Market By Component, Fidelity, End-user And Geography | Forecast 2019-2027

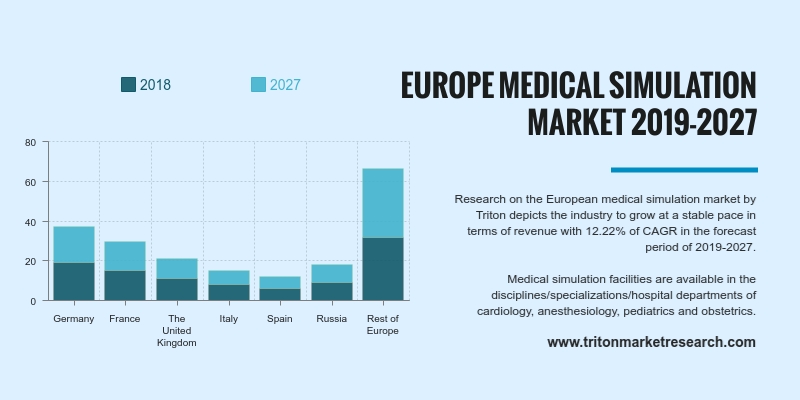

Research on the European medical simulation market by Triton depicts the industry to grow at a stable pace in terms of revenue with 12.22% of CAGR in the forecast period of 2019-2027.

The countries studied in the Europe market for medical simulation are:

• Russia

• Germany

• Spain

• Italy

• The UK

• France

• Rest of Europe

Due to the low level of initiatives by the government, medical simulation training services in the European region are largely provided by private players. In fact, Germany is forecasted to contribute the highest to the market share during the estimated period. Germany has a heterogeneous medical simulation expert community. The country lacks uniformity with respect to simulation training in hospitals & other medical centers. This does not imply that there is a complete absence of simulation training facilities in Germany; rather, there only a few selected fields & disciplines where simulation training is imparted.

Report scope can be customized per your requirements. Request For Customization

Medical simulation facilities are available in the disciplines/specializations/hospital departments of cardiology, anesthesiology, pediatrics and obstetrics. Fees from external training participants and cross-subsidization are used to finance medical simulation centers in the country. As a result, hospitals that include medical simulation in their programs for training medical professionals, mostly buy an external service for medical simulation, than implement it themselves. This situation depicts both, low implementation of as well as low interest in implementing medical simulation by the German government authorities.

The lack of governmental efforts, however, paves the way for market players to enter and expand into the German medical simulation market. Low patient satisfaction, as a result of medical professionals dispensing poor quality services, is responsible for this scenario. However, large private hospitals actively address these issues, owing to their emphasis on customer satisfaction. This shows that there is scope for the growth of the medical simulation market in Germany.

Laerdal Medical AS is engaged in manufacturing and marketing simulators for the healthcare industry. The products of the company can be classified into four categories: Simulation & Training, Courses & Learning, Medical Devices and Skills Proficiency. Simulation & training products like MegaCode Kid, Crash Kelly, PROMPT Flex and SimMan 3G, among others, form a part of the company’s product portfolio. Laerdal Medical nurtures partnerships and collaborations as a key element of its business strategy to accomplish its business objectives. It is headquartered in Stavanger, Norway.

1. EUROPE

MEDICAL SIMULATION MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL OUTLOOK

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE

2.2.3. BARGAINING

POWER OF BUYERS

2.2.4. BARGAINING

POWER OF SUPPLIERS

2.2.5. THREAT

OF COMPETITIVE RIVALRY

2.3. MARKET

TRENDS

2.4. REGULATORY

OUTLOOK

2.5. MARKET

SHARE OUTLOOK

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. MARKET

DRIVERS

2.7.1. GROWING

CONCERN FOR PATIENT SAFETY

2.7.2. INCREASING

DEMAND FOR MINIMALLY INVASIVE SURGERY (MIS)

2.8. MARKET

RESTRAINTS

2.8.1. HIGH

COST OF MEDICAL SIMULATORS

2.8.2. LACK

OF SKILLED PROFESSIONALS

2.8.3. AVERSENESS

TO ADOPT NEW SIMULATION TECHNOLOGIES

2.9. MARKET

OPPORTUNITIES

2.9.1. TECHNOLOGICAL

ADVANCEMENTS

2.10.

MARKET CHALLENGES

2.10.1.

