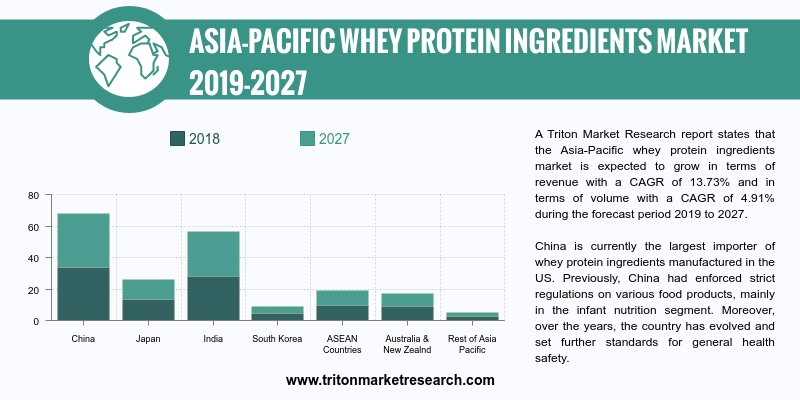

A Triton Market Research report states that the Asia-Pacific whey protein ingredients market is expected to grow in terms of revenue with a CAGR of 13.73% and in terms of volume with a CAGR of 4.91% during the forecast period 2019 to 2027.

The countries that have been studied in Asia-Pacific’s whey protein ingredients market are:

• China

• Japan

• India

• South Korea

• ASEAN countries

• Australia & New Zealand

• Rest of Asia-Pacific

Report scope can be customized per your requirements. Request For Customization

China is currently the largest importer of whey protein ingredients manufactured in the US. Previously, China had enforced strict regulations on various food products, mainly in the infant nutrition segment. Moreover, over the years, the country has evolved and set further standards for general health safety. Chinese consumers prefer imported whey protein ingredients over locally-manufactured varieties due to quality concerns. As people have become more aware of the benefits of a healthier lifestyle, whey protein ingredients have become an important element in their diet plan. The country has a huge population base that offers strong growth potential for whey protein ingredients.

The whey protein ingredients is essential for infant formula and China is a country with population of billions, so the demand for whey protein ingredients for infants is very large. With the consumers’ acceptation of whey protein ingredients used in sports drinks and other nutrition foods, the product becomes more necessary for Chinese consumers. As China happens to be the largest producer of pork globally, whey protein ingredients have become one of the prime components in the animal feed segment. Also, there is a supply gap in the Chinese market for whey protein ingredients and companies are now looking for partners to promote whey protein ingredient products in China.

Westland Milk Products is an independent farmer-owned co-operative dairy that produces milk-based products for nutritional, food and beverage industries. The company produces milk powders (skim milk, whole milk & buttermilk) and milk proteins (casein powders, milk protein concentrates, whey protein ingredients concentrates & protein hydrolysates). It also produces nutritional products, such as formula base powder, follow-on base powder, growing up milk powder (GUMP) base & colostrum and cream products. The company offers its products under the brands Westpro, EasiYo, Westpro Nutrition and Westgold. Westland operates in New Zealand, Australia, the US and the UK. It is headquartered in Hokitika, New Zealand.

1. ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET

- SUMMARY

2. INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCE ANALYSIS

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

BARGAINING POWER OF BUYERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. MARKET ATTRACTIVENESS INDEX

2.4. VENDOR SCORECARD

2.5. INDUSTRY COMPONENTS

2.5.1.

DAIRY/CHEESE INDUSTRY

2.5.2.

FOOD & BEVERAGE INDUSTRY

2.5.3.

VALUE-ADDED PRODUCT

2.5.4.

BIOETHANOL FUEL PRODUCTION

2.6. MANUFACTURING EXPENSES INVOLVED IN WHEY

PROTEIN INGREDIENTS MAKING PROCESS

2.7. MARKET DRIVERS

2.7.1.

GROWING AWARENESS OF WHEY PROTEIN INGREDIENTS

2.7.2.

HEALTH & WELLNESS PRODUCTS SHOW RISING TRENDS

2.8. MARKET RESTRAINTS

2.8.1.

RAW MATERIAL PRICE FLUCTUATIONS

2.8.2.

THE INDUSTRY IS HIGHLY FRAGMENTED IN NATURE

2.8.3.

HIGH COST OF MANUFACTURING

2.9. MARKET OPPORTUNITIES

2.9.1.

DEMAND FOR HIGH-QUALITY PROTEIN SUPPLEMENTS

2.9.2.

HEALTH-CONSCIOUS CONSUMERS ON RISE

2.9.3.

GROWTH OF PACKAGED & SPECIALTY FOOD

2.10. MARKET CHALLENGES

2.10.1.

INCIDENCE OF DISEASES FROM FARM ANIMALS REDUCES ADOPTION OF FARM

PRODUCTS

2.10.2.

