Market By Type, Technology, Application, End-user And Geography | Forecast 2019-2027

Research conducted by Triton estimates that the Europe geospatial analytics market will be progressing at a CAGR of 14.92% during the forecasting period 2019-2027.

European geospatial analytics market include countries such as:

• Germany

• United Kingdom

• Italy

• Spain

• Russia

• France

• Rest of Europe

We provide additional customization based on your specific requirements. Request For Customization

Europe is a world leader in the production of civil aircraft. Aeronautics is one of Europe’s high-tech sectors in the global market, providing lacs of jobs and generating a turnover of billions. The aerospace and defense sector is particularly significant in the region, driving the geospatial analytics market. GIS mapping is the key to ensuring the need for an infrastructure upgrade at reduced costs. Integrating geospatial analytics along with mainstream technologies like sensors, cloud computing and business processes is rapidly becoming one of the primary components in the comprehensive value chain of geospatial offerings. Several industries in Europe have now started to adopt geospatial capabilities into their integrated workflow instead of just providing point solutions.

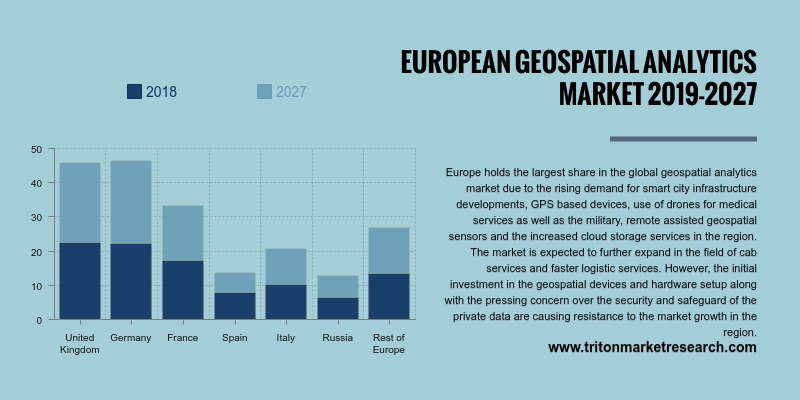

Europe holds the largest share in the global geospatial analytics market due to the rising demand for smart city infrastructure developments, GPS based devices, use of drones for medical services as well as the military, remote-assisted geospatial sensors and the increased cloud storage services in the region. The market is expected to further expand in the field of cab services and faster logistics services. However, the initial investment in geospatial devices and hardware set-up along with the pressing concern over the security and safeguarding of the private data are causing resistance for the market growth in the region.

1. EUROPE

GEOSPATIAL ANALYTICS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. EVOLUTION

& TRANSITION OF GEOSPATIAL ANALYTICS

2.4. PORTER'S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. REGULATORY

FRAMEWORK

2.7. VENDOR

SCORECARD

2.8. KEY

IMPACT ANALYSIS

2.9. MARKET

DRIVERS

2.9.1. COMMERCIALIZATION

OF SPATIAL DATA

2.9.2. RISING

DEMAND FROM DIFFERENT END-USER INDUSTRIES

2.9.3. TECHNOLOGICAL

ADVANCEMENTS

2.10.

MARKET RESTRAINTS

2.10.1.

HIGH COSTS ASSOCIATED WITH

GEOSPATIAL TECHNOLOGIES

2.10.2.

OPERATIONAL & LEGAL

CONCERNS

2.11.

MARKET OPPORTUNITIES

2.11.1.

USE OF BIG DATA & CLOUD IN

GEOSPATIAL ANALYTICS

2.11.2.

INCREASED SMART CITY &

INFRASTRUCTURE PROJECTS

2.11.3.

HIGH USAGE IN ENVIRONMENTAL MONITORING & LAND MANAGEMENT

2.12.

MARKET CHALLENGES

2.12.1.

PRIVACY & SECURITY

CONCERNS

2.12.2.

INTEROPERABILITY ISSUES

3. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY TYPE

3.1. SURFACE

ANALYSIS

3.2. NETWORK

ANALYSIS

3.3. GEO-VISUALIZATION

3.4. OTHER

TYPES

4. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY TECHNOLOGY

4.1. REMOTE

SENSING

4.2. GLOBAL

POSITIONING SYSTEM (GPS)

4.3. GEOGRAPHIC

INFORMATION SYSTEM (GIS)

4.4. OTHER

TECHNOLOGIES

5. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY APPLICATION

5.1. SURVEYING

5.2. DISASTER

RISK REDUCTION & MANAGEMENT

5.3. MEDICINE

& PUBLIC SAFETY

5.4. OTHER

APPLICATIONS

6. GEOSPATIAL

ANALYTICS MARKET OUTLOOK - BY END-USER

6.1. BUSINESS

6.2. UTILITY

& COMMUNICATION

6.3. DEFENSE

& INTELLIGENCE

6.4. GOVERNMENT

6.5. AUTOMOTIVE

6.6. OTHER

END-USER INDUSTRY

7. GEOSPATIAL

ANALYTICS MARKET - REGIONAL OUTLOOK

7.1. UNITED

KINGDOM

7.2. GERMANY

7.3. FRANCE

7.4. ITALY

7.5. SPAIN

7.6. RUSSIA

7.7. REST

OF EUROPE

8. COMPETITIVE

LANDSCAPE

8.1. ATKINS

8.2. AUTODESK,

INC.

