Market By Deployment Mode, Organization Size, Service And End-user | Forecast 2019-2027

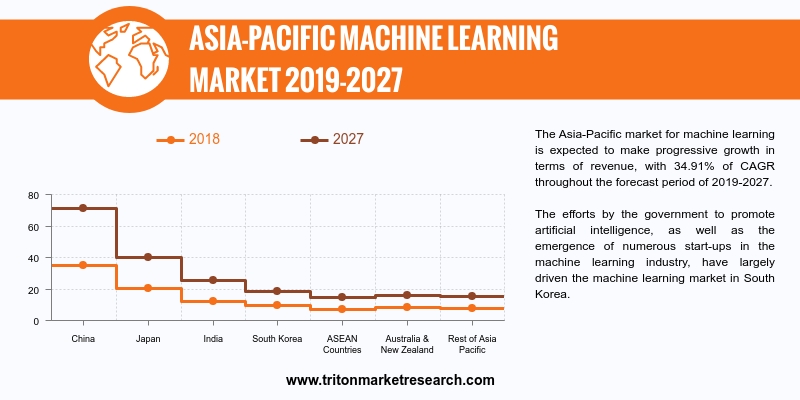

The Asia-Pacific market for machine learning is expected to make progressive growth in terms of revenue, with 34.91% of CAGR throughout the forecast period of 2019-2027.

The countries reviewed in the report on the machine learning market in the Asia-Pacific are:

• China

• Japan

• India

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of APAC

Report scope can be customized per your requirements. Request For Customization

The efforts by the government to promote artificial intelligence, as well as the emergence of numerous start-ups in the machine learning industry, have largely driven the machine learning market in South Korea. Realizing the importance of machine learning in the field of artificial intelligence, the South Korean government, in March 2016, announced its plans on spending $840 million by the year 2020, in its endeavors to boost ML and AI across the country. Thus, investments in artificial intelligence are expected to create lucrative opportunities for South Korea’s machine learning market, boosting its growth.

The Chinese government’s initiatives to promote artificial intelligence and the increased adoption of machine learning across the country are driving China’s machine learning market. In 2017, a National Artificial Intelligence plan was launched by the China Ministry of Science and Technology, which was aimed at developing AI applications, that included the framework & policies concerning risks associated with AI and focusing on international cooperation on ML. This plan helped promote deep integration of artificial intelligence and pay attention towards integrating machine learning in various industries. In addition, private sector companies have also been investing funds in developing ML services across the nation, which would supplement the market growth. Adopting AI- & ML-based services has helped market players in China to solve real-time problems and access large data amounts across several sectors. Thus, the large-scale adoption of machine learning in China is expected to fuel the growth of the country’s machine learning market.

Baidu is a multinational tech giant, operating in the field of internet-related services & products and artificial intelligence. The company offers deep learning/machine learning solutions, algorithmic search, enterprise search, image searches, news, online storage, navigation services, MP3 and voice assistance. The China-based company is headquartered in Beijing; it was founded in the year 2000. Baidu has over 2 billion active users worldwide. Its Apollo Project is one of the leading autonomous driving and AI programs, globally.

1.

ASIA-PACIFIC MACHINE LEARNING MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. EVOLUTION & TRANSITION OF MACHINE

LEARNING

2.3. KEY INSIGHTS

2.3.1. RISE IN IMPLEMENTATION OF DATA-DRIVEN

APPLICATIONS

2.3.2. AUGMENTED DEMAND FOR INTELLIGENT BUSINESS

PROCESSES

2.3.3. MACHINE LEARNING START-UPS TRANSFORMING THE

INDUSTRY

2.4. PORTER’S FIVE FORCES ANALYSIS

2.4.1. BARGAINING POWER OF BUYERS

2.4.2. BARGAINING POWER OF SUPPLIERS

2.4.3. THREAT OF NEW ENTRANTS

2.4.4. THREAT OF SUBSTITUTE

2.4.5. THREAT OF COMPETITIVE RIVALRY

2.5. KEY IMPACT ANALYSIS

2.5.1. COST

2.5.2. APPLICATION

2.5.3. SCALABILITY

2.5.4. TRAINING TIME

2.6. MARKET ATTRACTIVENESS INDEX

2.7. VENDOR SCORECARD

2.8. INDUSTRY COMPONENTS

2.8.1. SOFTWARE DEVELOPMENT

2.8.2. CLOUD

2.8.3. USERS

2.9. PATENT ANALYSIS

2.10.

