Market By Device Type, Therapeutic Area, Display Technologies, End-user And Geography | Forecast 2019-2027

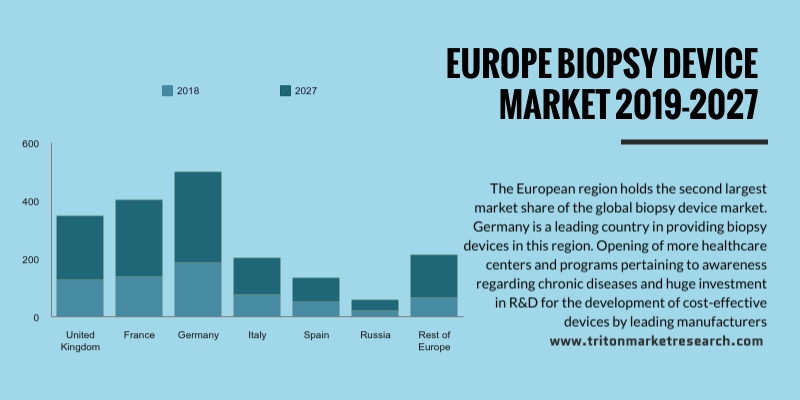

Triton Market Research estimates that the European biopsy device market is expected to grow at a CAGR of 6.66% in terms of revenue for the forecast years of 2019-2027.

Countries covered in the European biopsy device market are:

• Germany

• The United Kingdom

• Italy

• Spain

• Russia

• France

• Rest of Europe

The region has a fast-growing elderly population, giving rise to a large number of age-related chronic diseases such as skin disorders, kidney diseases, and cancer. These diseases require quick diagnosis using several types of tests, including biopsies. The usage of healthcare services in Europe is high among the elderly individuals due to their susceptibility to diseases and infection. The trend analysis in the region points out that the per capita health expenditure on healthcare is higher among elderly people as compared to people of other ages.

Porter’s five force analysis, market definitions, insights, attractiveness index, market drivers, restraint, challenges and opportunities have been discussed in detail by Triton in this report.

The European region holds the second largest market share of the global biopsy device market. Germany is a leading country in providing biopsy devices in this region. The opening of more healthcare centers and programs pertaining to the awareness of chronic diseases and huge investments in the R&D for developing cost-effective devices by leading manufacturers that can be marketed in developing countries where the chronic cancer patient proportion is high are going to boost the biopsy device market, especially for the needle-based biopsy instrument segment during the forecast years. However, stringent government rules for medical reimbursement, lack of trained professionals and infection risks associated with breast cancer biopsy methods are hampering the growth of European biopsy market.

1. EUROPEAN

BIOPSY DEVICE MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCE OUTLOOK

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTES

2.2.3. BARGAINING

POWER OF BUYERS

2.2.4. BARGAINING

POWER OF SUPPLIERS

2.2.5. THREAT

OF RIVALRY

2.3. VENDOR

SCORECARD

2.4. MARKET

ATTRACTIVENESS MATRIX

2.5. KEY

INSIGHTS

2.6. REGULATIONS

OUTLOOK

2.6.1. REGULATION

OF BIOPSY DEVICES IN THE EUROPEAN UNION

2.7. PATENTS

OUTLOOK

2.8. MARKET

DRIVERS

2.8.1. PREVALENCE

OF CHRONIC DISEASES ON THE RISE

2.8.2. GROWING

PUBLIC KNOWLEDGE OF DISEASE TRANSMISSION

2.8.3. INCREASING

DIAGNOSTIC CENTERS

2.9. RESTRAINTS

2.9.1. DEARTH

OF SKILLED PROFESSIONALS

2.9.2. REIMBURSEMENT

ISSUES

2.10.

OPPORTUNITIES

2.10.1.

INCREASING INCIDENCE OF LIVER

DISEASES

2.11.

MARKET CHALLENGES

2.11.1.

LIMITED TECHNICAL SKILLS

2.11.2.

