Market By Type, Application, Technology And Geography | Forecast 2019-2027

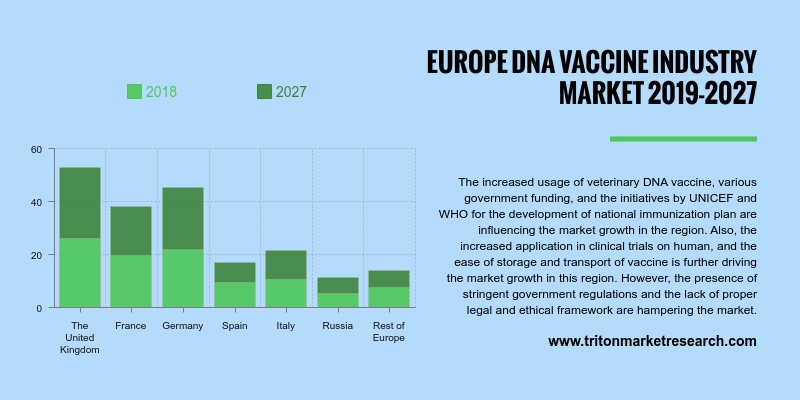

A study by Triton Market Research depicts that the Europe DNA vaccines market is expected to grow at a CAGR of 41.47% in terms of revenue for the forecasted years 2019-2027.

The countries analyzed in the European DNA vaccines market are:

• Germany

• The United Kingdom

• France

• Italy

• Spain

• Russia

• Rest of Europe

The DNA vaccines market in Europe is mainly driven by the investments from the government, rising healthcare R&D expenditure and the prevalence of chronic & infectious diseases. Vaccines utilized in the present scenario in the European locale are made out of dead pathogens or live lessened infections, through DNA immunizations comprising of the DNA grouping of the antigen that is directed in individuals to invigorate an invulnerable reaction. In the European market, this strategy offers various customary procedures, including the incitement of both B-cell and T-cells portable reactions, ventured forward antibody dependability, the non-availability of any irresistible specialist and the relative simplicity of huge-scale testing. DNA vaccines are majorly used in the clinical research labs and diagnostic centers, mainly in countries such as the United Kingdom and Germany.

We provide additional customization based on your specific requirements. Request For Customization

The United Kingdom DNA vaccines market is developing at a rapid pace. The rising prevalence of chronic and infectious diseases, including cancer, HIV, high blood pressure, etc., are acting as a key driver for the growth of the DNA vaccines market in the country. According to the World Health Organization, 30.7% of the male and 25% of the female population is affected by high blood pressure in the United Kingdom. The prevalence of human immunodeficiency virus in the country accounted for 17.7% in 2015. These chronic and infectious diseases cause a large number of deaths every year. Hence, DNA vaccines are being adopted at a constant pace and are expected to treat chronic diseases in an effective and efficient manner in the country.

GlaxoSmithKline, Inc. is a research-based healthcare and pharmaceutical company that develops and discovers medicines, vaccines, as well as consumer healthcare products for customers in the United Kingdom and other countries, The company provides medicines to treat a range of chronic and acute diseases, such as HIV and respiratory disease, along with off-patent, local and generics products. In the year 2016, the company generated a revenue of about $35.95 billion. GlaxoSmithKline was founded in the year 1902 and has its headquarters in the Brentford, United Kingdom; it employs over 99,300 employees across the globe.

1.

EUROPE DNA VACCINES MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREATS OF SUBSTITUTE PRODUCT

2.2.3.

BARGAINING POWER OF BUYER

2.2.4.

BARGAINING POWER OF SUPPLIER

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. VALUE CHAIN OUTLOOK

2.5. KEY INSIGHTS

2.6. REGULATORY FRAMEWORK

2.7. KEY BUYING OUTLOOK

2.8. MARKET DRIVERS

2.8.1.

SURGE IN NEW VACCINE DEVELOPMENT

2.8.2.

RISE IN THE USAGE OF DNA VACCINES FOR ANIMAL HEALTHCARE

2.8.3.

RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES

2.9. MARKET RESTRAINTS

2.9.1.

LACK OF LEGAL AND ETHICAL FRAMEWORK

2.9.2.

STRINGENT GOVERNMENT REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

GROWING DEMAND FOR GENE THERAPY

2.10.2.

STEADY VACCINES ARE EASY TO STORE AND

TRANSPORT

2.10.3.

INCREASING NUMBER OF CLINICAL TRIALS ON HUMANS

2.11.

MARKET CHALLENGES

2.11.1.

VARIATION IN THE REGULATORY PATHWAY AND THE POINTS OF CONSIDERATION

REGARDING ENVIRONMENTAL VALUATION

3.

