Market By Product, Application, Indication, End-user And Geography | Forecast 2019-2027

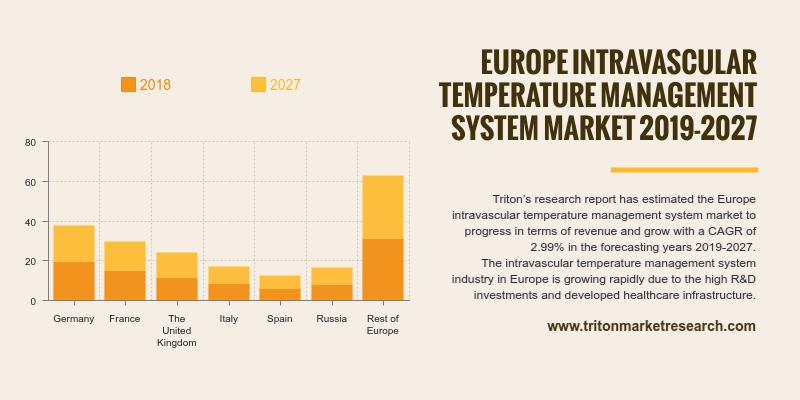

Triton’s research report has estimated the Europe intravascular temperature management system market to progress in terms of revenue and grow with a CAGR of 2.99% in the forecasting years 2019-2027.

The countries that have been analyzed in the report on Europe’s intravascular temperature management system market are:

• Germany

• France

• The United Kingdom

• Italy

• Spain

• Russia

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

The intravascular temperature management system industry in Europe is growing rapidly due to the high R&D investments and developed healthcare infrastructure. The presence of key players in this region, for instance, Geratherm Medical AG and The Surgical Company B.V. also serve as factors for growth. In addition, the rise in the number of surgical procedures and an increase in the prevalence of cardiovascular disorders further support the market growth in Europe. For instance, according to the European Heart Network, approximately 85 million people across Europe had cardiovascular conditions in 2015, with peripheral vascular disease and IHD being the most prevalent. The rapid rise in geriatric population is expected to further drive the market growth in this region.

The interventional cardiology surgeries such as CABG, heart transplant, heart valve surgery, cardiac and heart surgery are effectively performed in Italy. The country is equipped with a world-class healthcare system and has adopted innovative methods for cardiology surgeries. The minimally-invasive surgeries are preferred by surgeons and patients for critical heart surgeries. The non-conventional surgeries, such as robotic surgeries are adopted by Italy’s healthcare industry for better results that fuel the intravascular temperature management system market.

The rest of Europe region comprises countries in the NORDIC, Sweden, Switzerland and other countries that are part of the continent of Europe. In the rest of Europe, there is significant demand for cosmetic and surgical procedures, collectively from the constituting countries. The plastic surgeons in these countries are also making these treatments increasingly accessible by making deals with banks and offering services on loans. The popularity of cosmetic surgery in the rest of European region is also increasing with new medical facilities being set up and training being provided to surgeons for various procedures. The rising demand for cosmetic and surgical procedures is fueling the intravascular temperature management system market in the rest of Europe.

Inditherm Plc is a UK-based, privately held company, operating in medical and industrial-standard products. The medical segment includes warming solutions for both patients and staff. On the other hand, the industrial standard segment includes heating and insulating products for different kinds of industrial processes. The company was acquired by Inspiration Healthcare in 2015.

1.

EUROPE INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES MODEL

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTE

2.2.3.

BARGAINING POWER OF SUPPLIERS

2.2.4.

BARGAINING POWER OF BUYERS

2.2.5.

THREAT OF COMPETITIVE RIVALRY

2.3. MARKET ATTRACTIVENESS INDEX

2.4. KEY INSIGHT

2.4.1.

AMBULATORY SURGICAL CENTERS ARE ANTICIPATED TO GROW AT A SIGNIFICANT

RATE DURING THE FORECAST PERIOD

2.4.2.

PRE-OPERATIVE CARE IS A WIDELY USED APPLICATION

2.4.3.

CONSUMABLES SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE

2.4.4.

ACUTE MYOCARDIAL INFARCTION (AMI) IS THE LARGEST REVENUE-GENERATING

INDICATION

2.5. VENDOR SCORECARD

2.6. MARKET POSITION OUTLOOK

2.7. MARKET DRIVERS

2.7.1.

RISE IN THE PREVALENCE OF CARDIOVASCULAR DISEASE

2.7.2.

SURGE IN THE NUMBER OF SURGICAL PROCEDURES

2.8. MARKET RESTRAINTS

2.8.1.

SIGNIFICANT COST OF SURGERIES ASSOCIATED WITH INTRAVASCULAR TEMPERATURE

MANAGEMENT SYSTEM

2.9. MARKET OPPORTUNITIES

2.9.1.

ADVANCEMENT IN TECHNOLOGY

2.9.2.

GROWTH OPPORTUNITIES IN THE DEVELOPING ECONOMIES

2.10.

MARKET CHALLENGES

2.10.1.

STRINGENT REGULATION

3.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY PRODUCT

3.1. SYSTEM

3.2. CONSUMABLES

4.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY

APPLICATION

4.1. PRE-OPERATIVE CARE

4.2. OPERATIVE CARE

4.3. POST-OPERATIVE CARE

4.4. ACUTE/CRITICAL CARE

5.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY

INDICATION

5.1. ACUTE MYOCARDIAL INFARCTION (AMI)

5.2. STROKE

5.3. CARDIAC ARREST

5.4. FEVER/INFECTION

5.5. OTHER INDICATION

6.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET OUTLOOK - BY END-USER

6.1. SURGICAL CENTERS

6.2. EMERGENCY CARE UNITS

6.3. AMBULATORY SURGICAL CENTERS

6.4. OTHER END-USER

7.

