Market By Dosages, Formulation And Geography | Forecast 2019-2027

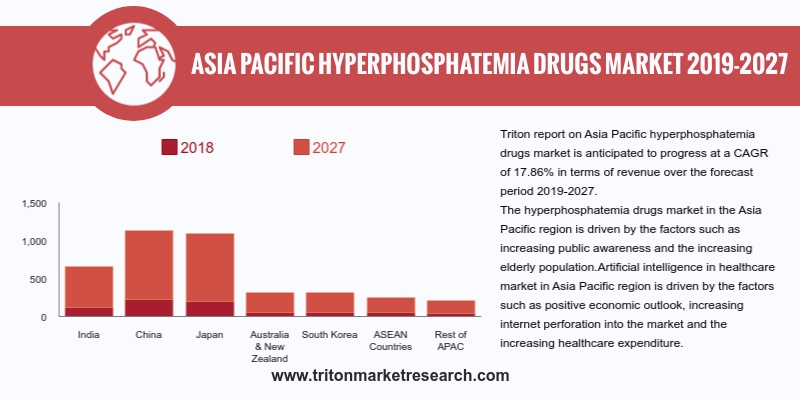

The Triton report on the Asia-Pacific hyperphosphatemia drugs market states that the market is anticipated to progress at a CAGR of 17.86% in terms of revenue over the forecast period of 2019-2027. The Asia-Pacific hyperphosphatemia drugs market is anticipated to account for the highest CAGR by the end of the forecast period.

Countries studied in the Asia-Pacific hyperphosphatemia drugs market:

• China

• Japan

• India

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of Asia-Pacific

Report scope can be customized per your requirements. Request For Customization

The increasing aging population in India is the major driving factor, which is strengthening the demand for hyperphosphatemia drugs in the country. It is estimated that India’s geriatric population will rise significantly throughout the next four decades. The rise in life expectancy throughout the years has increased the geriatric population. Out of this, the geriatric population, which is most susceptible to suffer from dementia, terminal illness, diseases and disabilities, is also the leading rising segment of the geriatric population. Most of the Indian geriatric population also suffer from non-communicable diseases (NCDs), which includes hypertension, diabetes, dementia, coronary heart disease, cataract-related blindness, osteoarthritis, cancer, stroke osteoporosis, depression and an enlarged prostate. These citizens require special attention, especially in rural areas.

In China, the growing pervasiveness of the osteoporosis disease is the major driving factor that has raised the demand for the hyperphosphatemia drugs market. Low bone osteopenia, osteoporosis and trauma fractures are popular in Japan. The total cost of fractures is expected to increase by the upcoming decade. Basically, these costs contain hospitalizations, emergency department, ambulance services, rehabilitation, outpatient services, community services and aged care. Men and women both are prone to osteopenia and osteoporosis, and it holds up to 30% of all fractures and their respective costs. The growth of rest of APAC is majorly driven due to the increasing cases of osteoporosis. It has been predicted that both the number of fractures caused due to osteoporosis and the healthcare costs associated with the disease will rise by more than 30% till 2020. Also, the overall cost of osteoporosis is anticipated to go up by nearly $1.15 billion per year.

1. ASIA-PACIFIC HYPERPHOSPHATEMIA DRUGS MARKET - SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCE MODEL

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

BARGAINING POWER OF BUYERS

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

THREAT OF SUBSTITUTE PRODUCT

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. KEY BUYING OUTLOOK

2.5. KEY INSIGHTS

2.6. KEY MARKET TRENDS

2.7. GUIDELINES RELATED TO THE PHOSPHATE BINDERS

2.8. MARKET DRIVERS

2.8.1.

CHRONIC DISORDERS ARE INCREASING RAPIDLY

2.8.2.

INCREASE IN PUBLIC COGNIZANCE

2.8.3.

INCREASE IN GERIATRIC POPULATION

2.9. MARKET RESTRAINTS

2.9.1.

SIDE-EFFECTS RELATED TO THE USAGE OF HYPERPHOSPHATEMIA DRUGS

2.9.2.

STRICT FOOD AND DRUG ADMINISTRATION (FDA) REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

RISE IN THE AGING POPULATION

2.11.

MARKET CHALLENGES

2.11.1.

