Market By Organization Size, Service, Deployment Mode, Industry Verticals And Geography | Forecast 2019-2027

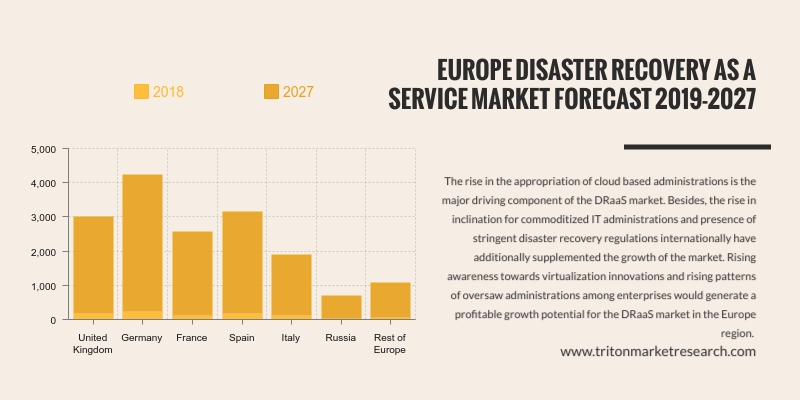

The Europe Disaster Recovery as a Service (DRaaS) market is anticipated to develop at a compound annual growth rate of 37.03% over the forecasting period.

The Europe DRaaS market is divided into major countries such as:

• United Kingdom

• Germany

• France

• Italy

• Spain

• Russia

• Rest of Europe

UK’s economy is forecasted to grow to between 1.1-2% per annum till 2019. Post-referendum vote, the economy has been marred with anxiety over future trade relations with the EU, immigration management and political anxiety. Inflation is slated to be at an average of 2.5% till 2019. Despite having temporary depreciation, the pound looks stronger from a global point of view. Pundits believe that the increasing inflation levels would indirectly affect manufacturing, IT software & services and consumer spending over the medium-term. The UK IT industry is anticipated to grow at 1.5-3.8% per annum till 2020. The entire IT sector is dominated by small and medium service companies comprising of less than 500 employees at present.

We provide additional customization based on your specific requirements. Request For Customization

Germany is presently a strong pillar of the Euro zone economy, leading in terms of research and application. Amid the sluggish economic environment in the EU for the last three years, Germany has remained fairly steady and is anticipated to grow at an average of 1.4% per annum till 2019. The influx of immigrants since 2014 is expected to positively impact the annual wage growth for the short-term period. The IT sector of Germany is considered to be advanced and largest in the world. Post Brexit, Germany’s IT sector gained confidence with new projects redirected from London. The IT sector revenue comes from services and software. Enterprises continue to invest in new services and technologies that can aid in growth. The growing bid analytics, increasing software services and the expanding cloud computing market will drive Disaster Recovery as a Service (DRaaS) market in Germany for the forecast period.

The economy of France is anticipated to grow between 1.2-2% till 2019. Post-recession, the economy is driven mainly by the increasing consumer expenditure, tax cuts and the French government’s entrepreneurial promotion policies. Investments are likely to spike for the short-term period, due to low interest rates and government tax cuts. France’s expenditure on IT is anticipated to grow steadily at 2.2% per annum till 2020. French government proposed a series of regulations for data protection and data processing. The service providers here have been asked to maintain a registry of data breaches.

Dominant players in the market are Microsoft Corporation, NTT Communications Corporation, Hewlett-Packard Company, Cisco Systems, Inc., Rackspace Hosting, Inc., VMware, Inc., SAP SE, Amazon, Inc., IBM Corporation and Jive.

1.

EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.3. TIERS OF DISASTER RECOVERY AS A SERVICE

(DRaaS)

2.4. COMPONENTS OF DISASTER RECOVERY AS A SERVICE (DRaaS)

2.4.1.

SERVICE SOFTWARE

2.4.2.

HARDWARE COMPONENTS

2.4.2.1.

STORAGE

2.4.2.2.

SERVERS

2.4.2.3.

SWITCHES/ROUTERS

2.4.3.

OTHERS

2.5. PORTER’S FIVE FORCE ANALYSIS

2.6. MARKET ATTRACTIVENESS MATRIX

2.7. VENDOR SCORECARD

2.8. KEY IMPACT ANALYSIS

2.9. INDUSTRY PLAYER POSITIONING

2.10.

KEY MARKET STRATEGIES

2.11.

