Market By Products, Services And Geography | Forecast 2019-2027

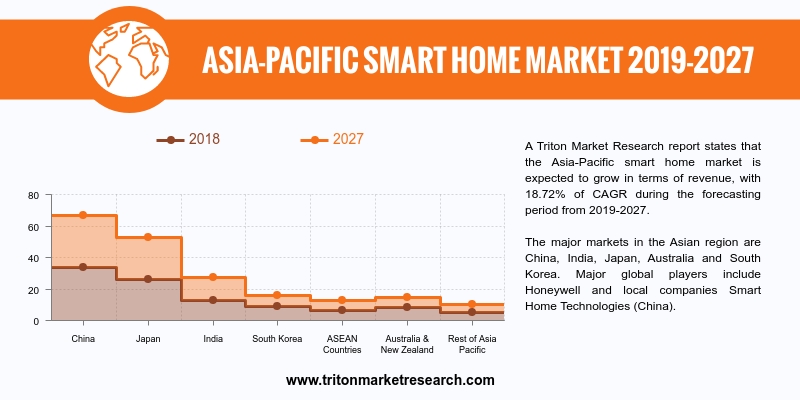

A Triton Market Research report states that the Asia-Pacific smart home market is expected to grow in terms of revenue, with 18.72% of CAGR during the forecasting period from 2019-2027.

The report on the Asia-Pacific smart home market includes the countries of:

• China

• Japan

• India

• South Korea

• ASEAN Countries

• Australia & New Zealand

• Rest of Asia-Pacific

Report scope can be customized per your requirements. Request For Customization

The major markets in the Asian region are China, India, Japan, Australia, and South Korea. Major global players include Honeywell and local companies Smart Home Technologies (China). The increasing disposable incomes are raising the living standards of the Asian population, and this is expected to drive the market. The price-sensitive Asian market is also expected to leverage the decreasing cost of smart home equipment. The majority of the market share was captured by China in the Asia-Pacific smart home market in 2018. On the other hand, India is predicted to be the fastest-growing country in the market in the forecast duration.

The consumers’ urge for change is the biggest driver of the smart home market in China. The growing demand for energy-efficient lighting and security solutions is the primary factor influencing the demand for smart homes. Companies like Alibaba, Midea, Baidu, Haier and Xiaomi have a strong presence in the Chinese smart home market through strategic collaborations and partnerships. The collaboration between internet companies, appliance companies, smartphone companies and even real estate companies is a major force influencing the growth of the market. A large number of devices and their complex connectivity & interoperability are major hindrances for the adoption of smart home appliances by consumers in China. The lack of a standardized communication platform between devices of different brands is another roadblock for the growth of the market. The willingness to adopt technology is high in China; the companies can leverage this to establish a strong smart home market in the country.

Samsung Electronics Co., Ltd. is a South Korean information technology (IT) company. The company offers televisions, smartphones, tablets, personal computers cameras, home appliances, long-term evolutions (LTE) systems, medical devices, semiconductors and light-emitting diode (LED) solutions. The company classifies its business operations into four reportable segments: information technology and mobile communications (IM), consumer electronics (CE), device solutions and Harman. As of December 2017, the company had 217 worldwide operation hubs, including 39 manufacturing sites, 55 sales offices, seven design centres, 35 R&D centres and 15 regional offices.

1. ASIA-PACIFIC SMART HOME MARKET - SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1. INCREASE IN ADOPTION OF ELECTRONIC GADGETS

