2027.

The countries that have been considered in the Asia-Pacific enterprise application market are:

O India

O China

O South Korea

O Japan

O Australia & New Zealand

O ASEAN countries

O Rest of APAC

We provide additional customization based on your specific requirements. Request For Customization

An enterprise application provides faster responses in a short amount of time and more user-friendly communication. Eliminating few routine activities like sending emails to the clients for responses by implementing automation messaging is one of the facilities that EAs offer. With the help of remote monitoring and controlling capabilities, it also enables employees to access data from anywhere, even while working away from the office.

Several enterprises are putting in efforts to enhance customer services. Enterprise software’s are known for its user-friendly interface. In order to have a better understanding of their client’s requirement, Enterprises feel the need to have more interactions with them. This is primarily because enhancing client satisfaction is key to sustaining the competitive business environment. Thus, the customer-oriented approach of the organization acts as a major driver for the market.

Data security is one of the biggest challenges that the SaaS-based Enterprise Applications market. Faces. The vendors in this market handle extremely sensitive client information. Hence, many enterprises are concerned about their data being misused by third parties. The SaaS-based vendors act as third parties, that manage the enterprise-wide data, which poses a serious concern for the managers and decision makers of enterprises that make use of the SaaS-based software. Hence, the misuse of any data by SaaS-based software providers may negatively affect the growth of the market.

The Asia-Pacific enterprise application market has been segregated by Delivery Model (On-Premises and Cloud), End Users (Manufacturing & Services, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Government, Aerospace & Defense, Telecom and Other End Users) and Solutions (Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Supply Chain Management (SCM), Business Intelligence, Business Process Management, Content Management System, Enterprise Asset Management, Web Conferencing and Other Applications)

The Triton report on the Asia-Pacific enterprise applications market gives a detailed analysis of the market attractiveness index, Porter’s five force analysis, vendor scorecard, key insights regarding the industry, market definition, industry components and key impact analysis.

1. ASIA-PACIFIC

ENTERPRISE APPLICATION MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY INSIGHTS

2.2.1. INCREASING

FOCUS ON REAL-TIME DECISION-MAKING

2.2.2. INORGANIC

GROWTH THROUGH ACQUISITIONS IS PREFERRED GROWTH STRATEGY

2.2.3. ASIA-PACIFIC

TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

2.2.4. ON

PREMISE SEGMENT LEADS THE DELIVERY MODEL SEGMENT

2.2.5. GROWING

INTEREST TOWARDS CLOUD BASED ENTERPRISE APPLICATIONS

2.3. PORTERS

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. CUSTOMER

CENTRIC APPROACH

2.4.2. COMPETITIVE

ADVANTAGES

2.4.3. EMERGING

TRENDS OF CLOUD

2.4.4. HIGHER

COST

2.4.5. OPEN

SOURCE APPLICATION

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

COMPONENTS

2.7.1. ELEMENT

PROVIDERS

2.7.2. APPLICATION

DEVELOPERS

2.7.3. DISTRIBUTION

CHANNEL

2.8. MARKET

DRIVERS

2.8.1. BUSINESS

SPECIFIC ADVANTAGES OFFERED BY ENTERPRISE APPLICATIONS

2.8.2. GROWING

DEMAND FOR REAL-TIME DATA ACCESS

2.8.3. CUSTOMER

ORIENTED APPROACH OF ENTERPRISES

2.8.4. EMERGENCE

OF CLOUD COMPUTING & MOBILE APPLICATIONS

2.9. MARKET

RESTRAINTS

2.9.1. COMPLEXITIES

IN DATA MIGRATION

2.9.2. DATA

SECURITY AND PRIVACY CONCERNS

2.9.3. COSTS

ASSOCIATED WITH ENTERPRISE APPLICATIONS

2.9.4. LACK

OF CONTROL AND FLEXIBILITY OVER CLOUD BASED ENTERPRISE APPLICATION SOFTWARE

2.10.

MARKET OPPORTUNITIES

2.10.1.

TRANSFORMING OR EVOLVING BUSINESS MODELS

2.10.2.

INCREASED ADOPTION FROM SMALL & MEDIUM-SIZED

ENTERPRISES

2.10.3.

GLOBALIZATION OF BUSINESS

2.11.

MARKET CHALLENGES

2.11.1.

OPEN SOURCE & FREEWARE APPLICATIONS

2.11.2.

LACK OF SKILLED PROFESSIONALS

3. ASIA-PACIFIC

ENTERPRISE APPLICATION MARKET OUTLOOK - BY DELIVERY MODEL

3.1. ON-PREMISES

3.2. CLOUD

4. ASIA-PACIFIC

ENTERPRISE APPLICATION MARKET OUTLOOK - BY END USER

4.1. MANUFACTURING

& SERVICES

4.2. BANKING,

FINANCIAL SERVICES & INSURANCE (BFSI)

4.3. HEALTHCARE

4.4. RETAIL

4.5. GOVERNMENT

4.6. AEROSPACE

& DEFENSE

4.7. TELECOMMUNICATIONS

4.8. OTHER

END USERS

5. ASIA-PACIFIC

ENTERPRISE APPLICATION MARKET OUTLOOK - BY SOLUTIONS

5.1. CUSTOMER

RELATIONSHIP MANAGEMENT (CRM)

