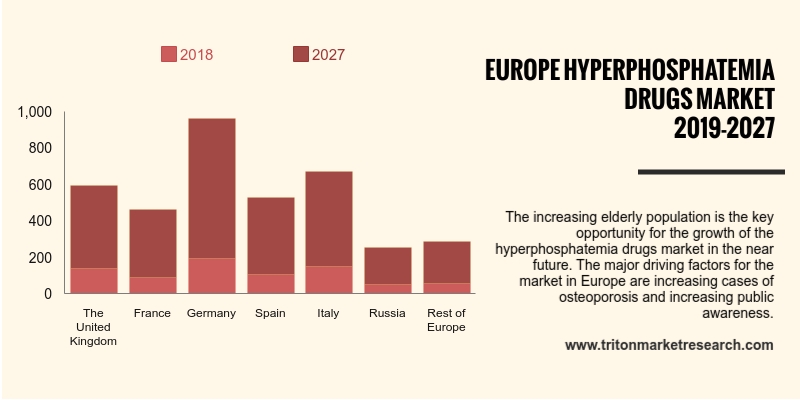

The Europe hyperphosphatemia drugs market is expected to grow rapidly at a CAGR of 16.11% during the forecasting years 2019-2027, as per a research conducted by Triton.

Countries that have been analyzed in the European hyperphosphatemia drugs market:

• United Kingdom

• Germany

• France

• Italy

• Spain

• Russia

• Rest of Europe

In the European region, the bone mineral density measurement is underutilized due to various reasons such as limitations in personnel acceptable to execute scans, imperfect availability of densitometers, limited or nonexistent reimbursements and low awareness regarding the benefits of BMD testing.

Report scope can be customized per your requirements. Request For Customization

Increasing osteoporosis disease cases in France have become a major driving factor in strengthening the demand for the hyperphosphatemia drugs market. The occurrences of diagnosed cases of osteoporosis were around 9.7%, and are expected to increase linearly as the population ages. Also, the incidences of osteoporotic vertebral fractures are increasing in the country. This would result in substantial morbidity, which might create a negative impact on life expectancy. Due to the rising aging population, the occurrence of low bone mass and osteoporosis diseases is anticipated to increase over the years.

The change in dietary habits is driving the hyperphosphatemia drug market in Germany. Foods high in proteins are naturally high in phosphorus, which contributes to higher phosphorus intake from an average diet. Foods containing phosphates, such as meat, dairy items, fast food, soft drinks, nuts, seeds, chocolate and processed food are increasing the demand for the hyperphosphatemia drugs market in Germany. Consumption of such processed foods can lead to an increase in the phosphorus levels in the blood. This high level of phosphate creates an electrolyte disturbance and thus causes hyperphosphatemia in the body. Processed food such as meat is better absorbed by the gastrointestinal tract as compared to natural food. Common salt used is highly rich in calcium phosphate. Such calcium-fortified foods can also increase phosphorus intake in our body.

RoE market is mainly driven by the aging population, expanding incidences of osteoporosis, obesity, poor dietary habits of people increasingly inclining towards consuming unhealthy & fat-rich foods and the growing number of people undergoing dialysis. Importantly, the aging population can be considered as the most crucial reason for the rising prevalence of hyperphosphatemia disorders that is driving the growth in the European market.

1.

EUROPE HYPERPHOSPHATEMIA DRUGS MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCE MODEL

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

BARGAINING POWER OF BUYERS

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

THREAT OF SUBSTITUTE PRODUCT

2.2.5.

INTENSITY OF COMPETITIVE RIVALRY

2.3. VENDOR SCORECARD

2.4. KEY BUYING OUTLOOK

2.5. KEY INSIGHTS

2.6. KEY MARKET TRENDS

2.7. GUIDELINES RELATED TO THE PHOSPHATE BINDERS

2.8. MARKET DRIVERS

2.8.1.

CHRONIC DISORDERS ARE INCREASING RAPIDLY

2.8.2.

INCREASE IN PUBLIC COGNIZANCE

2.8.3.

INCREASE IN GERIATRIC POPULATION

2.9. MARKET RESTRAINTS

2.9.1.

SIDE-EFFECTS RELATED TO THE USAGE OF HYPERPHOSPHATEMIA DRUGS

2.9.2.

STRICT FOOD AND DRUG ADMINISTRATION (FDA) REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

RISE IN THE AGING POPULATION

2.11.