ALTERNATIVE DIALYSIS TECHNIQUES

2.11.2.

ACCESSIBILITY OF DRUGS IS LIMITED

2.11.3.

NON-ADHERENCE TO TREATMENT REGIMES

3. HYPERPHOSPHATEMIA DRUGS MARKET OUTLOOK - BY

DOSAGES

3.1. SOLID

3.1.1.

TABLET

3.1.2.

POWDER

3.2. LIQUID

3.2.1.

SOLUTION

4. HYPERPHOSPHATEMIA DRUGS MARKET OUTLOOK - BY

FORMULATION

4.1.1.

CALCIUM-BASED PHOSPHATE BINDERS

4.1.2.

ALUMINUM-BASED PHOSPHATE BINDERS

4.1.3.

MAGNESIUM-BASED PHOSPHATE BINDERS

4.1.4.

IRON-BASED PHOSPHATE BINDERS

4.1.5.

OTHER PHOSPHATE BINDERS

5. HYPERPHOSPHATEMIA DRUGS MARKET - REGIONAL

OUTLOOK

5.1. ASIA-PACIFIC

5.1.1.

COUNTRY ANALYSIS

5.1.1.1.

INDIA

5.1.1.2.

CHINA

5.1.1.3.

JAPAN

5.1.1.4.

SOUTH KOREA

5.1.1.5.

ASEAN COUNTRIES

5.1.1.6.

AUSTRALIA & NEW ZEALAND

5.1.1.7.

REST OF APAC

6. COMPETITIVE LANDSCAPE

6.1. JOHNSON AND JOHNSON

6.2. ZERIA PHARMACEUTICAL

6.3. AMAG PHARMACEUTICALS

6.4. SANOFI

6.5. BRUNO FARMACEUTICI S.P.A.

6.6. ROCHE DIAGNOSTICS CORPORATION

6.7. ROYAL DSM N.V.

6.8. SHIRE

6.9. CIPLA

6.10.

ULTRAGENYX PHARMACEUTICAL, INC.

6.11.

FERMENTA BIOTECH, LTD.

6.12.

BIOTECH PHARMACAL

6.13.

SUN PHARMACEUTICAL INDUSTRIES, LTD.

6.14.

KERYX BIOPHARMACEUTICALS, INC.

6.15.

FRESENIUS MEDICAL CARE

6.16.

PFIZER, INC.

7. METHODOLOGY & SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

TABLE 2 PHOSPHOROUS LEVELS

IN SELECT FOODS

TABLE 3 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET BY FORMULATION 2019-2027 ($ MILLION)

TABLE 4 DIAGNOSIS AND

CLINICAL INDICATORS OF CHRONIC KIDNEY DISEASE

TABLE 5 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET COUNTRY ANALYSIS 2019-2027 ($ MILLION)

TABLE 6 PER CAPITA

CONSUMPTION OF DAIRY PRODUCTS IN AUSTRALIA

FIGURE 1 PORTER’S FIVE FORCE

MODEL OF HYPERPHOSPHATEMIA DRUGS MARKET

FIGURE 2 IRON-BASED

HYPERPHOSPHATEMIA DRUG APPROVAL STATUS 2014-2017

FIGURE 3 RATE OF ADHERENCE TO

PHOSPHATE BINDERS

FIGURE 4 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET IN CALCIUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 5 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET IN ALUMINUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 6 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET IN MAGNESIUM-BASED PHOSPHATE BINDERS 2019-2027

($ MILLION)

FIGURE 7 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET IN IRON-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 8 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET IN OTHER PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 9 ASIA-PACIFIC HYPERPHOSPHATEMIA

DRUGS MARKET SHARE 2018 & 2027 (%)

FIGURE 10 ASIA-PACIFIC

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 11 AGEWISE DISTRIBUTION OF

ELDERLY POPULATION IN INDIA

FIGURE 12 INDIA HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 13 CHINA HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 14 JAPAN HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 15 NUMBER OF FRACTURES DUE

TO OSTEOPOROSIS AND OSTEOPENIA

FIGURE 16 SOUTH KOREA

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 17 ASEAN

COUNTRIESHYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 18 AUSTRALIA & NEW

ZEALAND HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 19 ROAPAC

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)