Market By Blood Type, Application, End-users And Geography | Forecast 2019-2027

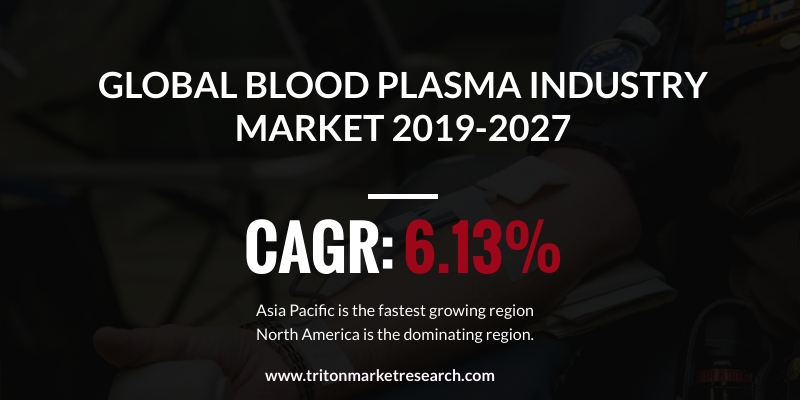

According to Triton, the global blood plasma market is expected to display a positive market trend over the forecast period of 2019-2027, exhibiting a CAGR of 6.13%. The market was assessed to be worth $18716.95 million in the year 2018 and is predicted to generate a revenue of approximately $32128.56 million by the year 2027.

Blood plasma, also known as plasma, is the liquid section of blood. It plays an essential role in delivering blood cells within the body and also helps in excreting waste products. This makes the blood plasma an extracellular matrix of the blood cells. Blood plasma makes up around 55% of the total blood volume of the body. It forms the intravascular fluid part of the extracellular fluid. It mostly consists of water i.e. up to 95% by volume and consists of dissolved proteins of about 6-8% (which mainly includes fibrinogen, globulins and serum albumins), clotting factors, glucose, electrolytes (Mg2+, Ca2+, Na+, etc.), hormones, and carbon dioxide (as plasma is a vital channel for the transportation of excretory products and oxygen).

Out of all the plasma components, immunoglobulins are used most extensively for treating various diseases and their increasing demand is the key booster for the global blood plasma market. Blood plasma also functions as the body’s protein reserve. It has an essential role in an intravascular osmotic effect that helps in keeping the electrolytes balanced and also in protecting the body against infections and other blood disorders. Plasma enables to distribute heat throughout the human body and also helps in maintaining homeostasis or biological stability, including acid-base balance in the blood and body.

Due to the emerging incidences of primary, as well as secondary immune-deficiencies, exploring the potential of blood plasma in the large-scale treatment of immunocompromised patients becomes essential. A rise in the cases of hemophilia A, hemophilia B, von Willebrand disease and other bleeding disorders has brought in a better understanding of blood plasma and the capability of blood plasma therapies in chronic disease management. The global blood plasma market is expected to achieve significant growth during the forecast period, primarily due to high demand by a large number of patients with hardly any alternative therapeutic approach.

Within this report from Triton, the key insights regarding the industry have been discussed. Also, the clinical guidelines, regulations in plasma therapeutics, the regulatory outlook, Porter’s five force analysis, market trends and patent outlook have been studied for the blood plasma market.

The key drivers like expansion in indication into new therapeutic areas and approval of immunoglobulin-centered therapies are boosting the market globally. Furthermore, the industry is facing market restraints like high costs of blood plasma treatments and easy availability of recombinant plasma, which are expected to obstruct the market growth over the forecasting years.

The key opportunities like the increasing public cognizance, rise in plasma products and the increasing occurrences of hemophilia are leveraging the industry to reach towards the estimated growth. However, the spread of pathogenic contaminants and high regulations are some of the challenges faced by the market and the companies.

