Market By Products, Services And Geography | Forecast 2019-2027

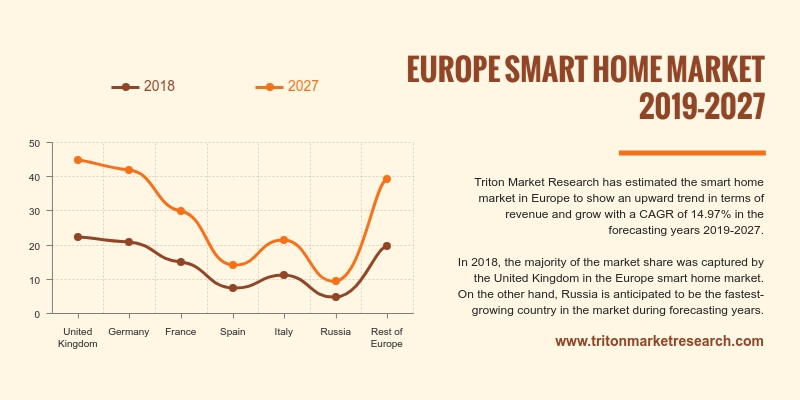

Triton Market Research has estimated the smart home market in Europe to show an upward trend in terms of revenue and grow with a CAGR of 14.97% in the forecasting years 2019-2027.

The countries that have been considered in the European smart home market are:

• The United Kingdom

• Germany

• France

• Spain

• Italy

• Russia

• Rest of Europe

Report scope can be customized per your requirements. Request For Customization

In 2018, the majority of the market share was captured by the United Kingdom in the Europe smart home market. On the other hand, Russia is anticipated to be the fastest-growing country in the market during forecasting years. The UK and Germany are the major countries in the European smart home market. In France, the level of awareness is low, but intense and direct marketing efforts focusing on both the end-users and the installers will impact the market and lead to its growth in the near future.

The growing need for convenience and security by consumers is the primary reason for the growth of the smart home market in Spain. The increasing aging population and their dependence on smart appliances is an important reason for the growth of the market. The increased application of IoT in home appliances is largely contributing to the growth of the market in the country. Nest, a subsidiary of Google, has entered the Spanish smart home market and plans to collaborate with similar local companies to provide smart home solutions. It penetrated the market with its smart thermostats and cameras. The low awareness amongst the consumers regarding the implementation of smart appliances and their advantages are the major roadblock for the growth of the Spanish smart home market.

Centrica Connected Home Limited (CCHL); formerly known as AlertMe.com Ltd., a subsidiary of Centrica Plc, is an energy management company. It principally offers smart energy-saving systems and home monitoring systems. Its product line comprises intelligent web-based solutions for energy efficiency, home monitoring & heating and related data insights. Its products include energy analytics, energy control and home automation. The company’s technology is based on a multiprotocol home gateway and cloud-based applications. The company has its presence in the UK, the US and Germany; it is headquartered in Cambridge, the United Kingdom.

