Market By End-users, Derivatives And Geography | Forecast 2019-2027

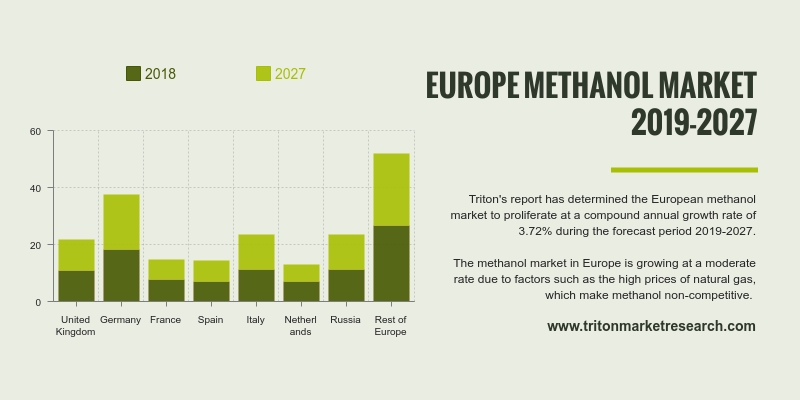

Triton's report has determined the European methanol market to proliferate at a compound annual growth rate of 3.72% during the forecast period 2019-2027.

The countries that have been analyzed for the report on Europe’s methanol market are:

• United Kingdom

• Germany

• France

• Spain

• Italy

• Russia

• The Netherlands

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

The methanol market in Europe is growing at a moderate rate due to factors such as the high prices of natural gas, which make methanol non-competitive. Thus, in the past few years, several plants had reduced their capacity utilization and ceased the manufacturing of methanol and its derivatives altogether. Most of the demand is now met through importing methanol from other countries. European countries are primarily importing methanol from APAC, predominantly China, owing to its dipping energy prices and flourishing MTO market. The primary reason for the growth of the methanol market in Europe is the increasing demand for derivatives of methanol, such as formaldehyde, MTBE and acetic acid. Several manufacturers are adopting the expansion strategy to meet the growing demand for MTBE.

UK’s chemicals market that includes methanol, possesses huge potential and is anticipated to witness significant growth during the forecast period. The rising demand for a sustainable environment, the increasing usage of bioplastics in various end-user industries and government policies are expected to spur the market demand and are the major drivers for the UK methanol market.

In Germany, the growth of the methanol market is largely driven by the increasing support from the government and mandates for environment-friendly sources & processes, environmental concerns and technological innovations. High oil prices are further driving the methanol market. Many end-user industries have widely accepted and are increasing the use of methanol in their production. Germany is considered as a mature market due to the high production of biopharmaceutical products. According to a report of federal health, the German generic market is anticipated to be the largest in Europe. This sector is estimated to expand over the forecast period but at a steady rate due to the stringent government regulations in this sector.

1.

EUROPE METHANOL

MARKET - SUMMARY

2.

INDUSTRY

OUTLOOK

2.1. MARKET DEFINITION

2.2. KEY INSIGHTS

2.2.1. AUTOMOTIVE SECTOR HOLDS THE LARGEST MARKET SHARE

2.2.2. FORMALDEHYDE IS WIDELY USED DERIVATIVE OF METHANOL

2.3. PORTER’S FIVE FORCE ANALYSIS

2.3.1. THREAT OF NEW ENTRANTS

2.3.2. THREAT OF SUBSTITUTE

2.3.3. BARGAINING POWER OF SUPPLIERS

2.3.4. BARGAINING POWER OF BUYERS

2.3.5. INTENSITY OF COMPETITIVE RIVALRY

2.4. MARKET ATTRACTIVENESS INDEX

2.5. VENDOR SCORECARD

2.6. MARKET DRIVERS

2.6.1. RISING ACCEPTANCE OF THE MTO TECHNOLOGY

2.6.2. RISE IN THE DEMAND FOR PETROCHEMICALS

2.6.3. NEED FOR CONVENTIONAL TRANSPORTATION FUELS

2.6.4. PROMOTION OF METHANOL AS AN ALTERNATIVE FUEL BY THE GOVERNMENT

2.7. MARKET RESTRAINTS

2.7.1. SCARCITY OF RAW MATERIALS

2.7.2. USE OF FUEL GRADE ETHANOL OR BIOETHANOL INSTEAD OF METHANOL

2.8. MARKET OPPORTUNITIES

2.8.1. INCREASE IN THE DEMAND FOR BIO-BASED PRODUCTS

2.8.2. DEVELOPMENT IN TECHNOLOGY FOR BIOREFINING

2.8.3. APPLICATION OF METHANOL AS A MARINE FUEL

2.9. MARKET CHALLENGES

2.9.1. UNSTABLE METHANOL PRICES

2.9.2. ECONOMIC SLOWDOWN HINDERS THE DEMAND

FOR METHANOL

2.9.3. REGULATIONS AND POLICIES

3.

