Market Segmented By Type, Application, And Geography | Forecasts 2019-2027

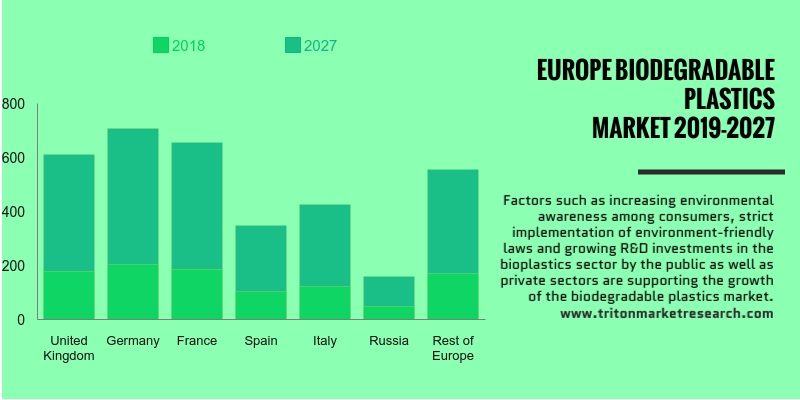

The Europe biodegradable plastic market is expected to rise at a CAGR of 10.65% over the forecast period of 2019-2027. The prime economies studied in the European biodegradable plastics market are:

• Germany

• United Kingdom

• France

• Spain

• Italy

• Russia

• Rest of Europe

We provide additional customization based on your specific requirements. Request For Customization

In 2015, during the United Nations climate change conference in Paris, statistics indicated that Europe is the third highest contributor to greenhouse emission. Following this, the Paris treaty was signed and made clear instructions to the European countries to reduce emission by at least 40% below by 2030. The countries such as Denmark, Sweden and Finland have switched to alternative renewable energy sources like windmills & Solar panels as well as have reduced their use of traditional plastics.

The rise in the awareness amid consumers for environment, the implementation of strict rules and policies by government and the rise in the R&D funding in bioplastics by the public as well as private sectors are the top factors supporting the biodegradable market growth in the region. The government decision to decrease the overall utilization of conventional plastics bags by 80% in the region over the coming years is one of the top potential opportunity for the market growth in the region.

1. EUROPEAN

BIODEGRADABLE PLASTIC MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. EVOLUTION

& TRANSITION OF BIODEGRADABLE PLASTIC

2.4. PORTER'S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

COMPONENTS

2.8. REGULATORY

FRAMEWORK

2.9. KEY

IMPACT ANALYSIS

2.10. MARKET

OPPORTUNITY INSIGHTS

2.11. INDUSTRY

PLAYER POSITIONING

2.12. KEY

MARKET STRATEGIES

2.13. MARKET

DRIVERS

2.13.1. RISE

IN THE PRODUCTION OF CORN AND OTHER RENEWABLE RESOURCES

2.13.2. INCREASING

SCOPE OF BIODEGRADABLE PLASTICS IN VARIOUS END-USE SEGMENTS

2.13.3. BIODEGRADABLE

PROPERTY OF THE BIODEGRADABLE PLASTICS

2.13.4. FAVORABLE

GOVERNMENT POLICIES TO REDUCE THE USE OF PETROLEUM-BASED POLYMERS

2.13.5. SHIFT

IN CONSUMER PREFERENCE TOWARDS THE ADOPTION OF ENVIRONMENTAL-FRIENDLY PACKAGING

SOLUTION

2.14. MARKET

RESTRAINTS

2.14.1. HIGH

COST OF BIODEGRADABLE PLASTICS AS COMPARED TO CONVENTIONAL PLASTICS

2.14.2. DURABILITY

ISSUES

2.15. MARKET

OPPORTUNITIES

2.15.1. INCREASED

BIOPLASTIC PRODUCTION ACROSS REGIONS

2.15.2. AVAILABILITY

OF COST-EFFECTIVE BIO-BASED RAW MATERIALS

2.16. MARKET

CHALLENGES

2.16.1. BIODEGRADABLE

PLASTICS IMPACT ON FOOD PRODUCTION AND SUPPLY

2.16.2. EASY

AVAILABILITY OF ALTERNATIVES

3. BIODEGRADABLE

PLASTIC INDUSTRY OUTLOOK - BY TYPE

3.1. PLA

3.2. STARCH

BLENDS

3.3. PCL

3.4. REGENERATED CELLULOSE

3.5. PBS

3.6. PHA

3.7. OTHER

TYPES

4. BIODEGRADABLE

PLASTIC INDUSTRY OUTLOOK - BY APPLICATION

4.1. PACKAGING

4.2. FIBERS

4.3. AGRICULTURE

4.4. INJECTION

MOLDING

4.5. OTHER

APPLICATIONS

5. BIODEGRADABLE

PLASTIC INDUSTRY - REGIONAL OUTLOOK

5.1. UNITED

KINGDOM

5.2. GERMANY

5.3. FRANCE

5.4. ITALY

5.5. SPAIN

5.6. RUSSIA

5.7. REST

OF EUROPE

6. COMPETITIVE

LANDSCAPE

6.1. BASF SE

6.2. BIOME BIOPLASTICS LIMITED

6.3. BIO-ON S.P.A.

6.4. CORBION N.V. (PURAC)

6.5. DANIMER SCIENTIFIC, LLC

6.6. DOW CHEMICAL COMPANY (MERGER WITH DUPONT)

6.7. FKUR KUNSTSTOFF GMBH

6.8. FUTERRO SA

6.9. MITSUBISHI CHEMICAL CORPORATION

6.10. NATUREWORKS LLC

6.11. PLANTIC TECHNOLOGIES (ACQUISITION BY KURARAY AMERICA, INC,)

6.12. SIGMA-ALDRICH (ACQUISITION BY MERCK)

6.13. SYNBRA HOLDING BV

6.14. TIANAN BIOLOGIC MATERIAL CO. LTD

6.15. ZHEJIANG HISUN BIOMATERIALS CO. LTD.

7. METHODOLOGY

& SCOPE

7.1. RESEARCH

SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1 MARKET ATTRACTIVENESS MATRIX FOR