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET - REGIONAL OUTLOOK

7.1. EUROPE

7.1.1.

COUNTRY ANALYSIS

7.1.1.1.

GERMANY

7.1.1.2.

FRANCE

7.1.1.3.

THE UNITED KINGDOM

7.1.1.4.

ITALY

7.1.1.5.

SPAIN

7.1.1.6.

RUSSIA

7.1.1.7.

REST OF EUROPE

8.

COMPANY PROFILES

8.1. ASAHI KASEI CORP.

8.2. VYAIRE MEDICAL, INC.

8.3. INDITHERM PLC (ACQUIRED BY INSPIRATION

HEALTHCARE)

8.4. BECTON, DICKINSON AND COMPANY

8.5. BIEGLER GMBH

8.6. THE 37COMPANY

8.7. ESTILL MEDICAL TECHNOLOGIES, INC.

8.8. GERATHERM MEDICAL AG

8.9. MEDTRONIC PLC

8.10.

THE SURGICAL COMPANY B.V.

8.11.

SMITHS GROUP PLC

8.12.

STIHLER ELECTRONIC GMBH (ACQUIRED BY GENTHERM GMBH)

8.13.

BELMONT INSTRUMENT CORPORATION

8.14.

STRYKER CORPORATION

8.15.

3M COMPANY

8.16.

ZOLL MEDICAL CORPORATION

9.

RESEARCH METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE & DELIVERABLES

9.1.1.

OBJECTIVES OF STUDY

9.1.2.

SCOPE OF STUDY

9.2. SOURCES OF DATA

9.2.1.

PRIMARY DATA SOURCES

9.2.2.

SECONDARY DATA SOURCES

9.3. RESEARCH METHODOLOGY

9.3.1.

EVALUATION OF PROPOSED MARKET

9.3.2.

IDENTIFICATION OF DATA SOURCES

9.3.3.

ASSESSMENT OF MARKET DETERMINANTS

9.3.4.

DATA COLLECTION

9.3.5.

DATA VALIDATION & ANALYSIS

TABLE 1 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

TABLE 2 INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM COMPANY MARKET POSITION OUTLOOK 2018

TABLE 3 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 4 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 5 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY INDICATION 2019-2027 ($ MILLION)

TABLE 6 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 7 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 8 GERMANY

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRODUCT 2019-2027 ($

MILLION)

TABLE 9 GERMANY

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY APPLICATION 2019-2027 ($

MILLION)

TABLE 10 GERMANY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY INDICATION 2019-2027 ($ MILLION)

TABLE 11 GERMANY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 12 FRANCE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 13 FRANCE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 14 FRANCE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY INDICATION 2019-2027 ($ MILLION)

TABLE 15 FRANCE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 16 THE UNITED KINGDOM

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRODUCT 2019-2027 ($

MILLION)

TABLE 17 THE UNITED KINGDOM

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY APPLICATION 2019-2027 ($

MILLION)

TABLE 18 THE UNITED KINGDOM

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY INDICATION 2019-2027 ($

MILLION)

TABLE 19 THE UNITED KINGDOM

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET BY END-USER 2019-2027 ($

MILLION)

TABLE 20 ITALY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 21 ITALY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 22 ITALY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY INDICATION 2019-2027 ($ MILLION)

TABLE 23 ITALY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 24 SPAIN INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY PRODUCT 2019-2027 ($ MILLION)

TABLE 25 SPAIN INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 26 SPAIN INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY INDICATION 2019-2027 ($ MILLION)

TABLE 27 SPAIN INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY END-USER 2019-2027 ($ MILLION)

FIGURE 1 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 2 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY SYSTEM 2019-2027 ($ MILLION)

FIGURE 3 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY CONSUMABLES 2019-2027 ($ MILLION)

FIGURE 4 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY PREOPERATIVE CARE 2019-2027 ($ MILLION)

FIGURE 5 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY OPERATIVE CARE 2019-2027 ($ MILLION)

FIGURE 6 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY POST-OPERATIVE CARE 2019-2027 ($

MILLION)

FIGURE 7 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY ACUTE/CRITICAL CARE 2019-2027 ($

MILLION)

FIGURE 8 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY ACUTE MYOCARDIAL INFARCTION (AMI)

2019-2027 ($ MILLION)

FIGURE 9 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY STROKE 2019-2027 ($ MILLION)

FIGURE 10 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY CARDIAC ARREST 2019-2027 ($ MILLION)

FIGURE 11 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY FEVER/INFECTION 2019-2027 ($ MILLION)

FIGURE 12 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY OTHER INDICATION 2019-2027 ($ MILLION)

FIGURE 13 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY SURGICAL CENTERS 2019-2027 ($ MILLION)

FIGURE 14 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY EMERGENCY CARE UNITS 2019-2027 ($

MILLION)

FIGURE 15 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY AMBULATORY SURGICAL CENTERS 2019-2027

($ MILLION)

FIGURE 16 EUROPE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET BY OTHER END-USER 2019-2027 ($ MILLION)

FIGURE 17 GERMANY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 18 FRANCE INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 19 THE UNITED KINGDOM

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 20 ITALY INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 21 SPAIN INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 22 RUSSIA INTRAVASCULAR

TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)

FIGURE 23 REST OF EUROPE

INTRAVASCULAR TEMPERATURE MANAGEMENT SYSTEM MARKET 2019-2027 ($ MILLION)