Market By Resolution, Spectrum, Frame Rate, Component, Application And Geography | Forecast 2019-2027

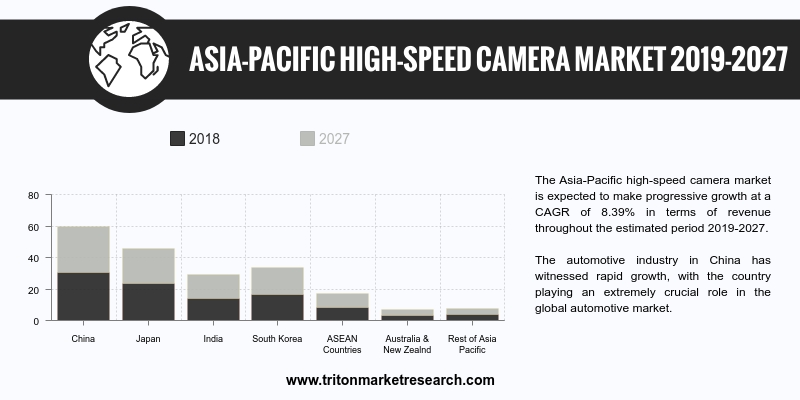

The Asia-Pacific high-speed camera market is expected to make progressive growth at a CAGR of 8.39% in terms of revenue throughout the estimated period 2019-2027.

The countries that have been studied in the Asia-Pacific high-speed camera market are:

• China

• Japan

• India

• South Korea

• ASEAN Countries

• Australia & New Zealand

• Rest of Asia-Pacific

The automotive industry in China has witnessed rapid growth, with the country playing an extremely crucial role in the global automotive market. The Ministry of Industry and Information Technology (MIIT) states that the countrywide automotive sales in China broke through the benchmark of 28 million in 2016, ranking first globally for eight consecutive years. High-speed cameras are used for vehicle impact testing, material handling, airbag deployment testing, and combustion testing. The usage of the high-speed camera provides precise detailing during these automotive testing to eliminate any failures or faults on the testing procedures. The automotive industry is among the largest adopters of high-speed cameras. The growing automotive market shows promising trends for high-speed camera market.

Besides, China makes use of next-gen speed cameras to catch rash drivers. These cameras installed at roadsides help in catching speeding drivers, which can be determined just by looking at the any irregularities in the paintwork or scratches on their car. The camera network is facilitated with AI, which helps in differentiating between cars by spotting any minute differences between them. The AI-enabled camera system is a part of Sky Net operation, which is China’s anti-corruption program, primarily aimed at tracking down fugitives. China is reported to have 170 million surveillance cameras. The country hopes to achieve a target of 570 million high-speed cameras in the year 2020 in order to develop a database that would be able to identify any citizen within three seconds.

iX Cameras, Inc. is a technology & product company that specializes in the field of high-speed imaging. The company designs, builds and sells ultra-fast cameras and software for a broad range of advanced applications for scientific research. For over a decade, Olympus developed and sold thousands of i-SPEED brand cameras, until the spinoff of the product development group came into existence in 2014. In the same way, iX Cameras continues to design innovative, state-of-the-art i-SPEED cameras. The company operates in the United Kingdom, United States, China and India.

1. ASIA-PACIFIC HIGH-SPEED CAMERA MARKET -

SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

VARIOUS APPLICATIONS OF HIGH-SPEED CAMERAS IN AUTOMOTIVE INDUSTRY

2.2.2.

USE OF HIGH-SPEED CAMERA HAS BEEN INCREASING RAPIDLY IN THE MEDIA &

ENTERTAINMENT INDUSTRY

2.2.3.

INCREASED INCORPORATION OF HIGH-SPEED IMAGING DEVICES FOR PRODUCT

DEVELOPMENT AND PROCESS OPTIMIZATION

2.2.4.

INCREASE IN USAGE OF HIGH-SPEED CAMERA IN SPORTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

COST

2.4.2.

FRAME RATE

2.4.3.

VIDEO STORAGE

2.4.4.

EVENT DURATION

2.4.5.

SUPPORT AND SERVICE

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

ADVANCEMENTS IN THE FIELD OF SEMICONDUCTOR TECHNOLOGIES EMPOWERING

HIGH-SPEED CAMERA

2.7.2.

INCREASED DEMAND FOR HIGH-SPEED CAMERA FOR RESEARCH AND DEVELOPMENT

2.7.3.

INCREASED AVAILABILITY OF ELECTRONIC & OPTIC COMPONENTS

2.8. MARKET RESTRAINTS

2.8.1.

STORAGE CAPACITY A MAJOR LIMITATION TO PROLONGED USE OF HIGH-SPEED

CAMERAS

2.9. MARKET OPPORTUNITIES

2.9.1.

GROWTH IN USAGE OF HIGH-SPEED CAMERAS IN INTELLIGENT TRANSPORTATION

SYSTEM (ITS)

2.9.2.

LUCRATIVE OPPORTUNITIES FROM AEROSPACE, DEFENSE & MANUFACTURING

SECTORS

2.10. MARKET CHALLENGES

2.10.1.

