Market By Type, End-users, Technology And Geography | Forecast 2019-2027

Triton’s research on the Europe biometrics market depicts that it will grow at a stable pace with a CAGR of 19.77% in terms of revenue during the forecast period 2019-2027.

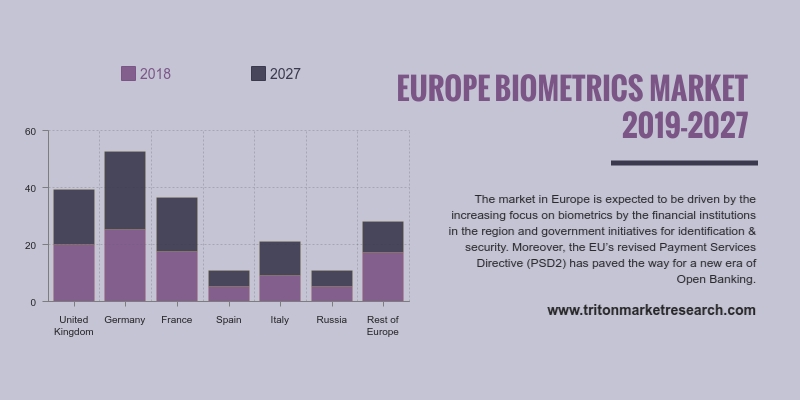

The countries analyzed in the biometrics market in Europe are:

• United Kingdom

• Germany

• France

• Spain

• Italy

• Russia.

• Rest of Europe

The market in Europe is expected to be driven by the increasing focus on biometrics by the financial institutions in the region and government initiatives for identification & security. Moreover, the EU’s revised Payment Services Directive (PSD2) has paved the way for a new era of Open Banking. Thus, it is expected to have huge impacts on business models, security mechanisms and innovation in banking. Requirements of PSD2 include delivering a robust two-factor authentication and transaction signature methods to all their customers. This is likely to boost the adoption of biometrics in the region’s payment ecosystem.

The United Kingdom has witnessed a consistent increase in fraud cases pertaining to identity theft in the BFSI segment. Additionally, the country has witnessed an increase in online card transaction value in recent years. Thus, to provide a secure & smooth transaction process, BFSI organizations are likely to turn towards biometrics solutions. In addition to this, immigration challenges and terrorism threats led to the UK Home Office investing GBP 96 million in fingerprint, facial recognition and DNA verification for law enforcement, visa application and counter-terrorism. All other major European countries too are facing immigration challenges, which is likely to result in such investments. This, in turn, driving the demand for biometrics solutions.

Fingerprint Cards AB is engaged in developing, producing & marketing biometric components and technologies for fingerprint identification & verification. The company offers a range of products, which includes touch sensors, swipe sensors, area sensors, processors, algorithms and modules for smartphones & tablets. It provides solutions, which are used in PCs, online devices, the Internet of Things (IoT), smart cards and automotives. Fingerprint Cards operates in Sweden, the US, South Korea and Denmark. It is headquartered in Gothenburg, Sweden.

1.

EUROPE

BIOMETRICS MARKET - SUMMARY

2.

INDUSTRY

OUTLOOK

2.1. MARKET DEFINITION

2.2. COMPONENTS OF A BIOMETRIC ACCESS CONTROL SYSTEM

2.2.1.

INPUT EXTRACTION

2.2.2.

TRANSMISSION

& SIGNAL PROCESSING

2.2.3.

QUALITY

ASSESSMENT

2.2.4.

DATA STORAGE

2.3. KEY INSIGHTS

2.3.1.

FAVORABLE

GOVERNMENT INITIATIVES

2.3.2.

INTRODUCTION

OF MULTIMODAL BIOMETRIC TECHNOLOGY

2.3.3.

RAPID ADOPTION

BY BANKING & FINANCIAL SERVICE INDUSTRIES

2.4. PORTERS FIVE FORCE ANALYSIS

2.4.1.

BARGAINING

POWER OF BUYERS

2.4.2.

BARGAINING

POWER OF SUPPLIERS

2.4.3.

THREAT OF NEW

ENTRANTS

2.4.4.

THREAT OF

SUBSTITUTE

2.4.5.

THREAT OF

COMPETITIVE RIVALRY

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. INDUSTRY COMPONENTS

2.7.1.

CORE

TECHNOLOGY

2.7.2.

PHYSICAL

COMPONENTS MANUFACTURER

2.7.3.

INTEGRATED BIOMETRIC

DEVICES

2.7.4.

MARKETING AND

DISTRIBUTION

2.7.5.

END-USERS

2.8. MARKET DRIVERS

2.8.1.

INCREASED

SAFETY & SECURITY CONCERNS

2.8.2.

RISE IN

IDENTITY THREATS & RELATED COSTS

2.8.3.

IMMENSE

PROLIFERATION OF SMARTPHONES & TABLETS WITH BIOMETRIC CAPABILITIES

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COST OF

TECHNOLOGY

2.9.2.

DIFFICULTIES

IN INTEGRATING BIOMETRICS INTO EXISTING SOFTWARE

2.10. MARKET OPPORTUNITIES

2.10.1.

THRIVING

E-COMMERCE INDUSTRY

2.10.2.

EMERGENCE OF

E-PASSPORT

2.11. MARKET CHALLENGES

2.11.1.

TECHNICAL

LIMITATIONS ASSOCIATED WITH BIOMETRIC TECHNOLOGY

2.11.2.

DATA SECURITY

& PRIVACY ISSUES

3.

EUROPE

BIOMETRICS MARKET OUTLOOK – BY TYPE

3.1. FIXED

3.2. MOBILE

4.