8.3. BENTLEY

SYSTEMS, INC.

8.4. ESRI,

INC. (ENVIRONMENTAL SYSTEMS RESEARCH INSTITUTE)

8.5. FUGRO

8.6. GENERAL

ELECTRICAL COMPANY

8.7. GOOGLE,

INC.

8.8. HARRIS

CORPORATION

8.9. PITNEY

BOWES, INC.

8.10. HARRIS CORPORATION

8.11. HEXAGON AB (SUBSIDIARY: INTERGRAPH)

8.12. MDA CORPORATION (MACDONALD DETTWILER, AND ASSOCIATES)

8.13. PITNEY BOWES, INC.

8.14. TRIMBLE GEOSPATIAL

8.15. URTHECAST CORPORATION

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1 MARKET

ATTRACTIVENESS MATRIX FOR GEOSPATIAL ANALYTICS MARKET

TABLE 2 VENDOR

SCORECARD OF GEOSPATIAL ANALYTICS MARKET

TABLE 3 REGULATORY FRAMEWORK OF GEOSPATIAL

ANALYTICS MARKET

TABLE 4 EUROPE GEOSPATIAL ANALYTICS MARKET,

COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 5 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

TYPE, 2019-2027 (IN $ MILLION)

TABLE 6 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 7 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 8 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

END-USER, 2019-2027 (IN $ MILLION)

FIGURE 1 EUROPE GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 2 PORTER’S FIVE FORCE ANALYSIS OF GEOSPATIAL

ANALYTICS MARKET

FIGURE 3 KEY IMPACT ANALYSIS

FIGURE 4 TIMELINE OF GEOSPATIAL ANALYTICS

FIGURE 5 USE OF LOCATION-BASED DATA IN NUMEROUS

INDUSTRIES (IN %)

FIGURE 6 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

SURFACE ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 7 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

NETWORK ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 8 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

GEO-VISUALIZATION, 2019-2027 (IN $ MILLION)

FIGURE 9 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

OTHER TYPE OF ANALYSIS, 2019-2027 (IN $ MILLION)

FIGURE 10 EUROPE GEOSPATIAL ANALYTICS MARKET, BY REMOTE

SENSING, 2019-2027 (IN $ MILLION)

FIGURE 11 EUROPE GEOSPATIAL ANALYTICS MARKET, BY GLOBAL

POSITIONING SYSTEM (GPS), 2019-2027 (IN $ MILLION)

FIGURE 12 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

GEOGRAPHIC INFORMATION SYSTEM (GIS), 2019-2027 (IN $ MILLION)

FIGURE 13 EUROPE GEOSPATIAL ANALYTICS MARKET, BY OTHER

TECHNOLOGIES, 2019-2027 (IN $ MILLION)

FIGURE 14 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

SURVEYING, 2019-2027 (IN $ MILLION)

FIGURE 15 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

DISASTER RISK REDUCTION & MANAGEMENT, 2019-2027 (IN $ MILLION)

FIGURE 16 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

MEDICINE & PUBLIC SAFETY, 2019-2027 (IN $ MILLION)

FIGURE 17 EUROPE GEOSPATIAL ANALYTICS MARKET, BY OTHER

APPLICATIONS, 2019-2027 (IN $ MILLION)

FIGURE 18 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

BUSINESS, 2019-2027 (IN $ MILLION)

FIGURE 19 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

UTILITY & COMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 20 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

DEFENSE & INTELLIGENCE, 2019-2027 (IN $ MILLION)

FIGURE 21 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

GOVERNMENT, 2019-2027 (IN $ MILLION)

FIGURE 22 EUROPE GEOSPATIAL ANALYTICS MARKET, BY

AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 23 EUROPE GEOSPATIAL ANALYTICS MARKET, BY OTHER

END-USER, 2019-2027 (IN $ MILLION)

FIGURE 24 EUROPE GEOSPATIAL ANALYTICS MARKET, COUNTRY

OUTLOOK, 2018 & 2027 (IN %)

FIGURE 25 UNITED KINGDOM GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 26 GERMANY GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 27 FRANCE GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 28 ITALY GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 29 SPAIN GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 30 RUSSIA GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 31 REST OF EUROPE GEOSPATIAL ANALYTICS MARKET, 2019-2027

(IN $ MILLION)