Market By Demographics, Products, Devices, Services And Geography | Forecast 2019-2027

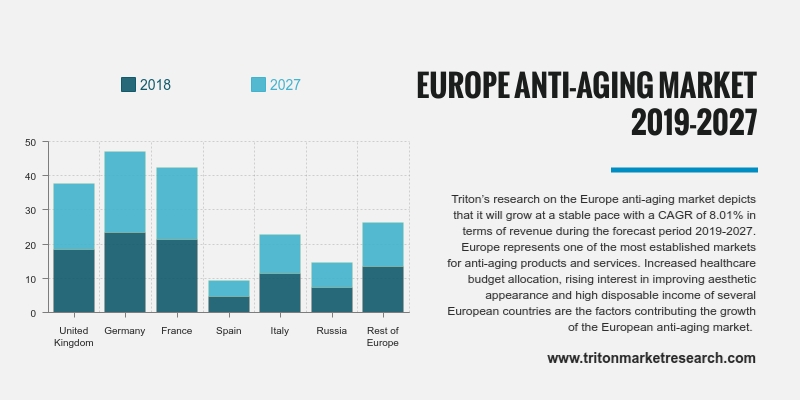

Triton’s research on the Europe anti-aging market depicts that it will grow at a stable pace with a CAGR of 8.01% in terms of revenue during the forecast period 2019-2027.

The countries analyzed in Europe’s anti-aging market are:

• The United Kingdom

• Spain

• France

• Germany

• Russia

• Italy

• Rest of Europe.

Europe represents one of the most established markets for anti-aging products and services. Increased healthcare budget allocation, rising interest in improving aesthetic appearance and high disposable income of several European countries are the factors contributing the growth of the European anti-aging market. With the rapid industrialization of European countries and their high economic growth, the region is witnessing significant technological innovations in the cosmetics or the aesthetic industry. Like any industrialized region, Europe also faces the challenges associated with population aging. Most people in European countries far exceed the average global life expectancy age limit. Premature skin aging is also a rising concern among residents of most developed countries of Europe. With increasing awareness about the availability of a wide range of anti-aging product options in the market, there is a huge demand for anti-aging devices among the overall European population which is directly propelling the growth of the anti-aging market.

The Russia anti-aging market is mainly driven by the high number of aesthetic plastic surgeries that take place in the country. The growing beauty consciousness nature of the Russian people has led to a rise in the number of aesthetic plastic surgery procedures. As per the International Society of Aesthetic Plastic Surgery (ISAPS) in 2016, Russia stood at the 6th place in the list of top 20 countries for cosmetic procedures. Therefore, the high number of aesthetic plastic surgery procedures would boost the demand for aesthetic plastic surgeries, which, in turn, would boost the demand for anti-aging devices.

Avon Products, Inc. is a beauty product manufacturing company founded in 1996 and headquartered in London, the United Kingdom. The company is a manufacturer and supplier of beauty & cosmetic products in more than 100 countries. The company’s product portfolio includes skincare, color cosmetics, fragrance and home & fashion products. Some of the top brands of the company include Avon Color, Skin-So-Soft, Advance Techniques, Mark and ANEW. Avon Products, Inc. generated a revalue of $5.7 billion in 2017.

1.

