Market By System, Applications, And Geography | Forecast 2019-2027

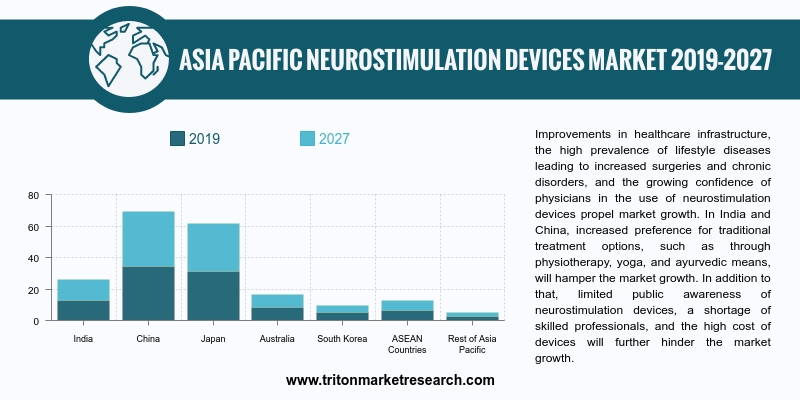

As per the Triton Market Research analysis, the Asia-Pacific neurostimulation device market is expected to flourish at a CAGR of 11.78% over the forecast period of 2019-2027.

Geographically, the countries studied in the Asia-Pacific neurostimulation device market are:

• China

• Japan

• India

• South Korea

• ASEAN Countries

• Australia

• Rest of Asia-Pacific

Report scope can be customized per your requirements. Request For Customization

The Asia-Pacific region is one of the most profitable markets available for the growth of neurostimulation devices. The region is expected to boom with the highest CAGR in terms of revenue during the forecasted period. An increase in lifestyle-oriented diseases, growing confidence of doctors in the use of neurostimulation devices, and developments in healthcare infrastructure are the major market drivers in the region.

In India, many state governments and foreign private organizations have been taking initiatives to contribute to the neurostimulation device market growth. For instance, according to the World Health Organization (WHO), the stroke rate accounts for 58 per 100000 individuals among the population of the country. People from the age group of 55 and above are likely to get affected by stroke in the country. This has led to an increase in the demand & adoption of neurostimulation devices in India.

Similarly, in China, the prevalence of the aging population and lifestyle diseases such as dementia drive the neurostimulation device market. According to the Ministry of Health, the number of individuals affected by dementia in China accounts for around 20% of dementia cases across the world in 2017, which is approximately 50 million. Thus, China is predicted to create the biggest market for neurostimulation devices during the forecasted years.

Boston Scientific Corporation is a leading company that manufactures, develops, and markets medical devices that are used in numerous interventional medical specialties. The company has a presence in almost every surgical segment due to its broad portfolio of products. The company provides drug-eluting coronary stent systems and intravascular catheter-directed ultrasound imaging catheters and systems. The company has its operations in Asia-Pacific, Europe, the Americas, and the Middle East and Africa.

1. ASIA-PACIFIC

NEUROSTIMULATION MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTES

2.2.3. BARGAINING

POWER OF SUPPLIERS

2.2.4. BARGAINING

POWER OF BUYERS

2.2.5. THREAT

OF RIVALRY

2.3. VALUE

CHAIN OUTLOOK

2.4. MARKET

TRENDS

2.5. MARKET

SHARE OUTLOOK

2.6. PESTLE

OUTLOOK

2.7. MARKET

ATTRACTIVENESS INDEX

2.8. KEY

INSIGHT

2.9. MARKET

DRIVERS

2.9.1. RISING

INCIDENCE OF NEURO DISEASES

2.9.2. INCREASING

GERIATRIC POPULATION

2.9.3. GROWING

DEMAND FOR MRI SCANS

2.9.4. FAVORABLE

REIMBURSEMENT POLICIES

2.10.

MARKET RESTRAINTS

2.10.1.

HIGH COST OF NEUROMODULATION TREATMENT

2.10.2.

PRESENCE OF ALTERNATIVE THERAPY

2.11.

MARKET OPPORTUNITIES

2.11.1.

HIGH MARKET POTENTIAL FOR SCS DEVICES IN

NEUROSTIMULATION

2.11.2.

TECHNOLOGICAL DEVELOPMENT

2.11.3.

GROWING INCIDENCE OF CHRONIC DISCOMFORT

2.12.

MARKET CHALLENGES

2.12.1.

STRINGENT REGULATORY APPROVALS

2.12.2.

