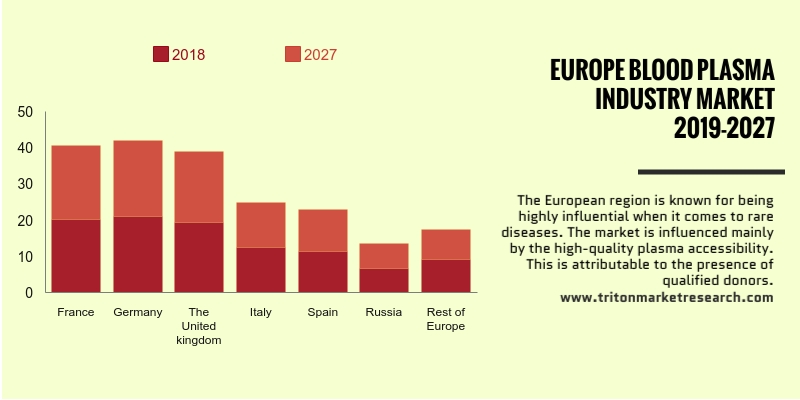

Triton’s research on the Europe blood plasma market depicts that the market will grow at a stable pace with a CAGR of 6.09% in terms of revenue during the forecast period 2019-2027.

The countries that have been studied in the Europe blood plasma market are:

• Germany

• The United Kingdom

• France

• Italy

• Spain

• Russia

• Rest of Europe

France is the predominant European blood plasma market due to its favorable reimbursement policies. However, Germany has displayed the fastest growth and has become a prime consumer of blood and blood products. Apart from the regulatory activities performed by the PPTA, EU policies motivate participation in developing novel plasma therapies often by influencing the demand for plasma in various therapies. For example, Commission Communication on Rare Diseases defined a widely applicable approach for improving the visibility of rare diseases throughout Europe. Demand for blood plasma therapies in Europe is significant and requires a steady supply of blood plasma throughout the region. Millions of patients undergo blood component transfusion per year to recover from several chronic diseases.

France is a major contributor to the European blood plasma market with regional market players focusing on maintaining track of France’s plasma supply. For example, LFB worked with Biolog-id to develop an RFID system to automate their process for bar codes that track plasma bags supplied from concerned organizations. LFB receives plasma from the French Blood Agency, which LFB fractionates to separate its various components. LFB Biomédicaments, one of the company's divisions, is the world’s sixth-largest player in the field of plasma-derived medicinal products and the largest in France. The use of RFID technology to ensure appropriate tracking of plasma fractionation in France offers easy traceability solutions for blood plasma suppliers.

Grifols S.A. is an international company manufacturing and supplying protein therapies for patients. The company, headquartered in Barcelona, Spain, also provides medical care tools to hospitals, pharmacies and other healthcare professionals. The three prime divisions of the company are bioscience, diagnostics and hospitals. Grifols provides innovative products, as well as services to medical professionals in more than 90 countries. It is a leading manufacturer of plasma-derived therapies, which are essentially used in the treatment of patients suffering from rare genetic diseases and severe infections. Grifols primarily manufactures diagnostic products, pharmaceutical and plasma products such as proteinase inhibitors, IV immunoglobulins, antihemophilic factor and coagulation factors.

1.

EUROPE BLOOD PLASMA MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTES

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF RIVALRY

2.3. VENDOR SCORECARD

2.4. CLINICAL GUIDELINES

2.5. REGULATION IN THE PLASMA THERAPEUTICS

2.6. KEY INSIGHTS

2.7. REGULATORY OUTLOOK

2.8. MARKET TRENDS

2.9. MARKET DRIVERS

2.9.1.

EXPANSION IN INDICATION FOR NEW THERAPEUTIC AREAS

2.9.2.

APPROVAL OF IMMUNOGLOBULIN-CENTERED THERAPIES

2.9.3.

SURGE IN THE HEMOPHILIA TREATMENT

2.10.

MARKET RESTRAINTS

2.10.1.

HIGH COSTS OF BLOOD PLASMA TREATMENTS

2.10.2.

EASY AVAILABILITY OF RECOMBINANT PLASMA

2.11.

MARKET OPPORTUNITIES

2.11.1.

INCREASING PUBLIC COGNIZANCE

2.11.2.

RISE IN THE PLASMA-DERIVED PRODUCTS OPPORTUNITIES

2.11.3.

INCREASING OCCURRENCE OF HEMOPHILIA

2.12.

MARKET CHALLENGES

2.12.1.

SPREAD OF PATHOGENIC CONTAMINANTS

2.12.2.

HIGH REGULATIONS IN THE MARKET

2.13.

BLOOD PLASMA INDUSTRY BY MODE OF DELIVERY

2.13.1.

INFUSION SOLUTIONS

2.13.2.

GELS

2.13.3.

SPRAYS

2.13.4.

BIOMEDICAL SEALANTS

3.

BLOOD PLASMA MARKET OUTLOOK - BY BLOOD TYPE

3.1. ALBUMIN

3.2. IMMUNOGLOBULIN

3.2.1.

INTRAVENOUS IMMUNOGLOBULIN

3.2.2.

SUBCUTANEOUS IMMUNOGLOBULIN

3.2.3.

OTHER IMMUNOGLOBULIN TYPE

3.3. COAGULATION FACTOR CONCENTRATES

3.4. HYPERIMMUNES

3.5. OTHER PLASMA FRACTIONATION PRODUCTS

4.

