Market By Resin Type, Technology, Application And Geography | Forecast 2019-2027

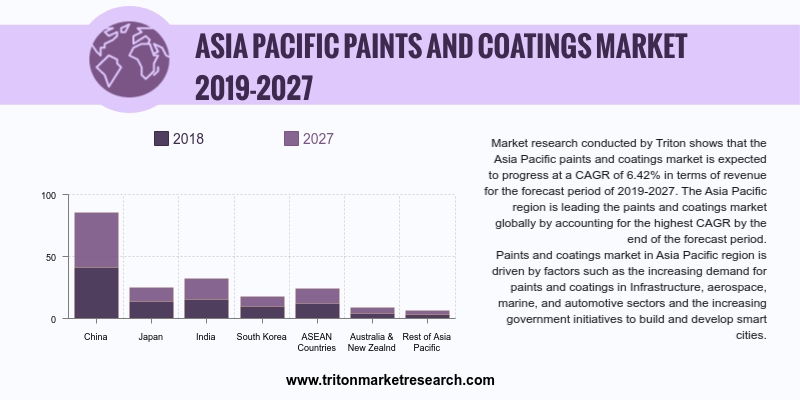

A Triton Market Research report states the Asia-Pacific paints & coatings market is expected to grow with a CAGR of 6.42% in terms of revenue and at a CAGR of 5.55% in terms of volume, in the forecasting period between 2019 and 2027.

The countries that have been studied in the Asia-Pacific paints & coatings market are:

• China

• Japan

• India

• South Korea

• ASEAN Countries

• Australia & New Zealand

• Rest of Asia-Pacific

Report scope can be customized per your requirements. Request For Customization

The large population in the Asia-Pacific and the growing urbanization are driving the growth of the paints & coatings market in the region. The increased awareness toward sustainable products is also influencing the demand for environment-friendly paints & coatings. The growing construction industry in the APAC region is a major contributor to the growth of the market.

China is an emerging economy and is the largest in terms of purchasing power parity and the second-largest economy in terms of nominal GDP. It is expected to grow at a healthy pace in the coming years. In the Asia-Pacific region, China is the largest consumer of industrial coatings. This increased demand can be attributed to the country’s growing automotive and aerospace industry. The country’s automotive sector is witnessing steady growth, owing to the rising demand for SUVs and electric vehicles. Additionally, the used car sales have also been increasing in the country, in turn, boosting both the automotive OEM and automotive refinish paints & coatings market in the region.

The market in Japan is growing at a slow pace. The earthquake that hit Kumamoto, the manufacturing hub of Japan, during mid-April 2016, slowed down the economy. The construction and automotive industries are growing at a low pace as the market is stable, and the demand is not varying significantly. However, the automotive sector in the country is witnessing a stable market with the contracted growth rate. With three of the major automobile manufacturers situated in the country, i.e. Honda, Toyota and Nissan; and with the rise in exports of automobiles from the country, the demand for and the usage of paints & coatings is expected to increase.

1.

ASIA-PACIFIC PAINTS & COATINGS MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.4. MARKET ATTRACTIVENESS MATRIX

2.5. VENDOR SCORECARD

2.6. INDUSTRY PLAYER POSITIONING

2.7. MARKET DRIVERS

2.7.1. EVOLVING AUTOMOTIVE INDUSTRY

2.7.2. SNOWBALLING INFRASTRUCTURE PROJECTS IN THE ASIA-PACIFIC

2.7.3. INCREASED DEMAND FROM AEROSPACE & MARINE

INDUSTRY

2.7.4. GROWING IMPORTANCE OF PAINTS & COATINGS

WITH FUNCTIONAL BENEFITS

2.8. MARKET RESTRAINTS

2.8.1. HIGH COSTS ASSOCIATED WITH PAINTS &

COATINGS

2.8.2. IMPLEMENTATION OF STRINGENT REGULATIONS FOR

REDUCING VOC EMISSIONS

2.9. MARKET OPPORTUNITIES

2.9.1. INCREASED DEMAND FROM EMERGING ECONOMIES

2.9.2. SHIFT TOWARDS ADOPTION OF SUSTAINABLE

PRODUCTS

2.9.3. EMERGENCE OF NANO & FLUOROPOLYMER

2.10. MARKET CHALLENGES

2.10.1. NEGATIVE IMPACT ON ENVIRONMENT

3.

ASIA-PACIFIC PAINTS & COATINGS MARKET OUTLOOK - BY RESIN TYPE (IN TERMS OF VALUE: $ MILLION & IN

TERMS OF VOLUME: KILO TONS)

3.1. ACRYLIC

3.2. POLYESTER

3.3. ALKYD

3.4. EPOXY

3.5. POLYURETHANE

3.6. OTHER RESIN TYPES

4.

ASIA-PACIFIC PAINTS & COATINGS MARKET OUTLOOK - BY TECHNOLOGY (IN TERMS OF VALUE: $ MILLION & IN

TERMS OF VOLUME: KILO TONS)

4.1. WATER-BORNE

4.2. SOLVENT-BORNE

4.3. POWDER COATING

4.4. HIGH-SOLIDS

4.5. RADIATION-CURED

4.6. EMERGING COATING TECHNOLOGIES

5.

ASIA-PACIFIC PAINTS & COATINGS MARKET OUTLOOK -BY APPLICATION (IN TERMS OF VALUE: $ MILLION & IN

TERMS OF VOLUME: KILO TONS)

5.1. ARCHITECTURAL APPLICATIONS

5.1.1. INTERIOR

5.1.2. EXTERIOR

5.2. INDUSTRIAL APPLICATIONS

5.2.1. AUTOMOTIVE

5.2.2. AEROSPACE & MARINE

5.2.3. INDUSTRIAL WOOD COATINGS

5.2.4. CONSUMER DURABLES

5.2.5. GENERAL INDUSTRIAL

5.2.6. OTHER INDUSTRIAL APPLICATIONS

6.