EUROPE ANTI-AGING MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PARENT MARKET ANALYSIS: BEAUTY & PERSONAL

CARE MARKET

2.3. EVOLUTION & TRANSITION OF ANTI-AGING

PRODUCTS, SERVICES & DEVICES

2.4. KEY INSIGHTS

2.4.1. ADVENT OF MULTIFUNCTIONAL PRODUCTS AND UV

ABSORBERS

2.4.2. INCREASING DEMAND FOR ANTI-AGING HAIR CARE

PRODUCTS

2.4.3. HIGH NUMBER OF START-UPS

2.4.4. RISING AWARENESS TOWARDS THE AGING SIGNS

2.5. PORTER’S FIVE FORCE ANALYSIS

2.5.1. BARGAINING POWER OF BUYERS

2.5.2. BARGAINING POWER OF SUPPLIERS

2.5.3. THREAT OF NEW ENTRANTS

2.5.4. THREAT OF SUBSTITUTE

2.5.5. THREAT OF COMPETITIVE RIVALRY

2.6. KEY IMPACT ANALYSIS

2.6.1. BRAND VALUE

2.6.2. PRODUCTS REVIEWS

2.6.3. COST

2.6.4. FORMULATION

2.7. MARKET ATTRACTIVENESS INDEX

2.8. VENDOR SCORECARD

2.9. INDUSTRY COMPONENTS

2.9.1. SUPPLIERS

2.9.2. RESEARCH & DEVELOPMENT

2.9.3. MANUFACTURING/PRODUCTION

2.9.4. DISTRIBUTION & MARKETING

2.9.5. END-USERS

2.10. REGULATORY FRAMEWORK

2.11. MARKET DRIVERS

2.11.1. UPSURGE IN AGING POPULATION

2.11.2. GROWING POPULATION WITH OBESITY

2.11.3. AGGREGATED AWARENESS OF ANTI-AGING PRODUCTS

2.11.4. NOVEL INVENTIONS IN ANTI-AGING TREATMENTS

2.12. MARKET RESTRAINTS

2.12.1. SHIFTING CONSUMER PREFERENCE TOWARDS NATURAL

& ORGANIC PRODUCTS

2.12.2. LOGISTICS CONCERNS

2.12.3. SIDE-EFFECTS OF ANTI-AGING PRODUCTS

2.13. MARKET OPPORTUNITIES

2.13.1. RISING HOUSEHOLD DISPOSABLE INCOME PER CAPITA

2.13.2. ENHANCED MARKETING & PROMOTION TECHNIQUES

2.13.3. RAPID ADOPTION OF HAIR RESTORATION

TECHNOLOGIES

2.14. MARKET CHALLENGES

2.14.1. ADOPTION OF HOME REMEDIES BY MAJOR PORTION OF

CONSUMERS

2.14.2. STRINGENT GOVERNMENT REGULATIONS REGARDING

COSMETICS AND DEVICES

3.

EUROPE ANTI-AGING MARKET OUTLOOK - BY DEMOGRAPHICS

3.1. BABY BOOMERS

3.2. GENERATION X

3.3. GENERATION Y

4.

EUROPE ANTI-AGING MARKET OUTLOOK - BY PRODUCTS

4.1. UV ABSORBERS

4.2. ANTI-WRINKLE

4.3. ANTI-STRETCH MARKS

4.4. HAIR COLOR

5.

EUROPE ANTI-AGING MARKET OUTLOOK - BY DEVICES

5.1. ANTI-CELLULITE TREATMENT DEVICES

5.2. MICRODERM ABRASION DEVICES

5.3. AESTHETIC LASER DEVICES

5.4. RADIOFREQUENCY DEVICES

6.

EUROPE ANTI-AGING MARKET OUTLOOK - BY SERVICES

6.1. ANTI-PIGMENTATION THERAPY

6.2. ADULT ACNE THERAPY

6.3. BREAST AUGMENTATION

6.4. LIPOSUCTION SERVICES

6.5. ABDOMINOPLASTY

6.6. CHEMICAL PEEL

6.7. EYELID SURGERY

6.8. HAIR RESTORATION

6.9. SCLEROTHERAPY

6.10. OTHER SERVICES

7.

EUROPE ANTI-AGING MARKET - REGIONAL OUTLOOK

7.1. UNITED KINGDOM

7.2. GERMANY

7.3. FRANCE

7.4. SPAIN

7.5. ITALY

7.6. RUSSIA

7.7. REST OF EUROPE

8.

COMPETITIVE LANDSCAPE

8.1. LUMENIS LTD. (ACQUIRED BY XIO)

8.2. SOLTA MEDICAL (VALEANT PHARMACEUTICALS)

8.3. ALMA LASER, INC. (ACQUIRED BY FOSUN PHARMA)

8.4. LUTRONIC CORPORATION

8.5. OLAY (ACQUIRED BY PROCTER & GAMBLE)

8.6. BEIERSDORF (ACQUIRED BY TCHIBO HOLDING AG)

8.7. SYNERON CANDELA

8.8. AVON PRODUCTS, INC.

8.9. COTY, INC.

8.10. PERSONAL MICRODERM

8.11. ALLERGAN PLC

8.12. L’ORÉAL S.A.

8.13. PHOTOMEDEX, INC. (ACQUIRED BY RADIANCY, INC.)

8.14. REVLON

8.15. CYNOSURE (ACQUIRED BY HOLOGIC)

9.

