Market By Product, Function, Deployment, End-user And Geography | Forecast 2019-2027

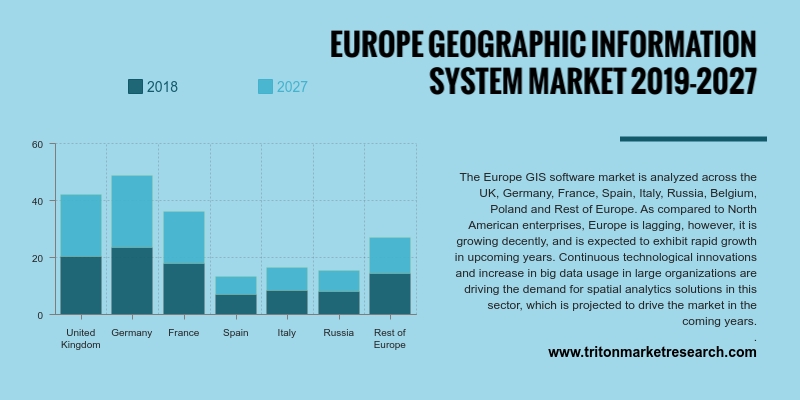

According to Triton, the research on the Europe geographic information system (GIS) market is estimated to record a significant growth at a CAGR of 7.34% in terms of revenue over the forecasting period 2019-2027.

Countries covered in the Europe geographic information system (GIS) market are:

• The United Kingdom

• France

• Germany

• Spain

• Italy

• Russia

• Rest of Europe

The technological innovations and increase in Big Data usage in large organizations have been boosting the demand for spatial analytics solutions, which is expected to drive the GIS market. Various government initiatives are further driving the growth of the GIS market.

Report scope can be customized per your requirements. Request For Customization

The use of geospatial data has increased in a wide variety of areas such as legislative & policy development, the allocation & management of natural resources, defense & public safety purposes, and spatial planning. This has resulted in the increased use of geographic information systems in Germany. GIS plays a vital role in urban development and increasing productivity in different industry verticals. Germany has been further using GIS for logistics & transport, resource planning, utility management, and asset management, such as tracking vehicle location and traffic information. GIS is also used in various domains of warfighting, business, and natural resources. For instance, in defense infrastructure, the military highly relies on GIS technologies like GPS, satellite imagery, and real-time tracking to achieve information dominance on the battlefield. This is expected to fuel the geographic information system (GIS) market in Germany.

France is one of the highest-growing countries for GIS in the European region. The strong aerospace, transportation & logistics, utilities & communication, and natural resources industries majorly drive the GIS market. For instance, the launch of SPOT-1 has made the country a leader in the commercial remote sensing satellite industry. Moreover, ISRO and CNES are partnering through joint missions on the use of satellite technology in order to overcome global challenges like climate change. Such strategic initiatives are further predicted to create significant opportunities for the growth of the geographic information system (GIS) market.

Autodesk Inc. provides 3D design, engineering, and entertainment software & services. It offers a portfolio of products that include 3D animation, 3D modeling software, civil engineering, 3D CAD software, 3D printing, construction, and 2D CAD drafting, sketching & painting. The company sells its products directly to customers as well as through a network of distributors and resellers. It operates across the Americas, Asia-Pacific, Europe, and the Middle East and Africa.

1. EUROPE

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. GROWING

DEMAND FOR SERVICE SECTOR

2.2.2. INCORPORATION

OF GIS IN BUSINESS INTELLIGENCE

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. MARKET

DRIVERS

2.6.1. RISE

IN ADOPTION OF GIS

2.6.2. INCREASING

DEMAND FOR SPATIAL DATA

2.6.3. DEVELOPMENT

OF SMART CITIES

2.7. MARKET

RESTRAINTS

2.7.1. HIGH

COSTS LEVIED ON GIS SOFTWARE

2.8. MARKET

OPPORTUNITIES

2.8.1. USE

OF GIS IN DISASTER MANAGEMENT

2.9. MARKET

CHALLENGES

2.9.1. STERN

RULES AND REGULATIONS

2.9.2. EASY

ACCESS OF OPEN SOURCE GEOGRAPHIC INFORMATION SYSTEM (GIS)