1. EUROPE

SMART HOME MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. INCREASE

IN ADOPTION OF ELECTRONIC GADGETS

2.2.2. CLOUD

TECHNOLOGY HELPS IN THE GROWTH OF THE MARKET

2.2.3. INCREASED

ADOPTION OF SMART HOMES

2.3. EVOLUTION

& TRANSITION OF SMART HOME

2.4. PORTER’S

FIVE FORCE ANALYSIS

2.4.1. THREAT

OF NEW ENTRANTS

2.4.2. THREAT

OF SUBSTITUTE

2.4.3. BARGAINING

POWER OF SUPPLIERS

2.4.4. BARGAINING

POWER OF BUYERS

2.4.5. THREAT

OF COMPETITIVE RIVALRY

2.5. KEY

IMPACT ANALYSIS

2.5.1. COST

2.5.2. DATA

SECURITY

2.5.3. COMFORT

2.6. MARKET

ATTRACTIVENESS INDEX

2.7. VENDOR

SCORECARD

2.8. INDUSTRY

COMPONENTS

2.9. MARKET

DRIVERS

2.9.1. GROWTH

IN AGING POPULATION

2.9.2. GROWTH

IN INTERNET OF THINGS (IOT) DEVICES

2.9.3. INCREASE

IN URBANIZATION AND INFRASTRUCTURE PROJECTS

2.9.4. GOVERNMENTAL

INITIATIVES

2.10. MARKET

RESTRAINTS

2.10.1. COMPLEX

INSTALLATION PROCEDURE OF SMART DEVICES

2.10.2. PROBLEMS

WITH DATA MANAGEMENT

2.10.3. HIGH

PRICE OF SMART HOME PROJECTS

2.10.4. PRIVACY

CONCERNS

2.11. MARKET

OPPORTUNITIES

2.11.1. DEMAND

FROM URBAN SECURITY

2.11.2. GROWTH

OF SMART CITY PROJECTS

2.12. MARKET

CHALLENGES

2.12.1. LOW

AWARENESS ABOUT THE MARKET

2.12.2. LACK

OF STANDARDIZATION AND PROBLEMS WITH INTEROPERABILITY

3. EUROPE

SMART HOME MARKET OUTLOOK - BY PRODUCTS

3.1. SECURITY

3.2. HVAC

3.3. LIGHTING

CONTROLLERS

3.4. ENTERTAINMENT

3.5. ENERGY

MANAGEMENT

3.6. HOME

HEALTH

3.7. OTHERS

4. EUROPE

SMART HOME MARKET OUTLOOK - BY SERVICES

4.1. INSTALLATION

AND REPAIR

4.2. CUSTOMIZATION

5. EUROPE

SMART HOME MARKET - REGIONAL OUTLOOK

5.1. THE

UNITED KINGDOM

5.2. GERMANY

5.3. FRANCE

5.4. SPAIN

5.5. ITALY

5.6. RUSSIA

5.7. REST

OF EUROPE

6. COMPETITIVE

LANDSCAPE

6.1. ABB

LTD.

6.2. BLUE

LINE INNOVATIONS, INC.

6.3. CENTRICA

CONNECTED HOME LIMITED

6.4. CENTURY

TECHNOLOGIES CORP.

6.5. CONTROL4

CORPORATION

6.6. CRESTRON

ELECTRONICS, INC.

6.7. EE

LIMITED

6.8. EMERSON

ELECTRIC, CO.

6.9. HONEYWELL

INTERNATIONAL, INC.

6.10. JOHNSON

CONTROLS, INC.

6.11. LG

ELECTRONICS, INC.

6.12. SAMSUNG

ELECTRONICS CO., LTD.

6.13. SCHNEIDER

ELECTRIC SE

6.14. SIEMENS

AG

6.15. SOLATUBE

INTERNATIONAL, INC.

6.16. UNITED

TECHNOLOGIES CORPORATION

6.17. VODAFONE

GROUP PLC

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.2. SOURCES

OF DATA

7.3. RESEARCH

METHODOLOGY

TABLE 1: EUROPE SMART

HOME MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: TECHNOLOGIES

USED IN A HOME AREA NETWORK

TABLE 3: VENDOR

SCORECARD

TABLE 4: KEY COUNTRIES

BY CRIME INDEX

TABLE 5: EUROPE SMART

HOME MARKET, BY PRODUCT, 2019-2027 (IN $ MILLION)

TABLE 6: EUROPE SMART

HOME MARKET, BY SERVICES, 2019-2027 (IN $ MILLION)

TABLE 7: EUROPE SMART

HOME MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

FIGURE 1: EVOLUTION OF

SMART HOME MARKET

FIGURE 2: PORTER’S FIVE

FORCE ANALYSIS

FIGURE 3: KEY BUYING

IMPACT ANALYSIS

FIGURE 4: MARKET

ATTRACTIVENESS INDEX

FIGURE 5: INDUSTRY

COMPONENTS

FIGURE 6: PERCENTAGE OF

URBAN POPULATION ACROSS MAJOR REGIONS, 2017

FIGURE 7: EUROPE SMART

HOME MARKET, BY SECURITY, 2019-2027 (IN $ MILLION)

FIGURE 8: EUROPE SMART

HOME MARKET, BY HVAC, 2019-2027 (IN $ MILLION)

FIGURE 9: EUROPE SMART

HOME MARKET, BY LIGHTING CONTROLLERS, 2019-2027 (IN $ MILLION)

FIGURE 10: EUROPE SMART

HOME MARKET, BY ENTERTAINMENT, 2019-2027 (IN $ MILLION)

FIGURE 11: EUROPE SMART

HOME MARKET, BY ENERGY MANAGEMENT, 2019-2027 (IN $ MILLION)

FIGURE 12: EUROPE SMART

HOME MARKET, BY HOME HEALTH, 2019-2027 (IN $ MILLION)

FIGURE 13: EUROPE SMART

HOME MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 14: EUROPE SMART

HOME MARKET, BY INSTALLATION & REPAIR, 2019-2027 (IN $ MILLION)

FIGURE 15: EUROPE SMART

HOME MARKET, BY CUSTOMIZATION, 2019-2027 (IN $ MILLION)

FIGURE 16: EUROPE SMART

HOME MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: THE UNITED

KINGDOM SMART HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: GERMANY

SMART HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: FRANCE SMART

HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: SPAIN SMART

HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: ITALY SMART

HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: RUSSIA SMART

HOME MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: REST OF

EUROPE SMART HOME MARKET, 2019-2027 (IN $ MILLION)