Market By Category, Source, Product And Geography | Forecast 2019-2027

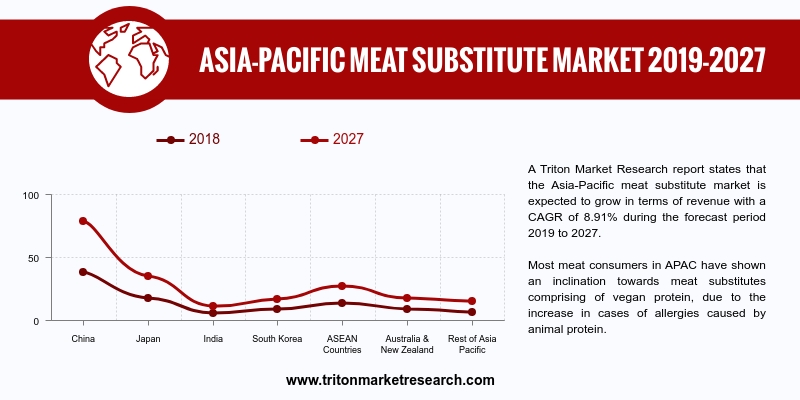

A Triton Market Research report states that the Asia-Pacific meat substitute market is expected to grow in terms of revenue with a CAGR of 8.91% during the forecast period 2019 to 2027.

The countries studied in the meat substitute market in the Asia-Pacific are:

• India

• China

• Japan

• South Korea

• Australia & New Zealand

• ASEAN countries

• Rest of APAC

Report scope can be customized per your requirements. Request For Customization

Most meat consumers in APAC have shown an inclination towards meat substitutes comprising of vegan protein, due to the increase in cases of allergies caused by animal protein. This has led to many consumers opting for plant protein-based products. The last few years have seen protein products obtained from other plant-based raw materials like chickpeas, peas, rice, lupins, canola and maize being developed in food-grade quality. The highest market share in the meat substitute market in the Asia-Pacific is contributed by textured vegetable protein (TVP). TVP is easily available and also has a low production cost, which makes it profitable for both producers as well as consumers.

The meat substitute market in Australia has shown significant growth, primarily due to growing concerns regarding health as well as the environment. There is an increase in awareness among consumers with regard to the food they consume and its impact on their health. Many people have adopted flexitarian lifestyles, which has led to meat substitutes forming an integral part of their diet. With an increasing number of consumers turning towards plant-based diets, protein or meat alternatives have proven to be a viable option. Though a large number of meat substitute products are made of soy or wheat-protein bases, products made using pea, egg, nuts and ancient grains are also being developed.

Sonic Biochem Extractions Limited is a manufacturer and exporter of food products. The company offers soya protein concentrates, Soya flour & flakes and TVP, among others. Sonic Biochem serves customers in India; it is headquartered in Indore, India.

1.

ASIA-PACIFIC MEAT SUBSTITUTE MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

ASIA-PACIFIC LEADS THE REGIONAL MARKET

2.2.2.

GROWING ADOPTION OF WHEAT-BASED FOODS

2.2.3.

RISE IN VEGAN CAFES AND RESTAURANTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1.

UPSURGE IN HEALTH-CONSCIOUS POPULACE

2.6.2.

HIGH DEMAND FOR PLANT-BASED DIET

2.6.3.

INCREASE IN OBESITY AIDS MARKET GROWTH

2.7. MARKET RESTRAINTS

2.7.1.

EASY ACCESS TO ALTERNATIVE PRODUCTS

2.8. MARKET OPPORTUNITIES

2.8.1.

GROWING ADOPTION OF VEGANISM

2.8.2.

INFILTRATION OF RETAIL CHAIN

2.9. MARKET CHALLENGES

2.9.1.

HIGH COST LEVIED ON ANALOG MEAT

2.9.2.

RISE IN ALLERGIES OWING TO SOYA-BASED PRODUCTS

3.