2.2.2. CLOUD TECHNOLOGY HELPS IN THE GROWTH OF THE

MARKET

2.2.3. INCREASED ADOPTION OF SMART HOMES

2.3. EVOLUTION & TRANSITION OF SMART HOME

2.4. PORTER’S FIVE FORCE ANALYSIS

2.4.1. THREAT OF NEW ENTRANTS

2.4.2. THREAT OF SUBSTITUTE

2.4.3. BARGAINING POWER OF SUPPLIERS

2.4.4. BARGAINING POWER OF BUYERS

2.4.5. THREAT OF COMPETITIVE RIVALRY

2.5. KEY IMPACT ANALYSIS

2.5.1. COST

2.5.2. DATA SECURITY

2.5.3. COMFORT

2.6. MARKET ATTRACTIVENESS INDEX

2.7. VENDOR SCORECARD

2.8. INDUSTRY COMPONENTS

2.9. MARKET DRIVERS

2.9.1. GROWTH IN AGING POPULATION

2.9.2. GROWTH IN INTERNET OF THINGS (IOT) DEVICES

2.9.3. INCREASE IN URBANIZATION AND INFRASTRUCTURE

PROJECTS

2.9.4. GOVERNMENTAL INITIATIVES

2.10. MARKET RESTRAINTS

2.10.1. COMPLEX INSTALLATION PROCEDURE OF SMART

DEVICES

2.10.2. PROBLEMS WITH DATA MANAGEMENT

2.10.3. HIGH PRICE OF SMART HOME PROJECTS

2.10.4. PRIVACY CONCERNS

2.11. MARKET OPPORTUNITIES

2.11.1. DEMAND FROM URBAN SECURITY

2.11.2. GROWTH OF SMART CITY PROJECTS

2.12. MARKET CHALLENGES

2.12.1. LOW AWARENESS ABOUT THE MARKET

2.12.2. LACK OF STANDARDIZATION AND PROBLEMS WITH

INTEROPERABILITY

3. ASIA-PACIFIC SMART HOME MARKET OUTLOOK - BY

PRODUCTS

3.1. SECURITY

3.2. HVAC

3.3. LIGHTING CONTROLLERS

3.4. ENTERTAINMENT

3.5. ENERGY MANAGEMENT

3.6. HOME HEALTH

3.7. OTHERS

4. ASIA-PACIFIC SMART HOME MARKET OUTLOOK - BY

SERVICES

4.1. INSTALLATION AND REPAIR

4.2. CUSTOMIZATION

5. ASIA-PACIFIC SMART HOME MARKET - REGIONAL

OUTLOOK

5.1. CHINA

5.2. JAPAN

5.3. INDIA

5.4. SOUTH KOREA

5.5. ASEAN COUNTRIES

5.6. AUSTRALIA & NEW ZEALAND

5.7. REST OF ASIA-PACIFIC

6. COMPETITIVE LANDSCAPE

6.1. ABB LTD.

6.2. BLUE LINE INNOVATIONS, INC.

6.3. CENTRICA CONNECTED HOME LIMITED

6.4. CENTURY TECHNOLOGIES CORP.

6.5. CONTROL4 CORPORATION

6.6. CRESTRON ELECTRONICS, INC.

6.7. EE LIMITED

6.8. EMERSON ELECTRIC, CO.

6.9. HONEYWELL INTERNATIONAL, INC.

6.10. JOHNSON CONTROLS, INC.

6.11. LG ELECTRONICS, INC.

6.12. SAMSUNG ELECTRONICS CO., LTD.

6.13. SCHNEIDER ELECTRIC SE

6.14. SIEMENS AG

6.15. SOLATUBE INTERNATIONAL, INC.

6.16. UNITED TECHNOLOGIES CORPORATION

6.17. VODAFONE GROUP PLC

7. RESEARCH METHODOLOGY & SCOPE

7.1. RESEARCH SCOPE & DELIVERABLES

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC SMART HOME MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: TECHNOLOGIES USED IN A HOME AREA NETWORK

TABLE 3: VENDOR SCORECARD

TABLE 4: KEY COUNTRIES BY CRIME INDEX

TABLE 5: ASIA-PACIFIC SMART HOME MARKET, BY PRODUCT, 2019-2027 (IN $

MILLION)

TABLE 6: ASIA-PACIFIC SMART HOME MARKET, BY SERVICES, 2019-2027 (IN $

MILLION)

TABLE 7: ASIA-PACIFIC SMART HOME MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: EVOLUTION OF SMART HOME MARKET

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: KEY BUYING IMPACT ANALYSIS

FIGURE 4: MARKET ATTRACTIVENESS INDEX

FIGURE 5: INDUSTRY COMPONENTS

FIGURE 6: PERCENTAGE OF URBAN POPULATION ACROSS MAJOR REGIONS, 2017

FIGURE 7: ASIA-PACIFIC SMART HOME MARKET, BY SECURITY, 2019-2027 (IN $

MILLION)

FIGURE 8: ASIA-PACIFIC SMART HOME MARKET, BY HVAC, 2019-2027 (IN $

MILLION)

FIGURE 9: ASIA-PACIFIC SMART HOME MARKET, BY LIGHTING CONTROLLERS,

2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC SMART HOME MARKET, BY ENTERTAINMENT, 2019-2027

(IN $ MILLION)

FIGURE 11: ASIA-PACIFIC SMART HOME MARKET, BY ENERGY MANAGEMENT,

2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC SMART HOME MARKET, BY HOME HEALTH, 2019-2027 (IN

$ MILLION)

FIGURE 13: ASIA-PACIFIC SMART HOME MARKET, BY OTHERS, 2019-2027 (IN $

MILLION)

FIGURE 14: ASIA-PACIFIC SMART HOME MARKET, BY INSTALLATION & REPAIR,

2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC SMART HOME MARKET, BY CUSTOMIZATION, 2019-2027

(IN $ MILLION)

FIGURE 16: ASIA-PACIFIC SMART HOME MARKET, REGIONAL OUTLOOK, 2018 &

2027 (IN %)

FIGURE 17: CHINA SMART HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: JAPAN SMART HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: INDIA SMART HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SOUTH KOREA SMART HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: ASEAN COUNTRIES SMART HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: AUSTRALIA & NEW ZEALAND SMART HOME MARKET, 2019-2027 (IN

$ MILLION)

FIGURE 23: REST OF ASIA-PACIFIC SMART HOME MARKET, 2019-2027 (IN $

MILLION)