5.2. ENTERPRISE

RESOURCE PLANNING (ERP)

5.3. SUPPLY

CHAIN MANAGEMENT (SCM)

5.4. WEB

CONFERENCING

5.5. BUSINESS

INTELLIGENCE (BI)

5.6. BUSINESS

PROCESS MANAGEMENT (BPM)

5.7. CONTENT

MANAGEMENT SYSTEM (CMS)

5.8. ENTERPRISE

ASSET MANAGEMENT (EAM)

5.9. OTHER

SOLUTIONS

6. ASIA-PACIFIC

ENTERPRISE APPLICATION MARKET - REGIONAL OUTLOOK

6.1. CHINA

6.2. JAPAN

6.3. INDIA

6.4. SOUTH

KOREA

6.5. ASEAN

COUNTRIES

6.6. AUSTRALIA

& NEW ZEALAND

6.7. REST

OF ASIA-PACIFIC

7. COMPETITIVE

LANDSCAPE

7.1. EPICOR

SOFTWARE CORPORATION

7.2. HEWLETT

PACKARD ENTERPRISE COMPANY

7.3. INDUSTRIAL

& FINANCIAL SYSTEMS, AB (IFS)

7.4. INFOR,

INC

7.5. INTERNATIONAL

BUSINESS MACHINES CORPORATION (IBM)

7.6. MICROSOFT

CORPORATION

7.7. ORACLE

CORPORATION

7.8. QAD,

INC

7.9. SALESFORCE.COM,

INC

7.10.

SAP SE

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.1.2. SCOPE

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY

COUNTRY, 2019-2027 (IN $ BILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY

COUNTRY, 2019-2027 (IN $ BILLION)

TABLE 5: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY

DELIVERY MODEL, 2019-2027 (IN $ BILLION)

TABLE 6: ADVANTAGES OF ON-PREMISES MODEL

TABLE 7: ADVANTAGES OF CLOUD BASED MODEL

TABLE 8: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY END

USER, 2019-2027 (IN $ BILLION)

TABLE 9: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY

SOLUTIONS, 2019-2027 (IN $ BILLION)

FIGURE

1: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY SOLUTIONS, 2018 & 2027

(IN %)

FIGURE

2: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

3: KEY BUYING IMPACT ANALYSIS

FIGURE

4: INDUSTRY COMPONENTS

FIGURE

5: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY ON-PREMISES, 2019-2027 (IN $

BILLION)

FIGURE

6: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY CLOUD, 2019-2027 (IN $

BILLION)

FIGURE

7: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY MANUFACTURING & SERVICES,

2019-2027 (IN $ BILLION)

FIGURE

8: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY BANKING, FINANCIAL SERVICES

& INSURANCE (BFSI), 2019-2027 (IN $ BILLION)

FIGURE

9: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY HEALTHCARE, 2019-2027 (IN $

BILLION)

FIGURE

10: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY RETAIL, 2019-2027 (IN $

BILLION)

FIGURE

11: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY GOVERNMENT, 2019-2027 (IN $

BILLION)

FIGURE

12: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY AEROSPACE & DEFENSE,

2019-2027 (IN $ BILLION)

FIGURE

13: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY TELECOMMUNICATIONS,

2019-2027 (IN $ BILLION)

FIGURE

14: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY OTHER END USERS, 2019-2027 (IN

$ BILLION)

FIGURE

15: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY CUSTOMER RELATIONSHIP

MANAGEMENT (CRM), 2019-2027 (IN $ BILLION)

FIGURE

16: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY ENTERPRISE RESOURCE PLANNING

(ERP), 2019-2027 (IN $ BILLION)

FIGURE

17: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY SUPPLY CHAIN MANAGEMENT

(SCM), 2019-2027 (IN $ BILLION)

FIGURE

18: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY WEB CONFERENCING, 2019-2027

(IN $ BILLION)

FIGURE

19: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY BUSINESS INTELLIGENCE (BI),

2019-2027 (IN $ BILLION)

FIGURE

20: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY BUSINESS PROCESS MANAGEMENT

(BPM), 2019-2027 (IN $ BILLION)

FIGURE

21: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY CONTENT MANAGEMENT SYSTEM

(CMS), 2019-2027 (IN $ BILLION)

FIGURE

22: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY ENTERPRISE ASSET MANAGEMENT

(EAM), 2019-2027 (IN $ BILLION)

FIGURE

23: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, BY OTHER SOLUTIONS, 2019-2027

(IN $ BILLION)

FIGURE

24: ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, REGIONAL OUTLOOK, 2018 &

2027 (IN %)

FIGURE

25: CHINA ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

26: SOFTWARE AS A SERVICE (SAAS) MARKET IN CHINA, 2015-2019 (IN $ MILLION)

FIGURE

27: JAPAN ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

28: SAAS SALES IN JAPAN 2016 (IN %)

FIGURE

29: INDIA ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

30: SOUTH KOREA ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

31: ASEAN COUNTRIES ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $ BILLION)

FIGURE

32: AUSTRALIA & NEW ZEALAND ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $

BILLION)

FIGURE

33: REST OF ASIA-PACIFIC ENTERPRISE APPLICATION MARKET, 2019-2027 (IN $

BILLION)