The geographies covered in the global blood plasma market are:

• North America: the United States and Canada

• Europe: United Kingdom, Germany, France, Italy, Spain, Russia and Rest of Europe

• Asia-Pacific: China, Japan, India, South Korea, ASEAN countries, Australia & New Zealand and Rest of Asia-Pacific

• Latin America: Brazil, Mexico and Rest of Latin America

• The Middle East and Africa: United Arab Emirates, Turkey, Saudi Arabia, South Africa and Rest of the Middle East & Africa

The global blood plasma market has been segmented as follows:

• By Blood Type:

O Albumin

O Immunoglobulin

• Intravenous immunoglobulin

• Subcutaneous immunoglobulin

• Other immunoglobulin types

O Coagulation factor concentrates

O Hyperimmune

O Other plasma fractionation products

• By Application:

O Oncology

O Hematology

O Transplantation

O Rheumatology

O Neurology

O Immunology

O Pulmonology

O Other applications

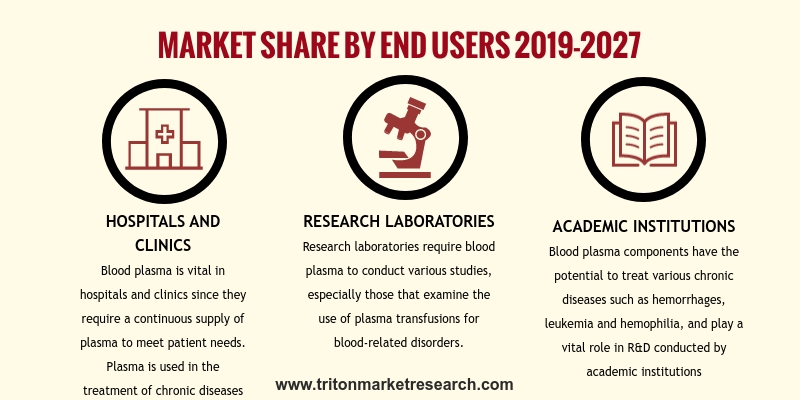

• By End-Users:

O Academic institutions

O Research laboratories

O Hospitals and clinics

The major players that have been studied in the market are Shire Plc, Arthrex, Octapharma AG, Baxter International, Inc., Grifols International S.A., Biotest AG, CSL Ltd., ADMA Biologics, Inc., China Biologic Products, Inc., General Electric, Co. and Cerus Corp.

The strategic analysis for each of these companies in blood plasma market has been covered in detail. The market share of the company helps in diving into the information about the market players and their hold in the market.

1.

GLOBAL BLOOD PLASMA MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTES

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF RIVALRY

2.3. VENDOR SCORECARD

2.4. CLINICAL GUIDELINES

2.5. REGULATION IN THE PLASMA THERAPEUTICS

2.6. KEY INSIGHTS

2.7. REGULATORY OUTLOOK

2.8. MARKET TRENDS

2.9. PATENT OUTLOOK

2.10.

MARKET DRIVERS

2.10.1.

EXPANSION IN INDICATION FOR NEW THERAPEUTIC AREAS

2.10.2.

APPROVAL OF IMMUNOGLOBULIN-CENTERED THERAPIES

2.10.3.

SURGE IN THE HEMOPHILIA TREATMENT

2.10.4.

RISE IN THE ELDERLY POPULATION

2.11.

MARKET RESTRAINTS

2.11.1.

HIGH COSTS OF BLOOD PLASMA TREATMENTS

2.11.2.

EASY AVAILABILITY OF RECOMBINANT PLASMA

2.12.

MARKET OPPORTUNITIES

2.12.1.

INCREASING PUBLIC COGNIZANCE

2.12.2.

RISE IN THE PLASMA-DERIVED PRODUCTS OPPORTUNITIES

2.12.3.

INCREASING OCCURRENCE OF HEMOPHILIA

2.13.

MARKET CHALLENGES

2.13.1.

SPREAD OF PATHOGENIC CONTAMINANTS

2.13.2.

HIGH REGULATIONS IN THE MARKET

2.14.

BLOOD PLASMA INDUSTRY BY MODE OF DELIVERY

2.14.1.

INFUSION SOLUTIONS

2.14.2.

GELS

2.14.3.

SPRAYS

2.14.4.

BIOMEDICAL SEALANTS

3.

BLOOD PLASMA MARKET OUTLOOK - BY

BLOOD TYPE

3.1. ALBUMIN

3.2. IMMUNOGLOBULIN

3.2.1.

INTRAVENOUS IMMUNOGLOBULIN

3.2.2.

SUBCUTANEOUS IMMUNOGLOBULIN

3.2.3.

