Market By Application, Type And Geography | Forecast 2019-2027

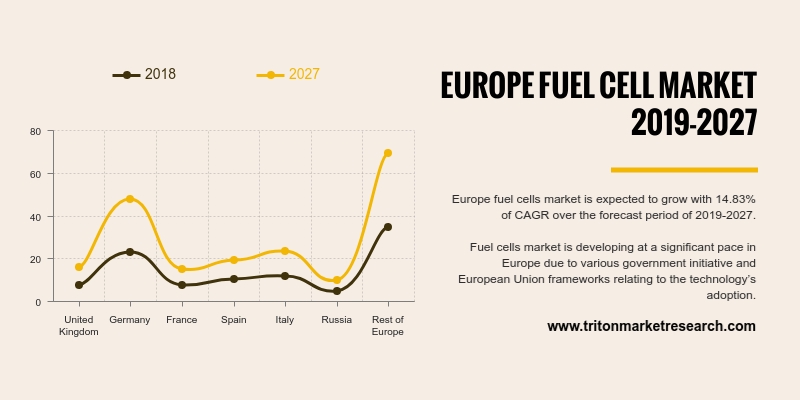

Europe fuel cells market is expected to grow with 14.83% of CAGR over the forecast period of 2019-2027.

The classification of European countries in the fuel cell market include:

• United Kingdom

• France

• Germany

• Spain

• Italy

• Russia

• Rest of Europe

We provide additional customization based on your specific requirements. Request For Customization

Fuel cells market is developing at a significant pace in Europe due to various government initiative and European Union frameworks relating to the technology’s adoption. The primary driver of the fuel cells market in the region is large Public-Private partnerships coupled with considerable investments in the R&D of fuel cells technology. Also, the rising utilization of fuel cells in transportation, power generations plants, logistics, automotive sector, medical, military and energy segments augmented the market growth. In addition to this, the adoption of the environment-friendly fuel cell will help Europe to achieve its target of developing the low carbon economy, thereby, fueling the market growth.

Many European countries show high adaptability of fuel cells due to numerous investments and funding by government organizations in partnership with private investors. Government initiative like fuel cell electric vehicle support scheme and financing to individual players drives the fuel cell market in United Kingdom. While venture capital investments of private establishments influence fuel cell market of France, the local private organizations push the market in Germany, Spain and Italy. Russia’ wide-ranging focus on research and development of the technology has made the region most developed user of the fuel cells in numerous areas like electric vehicles, hybrid electric vehicles, portable devices, electricity grid, hydrogen refuelling stations, Combined Heat and Power(CHP) and others.

1. EUROPE

FUEL CELL MARKET- SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. PROMISING

INVESTMENTS IN FUEL CELL

2.2.2. INCREASING

NUMBER OF PARTNERSHIPS BETWEEN PUBLIC & PRIVATE COMPANIES

2.2.3. GROWING

APPLICATION OF FUEL CELL IN EV’S, HEV’S & PHEV’S

2.2.4. PROACTIVE

INVOLVEMENT OF UNIVERSITIES, GOVERNMENT ORGANIZATIONS & COMPANIES IN

R&D

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. INDUSTRY

COMPONENTS

2.6.1. RAW

MATERIAL SUPPLIERS

2.6.2. MANUFACTURERS

2.6.3. DISTRIBUTORS

2.6.4. END-USERS

2.7. KEY

IMPACT ANALYSIS

2.7.1. COST

2.7.2. APPLICATION

2.7.3. EFFICIENCY

2.8. REGULATORY

FRAMEWORK

2.9. INDUSTRY

PLAYER POSITIONING

2.10.

MARKET DRIVERS

2.10.1. BENEFITS

OFFERED BY FUEL CELLS OVER OTHER POWER GENERATING SYSTEMS

2.10.2. GROWING

DEMAND FOR EFFICIENT & CLEANER TECHNOLOGIES

2.10.3. RAPID

INTEGRATION OF FUEL CELL TECHNOLOGY IN AUTOMOBILES

2.11.

MARKET RESTRAINTS

2.11.1. ISSUES

WITH DURABILITY OF FUEL CELL TECHNOLOGY

2.11.2. HIGH

CAPITAL COST OF FUEL CELLS

2.12.

MARKET OPPORTUNITIES

2.12.1. DECLINING

PRICES OF FUEL CELLS & FCV’S

2.12.2. GROWING

NUMBER OF HYDROGEN REFUELLING STATIONS

2.13.