SIDE-EFFECTS OF ASSOCIATED NEUROSTIMULATION

DEVICES

3. NEUROSTIMULATION

DEVICE MARKET OUTLOOK – BY SYSTEM

3.1. SPINAL

CORD STIMULATORS (SCS)

3.2. DEEP

BRAIN STIMULATORS (DBS)

3.3. SACRAL

NERVE STIMULATORS (SNS)

3.4. VAGUS

NERVE STIMULATORS (VNS)

3.5. GASTRIC

ELECTRIC STIMULATOR

3.6. OTHER

SYSTEMS

4. NEUROSTIMULATION

DEVICE MARKET OUTLOOK – BY APPLICATIONS

4.1. PAIN

MANAGEMENT

4.2. EPILEPSY

4.3. ESSENTIAL

TREMOR

4.4. URINARY

AND FECAL INCONTINENCE

4.5. DEPRESSION

4.6. DYSTONIA

4.7. GASTROPARESIS

4.8. PARKINSON’S

DISEASE

4.9. OTHER

APPLICATIONS

5. NEUROSTIMULATION

DEVICE MARKET – REGIONAL OUTLOOK

5.1.1. COUNTRY

ANALYSIS

5.1.1.1. INDIA

5.1.1.2. CHINA

5.1.1.3. JAPAN

5.1.1.4. AUSTRALIA

& NEW ZEALAND

5.1.1.5. SOUTH

KOREA

5.1.1.6. ASEAN

COUNTRIES

5.1.1.7. REST

OF ASIA-PACIFIC

6. COMPANY

PROFILES

6.1. NEURONETICS,

INC.

6.2. ST.

JUDE MEDICAL, INC. (ACQUIRED BY ABBOTT LABORATORIES)

6.3. HOCOMA

AG

6.4. NEVRO

CORP.

6.5. CYBERONICS

INC.

6.6. COGENTIX

MEDICAL, INC.

6.7. DEPUY

SYNTHES COMPANIES

6.8. DR.

LANGER MEDICAL GMBH

6.9. MEDTRONIC

PLC

6.10.

THE MAGSTIM COMPANY LIMITED

6.11.

ECTRON LIMITED

6.12.

BOSTON SCIENTIFIC CORPORATION

6.13.

EKSO BIONICS HOLDING INC.

6.14.

ALEVA NEUROTHERAPEUTICS SA

6.15.

HELIUS MEDICAL TECHNOLOGIES

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.1.1. OBJECTIVES

OF STUDY

7.1.2. SCOPE

OF STUDY

7.2. SOURCES

OF DATA

7.2.1. PRIMARY

DATA SOURCES

7.2.2. SECONDARY

DATA SOURCES

7.3. RESEARCH

METHODOLOGY

7.3.1. EVALUATION

OF PROPOSED MARKET

7.3.2. IDENTIFICATION

OF DATA SOURCES

7.3.3. ASSESSMENT

OF MARKET DETERMINANTS

7.3.4. DATA

COLLECTION

7.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET 2019-2027 ($

MILLION)

TABLE 2 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET BY SYSTEM

2019-2027 ($ MILLION)

TABLE 3 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET BY APPLICATIONS

2019-2027 ($ MILLION)

TABLE 4 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET BY COUNTRY

2019-2027 ($ MILLION)

FIGURE 1 ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET 2019-2027 ($ MILLION)

FIGURE 2 VALUE CHAIN OUTLOOK

FIGURE 3 NEUROSTIMULATION DEVICE COMPANY MARKET

SHARE OUTLOOK 2018 (%)

FIGURE 4 ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET BY SPINAL CORD STIMULATORS 2019-2027 ($ MILLION)

FIGURE 5 ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET BY DEEP BRAIN STIMULATORS 2019-2027 ($ MILLION)

FIGURE 6 ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET BY SACRAL NERVE STIMULATORS 2019-2027 ($ MILLION)

FIGURE 7 ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET BY VAGUS NERVE STIMULATORS 2019-2027 ($ MILLION)

FIGURE 8 ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET BY GASTRIC ELECTRIC STIMULATOR 2019-2027 ($ MILLION)

FIGURE 9 ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET BY OTHER SYSTEM 2019-2027 ($ MILLION)

FIGURE 10 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY PAIN MANAGEMENT 2019-2027 ($ MILLION)

FIGURE 11 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY EPILEPSY 2019-2027 ($ MILLION)

FIGURE 12 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY ESSENTIAL TREMOR 2019-2027 ($ MILLION)

FIGURE 13 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY URINARY AND FECAL INCONTINENCE 2019-2027 ($ MILLION)

FIGURE 14 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY DEPRESSION 2019-2027 ($ MILLION)

FIGURE 15 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY DYSTONIA 2019-2027 ($ MILLION)

FIGURE 16 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY GASTROPARESIS 2019-2027 ($ MILLION)

FIGURE 17 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY PARKINSON’S DISEASE 2019-2027 ($ MILLION)

FIGURE 18 ASIA-PACIFIC NEUROSTIMULATION DEVICE MARKET

BY OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 19 INDIA NEUROSTIMULATION DEVICE MARKET

2019-2027 ($ MILLION)

FIGURE 20 CHINA NEUROSTIMULATION DEVICE MARKET

2019-2027 ($ MILLION)

FIGURE 21 JAPAN NEUROSTIMULATION DEVICE MARKET

2019-2027 ($ MILLION)

FIGURE 22 AUSTRALIA & NEW ZEALAND NEUROSTIMULATION

DEVICE MARKET 2019-2027 ($ MILLION)

FIGURE 23 SOUTH KOREA NEUROSTIMULATION DEVICE MARKET

2019-2027 ($ MILLION)

FIGURE 24 ASEAN COUNTRIES NEUROSTIMULATION DEVICE

MARKET 2019-2027 ($ MILLION)

FIGURE 25 REST OF ASIA-PACIFIC NEUROSTIMULATION DEVICE

MARKET 2019-2027 ($ MILLION)