Market By Deployment Mode, Organization Size, Service And End-user | Forecast 2019-2027

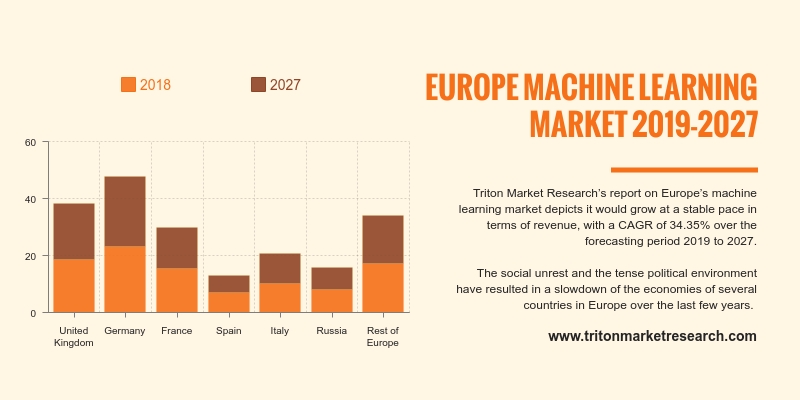

Triton Market Research’s report on Europe’s machine learning market depicts it would grow at a stable pace in terms of revenue, with a CAGR of 34.35% over the forecasting period 2019 to 2027.

The countries examined in the European machine learning market are:

• The United Kingdom

• Russia

• Germany

• France

• Italy

• Spain

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

The social unrest and the tense political environment have resulted in a slowdown of the economies of several countries in Europe over the last few years. However, with a 1.7% GDP growth in 2017, the region is set to recuperate from the setback. Several factors, such as the growth in the end-use industries, increased applications in the fields of AI & cognitive computing, heightened demand for analytical solutions and the growth of the IoT, have contributed to the growth of the machine learning market in Europe.

Amazon, SAP, Microsoft and several other renowned market players are present in the region, which has raised the demand for advanced applications. These companies are focusing towards expanding in the European region to tap the rising demands. This is expected to fuel the demand for machine learning, natural language processing and other applications, thereby fueling the growth of Europe’s machine learning market.

The rise in the adoption of advanced analytics and data-driven decision-making have driven the growth of the machine learning market in the United Kingdom. As per a report published by the Government of the UK on the economic value of data, in August 2018, organizations that adopt data-driven decisions are likely to have a 5-6% rise in their productivity and output. Substantial investments have been made by the country’s government, in both private as well as public sectors, to promote the adoption of digital and data-driven technologies.

SAP SE is a German company providing enterprise software solutions. It provides analytics, applications, and technology & cloud operations. SAP operates in various business verticals, such as asset management, finance, commerce, human resources, manufacturing, supply chain, engineering, marketing and sustainability. The company serves numerous industries, including financial services & public services, natural resources, discrete manufacturing, energy and consumer. Headquartered in Walldorf, Germany, SAP SE has its presence in the regions of Europe, the Americas, the Asia-Pacific, the Middle East and Africa.

1. EUROPE

MACHINE LEARNING MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. EVOLUTION

& TRANSITION OF MACHINE LEARNING

2.3. KEY

INSIGHTS

2.3.1. RISE

IN IMPLEMENTATION OF DATA-DRIVEN APPLICATIONS

2.3.2. AUGMENTED

DEMAND FOR INTELLIGENT BUSINESS PROCESSES

2.3.3. MACHINE

LEARNING START-UPS TRANSFORMING THE INDUSTRY

2.4. PORTER’S

FIVE FORCES ANALYSIS

2.4.1. BARGAINING

POWER OF BUYERS

2.4.2. BARGAINING

POWER OF SUPPLIERS

2.4.3. THREAT

OF NEW ENTRANTS

2.4.4. THREAT

OF SUBSTITUTE

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. COST

2.5.2. APPLICATION

2.5.3. SCALABILITY

2.5.4. TRAINING

TIME

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.8.1. SOFTWARE

DEVELOPMENT

2.8.2. CLOUD

2.8.3. USERS

2.9. PATENT

ANALYSIS

2.10.

MARKET DRIVERS

2.10.1. EXPANDING

DATA VOLUME ACROSS THE WORLD

2.10.2. WIDENING

APPLICATION OF ML IN DIFFERENT END-USE INDUSTRIES

2.10.3. SIGNIFICANT

DEVELOPMENTS IN THE FIELD OF MACHINE LEARNING

2.11.

MARKET RESTRAINTS

2.11.1. DIFFICULTIES

IN PROTECTING SENSITIVE & PRIVATE DATA

2.11.2. COMPONENTS’

FAILURE MAY DISRUPT ML SERVICE

2.12.

MARKET OPPORTUNITIES

2.12.1. INCORPORATION

OF ARTIFICIAL INTELLIGENCE & MACHINE LEARNING WITH BIG DATA

2.12.2. DEVELOPMENT

OF SMART ROBOTS

2.12.3. INCREASING

ADOPTION OF IoT-CONNECTED DEVICES

2.13.