BLOOD PLASMA MARKET OUTLOOK - BY APPLICATION

4.1. ONCOLOGY

4.2. HEMATOLOGY

4.3. TRANSPLANTATION

4.4. RHEUMATOLOGY

4.5. NEUROLOGY

4.6. IMMUNOLOGY

4.7. PULMONOLOGY

4.8. OTHER APPLICATIONS

5.

BLOOD PLASMA MARKET OUTLOOK - BY END-USER

5.1. ACADEMIC INSTITUTIONS

5.2. RESEARCH LABORATORIES

5.3. HOSPITALS AND CLINICS

6.

BLOOD PLASMA MARKET - REGIONAL OUTLOOK

6.1. EUROPE

6.1.1.

COUNTRY ANALYSIS

6.1.1.1.

FRANCE

6.1.1.2.

GERMANY

6.1.1.3.

THE UNITED KINGDOM

6.1.1.4.

ITALY

6.1.1.5.

SPAIN

6.1.1.6.

RUSSIA

6.1.1.7.

REST OF EUROPE

7.

COMPANY PROFILES

7.1. SHIRE PLC

7.2. ARTHREX

7.3. OCTAPHARMA AG

7.4. BAXTER INTERNATIONAL, INC.

7.5. GRIFOLS INTERNATIONAL S.A.

7.6. BIOTEST AG

7.7. CSL LTD.

7.8. ADMA BIOLOGICS, INC.

7.9. CHINA BIOLOGIC PRODUCTS, INC.

7.10.

GENERAL ELECTRIC CO.

7.11.

CERUS CORP.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 EUROPE BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

TABLE 2 BLOOD PLASMA

COMPONENTS

TABLE 3 EUROPE BLOOD PLASMA

MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 4 EUROPE BLOOD PLASMA

MARKET IN IMMUNOGLOBULIN BY TYPES 2019-2027 ($ MILLION)

TABLE 5 PROTEASE INHIBITORS

USED IN THE HIV INFECTION TREATMENT

TABLE 6 EUROPE BLOOD PLASMA

MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 7 EUROPE BLOOD PLASMA

MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 8 EUROPE BLOOD PLASMA

MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 EUROPE BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 2 IMMUNOGLOBULIN

INFUSIONS SIDE-EFFECTS

FIGURE 3 ROLE OF FIBRIN

SEALANT IN COAGULATION CASCADE

FIGURE 4 EUROPE BLOOD PLASMA

MARKET IN ALBUMIN 2019-2027 ($ MILLION)

FIGURE 5 EUROPE BLOOD PLASMA

MARKET IN IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 6 EUROPE IMMUNOGLOBULIN

MARKET IN INTRAVENOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 7 EUROPE IMMUNOGLOBULIN

MARKET IN SUBCUTANEOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 8 EUROPE IMMUNOGLOBULIN

MARKET IN OTHER IMMUNOGLOBULIN TYPE 2019-2027 ($ MILLION)

FIGURE 9 EUROPE BLOOD PLASMA

MARKET IN COAGULATION FACTOR CONCENTRATES 2019-2027 ($ MILLION)

FIGURE 10 HYPERIMMUNES ISOLATION

PROCESS

FIGURE 11 EUROPE BLOOD PLASMA

MARKET IN HYPERIMMUNES 2019-2027 ($ MILLION)

FIGURE 12 EUROPE BLOOD PLASMA

MARKET IN OTHER PLASMA FRACTIONATION PRODUCTS 2019-2027 ($ MILLION)

FIGURE 13 EUROPE BLOOD PLASMA

MARKET IN ONCOLOGY 2019-2027 ($ MILLION)

FIGURE 14 EUROPE BLOOD PLASMA

MARKET IN HEMATOLOGY 2019-2027 ($ MILLION)

FIGURE 15 EUROPE BLOOD PLASMA

MARKET IN TRANSPLANTATION 2019-2027 ($ MILLION)

FIGURE 16 LUPUS INFECTION

SYMPTOMS

FIGURE 17 EUROPE BLOOD PLASMA

MARKET IN RHEUMATOLOGY 2019-2027 ($ MILLION)

FIGURE 18 EUROPE BLOOD PLASMA MARKET

IN NEUROLOGY 2019-2027 ($ MILLION)

FIGURE 19 EUROPE BLOOD PLASMA

MARKET IN PULMONOLOGY 2019-2027 ($ MILLION)

FIGURE 20 EUROPE BLOOD PLASMA

MARKET IN IMMUNOLOGY 2019-2027 ($ MILLION)

FIGURE 21 EUROPE BLOOD PLASMA

MARKET IN OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 22 EUROPE BLOOD PLASMA

MARKET IN ACADEMIC INSTITUTIONS 2019-2027 ($ MILLION)

FIGURE 23 EUROPE BLOOD PLASMA

MARKET IN RESEARCH LABORATORIES 2019-2027 ($ MILLION)

FIGURE 24 EUROPE BLOOD PLASMA

MARKET IN HOSPITALS AND CLINICS 2019-2027 ($ MILLION)

FIGURE 25 FRANCE BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 26 GERMANY BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 27 THE UNITED KINGDOM

BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 28 ITALY BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 29 SPAIN BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 30 RUSSIA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 31 REST OF EUROPE BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)