HIGH COST OF BIOPSY TECHNIQUES

3. BIOPSY

DEVICE MARKET OUTLOOK - BY DEVICE TYPE

3.1. BREAST

BIOPSY

3.1.1. VACUUM-ASSISTED

CORE BIOPSY (VAB)

3.1.2. CORE

NEEDLE BIOPSY (CNB)

3.1.3. FINE

NEEDLE BIOPSY

3.2. GASTROINTESTINAL

(GI) BIOPSY

3.3. SOFT

TISSUE BIOPSY NEEDLES

3.4. BRONCHIAL BIOPSY

3.5. GYNECOLOGICAL BIOPSY DEVICE

3.6. ROBOTIC

GUIDANCE SYSTEM

3.7. OTHER

DEVICES

4. BIOPSY

DEVICE MARKET OUTLOOK - BY THERAPEUTIC

AREA

4.1. BREAST

BIOPSY

4.2. GI

BIOPSY

4.3. PROSTATE

BIOPSY

4.4. LIVER

BIOPSY

4.5. LUNG

BIOPSY

4.6. KIDNEY

BIOPSY

4.7. GYNECOLOGICAL BIOPSY

4.8. OTHER

THERAPEUTIC AREA

5. BIOPSY

DEVICE MARKET OUTLOOK - BY DISPLAY TECHNOLOGIES

5.1. MRI-GUIDED

BIOPSY

5.2. STEREOTACTIC-GUIDED BIOPSY

5.3. ULTRASOUND-GUIDED

BIOPSY

5.4. CT-GUIDED

BIOPSY

5.5. OTHER

DISPLAY TECHNOLOGIES

6. BIOPSY

DEVICE MARKET OUTLOOK - BY END-USER

6.1. DIAGNOSIS

CENTER

6.2. HOSPITALS

6.2.1. SPECIALIST

6.2.2. GENERAL

7. BIOPSY

DEVICE MARKET - REGIONAL OUTLOOK

7.1. UNITED

KINGDOM

7.2. FRANCE

7.3. GERMANY

7.4. ITALY

7.5. SPAIN

7.6. RUSSIA

7.7. REST

OF EUROPE

8. COMPANY

PROFILES

8.1. AD-TECH

MEDICAL INSTRUMENT, CORP.

8.2. ARGON

MEDICAL DEVICES, INC.

8.3. B.

BRAUN MELSUNGEN AG

8.4. BECTON,

DICKINSON

8.5. BOSTON

SCIENTIFIC CORPORATION

8.6. CARDINAL

HEALTH, INC.

8.7. C.

R. BARD, INC.

8.8. I.M.S.

INTERNAZIONALE MEDICO SCIENTIFICA SRL

8.9. PLANMECA

OY

8.10.

QIAGEN N.V.

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1 EUROPE BIOPSY DEVICE MARKET 2019-2027 ($

MILLION)

TABLE 2 IMPLEMENTATION OF BREAST CANCER

SCREENING PLATFORMS IN EU BY COUNTRY

TABLE 3 EUROPE BIOPSY DEVICE MARKET BY DEVICE

TYPE 2019-2027 ($ MILLION)

TABLE 4 EUROPE BIOPSY DEVICE MARKET IN BREAST

BIOPSY DEVICE BY TYPES 2019-2027 ($ MILLION)

TABLE 5 TYPES OF BREAST BIOPSY AND MAMMOGRAPHY

EQUIPMENT

TABLE 6 TYPES OF BIOPSY CURETTES

TABLE 7 EUROPE BIOPSY DEVICE MARKET BY

THERAPEUTIC AREA 2019-2027 ($ MILLION)

TABLE 8 EUROPE BIOPSY DEVICE MARKET BY DISPLAY

TECHNOLOGIES 2019-2027 ($ MILLION)

TABLE 9 EUROPE BIOPSY DEVICE MARKET BY END-USER

2019-2027 ($ MILLION)

TABLE 10 COMMON AREAS OF BIOPSY

TABLE 11 EUROPE BIOPSY DEVICE MARKET BY COUNTRIES

2019-2027 ($ MILLION)

FIGURE 1 SHARES OF THE EUROPEAN PATENT HOLDER (%)

FIGURE 2 EUROPE BIOPSY DEVICE MARKET IN BREAST

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 3 EUROPE BREAST BIOPSY DEVICE MARKET IN