MARKET DRIVERS

2.11.1.

INCREASED ADOPTION OF CLOUD-BASED SERVICES

2.11.2.

GROWING CONCERNS & INCIDENCES OF DATA LOSS

2.11.3.

FASTER RECOVERY & OFFERS FLEXIBILITY

2.11.4.

HIGH AWARENESS OF DATA LOSS

2.11.5.

FAVORABLE APPROACH OF GOVERNMENTS ACROSS THE GLOBE

2.12.

MARKET RESTRAINTS

2.12.1.

NEED FOR HIGHER BANDWIDTH FOR THE IMPLEMENTATION OF DRaaS

2.12.2.

SECURITY & PRIVACY CONCERNS

2.13.

MARKET OPPORTUNITIES

2.13.1.

GAINING IMPORTANCE OF HYBRID DRaaS

2.13.2.

INCREASED NUMBER OF INVESTMENTS IN DISASTER RISK REDUCTION MEASURES

2.14.

MARKET CHALLENGES

2.14.1.

HIGH COSTS & INTEGRATION ISSUES

2.14.2.

DIFFICULTIES IN DEPLOYMENT & MONITORING

3.

DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET OUTLOOK - BY ORGANIZATION

SIZE

3.1. LARGE COMPANIES

3.2. MID-SIZED COMPANIES

3.3. SMALL COMPANIES

4.

DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET OUTLOOK - BY SERVICE

4.1. BACKUP SERVICES

4.2. REAL-TIME REPLICATION SERVICES

4.3. DATA SECURITY SERVICES

4.4. PROFESSIONAL SERVICES

5.

DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET OUTLOOK - BY DEPLOYMENT

MODE

5.1. TO-CLOUD DEPLOYMENT

5.2. IN-CLOUD DEPLOYMENT

5.3. FROM-CLOUD DEPLOYMENT

6.

DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET OUTLOOK - BY INDUSTRY

VERTICALS

6.1. BANKING & FINANCIAL INSTITUTIONS

6.2. TELECOMMUNICATION & IT

6.3. E-COMMERCE & RETAIL

6.4. MEDIA & ENTERTAINMENT

6.5. HEALTHCARE

6.6. GOVERNMENT

6.7. EDUCATION

6.8. MANUFACTURING

6.9. TRANSPORTATION & LOGISTICS

6.10.

OTHER INDUSTRY VERTICALS

7.

DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET - REGIONAL OUTLOOK

7.1. UNITED KINGDOM

7.2. GERMANY

7.3. FRANCE

7.4. ITALY

7.5. SPAIN

7.6. RUSSIA

7.7. REST OF EUROPE

8.

COMPETITIVE LANDSCAPE

8.1. AMAZON.COM INC

8.2. CISCO SYSTEMS INC

8.3. GEMINARE, INCORPORATED

8.4. IBM CORPORATION

8.5. MICROSOFT CORPORATION

8.6. VMWARE INC

8.7. JIVE

8.8. SAP SE

8.9. COLUMBUS BUSINESS SOLUTION/CABLE & WIRELESS COMMUNICATIONS PLC

8.10. NTT COMMUNICATIONS CORPORATION

8.11. SUNGARD AVAILABILITY SERVICES (AS)

8.12. ZERTO, LTD.

8.13. ILAND INTERNET SOLUTIONS CORPORATION

8.14. HEWLETT-PACKARD COMPANY

8.15. RACKSPACE HOSTING INC

9.

METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE

9.2. SOURCES OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1 MARKET

ATTRACTIVENESS MATRIX FOR DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET

TABLE 2 VENDOR SCORECARD OF

DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET

TABLE 3 KEY STRATEGIC DEVELOPMENTS IN DISASTER

RECOVERY AS A SERVICE (DRaaS) MARKET

TABLE 4 GOVERNMENT

INITIATIVES TO SUPPORT DRaaS

TABLE 5 CAUSES LEADING TO

INVESTMENT IN DRaaS

TABLE 6 DIFFERENT TYPES OF

DATA STORAGE HARDWARE, BY CAPACITY

TABLE 7 EUROPE DISASTER

RECOVERY AS A SERVICE (DRaaS) MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 8 EUROPE DISASTER

RECOVERY AS A SERVICE (DRaaS) MARKET, BY ORGANIZATION SIZE, 2019-2027 (IN $

MILLION)

