Market By Type, Application, And Geography | Forecasts 2019-2027

After a detailed analysis, Triton has estimated that the global biodegradable plastic market is expected to display an upward trend in terms of revenue and is exhibiting a growth rate of 10.84% during the forecast years of 2019-2027. The market was assessed to be worth $2501.53million in the year 2018 and is predicted to generate a revenue of approximately $6153.50million by the year 2027.

Plastic has become an integral part of modern human life as it is used in almost all sectors of the economy. From bowls used in the kitchen to some of the components of cars, plastic has the de facto element of the human day to day life. With the increasing demand and use of plastic, the issue of pollution caused by its use has become a subject of concern due to its non-eco-friendly and non-biodegradable nature. To tackle this issue, the use of a new option in the form of biodegradable plastic has gained momentum.

We provide additional customization based on your specific requirements. Request For Customization

Biodegradable plastic has the capability to decompose naturally in the environment, which is achievable when microorganisms in the environment help in metabolizing and breaking down the structure of the biodegradable plastic. The end product after decomposition is the one which is less harmful to the environment than traditional plastics. All-natural plant materials are used to make biodegradable plastics, which include corn oil, starch, orange peels, and plants. Traditional plastic is made using chemical fillers that can be harmful to the environment most of the times when released during the meltdown of the plastic.

Biodegradable plastic is derived from natural sources that do not contain these chemical fillers; hence, it does not pose the same risk to the environment. The production of biodegradable plastics begins with the melting down of all the natural raw materials, and then this mixture is poured into molds of various shapes depending upon the product required, ex: for plastic water bottles and utensils.

The biodegradable plastic market is growing at a rapid pace, mainly due to an increase in the demand for plastic, in general, and environmental awareness. With continuous R&D activities undertaken by various market players, mainly to solve the problem of high costs associated with the production of biodegradable plastics, the market is projected to rise owing to the future advancements in the field. Support from government and positive efforts in R&D is set to minimize the production cost for the biodegradable plastics in the near future.

Within the biodegradable plastic markets report from Triton, market definitions and the key insights regarding the industry are discussed. Also, the report consists of market attractiveness matrix, vendor scorecard, key impact analysis, Porter's five force analysis, key impact analysis, industrial player positioning, and key market strategies.

Market drivers like increased production of other renewable resources, wide scope of biodegradable plastics in various end-use segments, the biodegradable property of biodegradable plastic, favorable government policies to reduce the use of petroleum-based products and consumer preference for environment-friendly products are analyzed in the report. The industry is facing restraints such as comparatively high cost of raw materials and durability issues.

To get detailed insights on segments, Request for a Free Sample Report

Key opportunities like increased biodegradable plastic production across regions and the increasing availability of raw materials can be leveraged by the industry to get towards the projected growth in the coming years. However, challenges such as biodegradable plastic production impact on food supply and production and availability of alternatives are faced by the industry at this moment.

The key regions covered in the global biodegradable plastic market are:

o North America Biodegradable Plastic: United States and Canada

o Europe Biodegradable Plastic: United Kingdom, Germany, France, Italy, Spain, Russia and Rest of Europe

o Asia Pacific Biodegradable Plastic: China, Japan, India, South Korea, ASEAN countries, Australia & New Zealand and Rest of Asia Pacific

o Latin America Biodegradable Plastic: Brazil, Mexico and Rest of Latin America

o Middle East and Africa Biodegradable Plastic: United Arab Emirates, Turkey, Saudi Arabia, South Africa and Rest of the Middle East and Africa

The biodegradable plastic market report is segmented into:

• By Biodegradable plastic type:

o PLA

o Starch blends

o PCL

o Regenerated cellulose

o PBS

o PHA

o Other types

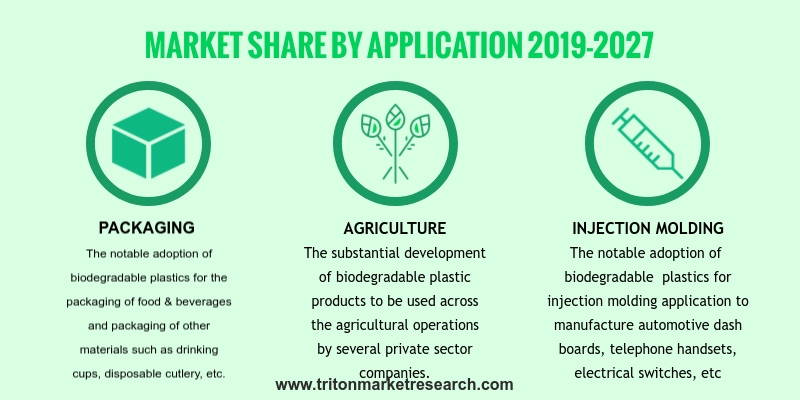

• Application:

