Market By Type, Application, And Geography | Forecast 2019-2027

According to Triton, the research on the Europe process oil market is estimated to record a significant growth at a CAGR of 3.61% in terms of revenue and 3.25% in terms of volume over the period 2019-2027.

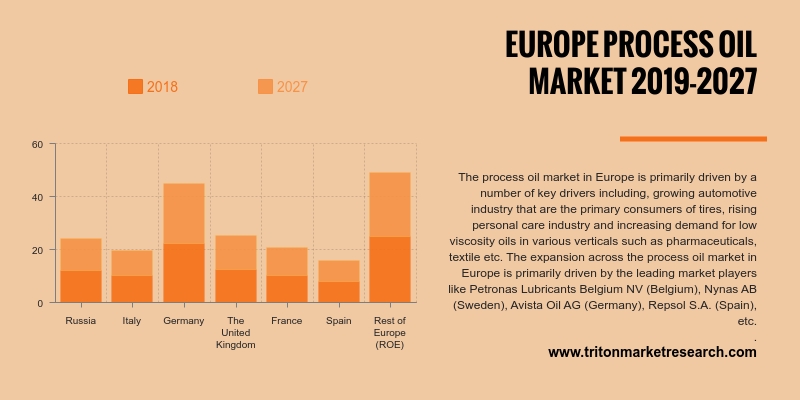

Countries that are studied in Europe’s process oil market are:

• Russia

• Italy

• Germany

• United Kingdom

• France

• Spain

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

The growing automotive industry, the rising personal care industry, and the increasing demand for low viscosity oils mainly drive the process oil market in Europe. There is an increasing demand for rubber process oil due to the requirement for rubber tires in growing motor vehicle consumption. Rubber process oil is used in the production of tires to enhance the rubber compound’s flow characteristics while improving the filler’s dispersion process.

Germany holds the largest market share in the European process oil market. The country dominates the automobile sector. In 2017, Germany sold around 3.8 million motor vehicles, which is further expected to grow the demand for process oils. Moreover, significant investments made for capacity expansion in the rubber & plastic industry in the country are also predicted to fuel the growth of the German process oil market.

Due to the rising consumer awareness of chemicals in cosmetics and toiletries, the demand for organic cosmetics has been increasing in the French market. France is the second-largest country for beauty and personal care products. Many multinational companies are launching innovative products to attract consumers. In the textile industry, process oil is used to minimize friction in the weaving process and improve efficiency. It works as a cleaning agent in the manufacturing process, and thus, growth in the textile industry is expected to drive the process oil market in Europe.

Nynas AB is a Swedish company that sells specialty oils products in the Nordic countries, the Rest of Europe, the Americas, and across the world through its subsidiaries. The company offers naphthenic specialty oils, such as transformer oils for insulation and cooling of power and distribution transformers, base oils for use as a component in cutting fluids for the metalworking and in greases and other industrial lubricants.

1. EUROPE

PROCESS OIL MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCES MODEL

2.2.1. BARGAINING

POWER OF BUYERS

2.2.2. BARGAINING

POWER OF SUPPLIERS

2.2.3. THREAT

OF NEW ENTRANTS

2.2.4. THREAT

OF SUBSTITUTES

2.2.5. THREAT

OF RIVALRY

2.3. REGULATORY

OUTLOOK

2.4. MARKET

TRENDS

2.5. MARKET

SHARE OUTLOOK

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. KEY

INSIGHT

2.8. MARKET

DRIVERS

2.8.1. INCREASING

DEMAND FOR PROCESS OIL IN THE TEXTILE INDUSTRY

2.8.2. GROWING

PERSONAL CARE INDUSTRY

2.8.3. RISING

VEHICULAR PRODUCTION AND GROWING AUTOMOTIVE SECTOR

2.9. MARKET

RESTRAINTS

2.9.1. RESTRICTIONS

IN THE USAGE OF POLYCYCLIC AROMATIC HYDROCARBON (PAH)

2.9.2. EMERGENCE

OF DRY-TYPE TRANSFORMERS

2.10.

