Market By Component, Fidelity, End-user And Geography | Forecast 2019-2027

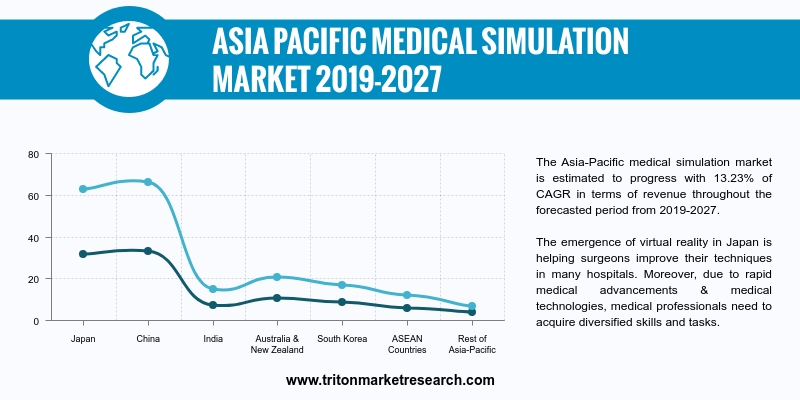

The Asia-Pacific medical simulation market is estimated to progress with 13.23% of CAGR in terms of revenue throughout the forecasted period from 2019-2027.

The countries studied in the report on the Asia-Pacific market for medical simulation are:

• China

• Japan

• India

• South Korea

• Australia & New Zealand

• ASEAN countries

• Rest of APAC

The emergence of virtual reality in Japan is helping surgeons improve their techniques in many hospitals. Moreover, due to rapid medical advancements & medical technologies, medical professionals need to acquire diversified skills and tasks.

Report scope can be customized per your requirements. Request For Customization

Researchers at Japan’s Tottori University Hospital, in 2017, entered into a collaboration with the medical company Tmsuk R&D, Inc. for creating a medical simulation robot by using 3D printing techniques. The robot, named ‘Mikoto,’ is intended to provide medical students with a realistic understanding of training simulation. The robot is also capable of expressing pain and a reflex, which would enable medical professionals and students to gain greater awareness regarding patient experience. The robot is programmed in such a way, that it can give each professional a score based on their performance in the training exercises.

The ultrasound training simulation provider MedSim has installed 82 units of ‘CompactSim’ – the company’s platform for ultrasound simulation – in various hospitals & universities in Japan, which includes Tokuyama Central Hospital, Yokohama Medical Center, Nagoya University and many others. Thus, all these advancements in technology are augmenting the growth of Japan’s medical simulation market and rapid market growth is expected in the future.

Kyoto Kagaku Co., Ltd. engages in the development and distribution of training models & educational equipment for medical treatment purposes. The company’s product offerings can be broadly classified into three categories – Patient Simulators for nurses, Patient Simulators for exam & procedural skills and Imaging Phantoms for ultrasound & radiology. It serves the fields of education, welfare and culture by providing high-quality models & educational equipment. Kyoto Kagaku is headquartered in Kyoto, Japan.

1.

ASIA-PACIFIC MEDICAL SIMULATION MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES MODEL OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. MARKET TRENDS

2.4. REGULATORY OUTLOOK

2.5. MARKET SHARE OUTLOOK

2.6. MARKET ATTRACTIVENESS INDEX

2.7. MARKET DRIVERS

2.7.1.

GROWING CONCERN FOR PATIENT SAFETY

2.7.2.

INCREASING DEMAND FOR MINIMALLY INVASIVE SURGERY (MIS)

2.8. MARKET RESTRAINTS

2.8.1.

HIGH COST OF MEDICAL SIMULATORS

2.8.2.

LACK OF SKILLED PROFESSIONALS

2.8.3.

AVERSENESS TO ADOPT NEW SIMULATION TECHNOLOGIES

2.9. MARKET OPPORTUNITIES

2.9.1.

TECHNOLOGICAL ADVANCEMENTS

2.9.2.

OPPORTUNITIES FOR CARRYING OUT SIMULATION IN THE EMERGING MARKETS

2.10.

MARKET CHALLENGES

2.10.1.

CHALLENGES IN THE MEDICAL SIMULATION OPRATION

3.

MEDICAL SIMULATION MARKET OUTLOOK – BY COMPONENT

3.1. MODEL-BASED SIMULATION

3.2. WEB-BASED SIMULATION

3.3. SIMULATION TRAINING SERVICES

4.

