Market By Technology, Application, Product, And Region | Forecast 2019-2027

Triton’s research on the European metagenomics market depicts the industry to grow substantially in terms of revenue, at a CAGR of 15.78% during the forecast period 2019-2027.

The countries analyzed in Europe’s metagenomics market are:

• Russia

• Spain

• Italy

• Germany

• France

• The United Kingdom

• Rest of Europe

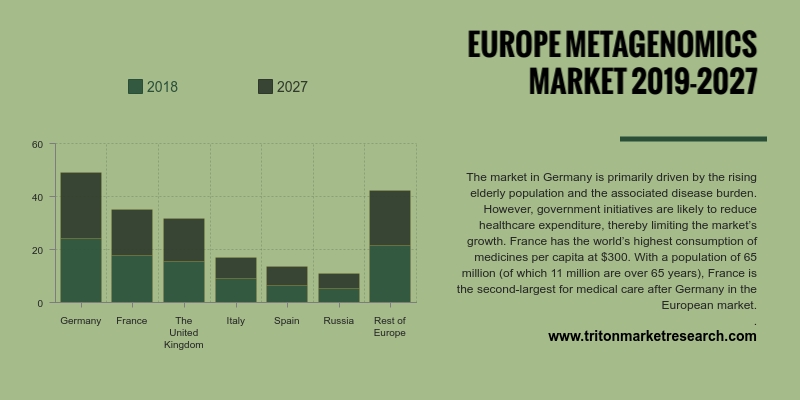

The Europe metagenomics market is being driven by the rising prevalence of chronic diseases, an increase in the number of diagnostic centers, growing healthcare spending, the surge in cardiovascular diseases, and advancements in technology. The Germany market is steadily gaining momentum and is slated to become the hub of innovative medicines in the future, providing a strong infrastructural support to both domestic as well as international players to establish and expand their base. The stable fiscal environment in the country is characterized by low corporate taxes, interest rates, and structural debt, which support its sustained economic growth. Germany’s transparent regulatory system encourages foreign companies to invest in this market. These factors are expected to fuel the German metagenomics market growth.

Italy is among the top five destinations in Europe for research & development purposes, having an overall attractiveness of 32%, states the European Commission. In 2015, the Government of Italy invested 1.68% of its total GDP for R&D and is planning to invest further in the coming future. The major proportion of research & development activity in the country is carried out at university levels. The life sciences industries, such as Biotech and CROs, and pharma companies have been collaborating with regional institutions for research purposes, thereby, enhancing the growth of the metagenomics market in Italy.

Qiagen N.V. provides sample and assay technologies for applied testing, molecular diagnostics and pharmaceutical and academic research. The company boasts of a product portfolio consisting of more than 500 products and has over 2,000 patents and licenses. Qiagen provides numerous kits and accessories for the process of cfDNA testing, and has also launched a number of products to assist in liquid biopsy. The company has its headquarters in Hilden, Germany. Qiagen has consolidated its position in the industry by acquiring companies like MO BIO Laboratories Inc., Exiqon A/S, and OmicSoft Corporation.

1. EUROPE

METAGENOMICS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. THREAT

OF SUBSTITUTE

2.2.3. BARGAINING

POWER OF SUPPLIERS

2.2.4. BARGAINING

POWER OF BUYERS

2.2.5. THREAT

OF COMPETITIVE RIVALRY

2.3. MARKET

ATTRACTIVENESS INDEX

2.4. MARKET

PLAYER POSITIONING

2.5. KEY

INSIGHT

2.6. MARKET

DRIVERS

2.6.1. GROWING

AWARENESS AND DEVELOPMENT IN PLATFORMS AND SEQUENCING DEVICES

2.6.2. INCREASE

IN COLLABORATION BETWEEN METAGENOMIC EXPERIMENTS AND COMPUTING TECHNOLOGIES

2.6.3. EXPANSION

OF METAGENOMICS APPLICATIONS

2.7. MARKET

RESTRAINTS

2.7.1. STRINGENT

REGULATORY FRAMEWORK

2.7.2. UNAVAILABILITY

OF SKILLED PROFESSIONALS

2.8. MARKET

OPPORTUNITIES

2.8.1. INCREASING

GOVERNMENT INITIATIVES IN THE DEVELOPING ECONOMIES

2.8.2. DEVELOPMENTS

IN NEXT-GENERATION SEQUENCING (NGS) PROCESS

2.9. MARKET

CHALLENGES

2.9.1. CHALLENGES

ASSOCIATED WITH DNA SEQUENCING PROCESS OR TECHNIQUES

2.9.2. BIOINFORMATICS

LIMITATION IN DNA SEQUENCING

3. METAGENOMICS

MARKET OUTLOOK- BY TECHNOLOGY

3.1. SEQUENCING

3.2. BIOINFORMATICS

4. METAGENOMICS

MARKET OUTLOOK- BY APPLICATION

4.1. GUT

MICROBE CHARACTERIZATION

4.2. INFECTIOUS

DISEASE DIAGNOSIS

4.3. BIOTECHNOLOGY

4.4. ENVIRONMENTAL

REMEDIATION

4.5. BIOFUEL

4.6. AGRICULTURE

5. METAGENOMICS

MARKET OUTLOOK- BY PRODUCT

5.1. CONSUMABLES

5.2. INSTRUMENTS

5.3. SOFTWARE

6. METAGENOMICS

MARKET - REGIONAL OUTLOOK

6.1. EUROPE

6.1.1. COUNTRY

ANALYSIS

6.1.1.1. GERMANY

6.1.1.2. FRANCE

6.1.1.3. THE

UNITED KINGDOM

6.1.1.4. ITALY

6.1.1.5. SPAIN

6.1.1.6. RUSSIA

6.1.1.7. REST

OF EUROPE

7. COMPANY

PROFILES

7.1. BIO-RAD

LABORATORIES, INC.