MARKET DRIVERS

2.10.1. EXPANDING DATA VOLUME ACROSS THE WORLD

2.10.2. WIDENING APPLICATION OF ML IN DIFFERENT END-USE

INDUSTRIES

2.10.3. SIGNIFICANT DEVELOPMENTS IN THE FIELD OF

MACHINE LEARNING

2.11.

MARKET RESTRAINTS

2.11.1. DIFFICULTIES IN PROTECTING SENSITIVE &

PRIVATE DATA

2.11.2. COMPONENTS’ FAILURE MAY DISRUPT ML SERVICE

2.12.

MARKET OPPORTUNITIES

2.12.1. INCORPORATION OF ARTIFICIAL INTELLIGENCE

& MACHINE LEARNING WITH BIG DATA

2.12.2. DEVELOPMENT OF SMART ROBOTS

2.12.3. INCREASING ADOPTION OF IoT-CONNECTED DEVICES

2.13.

MARKET CHALLENGES

2.13.1. TECHNOLOGICAL & COMPUTATIONAL BARRIERS

3.

ASIA-PACIFIC MACHINE LEARNING MARKET OUTLOOK - BY DEPLOYMENT MODE

3.1. CLOUD

3.2. ON-PREMISES

4.

ASIA-PACIFIC MACHINE LEARNING MARKET OUTLOOK - BY ORGANIZATION SIZE

4.1. LARGE ENTERPRISES

4.2. SMALL & MEDIUM-SIZED ENTERPRISES (SMEs)

5.

ASIA-PACIFIC MACHINE LEARNING MARKET OUTLOOK - BY SERVICE

5.1. PROFESSIONAL SERVICES

5.2. MANAGED SERVICES

6.

ASIA-PACIFIC MACHINE LEARNING MARKET OUTLOOK - BY END-USER

6.1. BANKING, FINANCIAL SERVICES & INSURANCE

(BFSI)

6.2. HEALTHCARE & LIFE SCIENCES

6.3. RETAIL

6.4. TELECOMMUNICATION

6.5. GOVERNMENT & DEFENSE

6.6. MANUFACTURING

6.7. MEDIA & ADVERTISING

6.8. ENERGY & UTILITIES

6.9. OTHER END-USERS

7.

ASIA-PACIFIC MACHINE LEARNING MARKET - REGIONAL OUTLOOK

7.1. CHINA

7.2. JAPAN

7.3. INDIA

7.4. SOUTH KOREA

7.5. ASEAN COUNTRIES

7.6. AUSTRALIA & NEW ZEALAND

7.7. REST OF ASIA-PACIFIC

8.

COMPETITIVE LANDSCAPE

8.1. TIBCO SOFTWARE, INC.

8.2. SAP SE

8.3. ORACLE CORPORATION

8.4. TERADATA CORPORATION

8.5. AMAZON WEB SERVICES, INC.

8.6. MICROSOFT CORPORATION

8.7. INTEL CORPORATION

8.8. FRACTAL ANALYTICS

8.9. GOOGLE, INC.

8.10.

BAIDU, INC.

8.11.

FAIR ISAAC CORPORATION (FICO)

8.12.

IBM CORPORATION (INTERNATIONAL BUSINESS MACHINES)

8.13.

HEWLETT PACKARD ENTERPRISE COMPANY (HPE)

8.14.

DELL TECHNOLOGIES, INC.

8.15.