METHANOL

INDUSTRY OUTLOOK - BY END-USERS

3.1. AUTOMOTIVE

3.2. CONSTRUCTION

3.3. ELECTRONICS

3.4. PAINTS AND COATINGS

3.5. OTHER END-USERS

4.

METHANOL INDUSTRY

OUTLOOK - BY DERIVATIVES

4.1. FORMALDEHYDE

4.2. ACETIC ACID

4.3. GASOLINE

4.4. DME

4.5. MTBE & TAME

4.6. OTHER DERIVATIVES

5.

METHANOL

INDUSTRY - EUROPE

5.1. UNITED KINGDOM

5.2. GERMANY

5.3. FRANCE

5.4. SPAIN

5.5. ITALY

5.6. RUSSIA

5.7. THE NETHERLANDS

5.8. REST OF EUROPE

6.

COMPETITIVE

LANDSCAPE

6.1. BASF AG

6.2. CELANESE CORPORATION

6.3. QATAR FUEL ADDITIVES COMPANY LIMITED

6.4. METHANOL HOLDINGS (TRINIDAD) LIMITED (MHTL)

6.5. METHANEX CORPORATION

6.6. MITSUBISHI CHEMICALS

6.7. MITSUI & CO., LTD.

6.8. PETROLIAM NASIONAL BERHAD (PETRONAS)

6.9. SAUDI BASIC INDUSTRIES CORPORATION

6.10.

TEIJIN

6.11.

VALERO

MARKETING AND SUPPLY COMPANY

6.12.

ZAGROS

PETROCHEMICAL COMPANY (ZPC)

7.

METHODOLOGY

& SCOPE

7.1. RESEARCH SCOPE

7.2. SOURCES OF DATA

7.3. RESEARCH METHODOLOGY

TABLE 1: EUROPE METHANOL

MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET ATTRACTIVENESS

INDEX

TABLE 3: VENDOR SCORECARD

TABLE 4: EUROPE METHANOL

MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 5: EUROPE METHANOL

MARKET, BY END-USERS, 2019-2027 (IN $ MILLION)

TABLE 6: EUROPE

METHANOL MARKET, BY DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 1: EUROPE METHANOL

MARKET, BY END-USERS, 2018 & 2027 (IN %)

FIGURE 2: EUROPE AUTOMOTIVE

MARKET FOR METHANOL, 2019-2027 (IN $ MILLION)

FIGURE 3: EUROPE FORMALDEHYDE MARKET,

2019-2027 (IN $ MILLION)

FIGURE 4: PORTER’S FIVE FORCE

ANALYSIS

FIGURE 5: EUROPE METHANOL

MARKET, BY AUTOMOTIVE, 2019-2027 (IN $ MILLION)

FIGURE 6: EUROPE METHANOL

MARKET, BY CONSTRUCTION, 2019-2027 (IN $ MILLION)

FIGURE 7: EUROPE METHANOL

MARKET, BY ELECTRONICS, 2019-2027 (IN $ MILLION)

FIGURE 8: EUROPE METHANOL

MARKET, BY PAINTS AND COATINGS, 2019-2027 (IN $ MILLION)

FIGURE 9: EUROPE METHANOL

MARKET, BY OTHER END-USERS, 2019-2027 (IN $ MILLION)

FIGURE 10: EUROPE METHANOL

MARKET, BY FORMALDEHYDE, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE METHANOL

MARKET, BY ACETIC ACID, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE METHANOL

MARKET, BY GASOLINE, 2019-2027 (IN $ MILLION)

FIGURE 13: EUROPE METHANOL

MARKET, BY DME, 2019-2027 (IN $ MILLION)

FIGURE 14: EUROPE METHANOL

MARKET, BY MTBE & TAME, 2019-2027 (IN $ MILLION)

FIGURE 15: EUROPE METHANOL

MARKET, BY OTHER DERIVATIVES, 2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE METHANOL

MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: UNITED KINGDOM

METHANOL MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: GERMANY METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: FRANCE METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SPAIN METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: ITALY METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: RUSSIA METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: THE NETHERLANDS METHANOL

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: REST OF

EUROPE METHANOL MARKET, 2019-2027 (IN $ MILLION)