EUROPE

BIOMETRICS MARKET OUTLOOK – BY END-USERS

4.1. GOVERNMENT

4.2. TRANSPORTATION

4.3. BFSI

4.4. HEALTHCARE

4.5. IT & TELECOMMUNICATION

4.6. RETAIL

4.7. OTHER END-USERS

5.

EUROPE

BIOMETRICS MARKET OUTLOOK – BY TECHNOLOGY

5.1. FINGERPRINT RECOGNITION

5.2. IRIS RECOGNITION

5.3. FACIAL RECOGNITION

5.4. HAND GEOMETRY

5.5. VEIN ANALYSIS

5.6. VOICE RECOGNITION

5.7. DNA ANALYSIS

5.8. GAIT

5.9. EEG/ECG

5.10. OTHER TECHNOLOGIES

6.

EUROPE

BIOMETRICS MARKET – REGIONAL OUTLOOK

6.1. UNITED KINGDOM

6.2. GERMANY

6.3. FRANCE

6.4. SPAIN

6.5. ITALY

6.6. RUSSIA

6.7. REST OF EUROPE

7.

COMPETITIVE

LANDSCAPE

7.1. AWARE, INC.

7.2. BIO-KEY INTERNATIONAL, INC.

7.3. CROSSMATCH TECHNOLOGIES, INC.

7.4. FINGERPRINT CARDS AB

7.5. FUJITSU LIMITED

7.6. FULCRUM BIOMETRICS LLC

7.7. GEMALTO N.V.

7.8. HID GLOBAL CORPORATION

7.9. IMAGEWARE SYSTEMS

7.10. IRIS ID SYSTEMS, INC.

7.11. M2SYS TECHNOLOGIES, INC.

7.12. NEC CORPORATION

7.13. NUANCE COMMUNICATIONS, INC.

7.14. IDEMIA FRANCE S.A.S. (SAFRAN IDENTITY & SECURITY S.A.S.)

7.15. PRECISE BIOMETRICS AB

7.16. SIEMENS AG

8.

RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: EUROPE BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: GOVERNMENT INITIATIVES & POLICIES RELATED TO BIOMETRICS

TABLE 3: VENDOR SCORECARD

TABLE 4: INSTANCES OF IDENTITY THEFTS IN KEY GEOGRAPHIES, 2017

TABLE 5: SOME OF THE PROMISING E-PASSPORT PROJECTS

TABLE 6: EUROPE BIOMETRICS MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 7: EUROPE BIOMETRICS MARKET, BY END-USERS, 2019-2027 (IN $

MILLION)

TABLE 8: EUROPE BIOMETRICS MARKET, BY TECHNOLOGY, 2019-2027 (IN $

MILLION)

TABLE 9: EUROPE BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: BASIC COMPONENTS OF BIOMETRIC AUTHENTICATION SYSTEMS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: INTERNAL PROCESS FOR IDENTIFICATION BY BIOMETRIC TECHNOLOGY

FIGURE 5: AVERAGE CYBERCRIME COST IN KEY GEOGRAPHIES, AUGUST 2017 (IN $

MILLION)

FIGURE 6: EUROPE BIOMETRICS MARKET, BY FIXED, 2019-2027 (IN $ MILLION)

FIGURE 7: EUROPE BIOMETRICS MARKET, BY MOBILE, 2019-2027 (IN $ MILLION)

FIGURE 8: EUROPE BIOMETRICS MARKET, BY GOVERNMENT, 2019-2027 (IN $

MILLION)

FIGURE 9: EUROPE BIOMETRICS MARKET, BY TRANSPORTATION, 2019-2027 (IN $

MILLION)

FIGURE 10: EUROPE BIOMETRICS MARKET, BY BFSI, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE BIOMETRICS MARKET, BY HEALTHCARE, 2019-2027 (IN $

MILLION)

FIGURE 12: EUROPE BIOMETRICS MARKET, BY IT & TELECOMMUNICATION,

2019-2027 (IN $ MILLION)

FIGURE 13: EUROPE BIOMETRICS MARKET, BY RETAIL, 2019-2027 (IN $ MILLION)

FIGURE 14: EUROPE BIOMETRICS MARKET, BY OTHER END-USERS, 2019-2027 (IN $

MILLION)

FIGURE 15: EUROPE BIOMETRICS MARKET, BY FINGERPRINT RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE BIOMETRICS MARKET, BY IRIS RECOGNITION, 2019-2027 (IN

$ MILLION)

FIGURE 17: EUROPE BIOMETRICS MARKET, BY FACIAL RECOGNITION, 2019-2027

(IN $ MILLION)

FIGURE 18: EUROPE BIOMETRICS MARKET, BY HAND GEOMETRY, 2019-2027 (IN $

MILLION)

FIGURE 19: EUROPE BIOMETRICS MARKET, BY VEIN ANALYSIS, 2019-2027 (IN $

MILLION)

FIGURE 20: EUROPE BIOMETRICS MARKET, BY VOICE RECOGNITION, 2019-2027 (IN

$ MILLION)

FIGURE 21: EUROPE BIOMETRICS MARKET, BY DNA ANALYSIS, 2019-2027 (IN $

MILLION)

FIGURE 22: EUROPE BIOMETRICS MARKET, BY GAIT, 2019-2027 (IN $ MILLION)

FIGURE 23: EUROPE BIOMETRICS MARKET, BY EEG/ECG, 2019-2027 (IN $

MILLION)

FIGURE 24: EUROPE BIOMETRICS MARKET, BY OTHER TECHNOLOGIES, 2019-2027

(IN $ MILLION)

FIGURE 25: UNITED KINGDOM BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: GERMANY BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: FRANCE BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: SPAIN BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: ITALY BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: RUSSIA BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: REST OF EUROPE BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)