TABLE 9 EUROPE DISASTER

RECOVERY AS A SERVICE (DRaaS) MARKET, BY SERVICE, 2019-2027 (IN $ MILLION)

TABLE 10 EUROPE DISASTER

RECOVERY AS A SERVICE (DRaaS) MARKET, BY DEPLOYMENT MODE, 2019-2027 (IN $

MILLION)

TABLE 11 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS)

MARKET, BY INDUSTRY VERTICALS, 2019-2027 (IN $ MILLION)

FIGURE 1 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, 2019-2027

(IN $ MILLION)

FIGURE 2 PORTER’S FIVE FORCE ANALYSIS OF DISASTER RECOVERY AS A SERVICE (DRaaS)

MARKET

FIGURE 3 KEY IMPACT ANALYSIS

FIGURE 4 KEY PLAYER POSITIONING IN 2018 (%)

FIGURE 5 CLOUD ADOPTION RATE ACROSS DISASTER RECOVERY AS A SERVICE (DRaaS)

IN 2016 (%)

FIGURE 6 ANTICIPATED TIMELINE FOR IMPLEMENTING CLOUD-BASED DISASTER

RECOVERY

FIGURE 7 BREACH INCIDENCES BY TYPE OF INCIDENCES IN 2016 (%)

FIGURE 8 INCIDENT CLASSIFICATION PATTERNS WITH THEIR FREQUENCY IN 2016

FIGURE 9 ANTICIPATED GROWTH IN GDP OF EMERGING NATIONS

FIGURE 10 UNDP’S DISASTER RISK REDUCTION INVESTMENT BY REGION

FIGURE 11 DRaaS DEPLOYMENT BY ORGANIZATION SIZE IN 2016 (%)

FIGURE 12 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY LARGE

COMPANIES, 2019-2027 (IN $ MILLION)

FIGURE 13 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

MID-SIZED COMPANIES, 2019-2027 (IN $ MILLION)

FIGURE 14 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY SMALL

COMPANIES, 2019-2027 (IN $ MILLION)

FIGURE 15 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY TO-CLOUD

DEPLOYMENT, 2019-2027 (IN $ MILLION)

FIGURE 16 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY IN-CLOUD

DEPLOYMENT, 2019-2027 (IN $ MILLION)

FIGURE 17 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

FROM-CLOUD DEPLOYMENT, 2019-2027 (IN $ MILLION)

FIGURE 18 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

BACKUP SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 19 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

REAL-TIME REPLICATION SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 20 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY DATA

SECURITY SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 21 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

PROFESSIONAL SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 22 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY BANKING

& FINANCIAL INSTITUTIONS, 2019-2027 (IN $ MILLION)

FIGURE 23 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

TELECOMMUNICATION & IT, 2019-2027 (IN $ MILLION)

FIGURE 24 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

E-COMMERCE & RETAIL, 2019-2027 (IN $ MILLION)

FIGURE 25 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY MEDIA

& ENTERTAINMENT, 2019-2027 (IN $ MILLION)

FIGURE 26 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

HEALTHCARE, 2019-2027 (IN $ MILLION)

FIGURE 27 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

GOVERNMENT, 2019-2027 (IN $ MILLION)

FIGURE 28 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

EDUCATION, 2019-2027 (IN $ MILLION)

FIGURE 29 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

MANUFACTURING, 2019-2027 (IN $ MILLION)

FIGURE 30 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY

TRANSPORTATION & LOGISTICS, 2019-2027 (IN $ MILLION)

FIGURE 31 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, BY OTHER

INDUSTRY VERTICALS, 2019-2027 (IN $ MILLION)

FIGURE 32 EUROPE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, REGIONAL

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 33 UNITED KINGDOM DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, 2019-2027

(IN $ MILLION)

FIGURE 34 GERMANY DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, 2019-2027

(IN $ MILLION)

FIGURE 35 FRANCE DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, 2019-2027

(IN $ MILLION)

FIGURE 36 ITALY DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, 2019-2027

(IN $ MILLION)

FIGURE 37 SPAIN DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, 2019-2027

(IN $ MILLION)

FIGURE 38 RUSSIA DISASTER RECOVERY AS A SERVICE (DRaaS) MARKET, 2019-2027

(IN $ MILLION)

FIGURE 39 REST OF EUROPE DISASTER RECOVERY AS A

SERVICE (DRaaS) MARKET, 2019-2027 (IN $ MILLION)