Market By Vehicle Type, Application, And Geography | Forecast 2019-2027

Triton’s study on the European automotive polycarbonate glazing market depicts the industry to grow at a stable pace at a CAGR of 7.79% in terms of revenue throughout the forecast period from 2019-2027.

The countries scrutinized in the report on Europe’s automotive polycarbonate glazing market are:

• The United Kingdom

• Germany

• France

• Italy

• Russia

• Spain

• Rest of Europe

The growing sales of automotives in the United Kingdom is expected to drive the demand for automotive polycarbonate glazing in the country. As per the International Organization of Motor Vehicle Manufacturers, 2.95 million new vehicles were sold in the UK in 2017, which increased from 2.29 million in 2010. Thus, growing sales of vehicles is expected to raise the demand for polycarbonate glazing given the growth in demand for lightweight glazing materials for reducing vehicular weight and improving the fuel efficiency. This would, in turn, fuel the growth of the market for automotive polycarbonate glazing in the UK.

The wide-scale adoption of lightweight technology drives the growth of the German automotive polycarbonate glazing market. Lightweight materials help enhance fuel efficiency, and thus are used in the automotive sector. As per the US Department of Energy, a 10% reduction in vehicular weight leads to about 6-8% increase in fuel efficiency. The light weight of the polycarbonate glazing materials is expected to raise the demand for the use of polycarbonate glazing in the automotive industry, thereby fueling the growth in the sales of automotives. As per sources, Germany leads in the sales of vehicles, with a record of 3.81 million vehicle units sold in 2017. The increased vehicle sales are expected to drive the growth of the automotive polycarbonate glazing market in Germany.

Covestro AG manufactures high-tech polymer materials for several end-user industries, including automotive and electronic, as well as, for other commercial purposes. It operates primarily in three segments: Polycarbonates, Polyurethanes, and Coatings. Established in 2015, Covestro AG has its headquarters in Leverkusen, Germany. In 2016, the company introduced the “hard coated polycarbonate film” it developed for automotive interiors to improve interior air quality. Adoption of third-party verification is expected to provide the company with opportunities to scale up its polycarbonate production to meet the increasing global demand.

1. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. SIDE

WINDOW IS A RAPIDLY GROWING APPLICATION OF THE AUTOMOTIVE POLYCARBONATE GLAZING

MARKET

2.2.2. PASSENGER

VEHICLE HAS THE MOST PROMINENT SHARE IN THE AUTOMOTIVE POLYCARBONATE GLAZING

MARKET

2.2.3. FRONT

WINDSHIELD IS THE LARGEST APPLICATION

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. KEY

BUYING CRITERIA

2.7. MARKET

DRIVERS

2.7.1. RISING

POPULARITY OF LIGHTWEIGHT GLAZING

2.7.2. STRICT

CARBON EMISSION RULES & REGULATIONS DUE TO CLIMATE CHANGE

2.7.3. INCREASING

APPLICATION OF SUNROOFS IN CARS

2.8. MARKET

RESTRAINTS

2.8.1. REGULATIONS

RELATED TO THE USE OF POLYCARBONATE FOR WINDSCREENS

2.8.2. INCREASING

COST OF AUTOMOTIVE POLYCARBONATE GLAZING

2.9. MARKET

OPPORTUNITIES

2.9.1. RISING

TREND OF THE ELECTRIC VEHICLE MARKET

2.9.2. ADVANCEMENT

IN AUTOMOTIVE DESIGNS

2.10.

MARKET CHALLENGES

2.10.1.

UNSTABLE POLITICAL AND

TERRITORIAL SITUATION

3. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET OUTLOOK – BY VEHICLE TYPE

3.1. PASSENGER

VEHICLE

3.2. COMMERCIAL

VEHICLE

4. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET OUTLOOK – BY APPLICATION