DNA VACCINES MARKET OUTLOOK - BY TYPE

3.1. ANIMAL DNA VACCINE

3.2. HUMAN DNA VACCINE

4.

DNA VACCINES MARKET OUTLOOK - BY APPLICATION

4.1. HUMAN DISEASE

4.2. VETERINARY DISEASE

5.

DNA VACCINES MARKET OUTLOOK - BY TECHNOLOGY

5.1. PLASMID DNA VACCINES

5.2. PLASMID DNA DELIVERY

6.

DNA VACCINES MARKET OUTLOOK - BY REGION

6.1. EUROPE

6.1.1.

THE UNITED KINGDOM

6.1.2.

FRANCE

6.1.3.

GERMANY

6.1.4.

SPAIN

6.1.5.

ITALY

6.1.6.

RUSSIA

6.1.7.

REST OF EUROPE

7.

COMPETITIVE LANDSCAPE

7.1. ASTELLAS PHARMA, INC.

7.2. DENDREON CORPORATION (ACQUIRED BY SANPOWER

GROUP)

7.3. ELI LILLY AND COMPANY

7.4. EUROGENTEC S.A.

7.5. GLAXOSMITHKLINE, INC.

7.6. INOVIO PHARMACEUTICALS, INC.

7.7. MADISON VACCINES, INCORPORATED (MVI)

7.8. MERCK & CO.

7.9. MERIAL LIMITED (ACQUIRED BY BOEHRINGER

INGELHEIM)

7.10.

NOVARTIS AG

7.11.

SANOFI

7.12.

VGXI

7.13.

VICAL, INCORPORATED

7.14.

XENETIC BIOSCIENCES, INC.

7.15.

ZOETIS, INC.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 EUROPE DNA VACCINES

MARKET 2019-2027 ($ MILLION)

TABLE 2 INTERVENTION AND

PHASE OF SOME DISEASES/CONDITIONS

TABLE 3 REGULATIONS TO

FOLLOW BEFORE COMMERCIALIZATION

TABLE 4 TEMPERATURE

REQUIREMENT IN PRESERVATION FOR VARIOUS VACCINES

TABLE 5 APPROACHES BEING

TESTED TO ENHANCE THE LOW IMMUNOGENICITY

TABLE 6 CLINICAL TRIALS ON

HUMANS INVOLVING DNA VACCINES

TABLE 7 EUROPE DNA VACCINES

MARKET BY TYPE 2019-2027 ($ MILLION)

TABLE 8 EUROPE DNA VACCINES

MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 9 EUROPE DNA VACCINES

MARKET BY TECHNOLOGY 2019-2027 ($ MILLION)

TABLE 10 EUROPE DNA VACCINES

MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 EUROPE DNA VACCINES

MARKET 2019-2027 ($ MILLION)

FIGURE 2 VALUE CHAIN ANALYSIS

FOR DNA VACCINE INDUSTRY

FIGURE 3 EUROPE DNA VACCINES

MARKET IN VETERINARY DISEASES 2019-2027

($ MILLION)

FIGURE 4 CLINICAL TRIALS OF

GENE THERAPY

FIGURE 5 EUROPE DNA VACCINES

MARKET IN ANIMAL DNA VACCINES 2019-2027

($ MILLION)

FIGURE 6 EUROPE DNA VACCINES

MARKET IN HUMAN DNA VACCINES 2019-2027 ($

MILLION)

FIGURE 7 EUROPE DNA VACCINES

MARKET SHARE BY APPLICATION 2017 & 2026 (%)

FIGURE 8 EUROPE DNA VACCINES

MARKET IN HUMAN DISEASES 2019-2027 ($ MILLION)

FIGURE 9 EUROPE DNA VACCINES

MARKET IN VETERINARY DISEASES 2019-2027

($ MILLION)

FIGURE 10 EUROPE DNA VACCINES

MARKET IN PLASMID DNA VACCINES TECHNOLOGY

2019-2027 ($ MILLION)

FIGURE 11 EUROPE DNA VACCINES

MARKET IN PLASMID DNA DELIVERY TECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 12 THE UNITED KINGDOM DNA

VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 13 FRANCE DNA VACCINES MARKET 2019-2027

($ MILLION)

FIGURE 14 GERMANY DNA VACCINES MARKET 2019-2027

($ MILLION)

FIGURE 15 SPAIN DNA VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 16 ITALY DNA VACCINES MARKET 2019-2027 ($ MILLION)

FIGURE 17 RUSSIA DNA VACCINES MARKET 2019-2027

($ MILLION)

FIGURE 18 REST OF EUROPE DNA

VACCINES MARKET 2019-2027 ($ MILLION)