7.2. QIAGEN

N.V.

7.3. ENTEROME

SA

7.4. SWIFT

BIOSCIENCES INC.

7.5. F.

HOFFMANN-LA ROCHE LTD

7.6. AGILENT

TECHNOLOGIES, INC.

7.7. THERMO

FISHER SCIENTIFIC INC.

7.8. ILLUMINA,

INC.

7.9. PERKINELMER,

INC.

7.10. INTEGRAGEN

S.A

7.11. OXFORD

NANOPORE TECHNOLOGIES LTD.

7.12. PACIFIC

BIOSCIENCES OF CALIFORNIA, INC.

7.13. TAKARA

BIO, INC.

7.14. GENOSCREEN

7.15. NOVOGENE

CO., LTD.

8. RESEARCH

METHODOLOGY & SCOPE

8.1. RESEARCH

SCOPE & DELIVERABLES

8.1.1. OBJECTIVES

OF STUDY

8.1.2. SCOPE

OF STUDY

8.2. SOURCES

OF DATA

8.2.1. PRIMARY

DATA SOURCES

8.2.2. SECONDARY

DATA SOURCES

8.3. RESEARCH

METHODOLOGY

8.3.1. EVALUATION

OF PROPOSED MARKET

8.3.2. IDENTIFICATION

OF DATA SOURCES

8.3.3. ASSESSMENT

OF MARKET DETERMINANTS

8.3.4. DATA

COLLECTION

8.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 EUROPE METAGENOMICS MARKET 2019-2027 ($

MILLION)

TABLE 2 COMPANY’S MARKET POSITION OUTLOOK IN

2017 (%)

TABLE 3 EUROPE METAGENOMICS MARKET BY TECHNOLOGY

2019-2027 ($ MILLION)

TABLE 4 EUROPE METAGENOMICS MARKET BY

APPLICATION 2019-2027 ($ MILLION)

TABLE 5 EUROPE METAGENOMICS MARKET BY PRODUCTS

2019-2027 ($ MILLION)

TABLE 6 EUROPE METAGENOMICS MARKET BY COUNTRY

2019-2027 ($ MILLION)

FIGURE 1 EUROPE METAGENOMICS MARKET 2019-2027 ($

MILLION)

FIGURE 2 EUROPE METAGENOMICS MARKET BY SEQUENCING

2019-2027 ($ MILLION)

FIGURE 3 EUROPE METAGENOMICS MARKET BY

BIOINFORMATICS 2019-2027 ($ MILLION)

FIGURE 4 EUROPE METAGENOMICS MARKET BY GUT MICROBE

CHARACTERIZATION 2019-2027 ($ MILLION)

FIGURE 5 EUROPE METAGENOMICS MARKET BY INFECTIOUS

DISEASE DIAGNOSIS 2019-2027 ($ MILLION)

FIGURE 6 EUROPE METAGENOMICS MARKET BY

BIOTECHNOLOGY 2019-2027 ($ MILLION)

FIGURE 7 EUROPE METAGENOMICS MARKET BY ENVIRONMENTAL

REMEDIATION 2019-2027 ($ MILLION)

FIGURE 8 EUROPE METAGENOMICS MARKET BY BIOFUEL

2019-2027 ($ MILLION)

FIGURE 9 EUROPE METAGENOMICS MARKET BY AGRICULTURE

2019-2027 ($ MILLION)

FIGURE 10 EUROPE METAGENOMICS MARKET BY CONSUMABLES

2019-2027 ($ MILLION)

FIGURE 11 EUROPE METAGENOMICS MARKET BY INSTRUMENTS

2019-2027 ($ MILLION)

FIGURE 12 EUROPE METAGENOMICS MARKET BY SOFTWARE

2019-2027 ($ MILLION)

FIGURE 13 GERMANY METAGENOMICS MARKET 2019-2027 ($

MILLION)

FIGURE 14 FRANCE METAGENOMICS MARKET 2019-2027 ($

MILLION)

FIGURE 15 THE UNITED KINGDOM METAGENOMICS MARKET

2019-2027 ($ MILLION)

FIGURE 16 ITALY METAGENOMICS MARKET 2019-2027 ($

MILLION)

FIGURE 17 SPAIN METAGENOMICS MARKET 2019-2027 ($

MILLION)

FIGURE 18 RUSSIA METAGENOMICS MARKET 2019-2027 ($ MILLION)

FIGURE 19 REST OF EUROPE METAGENOMICS MARKET 2019-2027

($ MILLION)