MARKET CHALLENGES

2.13.1. AVAILABILITY

OF ALTERNATIVE TECHNOLOGIES

2.13.2. LACK

OF FUEL INFRASTRUCTURE

3. EUROPE

FUEL CELL INDUSTRY OUTLOOK - BY APPLICATION

3.1. TRANSPORTATION

3.2. STATIONARY

3.3. PORTABLE

4. EUROPE

FUEL CELL INDUSTRY OUTLOOK - BY TYPE

4.1. SOLID

OXIDE FUEL CELLS (SOFC)

4.2. PHOSPHORIC

ACID FUEL CELLS (PAFC)

4.3. MOLTEN

CARBONATE FUEL CELLS (MCFC)

4.4. PROTON EXCHANGE MEMBRANE FUEL CELLS

(PEMFC)

4.5. OTHER

FUEL CELLS

5. EUROPE

FUEL CELL INDUSTRY – REGIONAL OUTLOOK

5.1. UNITED

KINGDOM

5.2. GERMANY

5.3. FRANCE

5.4. SPAIN

5.5. ITALY

5.6. RUSSIA

5.7. REST

OF EUROPE

6. COMPETITIVE

LANDSCAPE

6.1. HITACHI

LTD

6.2. GENERAL

ELECTRIC COMPANY

6.3. EXXON

MOBIL CORPORATION

6.4. AFC

ENERGY PLC

6.5. FUELCELL

ENERGY INC

6.6. HYDROGENICS

CORPORATION

6.7. AISIN

SEIKI CO LTD

6.8. BALLARD

POWER SYSTEMS

6.9. BLOOM

ENERGY CORPORATION

6.10.

CERES POWER HOLDINGS PLC

6.11.

PLUG POWER INC

6.12.

SFC ENERGY

AG

6.13.

PANASONIC CORPORATION

6.14.

TOYOTA MOTOR CORPORATION

6.15.

TOSHIBA CORPORATION

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.2. SOURCES

OF DATA

7.3. RESEARCH

METHODOLOGY

TABLE 1: EUROPE FUEL CELL

MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: PROMINENT INVESTMENT

IN FUEL CELLS

TABLE 3: VENDOR SCORECARD

TABLE 4: REGULATORY FRAMEWORK

TABLE 5: TYPICAL STACK SIZE OF

DIFFERENT FUEL CELL TECHNOLOGIES

TABLE 6: ENERGY CONVERSION

EFFICIENCY OF DIFFERENT ENERGY SOURCES

TABLE 7: ESTIMATED NUMBER OF

FCEV’S ON ROAD IN KEY GEOGRAPHIES, 2014- 2020

TABLE 8: EUROPE FUEL CELL MARKET,

BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 9: EUROPE FUEL CELL

MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 10: EUROPE FUEL CELL

MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

FIGURE 1: EUROPE FUEL CELL

MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: NETL’S SOFC PROGRAM

FIGURE 3: MARKET

ATTRACTIVENESS INDEX

FIGURE 4: INDUSTRY COMPONENTS

FIGURE 5: KEY IMPACT ANALYSIS

FIGURE 6: INDUSTRY PLAYER

POSITIONING IN 2018 (IN %)

FIGURE 7: FUEL CELL SYSTEM

COSTS ($)

FIGURE 8: ESTIMATED NUMBER OF

HYDROGEN FUELING STATIONS IN KEY GEOGRAPHIES, 2014-2020

FIGURE 9: EUROPE FUEL CELL

MARKET, BY TRANSPORTATION, 2019-2027 (IN $ MILLION)

FIGURE 10: EUROPE FUEL CELL

MARKET, BY STATIONARY, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE FUEL CELL

MARKET, BY PORTABLE, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE FUEL CELL

MARKET, BY SOLID OXIDE FUEL CELLS (SOFC), 2019-2027 (IN $ MILLION)

FIGURE 13: EUROPE FUEL CELL

MARKET, BY PHOSPHORIC ACID FUEL CELLS (PAFC), 2019-2027 (IN $ MILLION)

FIGURE 14: EUROPE FUEL CELL

MARKET, BY MOLTEN CARBONATE FUEL CELLS (MCFC), 2019-2027 (IN $ MILLION)

FIGURE 15: EUROPE FUEL CELL

MARKET, BY PROTON EXCHANGE MEMBRANE FUEL CELLS

(PEMFC), 2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE FUEL CELL

MARKET, BY OTHER FUEL CELLS, 2019-2027 (IN $ MILLION)

FIGURE 17: EUROPE FUEL CELL

MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 18: UNITED KINGDOM FUEL

CELL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: GERMANY FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: FRANCE FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: SPAIN FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: ITALY FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: RUSSIA FUEL CELL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: REST OF EUROPE FUEL

CELL MARKET, 2019-2027 (IN $ MILLION)