Market By Deployment, Type, Application And Geography | Forecast 2019-2027

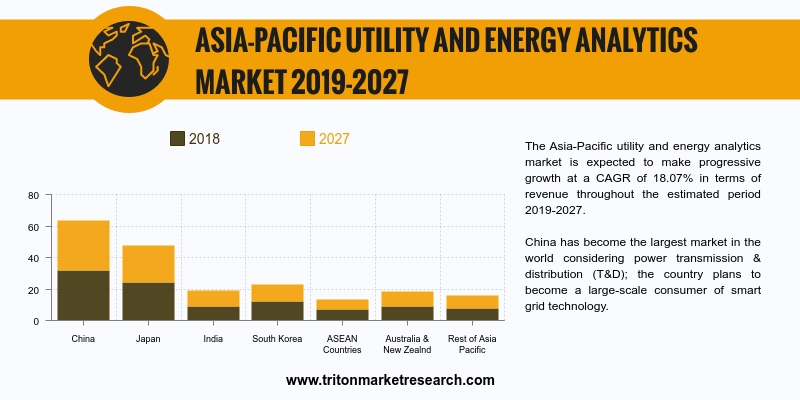

The Asia-Pacific utility and energy analytics market is expected to make progressive growth at a CAGR of 18.07% in terms of revenue throughout the estimated period 2019-2027.

The countries that have been scrutinized in the utility and energy analytics market in the Asia-Pacific are:

• Japan

• South Korea

• China

• India

• Australia & New Zealand

• ASEAN countries

• Rest of APAC

Report scope can be customized per your requirements. Request For Customization

China has become the largest market in the world considering power transmission & distribution (T&D); the country plans to become a large-scale consumer of smart grid technology. A massive change in China’s energy landscape will be observed owing to the use of renewable power and efforts made by the country’s political leaders at reducing the carbon intensity of its GDP by 40-45% by 2020 (relative to 2005).

China’s unique structural context would make it possible for the country to leap ahead in smart grid development - the government owning the T&D sector, the ability of the market to cut down equipment costs and the possibility of the government playing a pivotal role in the economy are likely to achieve the desired results. Also, increasing dedication by the country for green development will demand the usage of smart grid technologies. These factors are expected to make the smart grid market in China large and influential.

Embracing clean energy and energy efficiency would require smart grid capabilities to transform the demand & supply sides of China’s power industry. Urbanization has resulted in the introduction of electric vehicles, and the country is aggressively promoting their use; China is expected to have five million EVs by the year 2020. The EVs are expected to add considerable load to the electricity grid, which requires careful management.

Infosys is a global consulting & IT services company, headquartered in Bengaluru, India. It is one of the leading companies in the world in consulting and next-generation digital services. The company has more than 30 years of experience in handling the systems & workings of multinational enterprises. Infosys’ expertise in the field enables the company to aid clients to steer through their digital journey. In addition, the company has collaborated with leading business and technology players, so as to strengthen its services & business solutions.

1. ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS

MARKET - SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

HYBRID ANALYTICS IS FASTEST-GROWING IN DEPLOYMENT

2.2.2.

DISTRIBUTION PLANNING SECTOR IS THE FASTEST-GROWING APPLICATION

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. KEY IMPACT ANALYSIS

2.4.1.

PRICE

2.4.2.

MODE OF DEPLOYMENT

2.4.3.

APPLICATION

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. MARKET DRIVERS

2.7.1.

GROWING CONSUMER FOCUS ON ENERGY CONSUMPTION PATTERN ANALYSIS

2.7.2.

DEMAND FOR ENERGY AND UTILITY ANALYTICS INCREASES WITH EMPHASIS ON

RENEWABLE ENERGY

2.8. MARKET RESTRAINTS

2.8.1.

DEPLOYMENT REQUIRES HIGH CAPITAL INVESTMENT

2.9. MARKET OPPORTUNITIES

2.9.1.

ENERGY AND UTILITY INDUSTRY ADOPTS CLOUD TECHNOLOGY

2.9.2.

DEVELOPMENT OF SMART CITIES AND INFRASTRUCTURES

2.10. MARKET CHALLENGES

2.10.1. SECURITY ISSUES

2.10.2. LACK OF INDUSTRIAL EXPERTISE

3. ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS

MARKET OUTLOOK - BY DEPLOYMENT

3.1. CLOUD

3.2. ON-PREMISES

3.3. HYBRID

4. ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS

MARKET OUTLOOK - BY TYPE

4.1. SOFTWARE

4.2. SERVICES

5. ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS

MARKET OUTLOOK - BY APPLICATION

5.1. METER OPERATION

5.2. LOAD FORECASTING

5.3. DEMAND RESPONSE

5.4. DISTRIBUTION PLANNING

5.5. OTHER APPLICATIONS

6. ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS

MARKET - REGIONAL OUTLOOK

6.1. CHINA

6.2. JAPAN

6.3. INDIA

6.4. SOUTH KOREA

6.5. ASEAN COUNTRIES

6.6. AUSTRALIA & NEW ZEALAND

6.7. REST OF ASIA-PACIFIC

7. COMPETITIVE LANDSCAPE

7.1. CAPGEMINI SE

7.2. ORACLE CORPORATION

7.3. ABB CORPORATION

7.4. SAS INSTITUTE INC.

7.5. SIEMENS AG

7.6. IBM CORPORATION

7.7. GENERAL ELECTRIC COMPANY

7.8. SAP SE

7.9. INFOSYS LIMITED

7.10. WIPRO LIMITED

7.11. BUILDING IQ INC.

7.12. SCHNEIDER ELECTRIC SE

7.13. TERADATA CORPORATION

7.14. CISCO SYSTEMS INC.

7.15. EATON CORPORATION

8. RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 2: VENDOR SCORECARD

TABLE 3: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY

DEPLOYMENT, 2019-2027 (IN $ MILLION)

TABLE 4: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY TYPE,

2019-2027 (IN $ MILLION)

TABLE 5: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

FIGURE 1: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY

APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: HYBRID UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 3: DISTRIBUTION PLANNING UTILITY AND ENERGY ANALYTICS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE FORCE ANALYSIS

FIGURE 5: KEY BUYING IMPACT ANALYSIS

FIGURE 6: MARKET ATTRACTIVENESS INDEX

FIGURE 7: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY CLOUD,

2019-2027 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY

ON-PREMISES, 2019-2027 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY HYBRID,

2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY

SOFTWARE, 2019-2027 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY SERVICE,

2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY METER

OPERATION, 2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY LOAD

FORECASTING, 2019-2027 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY DEMAND

RESPONSE, 2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY

DISTRIBUTION PLANNING, 2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, BY OTHER

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 18: CHINA UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 19: JAPAN UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 20: INDIA UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 21: SOUTH KOREA UTILITY AND ENERGY ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 22: ASEAN COUNTRIES UTILITY AND ENERGY ANALYTICS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 23: AUSTRALIA & NEW ZEALAND UTILITY AND ENERGY ANALYTICS

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: REST OF ASIA-PACIFIC UTILITY AND ENERGY ANALYTICS MARKET,

2019-2027 (IN $ MILLION)