HIGH COST OF HIGH-SPEED CAMERAS REDUCES THE CONSUMER BASE

3. ASIA-PACIFIC HIGH-SPEED CAMERA MARKET OUTLOOK

- BY RESOLUTION

3.1. 0-2 MEGAPIXEL

3.2. 2-5 MEGAPIXEL

3.3. GREATER THAN 5 MEGAPIXEL

4. ASIA-PACIFIC HIGH-SPEED CAMERA MARKET OUTLOOK

- BY SPECTRUM

4.1. VISIBLE RGB

4.2. INFRARED

4.3. X-RAY

5. ASIA-PACIFIC HIGH-SPEED CAMERA MARKET OUTLOOK

- BY FRAME RATE

5.1. 1000-5000 FRAMES PER SECOND

5.2. 5000-20000 FRAMES PER SECOND

5.3. 20000-100000 FRAMES PER SECOND

5.4. 100000+ FRAMES PER SECOND

6. ASIA-PACIFIC HIGH-SPEED CAMERA MARKET OUTLOOK

- BY COMPONENT

6.1. IMAGE SENSOR

6.2. PROCESSORS

6.3. LENS

6.4. MEMORY

6.5. FANS & COOLING

6.6. OTHERS

7. ASIA-PACIFIC HIGH-SPEED CAMERA MARKET OUTLOOK

- BY APPLICATION

7.1. AUTOMOTIVE & TRANSPORTATION

7.2. RETAIL

7.3. AEROSPACE & DEFENSE

7.4. HEALTHCARE

7.5. MEDIA & ENTERTAINMENT

7.6. OTHERS

8. ASIA-PACIFIC HIGH-SPEED CAMERA MARKET -

REGIONAL OUTLOOK

8.1. CHINA

8.2. JAPAN

8.3. INDIA

8.4. SOUTH KOREA

8.5. ASEAN COUNTRIES

8.6. AUSTRALIA & NEW ZEALAND

8.7. REST OF ASIA-PACIFIC

9. COMPETITIVE LANDSCAPE

9.1. AMETEK

9.2. AOS TECHNOLOGIES AG

9.3. DEL IMAGING SYSTEMS LLC

9.4. FASTEC IMAGING CORPORATION

9.5. HS VISION GMBH

9.6. INTEGRATED DESIGN TOOLS

9.7. IX CAMERAS, INC.

9.8. LAETUS GMBH

9.9. LUMENERA CORPORATION

9.10. MIKROTRON GMBH

9.11. OPTRONIS GMBH

9.12. PCO AG

9.13. PHOTOMETRICS

9.14. PHOTRON LTD.

9.15. WEISSCAM GMBH

10. RESEARCH METHODOLOGY & SCOPE

10.1. RESEARCH SCOPE & DELIVERABLES

10.2. SOURCES OF DATA

10.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 2019-2027

(IN $ MILLION)

TABLE 4: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 2019-2027

(IN $ MILLION)

TABLE 5: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 2019-2027

(IN $ MILLION)

TABLE 6: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY COMPONENT, 2019-2027

(IN $ MILLION)

TABLE 7: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY APPLICATION,

2019-2027 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: KEY BUYING IMPACT ANALYSIS

FIGURE 3: MARKET ATTRACTIVENESS INDEX

FIGURE 4: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY 0-2 MEGAPIXEL,

2019-2027 (IN $ MILLION)

FIGURE 5: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY 2-5 MEGAPIXEL,

2019-2027 (IN $ MILLION)

FIGURE 6: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY GREATER THAN 5

MEGAPIXEL, 2019-2027 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY VISIBLE RGB,

2019-2027 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY INFRARED, 2019-2027

(IN $ MILLION)

FIGURE 9: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY X-RAY, 2019-2027 (IN

$ MILLION)

FIGURE 10: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY 1000-5000 FPS,

2019-2027 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY 5000-20000 FPS,

2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY 20000-100000 FPS,

2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY 100000+ FPS, 2019-2027

(IN $ MILLION)

FIGURE 14: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY IMAGE SENSOR,

2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY PROCESSORS,

2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY LENS, 2019-2027 (IN

$ MILLION)

FIGURE 17: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY MEMORY, 2019-2027

(IN $ MILLION)

FIGURE 18: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY FANS & COOLING,

2019-2027 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY OTHERS, 2019-2027

(IN $ MILLION)

FIGURE 20: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY AUTOMOTIVE &

TRANSPORTATION, 2019-2027 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY RETAIL, 2019-2027

(IN $ MILLION)

FIGURE 22: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY AEROSPACE &

DEFENSE, 2019-2027 (IN $ MILLION)

FIGURE 23: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY HEALTHCARE,

2019-2027 (IN $ MILLION)

FIGURE 24: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY MEDIA &

ENTERTAINMENT, 2019-2027 (IN $ MILLION)

FIGURE 25: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, BY OTHERS, 2019-2027

(IN $ MILLION)

FIGURE 26: ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, REGIONAL OUTLOOK, 2018

& 2027 (IN %)

FIGURE 27: CHINA HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: JAPAN HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: INDIA HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: SOUTH KOREA HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $

MILLION)

FIGURE 31: ASEAN COUNTRIES HIGH-SPEED CAMERA MARKET, 2019-2027 (IN $

MILLION)

FIGURE 32: AUSTRALIA & NEW ZEALAND HIGH-SPEED CAMERA MARKET,

2019-2027 (IN $ MILLION)

FIGURE 33: REST OF ASIA-PACIFIC HIGH-SPEED CAMERA MARKET, 2019-2027 (IN

$ MILLION)