VACUUM-ASSISTED CORE BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 4 EUROPE BREAST BIOPSY DEVICE MARKET IN CORE

NEEDLE BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 5 EUROPE BREAST BIOPSY DEVICE MARKET IN FINE

NEEDLE BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 6 EUROPE BIOPSY DEVICE MARKET IN GI BIOPSY

DEVICE 2019-2027 ($ MILLION)

FIGURE 7 EUROPE BIOPSY DEVICE MARKET IN SOFT TISSUE

BIOPSY NEEDLES MARKET 2019-2027 ($ MILLION)

FIGURE 8 EUROPE BIOPSY DEVICE MARKET IN BRONCHIAL

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 9 EUROPE BIOPSY DEVICE MARKET IN GYNECOLOGICAL

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 10 EUROPE BIOPSY DEVICE MARKET IN ROBOTIC

GUIDANCE SYSTEM 2019-2027 ($ MILLION)

FIGURE 11 EUROPE BIOPSY DEVICE MARKET IN OTHER BIOPSY

DEVICE 2019-2027 ($ MILLION)

FIGURE 12 EUROPE BIOPSY DEVICE MARKET IN BREAST BIOPSY

THERAPEUTIC AREA 2019-2027 ($ MILLION)

FIGURE 13 EUROPE BIOPSY DEVICE MARKET IN GI BIOPSY

2019-2027 ($ MILLION)

FIGURE 14 EUROPE BIOPSY DEVICE MARKET IN PROSTATE

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 15 EUROPE BIOPSY DEVICE MARKET IN LIVER BIOPSY

DEVICE 2019-2027 ($ MILLION)

FIGURE 16 EUROPE BIOPSY DEVICE MARKET IN LUNG BIOPSY

DEVICE MARKET 2019-2027 ($ MILLION)

FIGURE 17 EUROPE BIOPSY DEVICE MARKET IN KIDNEY BIOPSY

DEVICE 2019-2027 ($ MILLION)

FIGURE 18 EUROPE BIOPSY DEVICE MARKET IN GYNECOLOGICAL

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 19 EUROPE BIOPSY DEVICE MARKET IN OTHER

THERAPEUTIC AREA 2019-2027 ($ MILLION)

FIGURE 20 EUROPE BIOPSY DEVICE MARKET IN MRI-GUIDED

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 21 EUROPE BIOPSY DEVICE MARKET IN STEREOTACTIC

BREAST BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 22 EUROPE BIOPSY DEVICE MARKET IN ULTRASOUND-GUIDED

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 23 EUROPE BIOPSY DEVICE MARKET IN CT-GUIDED

BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 24 EUROPE BIOPSY DEVICE MARKET IN OTHER DISPLAY

TECHNOLOGIES BIOPSY DEVICE 2019-2027 ($ MILLION)

FIGURE 25 EUROPE BIOPSY DEVICE MARKET IN DIAGNOSIS

CENTER 2019-2027 ($ MILLION)

FIGURE 26 EUROPE BIOPSY DEVICE MARKET IN HOSPITAL

2019-2027 ($ MILLION)

FIGURE 27 EUROPE HOSPITAL MARKET IN SPECIALIST HOSPITAL

2019-2027 ($ MILLION)

FIGURE 28 EUROPE HOSPITAL MARKET IN GENERAL HOSPITAL

2019-2027 ($ MILLION)

FIGURE 29 EUROPE BIOPSY DEVICE MARKET 2019-2027 ($

MILLION)

FIGURE 30 UNITED KINGDOM BIOPSY DEVICE MARKET 2019-2027

($ MILLION)

FIGURE 31 FRANCE BIOPSY DEVICE MARKET 2019-2027 ($

MILLION)

FIGURE 32 GERMANY BIOPSY DEVICE MARKET 2019-2027 ($

MILLION)

FIGURE 33 ITALY BIOPSY DEVICE MARKET 2019-2027 ($

MILLION)

FIGURE 34 SPAIN BIOPSY DEVICE MARKET 2019-2027 ($

MILLION)

FIGURE 35 RUSSIA BIOPSY DEVICE MARKET 2019-2027 ($

MILLION)

FIGURE 36 REST OF EUROPE BIOPSY DEVICE MARKET 2019-2027

($ MILLION)