Market By Category, Source, Product And Geography | Forecast 2019-2027

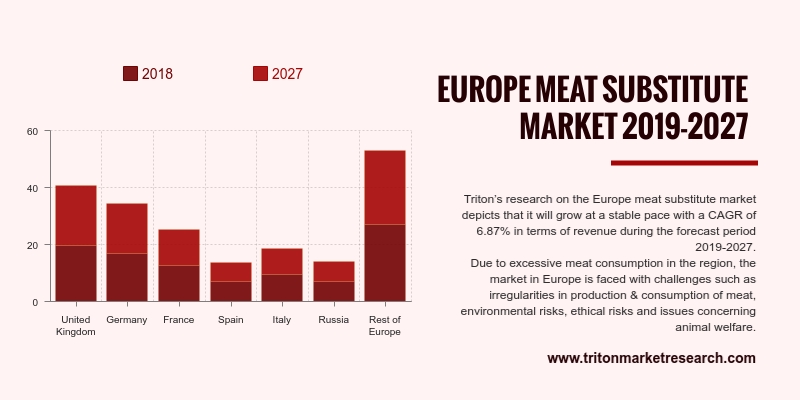

Triton’s research on the Europe meat substitute market depicts that it will grow at a stable pace with a CAGR of 6.87% in terms of revenue during the forecast period 2019-2027.

The countries scrutinized in the European market for meat substitutes are:

• The United Kingdom

• Spain

• France

• Italy

• Germany

• Russia

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

Due to excessive meat consumption in the region, the market in Europe is faced with challenges such as irregularities in production & consumption of meat, environmental risks, ethical risks and issues concerning animal welfare. Consumers have become apprehensive of meat due to instances of contamination of meat with other products. The United Kingdom faced a serious meat contamination issue, wherein horsemeat was contaminated with other meats and distributed across retail stores. This led to the consumers to move to meat substitutes.

The urbanized lifestyles of people, as well as the demand for snacks made from faux meat, have led to increased consumption of convenient foods, which is another factor that drives the meat substitute market. Moreover, meat substitutes made from soybean and wheat have several health benefits; these products have high fibre content, aid in boosting immunity and provide proper protein for development & repair. These products are also rich in antioxidants, which is driving the increasingly health-conscious population towards them, thus stimulating market growth. Furthermore, innovative marketing techniques, such as promoting brands over social media and across various retail chains, are also boosting the growth of this market.

VBites Foods Limited produces and sells natural plant-based and animal-free foods. It offers ham, chicken, beef, garlic sausage, sage and onion, pepperoni, and turkey slices, as well as roast turkey and beef, streaky-style vegetarian rashers, dairy-free cheese and chorizo style chunks; and gourmet foods, including Thai fish-style cakes, fish style fingers, spicy falafel and ready-to-eat sausages. The company also provides vegetarian mince, chicken style pieces, fishless steaks, beanfeast pates, instant gravy and meat-free burgers. VBites’ products are available in health food stores as well as on online retail platforms. The company was formerly known as The Redwood Wholefood Company Limited and changed its name to VBites Foods Limited in May 2013. VBites Foods Limited was incorporated in 1993 and is based in Corby, the United Kingdom.

1.

EUROPE MEAT SUBSTITUTE MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1.

GROWING ADOPTION OF WHEAT-BASED FOODS

2.2.2.

RISE IN VEGAN CAFES AND RESTAURANTS

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1.

THREAT OF NEW ENTRANTS

2.3.2.

THREAT OF SUBSTITUTE

2.3.3.

BARGAINING POWER OF SUPPLIERS

2.3.4.

BARGAINING POWER OF BUYERS

2.3.5.

THREAT OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1.

UPSURGE IN HEALTH-CONSCIOUS POPULACE

2.6.2.

HIGH DEMAND FOR PLANT-BASED DIET

2.6.3.

INCREASE IN OBESITY AIDS MARKET GROWTH

2.7. MARKET RESTRAINTS

2.7.1.

EASY ACCESS OF ALTERNATIVE PRODUCTS

2.8. MARKET OPPORTUNITIES

2.8.1.

GROWING ADOPTION OF VEGANISM

2.8.2.

INFILTRATION OF RETAIL CHAIN

2.9. MARKET CHALLENGES

2.9.1.

HIGH COST LEVIED ON ANALOG MEAT

2.9.2.

RISE IN ALLERGIES OWING TO SOYA-BASED PRODUCTS

3.

EUROPE MEAT SUBSTITUTE MARKET OUTLOOK - BY CATEGORY

3.1. FROZEN

3.2. REFRIGERATED

3.3. SHELF-STABLE

4.