HEALTH-RELATED PROBLEMS FROM WHEY PROTEIN INGREDIENTS

3. ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET

OUTLOOK - BY TYPE (IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME:

KILOTONS)

3.1. WPI

3.2. WPC 80

3.3. WPC 50-79

3.4. WPC 35

3.5. DWP

3.6. WPH

4. ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET

OUTLOOK - BY END-USER (IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME:

KILOTONS)

4.1. BAKERY & CONFECTIONERY

4.2. DAIRY PRODUCTS

4.3. FROZEN FOODS

4.4. SPORTS NUTRITION

4.5. BEVERAGES

4.6. MEAT PRODUCTS

4.7. MEDICINE

4.8. OTHERS

5. ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET

OUTLOOK - BY APPLICATION (IN TERMS OF VALUE: $ MILLION & IN TERMS OF

VOLUME: KILOTONS)

5.1. FUNCTIONAL FOODS & BEVERAGES

5.2. INFANT NUTRITION

5.3. SPORTS FOOD & BEVERAGES

5.4. CLINICAL NUTRITION

5.5. OTHER APPLICATIONS

6. ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET

- REGIONAL OUTLOOK (IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME:

KILOTONS)

6.1. CHINA

6.2. JAPAN

6.3. INDIA

6.4. SOUTH KOREA

6.5. ASEAN COUNTRIES

6.6. AUSTRALIA & NEW ZEALAND

6.7. REST OF ASIA-PACIFIC

7. COMPANY ANALYSIS

7.1. CARGILL, INCORPORATED

7.2. DANONE S.A.

7.3. ARLA FOODS

7.4. FONTERRA CO-OPERATIVE GROUP LIMITED

7.5. OMEGA PROTEIN

7.6. ERIE FOODS INTERNATIONAL, INC.

7.7. GRANDE CUSTOM INGREDIENTS

7.8. AGROPUR MSI, LLC

7.9. AMERICAN DAIRY PRODUCTS INSTITUTE

7.10. LEPRINO FOODS, CO.

7.11. MEGGLE GROUP

7.12. MILK SPECIALTIES

7.13. WARRNAMBOOL CHEESE AND BUTTER FACTORY

7.14. WESTLAND MILK PRODUCTS

7.15. SAPUTO INGREDIENTS

8. RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 2: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN KILOTONS)

TABLE 3: VENDOR SCORECARD

TABLE 4: WHEY POWDER MANUFACTURING EXPENSES IN PERCENTAGE

TABLE 5: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY TYPE,

2019-2027 (IN $ MILLION)

TABLE 6: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY TYPE,

2019-2027 (IN KILOTONS)

TABLE 7: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY END-USER,

2019-2027 (IN $ MILLION)

TABLE 8: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY END-USER, 2019-2027

(IN KILOTONS)

TABLE 9: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION,

2019-2027 (IN $ MILLION)

TABLE 10: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION,

2019-2027 (IN KILOTONS)

TABLE 11: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN $ MILLION)

TABLE 12: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY,

2019-2027 (IN KILOTONS)

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY WPI,

2019-2027 (IN $ MILLION)

FIGURE 5: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY WPC 80,

2019-2027 (IN $ MILLION)

FIGURE 6: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY WPC 50-79,

2019-2027 (IN $ MILLION)

FIGURE 7: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY WPC 35,

2019-2027 (IN $ MILLION)

FIGURE 8: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY DWP,

2019-2027 (IN $ MILLION)

FIGURE 9: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY WPH,

2019-2027 (IN $ MILLION)

FIGURE 10: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY BAKERY &

CONFECTIONERY, 2019-2027 (IN $ MILLION)

FIGURE 11: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY DAIRY

PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 12: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY FROZEN

FOODS, 2019-2027 (IN $ MILLION)

FIGURE 13: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY SPORTS

NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 14: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY BEVERAGES,

2019-2027 (IN $ MILLION)

FIGURE 15: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY MEAT

PRODUCTS, 2019-2027 (IN $ MILLION)

FIGURE 16: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY MEDICINE,

2019-2027 (IN $ MILLION)

FIGURE 17: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY OTHERS,

2019-2027 (IN $ MILLION)

FIGURE 18: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY FUNCTIONAL

FOODS & BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 19: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY INFANT NUTRITION,

2019-2027 (IN $ MILLION)

FIGURE 20: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY SPORTS FOOD

& BEVERAGES, 2019-2027 (IN $ MILLION)

FIGURE 21: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY CLINICAL

NUTRITION, 2019-2027 (IN $ MILLION)

FIGURE 22: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY OTHER

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 23: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 24: CHINA WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 25: JAPAN WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 26: INDIA WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 27: SOUTH KOREA WHEY PROTEIN INGREDIENTS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 28: ASEAN COUNTRIES WHEY PROTEIN INGREDIENTS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 29: AUSTRALIA & NEW ZEALAND WHEY PROTEIN INGREDIENTS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 30: REST OF ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET,

2019-2027 (IN $ MILLION)