RESEARCH METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE & DELIVERABLES

9.2. SOURCES OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1: EUROPE ANTI-AGING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: EVOLUTION & TRANSITION OF ANTI-AGING PRODUCTS, SERVICES

& DEVICES

TABLE 3: PROMINENT START-UPS IN ANTI-AGING MARKET

TABLE 4: VENDOR SCORECARD

TABLE 5: REGULATORY FRAMEWORK

TABLE 6: PRODUCERS GROWTH IN ANTI-AGING MARKET

TABLE 7: REGIONWISE GROWTH IN AGING POPULATION, 2015-2050F

TABLE 8: EUROPE ANTI-AGING MARKET, BY DEMOGRAPHICS, 2019-2027 (IN $

MILLION)

TABLE 9: EUROPE ANTI-AGING MARKET, BY PRODUCTS, DEVICES & SERVICES,

2019-2027 (IN $ MILLION)

TABLE 10: EUROPE ANTI-AGING MARKET, BY PRODUCTS, 2019-2027 (IN $

MILLION)

TABLE 11: EUROPE ANTI-AGING MARKET, BY DEVICES, 2019-2027 (IN $ MILLION)

TABLE 12: EUROPE ANTI-AGING MARKET, BY SERVICES, 2019-2027 (IN $

MILLION)

TABLE 13: EUROPE ANTI-AGING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: KEY BUYING IMPACT ANALYSIS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: WORLDWIDE GERIATRIC POPULATION (AGED 65 YEARS & ABOVE),

2014-2022 (IN MILLION)

FIGURE 5: COUNTRIES WITH MOST OBESE POPULATION (IN %)

FIGURE 6: PATENT APPLICATIONS RECEIVED FOR ANTI-AGING MOISTURIZERS WITH

NATURAL INGREDIENTS

FIGURE 7: HOUSEHOLD DISPOSABLE INCOME PER CAPITA OF OECD COUNTRIES IN

2017 (IN $)

FIGURE 8: EUROPE ANTI-AGING MARKET, BY BABY BOOMERS, 2019-2027 (IN $

MILLION)

FIGURE 9: EUROPE ANTI-AGING MARKET, BY GENERATION X, 2019-2027 (IN $

MILLION)

FIGURE 10: EUROPE ANTI-AGING MARKET, BY GENERATION Y, 2019-2027 (IN $

MILLION)

FIGURE 11: EUROPE ANTI-AGING MARKET, BY UV ABSORBERS, 2019-2027 (IN $

MILLION)

FIGURE 12: EUROPE ANTI-AGING MARKET, BY ANTI-WRINKLE, 2019-2027 (IN $

MILLION)

FIGURE 13: EUROPE ANTI-AGING MARKET, BY ANTI-STRETCH MARKS, 2019-2027

(IN $ MILLION)

FIGURE 14: EUROPE ANTI-AGING MARKET, BY HAIR COLOR, 2019-2027 (IN $

MILLION)

FIGURE 15: EUROPE ANTI-AGING MARKET, BY ANTI-CELLULITE TREATMENT DEVICES,

2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE ANTI-AGING MARKET, BY MICRODERM ABRASION DEVICES,

2019-2027 (IN $ MILLION)

FIGURE 17: EUROPE ANTI-AGING MARKET, BY AESTHETIC LASER DEVICES,

2019-2027 (IN $ MILLION)

FIGURE 18: EUROPE ANTI-AGING MARKET, BY RADIOFREQUENCY DEVICES,

2019-2027 (IN $ MILLION)

FIGURE 19: EUROPE ANTI-AGING MARKET, BY ANTI-PIGMENTATION THERAPY,

2019-2027 (IN $ MILLION)

FIGURE 20: EUROPE ANTI-AGING MARKET, BY ADULT ACNE THERAPY, 2019-2027

(IN $ MILLION)

FIGURE 21: EUROPE ANTI-AGING MARKET, BY BREAST AUGMENTATION, 2019-2027

(IN $ MILLION)

FIGURE 22: EUROPE ANTI-AGING MARKET, BY LIPOSUCTION SERVICES, 2019-2027

(IN $ MILLION)

FIGURE 23: EUROPE ANTI-AGING MARKET, BY ABDOMINOPLASTY, 2019-2027 (IN $

MILLION)

FIGURE 24: EUROPE ANTI-AGING MARKET, BY CHEMICAL PEEL, 2019-2027 (IN $

MILLION)

FIGURE 25: EUROPE ANTI-AGING MARKET, BY EYELID SURGERY, 2019-2027 (IN $

MILLION)

FIGURE 26: EUROPE ANTI-AGING MARKET, BY HAIR RESTORATION, 2019-2027 (IN

$ MILLION)

FIGURE 27: EUROPE ANTI-AGING MARKET, BY SCLEROTHERAPY, 2019-2027 (IN $

MILLION)

FIGURE 28: EUROPE ANTI-AGING MARKET, BY OTHER SERVICES, 2019-2027 (IN $

MILLION)

FIGURE 29: UNITED KINGDOM ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: GERMANY ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: FRANCE ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32: SPAIN ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 33: ITALY ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 34: RUSSIA ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 35: REST OF EUROPE ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)