ASIA-PACIFIC MEAT SUBSTITUTE MARKET OUTLOOK - BY CATEGORY

3.1. FROZEN

3.2. REFRIGERATED

3.3. SHELF-STABLE

4.

ASIA-PACIFIC MEAT SUBSTITUTE MARKET OUTLOOK - BY SOURCE

4.1. SOY-BASED

4.2. WHEAT-BASED

4.3. MYCOPROTEIN

4.4. OTHER SOURCES

5.

ASIA-PACIFIC MEAT SUBSTITUTE MARKET OUTLOOK - BY PRODUCT

5.1. TOFU-BASED

5.2. TEMPEH-BASED

5.3. TVP-BASED

5.4. SEITAN-BASED

5.5. QUORN-BASED

5.6. OTHER PRODUCTS

6.

ASIA-PACIFIC MEAT SUBSTITUTE MARKET - REGIONAL OUTLOOK

6.1. ASIA-PACIFIC

6.1.1.

CHINA

6.1.2.

JAPAN

6.1.3.

INDIA

6.1.4.

SOUTH KOREA

6.1.5.

ASEAN COUNTRIES

6.1.6.

AUSTRALIA & NEW ZEALAND

6.1.7.

REST OF ASIA-PACIFIC

7.

COMPETITIVE LANDSCAPE

7.1. AMY’S KITCHEN INC.

7.2. BEYOND MEAT

7.3. CAULDRON FOODS LTD

7.4. QUORN FOODS LTD

7.5. KELLOGG CO.

7.6. TOFURKY

7.7. SUPERBOM

7.8. MEATLESS B.V.

7.9. VBITES FOOD LTD.

7.10. MGP INGREDIENTS

7.11. IMPOSSIBLE FOODS INC.

7.12. CONAGRA BRANDS INC.

7.13. THE CAMPBELL SOUP COMPANY

7.14. SONIC BIOCHEM LTD

7.15. VEGABOM HEALTHY OPTION

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY COUNTRY, 2019-2027 (IN

$ MILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY CATEGORY, 2019-2027 (IN

$ MILLION)

TABLE 5: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY SOURCE, 2019-2027 (IN $

MILLION)

TABLE 6: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY PRODUCT, 2019-2027 (IN

$ MILLION)

TABLE 7: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY COUNTRY, 2019-2027 (IN

$ MILLION)

FIGURE 1: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY CATEGORY, 2018 &

2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY FROZEN, 2019-2027 (IN

$ MILLION)

FIGURE 4: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY REFRIGERATED,

2019-2027 (IN $ MILLION)

FIGURE 5: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY SHELF-STABLE,

2019-2027 (IN $ MILLION)

FIGURE 6: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY SOY-BASED, 2019-2027

(IN $ MILLION)

FIGURE 7: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY WHEAT-BASED, 2019-2027

(IN $ MILLION)

FIGURE 8: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY MYCOPROTEIN, 2019-2027

(IN $ MILLION)

FIGURE 9: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY OTHER SOURCES,

2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY TOFU-BASED, 2019-2027

(IN $ MILLION)

FIGURE 11: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY TEMPEH-BASED,

2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY TVP-BASED, 2019-2027

(IN $ MILLION)

FIGURE 13: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY SEITAN-BASED, 2019-2027

(IN $ MILLION)

FIGURE 14: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY QUORN-BASED,

2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, BY OTHER PRODUCTS,

2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC MEAT SUBSTITUTE MARKET, REGIONAL OUTLOOK, 2018

& 2027 (IN %)

FIGURE 17: CHINA MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: JAPAN MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: INDIA MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SOUTH KOREA MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: ASEAN COUNTRIES MEAT SUBSTITUTE MARKET, 2019-2027 (IN $

MILLION)

FIGURE 22: AUSTRALIA & NEW ZEALAND MEAT SUBSTITUTE MARKET, 2019-2027

(IN $ MILLION)

FIGURE 23: REST OF ASIA-PACIFIC MEAT SUBSTITUTE MARKET, 2019-2027 (IN $

MILLION)