o Packaging

o Fibers

o Agriculture

o Injection Molding

o Other Applications

The major key players leading the biodegradable market are Sigma-Aldrich (Acquisition By Merck), Plantic Technologies (Acquisition By Kuraray America Inc), Zhejiang Hisun Biomaterials Co. Ltd, Natureworks Llc, Corbion N.V. (Purac), Bio-On S.P.A., Tianan Biologic Material Co. Ltd, Fkur Kunststoff Gmbh, Futerro SA, Synbra Holding BV, Mitsubishi Chemical Corporation, BASF SE, Dow Chemical Company (Merger With Dupont), Danimer Scientific Llc, Biome Bioplastics Limited

The strategic analysis for each of these companies is detailed in the report. The company market share helps to analyze the information of the key players along with their hold in the market.

1. GLOBAL

BIODEGRADABLE PLASTIC MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. EVOLUTION

& TRANSITION OF BIODEGRADABLE PLASTIC

2.4. PORTER'S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

COMPONENTS

2.8. REGULATORY

FRAMEWORK

2.9. KEY

IMPACT ANALYSIS

2.10. MARKET

OPPORTUNITY INSIGHTS

2.11. INDUSTRY

PLAYER POSITIONING

2.12. KEY

MARKET STRATEGIES

2.13. MARKET

DRIVERS

2.13.1. RISE

IN THE PRODUCTION OF CORN AND OTHER RENEWABLE RESOURCES

2.13.2. INCREASING

SCOPE OF BIODEGRADABLE PLASTICS IN VARIOUS END-USE SEGMENTS

2.13.3. BIODEGRADABLE

PROPERTY OF THE BIODEGRADABLE PLASTICS

2.13.4. FAVORABLE

GOVERNMENT POLICIES TO REDUCE THE USE OF PETROLEUM-BASED POLYMERS

2.13.5. SHIFT

IN CONSUMER PREFERENCE TOWARDS THE ADOPTION OF ENVIRONMENTAL-FRIENDLY PACKAGING

SOLUTION

2.14. MARKET

RESTRAINTS

2.14.1. HIGH

COST OF BIODEGRADABLE PLASTICS AS COMPARED TO CONVENTIONAL PLASTICS

2.14.2. DURABILITY

ISSUES

2.15. MARKET

OPPORTUNITIES

2.15.1. INCREASED

BIOPLASTIC PRODUCTION ACROSS REGIONS

2.15.2. AVAILABILITY

OF COST-EFFECTIVE BIO-BASED RAW MATERIALS

2.16. MARKET

CHALLENGES

2.16.1. BIODEGRADABLE

PLASTICS IMPACT ON FOOD PRODUCTION AND SUPPLY

2.16.2. EASY

AVAILABILITY OF ALTERNATIVES

3. BIODEGRADABLE

PLASTIC INDUSTRY OUTLOOK – BY TYPE

3.1. PLA

3.2. STARCH

BLENDS

3.3. PCL

3.4. REGENERATED CELLULOSE

3.5. PBS

3.6. PHA

3.7. OTHER

TYPES

4. BIODEGRADABLE

PLASTIC INDUSTRY OUTLOOK - BY APPLICATION

4.1. PACKAGING

4.2. FIBERS

4.3. AGRICULTURE

4.4. INJECTION

MOLDING

4.5. OTHER

APPLICATIONS

5. BIODEGRADABLE

PLASTIC INDUSTRY - REGIONAL OUTLOOK

5.1. NORTH

AMERICA

5.1.1. MARKET

BY BIODEGRADABLE PLASTIC TYPE

5.1.2. MARKET

BY APPLICATION

5.1.3. COUNTRY

ANALYSIS

5.1.3.1. UNITED

STATES

5.1.3.2. CANADA

5.2. EUROPE

5.2.1. MARKET

BY BIODEGRADABLE PLASTIC TYPE

5.2.2. MARKET

BY APPLICATION

5.2.3. COUNTRY

ANALYSIS

5.2.3.1. UNITED

KINGDOM

5.2.3.2. GERMANY

5.2.3.3. FRANCE

5.2.3.4. ITALY

5.2.3.5. SPAIN

5.2.3.6. RUSSIA

5.2.3.7. REST

OF EUROPE

5.3. ASIA

PACIFIC

5.3.1. MARKET

BY BIODEGRADABLE PLASTIC TYPE

5.3.2. MARKET

BY APPLICATION

5.3.3. COUNTRY

ANALYSIS

5.3.3.1. CHINA

5.3.3.2. JAPAN

5.3.3.3. INDIA

5.3.3.4. SOUTH

KOREA

5.3.3.5. ASEAN

COUNTRIES

5.3.3.6. AUSTRALIA