MEDICAL SIMULATION MARKET OUTLOOK – BY FIDELITY

4.1. LOW-FIDELITY

4.2. MEDIUM-FIDELITY

4.3. HIGH-FIDELITY

5.

MEDICAL SIMULATION MARKET OUTLOOK – BY END-USER

5.1. ACADEMIC INSTITUTIONS & RESEARCH CENTERS

5.2. HOSPITALS & CLINICS

5.3. MILITARY ORGANIZATIONS

6.

MEDICAL SIMULATION MARKET – REGIONAL OUTLOOK

6.1. ASIA-PACIFIC

6.1.1.

COUNTRY ANALYSIS

6.1.1.1.

JAPAN

6.1.1.2.

CHINA

6.1.1.3.

INDIA

6.1.1.4.

AUSTRALIA & NEW ZEALAND

6.1.1.5.

SOUTH KOREA

6.1.1.6.

ASEAN COUNTRIES

6.1.1.7.

REST OF ASIA-PACIFIC

7.

COMPETITIVE LANDSCAPE

7.1. GAUMARD SCIENTIFIC COMPANY

7.2. CANADIAN AVIATION ELECTRONICS (CAE)

7.3. MENTICE AB

7.4. KYOTO KAGAKU CO., LTD.

7.5. SIMULAIDS, INC.

7.6. KINDHEART, INC.

7.7. 3D SYSTEMS CORPORATION

7.8. LAERDAL MEDICAL AS

7.9. SURGICAL SCIENCE SWEDEN AB

7.10.

LIMBS & THINGS LTD.

7.11.

INTELLIGENT ULTRASOUND GROUP PLC (FORMERLY MEDAPHOR GROUP PLC)

7.12.

NASCO

7.13.

SIMULAB CORPORATION

8.

RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.1.1.

OBJECTIVES OF STUDY

8.1.2.

SCOPE OF STUDY

8.2. SOURCES OF DATA

8.2.1.

PRIMARY DATA SOURCES

8.2.2.

SECONDARY DATA SOURCES

8.3. RESEARCH METHODOLOGY

8.3.1.

EVALUATION OF PROPOSED MARKET

8.3.2.

IDENTIFICATION OF DATA SOURCES

8.3.3.

ASSESSMENT OF MARKET DETERMINANTS

8.3.4.

DATA COLLECTION

8.3.5.

DATA VALIDATION & ANALYSIS

TABLE 1 ASIA-PACIFIC MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

TABLE 2 COST OF SIMULATION

EQUIPMENT

TABLE 3 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY COMPONENT 2019-2027 ($ MILLION)

TABLE 4 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY FIDELITY 2019-2027 ($ MILLION)

TABLE 5 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 6 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 ASIA-PACIFIC MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

FIGURE 2 COMPANY MARKET SHARE

OUTLOOK OF MEDICAL SIMULATION 2018 (%)

FIGURE 3 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY MODEL-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 4 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY WEB-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 5 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY SIMULATION TRAINING SERVICES 2019-2027 ($ MILLION)

FIGURE 6 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY LOW-FIDELITY 2019-2027 ($ MILLION)

FIGURE 7 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY MEDIUM-FIDELITY 2019-2027 ($ MILLION)

FIGURE 8 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY HIGH-FIDELITY 2019-2027 ($ MILLION)

FIGURE 9 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY ACADEMIC INSTITUTIONS & RESEARCH CENTERS 2019-2027 ($

MILLION)

FIGURE 10 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY HOSPITALS & CLINICS 2019-2027 ($ MILLION)

FIGURE 11 ASIA-PACIFIC MEDICAL

SIMULATION MARKET BY MILITARY ORGANIZATIONS 2019-2027 ($ MILLION)

FIGURE 12 JAPAN MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

FIGURE 13 CHINA MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

FIGURE 14 INDIA MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

FIGURE 15 AUSTRALIA & NEW

ZEALAND MEDICAL SIMULATION MARKET 2019-2027 ($ MILLION)

FIGURE 16 SOUTH KOREA MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

FIGURE 17 ASEAN COUNTRIES MEDICAL

SIMULATION MARKET 2019-2027 ($ MILLION)

FIGURE 18 REST

OF ASIA-PACIFIC MEDICAL SIMULATION MARKET 2019-2027 ($ MILLION)