CHALLENGES IN THE MEDICAL

SIMULATION OPRATION

3. MEDICAL

SIMULATION MARKET OUTLOOK – BY COMPONENT

3.1. MODEL-BASED

SIMULATION

3.2. WEB-BASED

SIMULATION

3.3. SIMULATION

TRAINING SERVICES

4. MEDICAL

SIMULATION MARKET OUTLOOK – BY FIDELITY

4.1. LOW-FIDELITY

4.2. MEDIUM-FIDELITY

4.3. HIGH-FIDELITY

5. MEDICAL

SIMULATION MARKET OUTLOOK – BY END-USER

5.1. ACADEMIC

INSTITUTIONS & RESEARCH CENTERS

5.2. HOSPITALS

& CLINICS

5.3. MILITARY

ORGANIZATIONS

6. MEDICAL

SIMULATION MARKET – REGIONAL OUTLOOK

6.1. EUROPE

6.1.1. COUNTRY

ANALYSIS

6.1.1.1. GERMANY

6.1.1.2. FRANCE

6.1.1.3. THE

UNITED KINGDOM

6.1.1.4. ITALY

6.1.1.5. SPAIN

6.1.1.6. RUSSIA

6.1.1.7. REST

OF EUROPE

7. COMPETITIVE

LANDSCAPE

7.1. GAUMARD

SCIENTIFIC COMPANY

7.2. CANADIAN

AVIATION ELECTRONICS (CAE)

7.3. MENTICE

AB

7.4. KYOTO

KAGAKU CO., LTD.

7.5. SIMULAIDS,

INC.

7.6. KINDHEART,

INC.

7.7. 3D

SYSTEMS CORPORATION

7.8. LAERDAL

MEDICAL AS

7.9. SURGICAL

SCIENCE SWEDEN AB

7.10.

LIMBS & THINGS LTD.

7.11.

INTELLIGENT ULTRASOUND GROUP

PLC (FORMERLY MEDAPHOR GROUP PLC)

7.12.

NASCO

7.13.

SIMULAB CORPORATION

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.1.2. SCOPE

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 EUROPE MEDICAL SIMULATION MARKET 2019-2027

($ MILLION)

TABLE 2 COST OF SIMULATION EQUIPMENT

TABLE 3 EUROPE MEDICAL SIMULATION MARKET BY

COMPONENT 2019-2027 ($ MILLION)

TABLE 4 EUROPE MEDICAL SIMULATION MARKET BY

FIDELITY 2019-2027 ($ MILLION)

TABLE 5 EUROPE MEDICAL SIMULATION MARKET BY END-USER

2019-2027 ($ MILLION)

TABLE 6 EUROPE MEDICAL SIMULATION MARKET BY

COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 EUROPE MEDICAL SIMULATION MARKET 2019-2027

($ MILLION)

FIGURE 2 COMPANY MARKET SHARE OUTLOOK OF MEDICAL

SIMULATION 2018 (%)

FIGURE 3 EUROPE MEDICAL SIMULATION MARKET BY

MODEL-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 4 EUROPE MEDICAL SIMULATION MARKET BY

WEB-BASED SIMULATION 2019-2027 ($ MILLION)

FIGURE 5 EUROPE MEDICAL SIMULATION MARKET BY

SIMULATION TRAINING SERVICES 2019-2027 ($ MILLION)

FIGURE 6 EUROPE MEDICAL SIMULATION MARKET BY

LOW-FIDELITY 2019-2027 ($ MILLION)

FIGURE 7 EUROPE MEDICAL SIMULATION MARKET BY

MEDIUM-FIDELITY 2019-2027 ($ MILLION)

FIGURE 8 EUROPE MEDICAL SIMULATION MARKET BY HIGH-FIDELITY

2019-2027 ($ MILLION)

FIGURE 9 EUROPE MEDICAL SIMULATION MARKET BY

ACADEMIC INSTITUTIONS & RESEARCH CENTERS 2019-2027 ($ MILLION)

FIGURE 10 EUROPE MEDICAL SIMULATION MARKET BY HOSPITALS

& CLINICS 2019-2027 ($ MILLION)

FIGURE 11 EUROPE MEDICAL SIMULATION MARKET BY MILITARY

ORGANIZATIONS 2019-2027 ($ MILLION)

FIGURE 12 GERMANY MEDICAL SIMULATION MARKET 2019-2027

($ MILLION)

FIGURE 13 FRANCE MEDICAL SIMULATION MARKET 2019-2027 ($

MILLION)

FIGURE 14 THE UNITED KINGDOM MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)

FIGURE 15 ITALY MEDICAL SIMULATION MARKET 2019-2027 ($

MILLION)

FIGURE 16 SPAIN MEDICAL SIMULATION MARKET 2019-2027 ($

MILLION)

FIGURE 17 RUSSIA MEDICAL SIMULATION MARKET 2019-2027 ($

MILLION)

FIGURE 18 REST OF EUROPE MEDICAL SIMULATION MARKET

2019-2027 ($ MILLION)