AND NEW ZEALAND

5.3.3.7. REST

OF ASIA PACIFIC

5.4. LATIN

AMERICA

5.4.1. MARKET

BY BIODEGRADABLE PLASTIC TYPE

5.4.2. MARKET

BY APPLICATION

5.4.3. COUNTRY

ANALYSIS

5.4.3.1. BRAZIL

5.4.3.2. MEXICO

5.4.3.3. REST

OF LATIN AMERICA

5.5. MIDDLE

EAST AND AFRICA

5.5.1. MARKET

BY BIODEGRADABLE PLASTIC TYPE

5.5.2. MARKET

BY APPLICATION

5.5.3. COUNTRY

ANALYSIS

5.5.3.1. UNITED

ARAB EMIRATES

5.5.3.2. TURKEY

5.5.3.3. SAUDI

ARABIA

5.5.3.4. SOUTH

AFRICA

5.5.3.5. REST

OF MIDDLE EAST & AFRICA

6. COMPETITIVE

LANDSCAPE

6.1. BASF

SE

6.2. BIOME

BIOPLASTICS LIMITED

6.3. BIO-ON

S.P.A.

6.4. CORBION

N.V. (PURAC)

6.5. DANIMER

SCIENTIFIC, LLC

6.6. DOW

CHEMICAL COMPANY (MERGER WITH DUPONT)

6.7. FKUR

KUNSTSTOFF GMBH

6.8. FUTERRO SA

6.9. MITSUBISHI

CHEMICAL CORPORATION

6.10. NATUREWORKS

LLC

6.11. PLANTIC TECHNOLOGIES (ACQUISITION BY

KURARAY AMERICA, INC,)

6.12. SIGMA-ALDRICH

(ACQUISITION BY MERCK)

6.13. SYNBRA

HOLDING BV

6.14. TIANAN

BIOLOGIC MATERIAL CO. LTD

6.15. ZHEJIANG

HISUN BIOMATERIALS CO. LTD.

7. METHODOLOGY

& SCOPE

7.1. RESEARCH

SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1 MARKET

ATTRACTIVENESS MATRIX FOR BIODEGRADABLE PLASTIC MARKET

TABLE 2 VENDOR

SCORECARD OF BIODEGRADABLE PLASTIC MARKET

TABLE 3 REGULATORY

FRAMEWORK OF BIODEGRADABLE PLASTIC MARKET

TABLE 4 KEY STRATEGIC

DEVELOPMENTS IN BIODEGRADABLE PLASTIC MARKET

TABLE 5 COMPARISON

BETWEEN BIOPLASTICS AND CONVENTIONAL PLASTICS

TABLE 6 COST ANALYSIS

OF BIODEGRADABLE PLASTICS IN 2016

TABLE 7 COST ANALYSIS

OF FOSSIL BASED PLASTICS IN 2016

TABLE 8 SUSTAINABILITY

OF MAJOR BIO-BASED PLASTIC TYPES FOR DIFFERENT APPLICATIONS

TABLE 9 GLOBAL

BIODEGRADABLE PLASTIC MARKET, BY BIODEGRADABLE PLASTIC TYPE, 2019-2027, (IN $

MILLION)

TABLE 10 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY

APPLICATION, 2019-2027, (IN $ MILLION)

TABLE 11 GLOBAL BIODEGRADABLE PLASTIC MARKET,

REGIONAL OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 12 NORTH AMERICA BIODEGRADABLE PLASTIC

MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 13 NORTH AMERICA BIODEGRADABLE PLASTIC

MARKET, BY BIODEGRADABLE PLASTIC TYPE, 2019-2027 (IN $ MILLION)

TABLE 14 NORTH AMERICA BIODEGRADABLE PLASTIC

MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 15 EUROPE BIODEGRADABLE PLASTIC MARKET,

COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 16 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

BIODEGRADABLE PLASTIC TYPE, 2019-2027 (IN $ MILLION)

TABLE 17 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 18 ASIA PACIFIC BIODEGRADABLE PLASTIC MARKET,

COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 19 ASIA PACIFIC BIODEGRADABLE PLASTIC MARKET,

BY BIODEGRADABLE PLASTIC TYPE, 2019-2027 (IN $ MILLION)

TABLE 20 ASIA PACIFIC BIODEGRADABLE PLASTIC MARKET,

BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 21 LATIN AMERICA BIODEGRADABLE PLASTIC

MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 22 LATIN AMERICA BIODEGRADABLE PLASTIC

