Market By End-user, Derivatives And Geography | Forecast 2019-2027

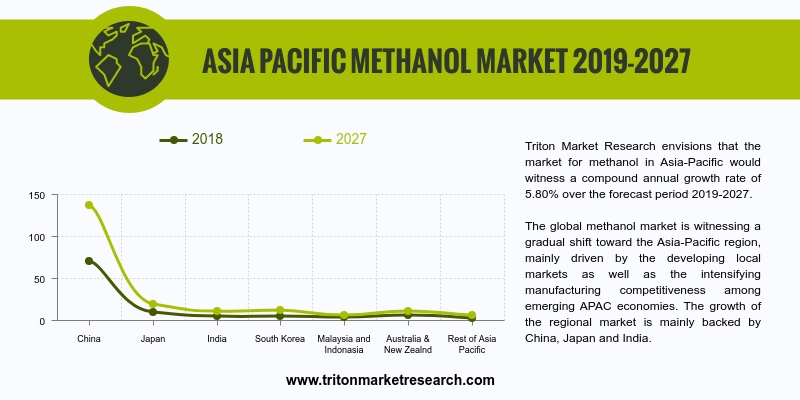

Triton Market Research envisions that the market for methanol in Asia-Pacific would witness a compound annual growth rate of 5.80% over the forecast period 2019-2027.

The countries that have been considered in the Asia-Pacific methanol market are:

• India

• China

• South Korea

• Japan

• Australia & New Zealand

• Malaysia & Indonesia

• Rest of APAC

Report scope can be customized per your requirements. Request For Customization

The global methanol market is witnessing a gradual shift toward the Asia-Pacific region, mainly driven by the developing local markets as well as the intensifying manufacturing competitiveness among emerging APAC economies. The growth of the regional market is mainly backed by China, Japan and India.

The Chinese methanol market has grown exceptionally in the past years and is expected to witness further growth during the forecast period, owing to an increase in the construction activities in the country. The implementation of policies such as mandates on producing eco-friendly products and emission control will further drive the market's growth in the region in the next few years. The increasing number of MTO/MTP plants and the increase in the production of olefins will also have a positive impact on the market's growth.

The whole APAC region has agriculture as a major source of income and the demand for food products is increasing day-by-day. So, in order to get more quantity of agricultural products, the use of pesticides is expected to drive the growth of the market. Countries like Bangladesh, Nepal and Bhutan are still having the urge for food and energy. Also, the need for energy sources in economically developing countries where conventional energy sources are not available is anticipated to act as another driving factor for the growth of the market.

Triton Market Research’s report on the methanol market provides information about the key insights regarding the industry, vendor scorecard, market attractiveness matrix, market definition and Porter’s five force analysis.

1.

ASIA-PACIFIC METHANOL MARKET - SUMMARY

2.

INDUSTRY

OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1. AUTOMOTIVE SECTOR HOLDS THE LARGEST MARKET SHARE

2.2.2. FORMALDEHYDE IS WIDELY USED DERIVATIVE OF METHANOL

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1. THREAT OF NEW ENTRANTS

2.3.2. THREAT OF SUBSTITUTE

2.3.3. BARGAINING POWER OF SUPPLIERS

2.3.4. BARGAINING POWER OF BUYERS

2.3.5. INTENSITY OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1. RISING ACCEPTANCE OF THE MTO TECHNOLOGY

2.6.2. RISE IN THE DEMAND FOR PETROCHEMICALS

2.6.3. NEED FOR CONVENTIONAL TRANSPORTATION FUELS

2.6.4. PROMOTION OF METHANOL AS AN ALTERNATIVE FUEL BY THE GOVERNMENT

2.7. MARKET RESTRAINTS

2.7.1. SCARCITY OF RAW MATERIALS

2.7.2. USE OF FUEL GRADE ETHANOL OR BIOETHANOL INSTEAD OF METHANOL

2.8. MARKET OPPORTUNITIES

2.8.1. INCREASE IN THE DEMAND FOR BIO-BASED PRODUCTS

2.8.2. DEVELOPMENT IN TECHNOLOGY FOR BIOREFINING

2.8.3. APPLICATION OF METHANOL AS A MARINE FUEL

2.9. MARKET CHALLENGES

2.9.1. UNSTABLE METHANOL PRICES

2.9.2. ECONOMIC SLOWDOWN HINDERS THE DEMAND FOR METHANOL

2.9.3. REGULATIONS AND POLICIES

3.

METHANOL MARKET

OUTLOOK - BY END-USER

3.1. AUTOMOTIVE

3.2. CONSTRUCTION

3.3. ELECTRONICS

3.4. PAINTS AND COATINGS

3.5. OTHER END-USERS

4.

METHANOL MARKET

OUTLOOK - BY DERIVATIVES

4.1. FORMALDEHYDE

4.2. ACETIC ACID

4.3. GASOLINE

4.4. DME

4.5. MTBE & TAME

4.6. OTHER DERIVATIVES

5.

METHANOL MARKET

- ASIA-PACIFIC

5.1. CHINA

5.2. JAPAN

5.3. INDIA

5.4. SOUTH KOREA

5.5. MALAYSIA & INDONESIA

5.6. AUSTRALIA & NEW ZEALAND

5.7. REST OF ASIA-PACIFIC

6.

COMPETITIVE

LANDSCAPE

6.1. BASF AG

6.2. CELANESE CORPORATION

6.3. QATAR FUEL ADDITIVES COMPANY LIMITED

6.4. METHANOL HOLDINGS (TRINIDAD) LIMITED (MHTL)

6.5. METHANEX CORPORATION

6.6. MITSUBISHI CHEMICALS

6.7. MITSUI & CO., LTD.

6.8. PETROLIAM NASIONAL BERHAD (PETRONAS)

6.9. SAUDI BASIC INDUSTRIES CORPORATION

6.10.

TEIJIN

6.11.

VALERO

MARKETING AND SUPPLY COMPANY

6.12.

ZAGROS PETROCHEMICAL

COMPANY (ZPC)

7.

METHODOLOGY

& SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC METHANOL

MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET ATTRACTIVENESS

INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: ASIA-PACIFIC METHANOL

MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC METHANOL

MARKET, BY END-USERS, 2019-2027 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC METHANOL

MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 1: ASIA-PACIFIC

METHANOL MARKET, BY END-USER, 2018 & 2027 (IN %)

FIGURE 2: ASIA-PACIFIC AUTOMOTIVE

MARKET FOR METHANOL, 2019-2027 (IN $ MILLION)

FIGURE 3: ASIA-PACIFIC

FORMALDEHYDE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 5: ASIA-PACIFIC

METHANOL MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 6: ASIA-PACIFIC

METHANOL MARKET, BY CONSTRUCTION, 2019-2027 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC

METHANOL MARKET, BY ELECTRONICS, 2019-2027 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC

METHANOL MARKET, BY PAINTS AND COATINGS, 2019-2027 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC

METHANOL MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC

METHANOL MARKET, BY FORMALDEHYDE, 2019-2027 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC

METHANOL MARKET, BY ACETIC ACID, 2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC

METHANOL MARKET, BY GASOLINE, 2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC

METHANOL MARKET, BY DME, 2019-2027 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC

METHANOL MARKET, BY MTBE & TAME, 2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC

METHANOL MARKET, BY OTHER DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC

METHANOL MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: CHINA METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: JAPAN METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: INDIA METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SOUTH KOREA

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: MALAYSIA &

INDONESIA METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: AUSTRALIA & NEW

ZEALAND METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: REST OF ASIA-PACIFIC

METHANOL MARKET, 2019-2027 (IN $ MILLION)