MARKET OPPORTUNITIES

2.10.1.

OPPORTUNITIES PRESENTED BY ADHERING TO THE

USAGE OF LOW POLYAROMATIC HYDROCARBON (PAH) OILS

2.10.2.

MOUNTING EXPLORATION ACTIVITY OF HYDROCARBONS

IN NON-OPEC REGIONS

2.11.

MARKET CHALLENGES

2.11.1.

FLUCTUATING RAW MATERIAL PRICES

2.11.2.

CHANGING CRUDE OIL PRICES

3. PROCESS

OIL MARKET OUTLOOK – BY TYPE

3.1. NAPHTHENIC

OIL

3.2. PARAFFIN

3.3. AROMATIC

3.4. NON-CARCINOGENIC

4. PROCESS

OIL MARKET OUTLOOK – BY APPLICATION

4.1. TIRE

& RUBBER

4.2. POLYMER

4.3. PERSONAL

CARE

4.4. TEXTILE

4.5. OTHER

APPLICATIONS

5. PROCESS

OIL MARKET – REGIONAL OUTLOOK

5.1. EUROPE

5.1.1. COUNTRY

ANALYSIS

5.1.1.1. THE

UNITED KINGDOM

5.1.1.2. ITALY

5.1.1.3. GERMANY

5.1.1.4. FRANCE

5.1.1.5. SPAIN

5.1.1.6. RUSSIA

5.1.1.7. REST

OF EUROPE

6. COMPANY

PROFILES

6.1. CHEVRON

CORPORATION

6.2. GAZPROM

6.3. GP

PETROLEUMS

6.4. APAR

INDUSTRIES LTD.

6.5. LANXESS

PROCESS OIL

6.6. ROYAL

DUTCH SHELL PLC

6.7. HINDUSTAN

PETROLEUM CORPORATION LTD.

6.8. HOLLYFRONTIER

REFINING & MARKETING INC.

6.9. CALUMET

SPECIALTY PRODUCTS PARTNERS, L.P.

6.10.

ERGON NORTH & SOUTH AMERICA

6.11.

TOTAL SA

6.12.

PETROCHINA COMPANY LTD.

6.13.

IDEMITSU KOSAN CO., LTD.

6.14.

EXXON MOBIL CHEMICAL COMPANY

6.15.

PETROBRAS

6.16.

REPSOL S.A.

6.17.

SASOL

6.18.

IRANOL COMPANY

6.19.

JX NIPPON OIL & GAS EXPLORATION

6.20.

NYNAS AB

6.21.

SUNOCO LP

6.22.

LUKOIL

6.23.

ORGKHIM BIOCHEMICAL HOLDING

6.24.

PANAMA PETROCHEM LTD.

6.25.

PETRONAS LUBRICANTS INTERNATIONAL

6.26.

ROSNEFT

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.1.1. OBJECTIVES

OF STUDY

7.1.2. SCOPE

OF STUDY

7.2. SOURCES

OF DATA

7.2.1. PRIMARY

DATA SOURCES

7.2.2. SECONDARY

DATA SOURCES

7.3. RESEARCH

METHODOLOGY

7.3.1. EVALUATION

OF PROPOSED MARKET

7.3.2. IDENTIFICATION

OF DATA SOURCES

7.3.3. ASSESSMENT

OF MARKET DETERMINANTS

7.3.4. DATA

COLLECTION

7.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1 EUROPE PROCESS OIL MARKET, 2019-2027 ($ MILLION)

TABLE 2 EUROPE PROCESS OIL MARKET, 2019-2027 (KILOTONS)

TABLE 3 TYPE OF PROCESS OIL

TABLE 4 GROUPING AS PER REFINING PROCESS

TABLE 5 PROPERTIES OF LIGHT NEUTRAL BASE OILS

TABLE 6 CHARACTERISTICS OF TEMPERATURE ON VISCOSITY

TABLE 7 CARCINOGENIC CLASSIFICATIONS OF PAH COMPOUNDS BY SPECIFIC

AGENCIES

TABLE 8 EUROPE PROCESS OIL MARKET, BY TYPE, 2019-2027 ($ MILLION)