MARKET, BY BIODEGRADABLE PLASTIC TYPE, 2019-2027 (IN $ MILLION)

TABLE 23 LATIN AMERICA BIODEGRADABLE PLASTIC

MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 24 MIDDLE EAST & AFRICA BIODEGRADABLE

PLASTIC MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 25 MIDDLE EAST & AFRICA BIODEGRADABLE

PLASTIC MARKET, BY BIODEGRADABLE PLASTIC TYPE, 2019-2027 (IN $ MILLION)

TABLE 26 MIDDLE EAST & AFRICA BIODEGRADABLE

PLASTIC MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

FIGURE 1 GLOBAL BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 2 PORTER’S FIVE FORCE ANALYSIS OF

BIODEGRADABLE PLASTIC MARKET

FIGURE 3 INDUSTRY COMPONENTS OF BIODEGRADABLE

PLASTIC MARKET

FIGURE 4 MARKET OPPORTUNITY INSIGHTS, BY REGION,

2018

FIGURE 5 MARKET OPPORTUNITY INSIGHTS, BY PLASTIC

TYPE, 2018

FIGURE 6 MARKET OPPORTUNITY INSIGHTS, BY

APPLICATION, 2018

FIGURE 7 KEY PLAYER POSITIONING IN 2017 (%)

FIGURE 8 SUGARCANE AND CORN PRODUCTION IN KEY

COUNTRIES, 2016 (IN %)

FIGURE 9 WORLDWIDE PRODUCTION OF SUGAR CANE AND

CORN, 2014- 2023 (IN MILLION TONNES)

FIGURE 10 TIMELINE OF BIODEGRADABLE PLASTICS

FIGURE 11 WORLDWIDE CORN PRODUCTION, 2010-2017, (IN

MILLION METRIC TONNES)

FIGURE 12 MAJOR CORN PRODUCERS ACROSS THE GLOBE,

2015-2016 (% OF TOTAL PRODUCTION)

FIGURE 13 WORLDWIDE BIOPLASTIC PRODUCTION CAPACITY,

2017-2022 (IN ‘000 TONNES)

FIGURE 14 PERCENTAGE SHARE OF TOTAL BIOPLASTIC

PRODUCTION ACROSS REGIONS IN 2017 (IN %)

FIGURE 15 MAJOR SUGARCANE PRODUCERS ACROSS THE GLOBE IN

2016 (IN MILLION TONNES)

FIGURE 16 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY PLA,

2019-2027 (IN $ MILLION)

FIGURE 17 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY

STARCH BLENDS, 2019-2027 (IN $ MILLION)

FIGURE 18 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY PCL,

2019-2027 (IN $ MILLION)

FIGURE 19 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY

REGENERATED CELLULOSE, 2019-2027 (IN $ MILLION)

FIGURE 20 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY PBS,

2019-2027 (IN $ MILLION)

FIGURE 21 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY PHA,

2019-2027 (IN $ MILLION)

FIGURE 22 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY OTHER

TYPES, 2019-2027 (IN $ MILLION)

FIGURE 23 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY

PACKAGING, 2019-2027 (IN $ MILLION)

FIGURE 24 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY

FIBERS, 2019-2027 (IN $ MILLION)

FIGURE 25 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY

AGRICULTURE, 2019-2027 (IN $ MILLION)

FIGURE 26 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY

INJECTION MOLDING, 2019-2027 (IN $ MILLION)

FIGURE 27 GLOBAL BIODEGRADABLE PLASTIC MARKET, BY OTHER

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 28 GLOBAL BIODEGRADABLE PLASTIC MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 29 UNITED STATES BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 30 CANADA BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 31 UNITED KINGDOM BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 32 GERMANY BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 33 FRANCE BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 34 ITALY BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 35 SPAIN BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 36 RUSSIA BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 37 REST OF EUROPE BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 38 CHINA BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 39 JAPAN BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 40 INDIA BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 41 SOUTH KOREA BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 42 ASEAN COUNTRIES BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 43 AUSTRALIA & NEW ZEALAND BIODEGRADABLE

PLASTIC MARKET, 2019-2027 (IN $ MILLION)

FIGURE 44 REST OF ASIA-PACIFIC BIODEGRADABLE PLASTIC

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 45 BRAZIL BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 46 MEXICO BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 47 REST OF LATIN AMERICA BIODEGRADABLE PLASTIC

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 48 UNITED ARAB EMIRATES BIODEGRADABLE PLASTIC

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 49 SAUDI ARABIA BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 50 TURKEY BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 51 SOUTH AFRICA BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 52 REST OF MIDDLE EAST & AFRICA

BIODEGRADABLE PLASTIC MARKET, 2019-2027 (IN $ MILLION)