EUROPE MEAT SUBSTITUTE MARKET OUTLOOK - BY SOURCE

4.1. SOY-BASED

4.2. WHEAT-BASED

4.3. MYCOPROTEIN

4.4. OTHER SOURCES

5.

EUROPE MEAT SUBSTITUTE MARKET OUTLOOK - BY PRODUCT

5.1. TOFU-BASED

5.2. TEMPEH-BASED

5.3. TVP-BASED

5.4. SEITAN-BASED

5.5. QUORN-BASED

5.6. OTHER PRODUCTS

6.

EUROPE MEAT SUBSTITUTE MARKET - REGIONAL OUTLOOK

6.1. EUROPE

6.1.1.

UNITED KINGDOM

6.1.2.

GERMANY

6.1.3.

FRANCE

6.1.4.

SPAIN

6.1.5.

ITALY

6.1.6.

RUSSIA

6.1.7.

REST OF EUROPE

7.

COMPETITIVE LANDSCAPE

7.1. AMY’S KITCHEN INC.

7.2. BEYOND MEAT

7.3. CAULDRON FOOD LTD

7.4. QUORN FOODS LTD

7.5. KELLOGG CO.

7.6. TOFURKY

7.7. SUPERBOM

7.8. MEATLESS B.V.

7.9. VBITES FOOD LTD.

7.10. MGP INGREDIENTS

7.11. IMPOSSIBLE FOODS INC.

7.12. CONAGRA BRANDS INC.

7.13. THE CAMPBELL SOUP COMPANY

7.14. SONIC BIOCHEM LTD

7.15. VEGABOM HEALTHY OPTION

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: EUROPE MEAT SUBSTITUTE MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: MARKET ATTRACTIVENESS INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: EUROPE MEAT SUBSTITUTE MARKET, BY CATEGORY, 2019-2027 (IN $

MILLION)

TABLE 5: EUROPE MEAT SUBSTITUTE MARKET, BY SOURCE, 2019-2027 (IN $

MILLION)

TABLE 6: EUROPE MEAT SUBSTITUTE MARKET, BY PRODUCT, 2019-2027 (IN $

MILLION)

TABLE 7: EUROPE MEAT SUBSTITUTE MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: EUROPE MEAT SUBSTITUTE MARKET, BY CATEGORY, 2018 & 2027

(IN %)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: EUROPE MEAT SUBSTITUTE MARKET, BY FROZEN, 2019-2027 (IN $

MILLION)

FIGURE 4: EUROPE MEAT SUBSTITUTE MARKET, BY REFRIGERATED, 2019-2027 (IN

$ MILLION)

FIGURE 5: EUROPE MEAT SUBSTITUTE MARKET, BY SHELF-STABLE, 2019-2027 (IN

$ MILLION)

FIGURE 6: EUROPE MEAT SUBSTITUTE MARKET, BY SOY-BASED, 2019-2027 (IN $

MILLION)

FIGURE 7: EUROPE MEAT SUBSTITUTE MARKET, BY WHEAT-BASED, 2019-2027 (IN $

MILLION)

FIGURE 8: EUROPE MEAT SUBSTITUTE MARKET, BY MYCOPROTEIN, 2019-2027 (IN $

MILLION)

FIGURE 9: EUROPE MEAT SUBSTITUTE MARKET, BY OTHER SOURCES, 2019-2027 (IN

$ MILLION)

FIGURE 10: EUROPE MEAT SUBSTITUTE MARKET, BY TOFU-BASED, 2019-2027 (IN $

MILLION)

FIGURE 11: EUROPE MEAT SUBSTITUTE MARKET, BY TEMPEH-BASED, 2019-2027 (IN

$ MILLION)

FIGURE 12: EUROPE MEAT SUBSTITUTE MARKET, BY TVP-BASED, 2019-2027 (IN $

MILLION)

FIGURE 13: EUROPE MEAT SUBSTITUTE MARKET, BY SEITAN-BASED, 2019-2027 (IN

$ MILLION)

FIGURE 14: EUROPE MEAT SUBSTITUTE MARKET, BY QUORN-BASED, 2019-2027 (IN

$ MILLION)

FIGURE 15: EUROPE MEAT SUBSTITUTE MARKET, BY OTHER PRODUCTS, 2019-2027

(IN $ MILLION)

FIGURE 16: EUROPE MEAT SUBSTITUTE MARKET, REGIONAL OUTLOOK, 2018 &

2027 (IN %)

FIGURE 17: UNITED KINGDOM MEAT SUBSTITUTE MARKET, 2019-2027 (IN $

MILLION)

FIGURE 18: GERMANY MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: FRANCE MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SPAIN MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: ITALY MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: RUSSIA MEAT SUBSTITUTE MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: REST OF EUROPE MEAT SUBSTITUTE MARKET, 2019-2027 (IN $

MILLION)