BIODEGRADABLE PLASTIC MARKET

TABLE 2 VENDOR SCORECARD OF BIODEGRADABLE PLASTIC

MARKET

TABLE 3 REGULATORY FRAMEWORK OF BIODEGRADABLE

PLASTIC MARKET

TABLE 4 KEY STRATEGIC DEVELOPMENTS IN

BIODEGRADABLE PLASTIC MARKET

TABLE 5 COMPARISON BETWEEN BIOPLASTICS AND

CONVENTIONAL PLASTICS

TABLE 6 COST ANALYSIS OF BIODEGRADABLE PLASTICS IN

2016

TABLE 7 COST ANALYSIS OF FOSSIL BASED PLASTICS IN

2016

TABLE 8 SUSTAINABILITY OF MAJOR BIO-BASED PLASTIC

TYPES FOR DIFFERENT APPLICATIONS

TABLE 9 EUROPE BIODEGRADABLE PLASTIC MARKET,

COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 10 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

BIODEGRADABLE PLASTIC TYPE, 2019-2027 (IN $ MILLION)

TABLE 11 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

FIGURE 1 EUROPE BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 2 PORTER’S FIVE FORCE ANALYSIS OF

BIODEGRADABLE PLASTIC MARKET

FIGURE 3 INDUSTRY COMPONENTS OF BIODEGRADABLE

PLASTIC MARKET

FIGURE 4 MARKET OPPORTUNITY INSIGHTS, BY PLASTIC

TYPE, 2018

FIGURE 5 MARKET OPPORTUNITY INSIGHTS, BY

APPLICATION, 2018

FIGURE 6 KEY PLAYER POSITIONING IN 2018 (%)

FIGURE 7 SUGARCANE AND CORN PRODUCTION IN KEY

COUNTRIES, 2016 (IN %)

FIGURE 8 WORLDWIDE PRODUCTION OF SUGAR CANE AND

CORN, 2014- 2023 (IN MILLION TONNES)

FIGURE 9 TIMELINE OF BIODEGRADABLE PLASTICS

FIGURE 10 WORLDWIDE CORN PRODUCTION, 2010-2017, (IN

MILLION METRIC TONNES)

FIGURE 11 MAJOR CORN PRODUCERS ACROSS THE GLOBE,

2015-2016 (% OF TOTAL PRODUCTION)

FIGURE 12 WORLDWIDE BIOPLASTIC PRODUCTION CAPACITY,

2017-2022 (IN ‘000 TONNES)

FIGURE 13 PERCENTAGE SHARE OF TOTAL BIOPLASTIC

PRODUCTION ACROSS REGIONS IN 2017 (IN %)

FIGURE 14 MAJOR SUGARCANE PRODUCERS ACROSS THE GLOBE IN

2016 (IN MILLION TONNES)

FIGURE 15 EUROPE BIODEGRADABLE PLASTIC MARKET, BY PLA,

2019-2027 (IN $ MILLION)

FIGURE 16 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

STARCH BLENDS, 2019-2027 (IN $ MILLION)

FIGURE 17 EUROPE BIODEGRADABLE PLASTIC MARKET, BY PCL,

2019-2027 (IN $ MILLION)

FIGURE 18 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

REGENERATED CELLULOSE, 2019-2027 (IN $ MILLION)

FIGURE 19 EUROPE BIODEGRADABLE PLASTIC MARKET, BY PBS,

2019-2027 (IN $ MILLION)

FIGURE 20 EUROPE BIODEGRADABLE PLASTIC MARKET, BY PHA,

2019-2027 (IN $ MILLION)

FIGURE 21 EUROPE BIODEGRADABLE PLASTIC MARKET, BY OTHER

TYPES, 2019-2027 (IN $ MILLION)

FIGURE 22 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

PACKAGING, 2019-2027 (IN $ MILLION)

FIGURE 23 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

FIBERS, 2019-2027 (IN $ MILLION)

FIGURE 24 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

AGRICULTURE, 2019-2027 (IN $ MILLION)

FIGURE 25 EUROPE BIODEGRADABLE PLASTIC MARKET, BY

INJECTION MOLDING, 2019-2027 (IN $ MILLION)

FIGURE 26 EUROPE BIODEGRADABLE PLASTIC MARKET, BY OTHER

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 27 EUROPE BIODEGRADABLE PLASTIC MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 28 UNITED KINGDOM BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 29 GERMANY BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 30 FRANCE BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 31 ITALY BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 32 SPAIN BIODEGRADABLE PLASTIC MARKET, 2019-2027

(IN $ MILLION)

FIGURE 33 RUSSIA BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)

FIGURE 34 REST OF EUROPE BIODEGRADABLE PLASTIC MARKET,

2019-2027 (IN $ MILLION)