MARKET CHALLENGES

2.13.1. TECHNOLOGICAL

& COMPUTATIONAL BARRIERS

3. EUROPE

MACHINE LEARNING MARKET OUTLOOK - BY DEPLOYMENT MODE

3.1. CLOUD

3.2. ON-PREMISES

4. EUROPE

MACHINE LEARNING MARKET OUTLOOK - BY ORGANIZATION SIZE

4.1. LARGE

ENTERPRISES

4.2. SMALL

& MEDIUM-SIZED ENTERPRISES (SMEs)

5. EUROPE

MACHINE LEARNING MARKET OUTLOOK - BY SERVICE

5.1. PROFESSIONAL

SERVICES

5.2. MANAGED

SERVICES

6. EUROPE

MACHINE LEARNING MARKET OUTLOOK - BY END-USER

6.1. BANKING,

FINANCIAL SERVICES & INSURANCE (BFSI)

6.2. HEALTHCARE

& LIFE SCIENCES

6.3. RETAIL

6.4. TELECOMMUNICATION

6.5. GOVERNMENT

& DEFENSE

6.6. MANUFACTURING

6.7. MEDIA

& ADVERTISING

6.8. ENERGY

& UTILITIES

6.9. OTHER

END-USERS

7. EUROPE

MACHINE LEARNING MARKET - REGIONAL OUTLOOK

7.1. UNITED

KINGDOM

7.2. GERMANY

7.3. FRANCE

7.4. SPAIN

7.5. ITALY

7.6. RUSSIA

7.7. REST

OF EUROPE

8. COMPETITIVE

LANDSCAPE

8.1. TIBCO

SOFTWARE, INC.

8.2. SAP

SE

8.3. ORACLE

CORPORATION

8.4. TERADATA

CORPORATION

8.5. AMAZON

WEB SERVICES, INC.

8.6. MICROSOFT

CORPORATION

8.7. INTEL

CORPORATION

8.8. FRACTAL

ANALYTICS

8.9. GOOGLE,

INC.

8.10.

BAIDU, INC.

8.11.

FAIR ISAAC CORPORATION (FICO)

8.12.

IBM CORPORATION (INTERNATIONAL

BUSINESS MACHINES)

8.13.

HEWLETT PACKARD ENTERPRISE

COMPANY (HPE)

8.14.

DELL TECHNOLOGIES, INC.

8.15.

CLARIVATE ANALYTICS LLC

(TRADEMARKVISION)

9. RESEARCH

METHODOLOGY & SCOPE

9.1. RESEARCH

SCOPE & DELIVERABLES

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: EUROPE MACHINE

LEARNING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: EVOLUTION

& TRANSITION OF MACHINE LEARNING

TABLE 3: LIST OF

PROMINENT START-UPS IN MACHINE LEARNING

TABLE 4: VENDOR

SCORECARD

TABLE 5: PATENTS FILLED

IN MACHINE LEARNING BY KEY TECHNOLOGY COMPANIES, 2018

TABLE 6: TOP 20 FIRST

PATENT FILERS IN MACHINE LEARNING IN 2016

TABLE 7: EUROPE MACHINE

LEARNING MARKET, BY DEPLOYMENT MODE, 2019-2027 (IN $ MILLION)

TABLE 8: EUROPE MACHINE

LEARNING MARKET, BY ORGANIZATION SIZE, 2019-2027 (IN $ MILLION)

TABLE 9: EUROPE MACHINE

LEARNING MARKET, BY SERVICE, 2019-2027 (IN $ MILLION)

TABLE 10: EUROPE

MACHINE LEARNING MARKET, BY END-USER, 2019-2027 (IN $ MILLION)

TABLE 11: EUROPE

MACHINE LEARNING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: KEY BUYING

IMPACT ANALYSIS

FIGURE 2: MARKET

ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY

COMPONENTS

FIGURE 4: VOLUME OF

DATA CREATED WORLDWIDE, 2010-2025 (IN ZETTABYTES)

FIGURE 5: NUMBER OF

CONNECTED DEVICES WORLDWIDE, 2015-2025

FIGURE 6: EUROPE

MACHINE LEARNING MARKET, BY CLOUD, 2019-2027 (IN $ MILLION)

FIGURE 7: EUROPE

MACHINE LEARNING MARKET, BY ON-PREMISES, 2019-2027 (IN $ MILLION)

FIGURE 8: EUROPE

MACHINE LEARNING MARKET, BY LARGE ENTERPRISES, 2019-2027 (IN $ MILLION)

FIGURE 9: EUROPE

MACHINE LEARNING MARKET, BY SMALL & MEDIUM-SIZED ENTERPRISES (SMEs),

2019-2027 (IN $ MILLION)

FIGURE 10: EUROPE

MACHINE LEARNING MARKET, BY PROFESSIONAL SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE

MACHINE LEARNING MARKET, BY MANAGED SERVICES, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE

MACHINE LEARNING MARKET, BY BANKING, FINANCIAL SERVICES & INSURANCE (BFSI),

2019-2027 (IN $ MILLION)

FIGURE 13: EUROPE

MACHINE LEARNING MARKET, BY HEALTHCARE & LIFE SCIENCES, 2019-2027 (IN $

MILLION)

FIGURE 14: EUROPE

MACHINE LEARNING MARKET, BY RETAIL, 2019-2027 (IN $ MILLION)

FIGURE 15: EUROPE

MACHINE LEARNING MARKET, BY TELECOMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE

MACHINE LEARNING MARKET, BY GOVERNMENT & DEFENSE, 2019-2027 (IN $ MILLION)

FIGURE 17: EUROPE

MACHINE LEARNING MARKET, BY MANUFACTURING, 2019-2027 (IN $ MILLION)

FIGURE 18: EUROPE MACHINE

LEARNING MARKET, BY MEDIA & ADVERTISING, 2019-2027 (IN $ MILLION)

FIGURE 19: EUROPE

MACHINE LEARNING MARKET, BY ENERGY & UTILITIES, 2019-2027 (IN $ MILLION)

FIGURE 20: EUROPE

MACHINE LEARNING MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 21: EUROPE

MACHINE LEARNING MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 22: UNITED

KINGDOM MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: GERMANY

MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: FRANCE

MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: SPAIN

MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: ITALY

MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: RUSSIA

MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: REST OF

EUROPE MACHINE LEARNING MARKET, 2019-2027 (IN $ MILLION)