4.1. SIDE

WINDOW

4.2. FRONT

WINDSHIELD

4.3. SUNROOF

4.4. REAR

WINDSHIELD

4.5. LARGE

WINDSCREEN

4.6. HYDROPHOBIC

GLAZING

4.7. HEAD-UP

DISPLAY

4.8. SWITCHABLE

GLAZING

5. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET – EUROPE

5.1. UNITED

KINGDOM

5.2. GERMANY

5.3. FRANCE

5.4. SPAIN

5.5. ITALY

5.6. RUSSIA

5.7. REST

OF EUROPE

6. COMPETITIVE

LANDSCAPE

6.1. CHI MEI CORPORATION

6.2. IDEMITSU KOSAN CO. LTD

6.3. SABIC

6.4. ENGEL AUSTRIA GMBH

6.5. TEIJIN LTD

6.6. WEBASTO SE

6.7. RENIAS CO., LTD.

6.8. SUMITOMO CHEMICAL CO. LTD

6.9. TRINSEO S.A.

6.10. MITSUBISHI CHEMICAL CORPORATION

6.11. COVESTRO AG

6.12. KRD SICHERHEITSTECHNIK GMBH

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.1.1. OBJECTIVES

OF STUDY

7.1.2. SCOPE

OF STUDY

7.2. SOURCES

OF DATA

7.2.1. PRIMARY

DATA SOURCES

7.2.2. SECONDARY

DATA SOURCES

7.3. RESEARCH

METHODOLOGY

7.3.1. EVALUATION

OF PROPOSED MARKET

7.3.2. IDENTIFICATION

OF DATA SOURCES

7.3.3. ASSESSMENT

OF MARKET DETERMINANTS

7.3.4. DATA

COLLECTION

7.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY VEHICLE TYPE, 2019-2027 (IN $

MILLION)

TABLE 4: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY APPLICATION, 2019-2027 (IN $

MILLION)

TABLE 5: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: SIDE WINDOW

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 3: PASSENGER

VEHICLE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 4: FRONT

WINDSHIELD MARKET, 2019-2027 (IN $ MILLION)

FIGURE 5: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 6: MARKET

ATTRACTIVENESS INDEX

FIGURE 7: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY PASSENGER VEHICLE, 2019-2027 (IN $

MILLION)

FIGURE 8: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COMMERCIAL VEHICLE, 2019-2027 (IN $

MILLION)

FIGURE 9: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SIDE WINDOW, 2019-2027 (IN $

MILLION)

FIGURE 10: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY FRONT WINDSHIELD, 2019-2027 (IN $

MILLION)

FIGURE 11: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SUNROOF, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY REAR WINDSHIELD, 2019-2027 (IN $

MILLION)

FIGURE 13: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY LARGE WINDSCREEN, 2019-2027 (IN $

MILLION)

FIGURE 14: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY HYDROPHOBIC GLAZING, 2019-2027 (IN

$ MILLION)

FIGURE 15: EUROPE AUTOMOTIVE

POLYCARBONATE GLAZING MARKET, BY HEAD-UP DISPLAY, 2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SWITCHABLE GLAZING, 2019-2027 (IN $

MILLION)

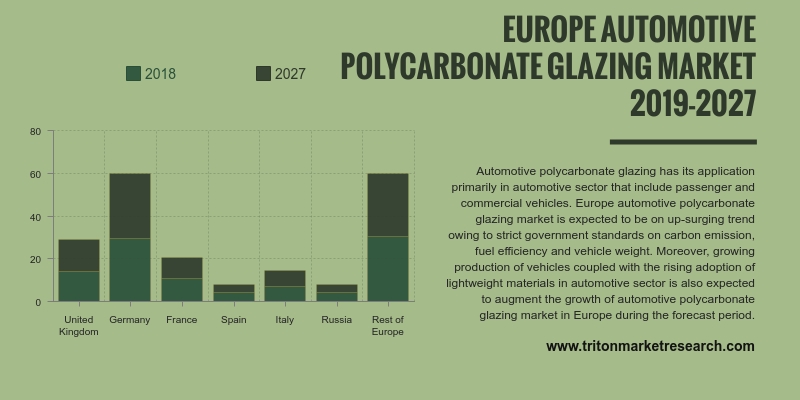

FIGURE 17: EUROPE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN

%)

FIGURE 18: UNITED

KINGDOM AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: GERMANY

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: FRANCE

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: SPAIN

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: ITALY

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: RUSSIA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: REST OF

EUROPE AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)