MARKET CHALLENGES

2.11.1.

ALTERNATIVE DIALYSIS TECHNIQUES

2.11.2.

ACCESSIBILITY OF DRUGS IS LIMITED

2.11.3.

NON-ADHERENCE TO TREATMENT REGIMES

3.

HYPERPHOSPHATEMIA DRUGS MARKET OUTLOOK - BY DOSAGES

3.1. SOLID

3.1.1.

TABLET

3.1.2.

POWDER

3.2. LIQUID

3.2.1.

SOLUTION

4.

HYPERPHOSPHATEMIA DRUGS MARKET OUTLOOK - BY FORMULATION

4.1.1.

CALCIUM-BASED PHOSPHATE BINDERS

4.1.2.

ALUMINUM-BASED PHOSPHATE BINDERS

4.1.3.

MAGNESIUM-BASED PHOSPHATE BINDERS

4.1.4.

IRON-BASED PHOSPHATE BINDERS

4.1.5.

OTHER PHOSPHATE BINDERS

5.

HYPERPHOSPHATEMIA DRUGS MARKET - REGIONAL OUTLOOK

5.1. EUROPE

5.1.1.

COUNTRY ANALYSIS

5.1.1.1.

UNITED KINGDOM

5.1.1.2.

FRANCE

5.1.1.3.

GERMANY

5.1.1.4.

SPAIN

5.1.1.5.

ITALY

5.1.1.6.

RUSSIA

5.1.1.7.

REST OF EUROPE

6.

COMPETITIVE LANDSCAPE

6.1. JOHNSON AND JOHNSON

6.2. ZERIA PHARMACEUTICAL

6.3. AMAG PHARMACEUTICALS

6.4. SANOFI

6.5. BRUNO FARMACEUTICI S.P.A.

6.6. ROCHE DIAGNOSTICS CORPORATION

6.7. ROYAL DSM N.V.

6.8. SHIRE

6.9. CIPLA

6.10.

ULTRAGENYX PHARMACEUTICAL, INC.

6.11.

FERMENTA BIOTECH, LTD.

6.12.

BIOTECH PHARMACAL

6.13.

SUN PHARMACEUTICAL INDUSTRIES, LTD.

6.14.

KERYX BIOPHARMACEUTICALS, INC.

6.15.

FRESENIUS MEDICAL CARE

6.16.

PFIZER, INC.

7.

METHODOLOGY & SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1 EUROPE

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

TABLE 2 PHOSPHOROUS LEVELS

IN SELECT FOODS

TABLE 3 EUROPE HYPERPHOSPHATEMIA

DRUGS MARKET BY FORMULATION 2019-2027 ($ MILLION)

TABLE 4 DIAGNOSIS AND

CLINICAL INDICATORS OF CHRONIC KIDNEY DISEASE

TABLE 5 EUROPE

HYPERPHOSPHATEMIA DRUGS MARKET COUNTRY ANALYSIS 2019-2027 ($ MILLION)

FIGURE 1 PORTER’S FIVE FORCES

MODEL OF HYPERPHOSPHATEMIA DRUGS MARKET

FIGURE 2 IRON-BASED

HYPERPHOSPHATEMIA DRUG APPROVAL STATUS 2014-2017

FIGURE 3 RATE OF ADHERENCE TO

PHOSPHATE BINDERS

FIGURE 4 EUROPE

HYPERPHOSPHATEMIA DRUGS MARKET IN CALCIUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 5 EUROPE

HYPERPHOSPHATEMIA DRUGS MARKET IN ALUMINUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 6 EUROPE

HYPERPHOSPHATEMIA DRUGS MARKET IN MAGNESIUM-BASED PHOSPHATE BINDERS 2019-2027 ($

MILLION)

FIGURE 7 EUROPE HYPERPHOSPHATEMIA

DRUGS MARKET IN IRON-BASED PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 8 EUROPE

HYPERPHOSPHATEMIA DRUGS MARKET IN OTHER PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 9 EUROPE HYPERPHOSPHATEMIA

DRUGS MARKET SHARE 2018 & 2027 (%)

FIGURE 10 EUROPE

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 11 UNITED KINGDOM

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 12 FRANCE

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 13 GERMANY

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 14 SPAIN HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 15 ITALY HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 16 RUSSIA

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 17 REST OF EUROPE HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)