CLARIVATE ANALYTICS LLC (TRADEMARKVISION)

9.

RESEARCH METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE & DELIVERABLES

9.2. SOURCES OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC MACHINE LEARNING MARKET, BY COUNTRY, 2019-2027 (IN

$ MILLION)

TABLE 2: EVOLUTION & TRANSITION OF MACHINE LEARNING

TABLE 3: LIST OF PROMINENT START-UPS IN MACHINE LEARNING

TABLE 4: VENDOR SCORECARD

TABLE 5: PATENTS FILLED IN MACHINE LEARNING BY KEY TECHNOLOGY COMPANIES,

2018

TABLE 6: TOP 20 FIRST PATENT FILERS IN MACHINE LEARNING IN 2016

TABLE 7: ASIA-PACIFIC MACHINE LEARNING MARKET, BY DEPLOYMENT MODE,

2019-2027 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC MACHINE LEARNING MARKET, BY ORGANIZATION SIZE,

2019-2027 (IN $ MILLION)

TABLE 9: ASIA-PACIFIC MACHINE LEARNING MARKET, BY SERVICE, 2019-2027 (IN

$ MILLION)

TABLE 10: ASIA-PACIFIC MACHINE LEARNING MARKET, BY END-USER, 2019-2027

(IN $ MILLION)

TABLE 11: ASIA-PACIFIC MACHINE LEARNING MARKET, BY COUNTRY, 2019-2027

(IN $ MILLION)

FIGURE 1: KEY BUYING IMPACT ANALYSIS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: VOLUME OF DATA CREATED WORLDWIDE, 2010-2025 (IN ZETTABYTES)

FIGURE 5: NUMBER OF CONNECTED DEVICES WORLDWIDE, 2015-2025

FIGURE 6: ASIA-PACIFIC MACHINE LEARNING MARKET, BY CLOUD, 2019-2027 (IN

$ MILLION)

FIGURE 7: ASIA-PACIFIC MACHINE LEARNING MARKET, BY ON-PREMISES,

2019-2027 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC MACHINE LEARNING MARKET, BY LARGE ENTERPRISES,

2019-2027 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC MACHINE LEARNING MARKET, BY SMALL &

MEDIUM-SIZED ENTERPRISES (SMEs), 2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC MACHINE LEARNING MARKET, BY PROFESSIONAL

SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC MACHINE LEARNING MARKET, BY MANAGED SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC MACHINE LEARNING MARKET, BY BANKING, FINANCIAL

SERVICES & INSURANCE (BFSI), 2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC MACHINE LEARNING MARKET, BY HEALTHCARE &

LIFE SCIENCES, 2019-2027 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC MACHINE LEARNING MARKET, BY RETAIL, 2019-2027

(IN $ MILLION)

FIGURE 15: ASIA-PACIFIC MACHINE LEARNING MARKET, BY TELECOMMUNICATION,

2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC MACHINE LEARNING MARKET, BY GOVERNMENT &

DEFENSE, 2019-2027 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC MACHINE LEARNING MARKET, BY MANUFACTURING,

2019-2027 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC MACHINE LEARNING MARKET, BY MEDIA &

ADVERTISING, 2019-2027 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC MACHINE LEARNING MARKET, BY ENERGY &

UTILITIES, 2019-2027 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC MACHINE LEARNING MARKET, BY OTHER END-USERS,

2019-2027 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC MACHINE LEARNING MARKET, REGIONAL OUTLOOK, 2018

& 2027 (IN %)

FIGURE 22: CHINA MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: JAPAN MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: INDIA MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: SOUTH KOREA MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: ASEAN COUNTRIES MACHINE LEARNING MARKET, 2019-2027 (IN $

MILLION)

FIGURE 27: AUSTRALIA & NEW ZEALAND MACHINE LEARNING MARKET,

2019-2027 (IN $ MILLION)

FIGURE 28: REST OF ASIA-PACIFIC MACHINE LEARNING MARKET, 2019-2027 (IN $

MILLION)