TABLE 9 COMPARISON OF DIFFERENT TYPES OF RUBBER PROCESS OIL

TABLE 10 EUROPE PROCESS OIL MARKET, BY TYPE,

2019-2027 (KILOTONS)

TABLE 11 EUROPE PROCESS OIL MARKET, BY APPLICATION,

2019-2027 ($ MILLION)

TABLE 12 PROCESS OIL PRODUCTS USED IN TEXTILE

INDUSTRIES

TABLE 13 PRODUCT TYPE FOR HOT MELT ADHESIVE

MANUFACTURING INDUSTRY

TABLE 14 EUROPE PROCESS OIL MARKET, BY COUNTRY,

2019-2027 ($ MILLION)

TABLE 15 EUROPE PROCESS OIL MARKET, BY COUNTRY,

2019-2027 (KILOTONS)

FIGURE 1 EUROPE PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 2 EUROPE PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 3 PROCESS OIL COMPANY MARKET SHARE OUTLOOK

2018 (%)

FIGURE 4 EUROPE PROCESS OIL MARKET, BY NAPHTHENIC

OIL, 2019-2027 ($ MILLION)

FIGURE 5 EUROPE PROCESS OIL MARKET, BY NAPHTHENIC

OIL, 2019-2027 (KILOTONS)

FIGURE 6 EUROPE PROCESS OIL MARKET, BY PARAFFIN,

2019-2027 ($ MILLION)

FIGURE 7 EUROPE PROCESS OIL MARKET, BY PARAFFIN,

2019-2027 (KILOTONS)

FIGURE 8 EUROPE PROCESS OIL MARKET, BY AROMATIC,

2019-2027 ($ MILLION)

FIGURE 9 EUROPE PROCESS OIL MARKET, BY AROMATIC,

2019-2027 (KILOTONS)

FIGURE 10 EUROPE PROCESS OIL MARKET, BY

NON-CARCINOGENIC, 2019-2027 ($ MILLION)

FIGURE 11 EUROPE PROCESS OIL MARKET, BY

NON-CARCINOGENIC, 2019-2027 (KILOTONS)

FIGURE 12 EUROPE PROCESS OIL MARKET, BY TIRE &

RUBBER, 2019-2027 ($ MILLION)

FIGURE 13 EUROPE PROCESS OIL MARKET, BY POLYMER,

2019-2027 ($ MILLION)

FIGURE 14 EUROPE PROCESS OIL MARKET, BY PERSONAL CARE,

2019-2027 ($ MILLION)

FIGURE 15 EUROPE PROCESS OIL MARKET, BY TEXTILE,

2019-2027 ($ MILLION)

FIGURE 16 EUROPE PROCESS OIL MARKET, BY OTHER

APPLICATION, 2019-2027 ($ MILLION)

FIGURE 17 THE UNITED KINGDOM PROCESS OIL MARKET,

2019-2027 ($ MILLION)

FIGURE 18 THE UNITED KINGDOM PROCESS OIL MARKET,

2019-2027 (KILOTONS)

FIGURE 19 THE UNITED KINGDOM MOTOR VEHICLE PRODUCTION

2016-2018 (MILLION)

FIGURE 20 ITALY PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 21 ITALY PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 22 GERMANY PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 23 GERMANY PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 24 FRANCE PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 25 FRANCE PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 26 SPAIN PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 27 SPAIN PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 28 RUSSIA PROCESS OIL MARKET, 2019-2027 ($

MILLION)

FIGURE 29 RUSSIA PROCESS OIL MARKET, 2019-2027

(KILOTONS)

FIGURE 30 REST OF EUROPE PROCESS OIL MARKET, 2019-2027

($ MILLION)

FIGURE 31 REST OF EUROPE PROCESS OIL MARKET, 2019-2027

(KILOTONS)