3. EUROPE

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY PRODUCT

3.1. SOFTWARE

3.2. DATA

3.3. SERVICE

4. EUROPE

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY FUNCTION

4.1. MAPPING

4.2. SURVEYING

4.3. LOCATION-BASED

SERVICES

4.4. NAVIGATION

AND TELEMATICS

4.5. OTHERS

5. EUROPE

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY DEPLOYMENT

5.1. DESKTOP

GIS

5.2. SERVER

GIS

5.3. DEVELOPER

GIS

5.4. MOBILE

GIS

5.5. OTHERS

6. EUROPE

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET OUTLOOK - BY END-USER

6.1. DEFENSE

6.2. AGRICULTURE

6.3. OIL

& GAS

6.4. CONSTRUCTION

6.5. UTILITIES

6.6. TRANSPORTATION

& LOGISTICS

6.7. OTHERS

7. EUROPE

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET – REGIONAL OUTLOOK

7.1. UNITED

KINGDOM

7.2. GERMANY

7.3. FRANCE

7.4. SPAIN

7.5. ITALY

7.6. RUSSIA

7.7. REST

OF EUROPE

8. COMPETITIVE

LANDSCAPE

8.1. HEXAGON

AB

8.2. ESRI

8.3. AUTODESK

INC.

8.4. BENTLEY

SYSTEMS INC.

8.5. GENERAL

ELECTRIC COMPANY

8.6. PITNEY

BOWES INC.

8.7. TRIMBLE

INC.

8.8. MACDONALD,

DETTWILER AND ASSOCIATES CORPORATION

8.9. CALIPER

CORPORATION

8.10. COMPUTER

AIDED DEVELOPMENT CORPORATION LIMITED (CADCORP)

8.11. SUPERMAP

SOFTWARE CO. LTD.

8.12. HI-TARGET

SURVEYING INSTRUMENT CO. LTD.

8.13. TAKOR

GROUP LTD

8.14. ATKINS.

8.15. FUGRO N.V

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: EUROPE GEOGRAPHIC INFORMATION

SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET ATTRACTIVENESS

INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 5: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY FUNCTION, 2019-2027 (IN $ MILLION)

TABLE 6: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY DEPLOYMENT, 2019-2027 (IN $ MILLION)

TABLE 7: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 8: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY PRODUCT, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 3: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY SOFTWARE, 2019-2027 (IN $ MILLION)

FIGURE 4: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY DATA, 2019-2027 (IN $ MILLION)

FIGURE 5: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY SERVICE, 2019-2027 (IN $ MILLION)

FIGURE 6: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY MAPPING, 2019-2027 (IN $ MILLION)

FIGURE 7: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY SURVEYING, 2019-2027 (IN $ MILLION)

FIGURE 8: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY LOCATION-BASED SERVICES, 2019-2027 (IN $

MILLION)

FIGURE 9: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY NAVIGATION AND TELEMATICS, 2019-2027 (IN $

MILLION)

FIGURE 10: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY DESKTOP GIS, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY SERVER GIS, 2019-2027 (IN $ MILLION)

FIGURE 13: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY DEVELOPER GIS, 2019-2027 (IN $ MILLION)

FIGURE 14: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY MOBILE GIS, 2019-2027 (IN $ MILLION)

FIGURE 15: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY DEFENSE, 2019-2027 (IN $ MILLION)

FIGURE 17: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY AGRICULTURE, 2019-2027 (IN $ MILLION)

FIGURE 18: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY OIL & GAS, 2019-2027 (IN $ MILLION)

FIGURE 19: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY CONSTRUCTION, 2019-2027 (IN $ MILLION)

FIGURE 20: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY UTILITIES, 2019-2027 (IN $ MILLION)

FIGURE 21: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY TRANSPORTATION & LOGISTICS, 2019-2027

(IN $ MILLION)

FIGURE 22: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 23: EUROPE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 24: UNITED KINGDOM

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: GERMANY GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: FRANCE GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: SPAIN GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: ITALY GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: RUSSIA GEOGRAPHIC

INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: REST OF EUROPE

GEOGRAPHIC INFORMATION SYSTEM (GIS) MARKET, 2019-2027 (IN $ MILLION)