ASIA-PACIFIC PAINTS & COATINGS MARKET - REGIONAL OUTLOOK (IN TERMS OF VALUE: $ MILLION & IN

TERMS OF VOLUME: KILO TONS)

6.1. CHINA

6.2. JAPAN

6.3. INDIA

6.4. SOUTH KOREA

6.5. ASEAN COUNTRIES

6.6. AUSTRALIA & NEW ZEALAND

6.7. REST OF ASIA-PACIFIC

7.

COMPETITIVE LANDSCAPE

7.1. AKZONOBEL N.V.

7.2. ASIAN PAINTS, LIMITED

7.3. AXALTA COATING SYSTEM LLC

7.4. BASF COATINGS

7.5. BECKERS GROUP

7.6. BERGER PAINTS INDIA LIMITED

7.7. INDIGO PAINTS PVT. LTD.

7.8. JOTUN A/S

7.9. KANSAI PAINT CO., LTD.

7.10. KELLY-MOORE PAINTS

7.11. NIPPON PAINT HOLDINGS CO., LTD.

7.12. PPG INDUSTRIES

7.13. RPM INTERNATIONAL, INC.

7.14. THE SHERWIN-WILLIAMS

7.15. VALSPAR CORPORATION

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: MARKET ATTRACTIVENESS MATRIX FOR PAINTS & COATINGS MARKET

TABLE 2: VENDOR SCORECARD OF PAINTS & COATINGS MARKET

TABLE 3: ASIA-PACIFIC PAINTS & COATINGS MARKET, COUNTRY OUTLOOK,

2019-2027 (IN $ MILLION)

TABLE 4: ASIA-PACIFIC PAINTS & COATINGS MARKET, COUNTRY OUTLOOK,

2019-2027 (IN KILO TONS)

TABLE 5: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY RESIN TYPE,

2019-2027 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY RESIN TYPE,

2019-2027 (IN KILO TONS)

TABLE 7: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2019-2027 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2019-2027 (IN KILO TONS)

TABLE 9: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY APPLICATION,

2019-2027 (IN $ MILLION)

TABLE 10: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY APPLICATION,

2019-2027 (IN KILO TONS)

FIGURE 1: ASIA-PACIFIC PAINTS & COATINGS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS OF PAINTS & COATINGS MARKET

FIGURE 3: KEY PLAYER POSITIONING IN 2018 (%)

FIGURE 4: ANTICIPATED GROWTH IN GDP OF EMERGING NATIONS

FIGURE 5: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY WATER-BORNE,

2019-2027 (IN $ MILLION)

FIGURE 6: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY SOLVENT-BORNE,

2019-2027 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY POWDER COATING,

2019-2027 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY HIGH-SOLIDS,

2019-2027 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY RADIATION-CURED,

2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY OTHER EMERGING

COATING TECHNOLOGIES, 2019-2027 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY ACRYLIC,

2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY POLYESTER,

2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY ALKYD,

2019-2027 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY EPOXY,

2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY POLYURETHANE,

2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY OTHER RESIN

TYPES, 2019-2027 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY ARCHITECTURAL

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC ARCHITECTURAL PAINTS & COATINGS MARKET, BY

INTERIOR, 2019-2027 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC ARCHITECTURAL PAINTS & COATINGS MARKET, BY

EXTERIOR, 2019-2027 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC PAINTS & COATINGS MARKET, BY INDUSTRIAL

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC INDUSTRIAL PAINTS & COATINGS MARKET, BY

AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 22: ASIA-PACIFIC INDUSTRIAL PAINTS & COATINGS MARKET, BY

AEROSPACE & MARINE, 2019-2027 (IN $ MILLION)

FIGURE 23: BOEING’S COMMERCIAL AIRCRAFTS MARKET OUTLOOK, BY REGION,

2016-2035

FIGURE 24: ASIA-PACIFIC INDUSTRIAL PAINTS & COATINGS MARKET, BY

INDUSTRIAL WOOD COATINGS, 2019-2027 (IN $ MILLION)

FIGURE 25: ASIA-PACIFIC INDUSTRIAL PAINTS & COATINGS MARKET, BY

CONSUMER DURABLES, 2019-2027 (IN $ MILLION)

FIGURE 26: ASIA-PACIFIC INDUSTRIAL PAINTS & COATINGS MARKET, BY

GENERAL INDUSTRIAL, 2019-2027 (IN $ MILLION)

FIGURE 27: ASIA-PACIFIC INDUSTRIAL PAINTS & COATINGS MARKET, BY

OTHER INDUSTRIAL APPLICATION, 2019-2027 (IN $ MILLION)

FIGURE 28: ASIA-PACIFIC PAINTS & COATINGS MARKET, REGIONAL OUTLOOK,

2018 & 2027 (IN %)

FIGURE 29: CHINA PAINTS & COATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: JAPAN PAINTS & COATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: INDIA PAINTS & COATINGS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32: SOUTH KOREA PAINTS & COATINGS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 33: ASEAN COUNTRIES PAINTS & COATINGS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 34: AUSTRALIA & NEW ZEALAND PAINTS & COATINGS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 35: REST OF ASIA-PACIFIC PAINTS & COATINGS

MARKET, 2019-2027 (IN $ MILLION)