OTHER IMMUNOGLOBULIN TYPE

3.3. COAGULATION FACTOR CONCENTRATES

3.4. HYPERIMMUNES

3.5. OTHER PLASMA FRACTIONATION PRODUCTS

4.

BLOOD PLASMA MARKET OUTLOOK - BY

APPLICATION

4.1. ONCOLOGY

4.2. HEMATOLOGY

4.3. TRANSPLANTATION

4.4. RHEUMATOLOGY

4.5. NEUROLOGY

4.6. IMMUNOLOGY

4.7. PULMONOLOGY

4.8. OTHER APPLICATIONS

5.

BLOOD PLASMA MARKET OUTLOOK - BY

END-USER

5.1. ACADEMIC INSTITUTIONS

5.2. RESEARCH LABORATORIES

5.3. HOSPITALS AND CLINICS

6.

BLOOD PLASMA MARKET - REGIONAL

OUTLOOK

6.1. NORTH AMERICA

6.1.1.

MARKET BY BLOOD TYPE

6.1.2.

MARKET BY END-USER

6.1.3.

MARKET BY APPLICATION

6.1.4.

COUNTRY ANALYSIS

6.1.4.1.

THE UNITED STATES

6.1.4.2.

CANADA

6.2. EUROPE

6.2.1.

MARKET BY BLOOD TYPE

6.2.2.

MARKET BY END-USER

6.2.3.

MARKET BY APPLICATION

6.2.4.

COUNTRY ANALYSIS

6.2.4.1.

FRANCE

6.2.4.2.

GERMANY

6.2.4.3.

THE UNITED KINGDOM

6.2.4.4.

ITALY

6.2.4.5.

SPAIN

6.2.4.6.

RUSSIA

6.2.4.7.

REST OF EUROPE

6.3. ASIA-PACIFIC

6.3.1.

MARKET BY BLOOD TYPE

6.3.2.

MARKET BY END-USER

6.3.3.

MARKET BY APPLICATION

6.3.4.

COUNTRY ANALYSIS

6.3.4.1.

JAPAN

6.3.4.2.

CHINA

6.3.4.3.

AUSTRALIA & NEW ZEALAND

6.3.4.4.

INDIA

6.3.4.5.

SOUTH KOREA

6.3.4.6.

ASEAN COUNTRIES

6.3.4.7.

REST OF ASIA-PACIFIC

6.4. LATIN AMERICA

6.4.1.

MARKET BY BLOOD TYPE

6.4.2.

MARKET BY END-USER

6.4.3.

MARKET BY APPLICATION

6.4.4.

COUNTRY ANALYSIS

6.4.4.1.

BRAZIL

6.4.4.2.

MEXICO

6.4.4.3.

REST OF LATIN AMERICA

6.5. MIDDLE EAST AND AFRICA

6.5.1.

MARKET BY BLOOD TYPE

6.5.2.

MARKET BY END-USER

6.5.3.

MARKET BY APPLICATION

6.5.4.

COUNTRY ANALYSIS

6.5.4.1.

SAUDI ARABIA

6.5.4.2.

TURKEY

6.5.4.3.

THE UNITED ARAB EMIRATES

6.5.4.4.

SOUTH AFRICA

6.5.4.5.

REST OF MIDDLE EAST & AFRICA

7.

COMPANY PROFILES

7.1. SHIRE PLC

7.2. ARTHREX

7.3. OCTAPHARMA AG

7.4. BAXTER INTERNATIONAL, INC.

7.5. GRIFOLS INTERNATIONAL S.A.

7.6. BIOTEST AG

7.7. CSL LTD.

7.8. ADMA BIOLOGICS, INC.

7.9. CHINA BIOLOGIC PRODUCTS, INC.

7.10.

GENERAL ELECTRIC CO.

7.11.

CERUS CORP.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 GLOBAL BLOOD PLASMA

MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 2 BLOOD PLASMA

COMPONENTS

TABLE 3 BLOOD PLASMA

PRODUCTS NUMBER OF PATENTS ISSUED 2014-2016

TABLE 4 GLOBAL BLOOD PLASMA

MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 5 GLOBAL BLOOD PLASMA

MARKET IN IMMUNOGLOBULIN BY TYPES 2019-2027 ($ MILLION)

TABLE 6 PROTEASE INHIBITORS

USED IN THE HIV INFECTION TREATMENT

TABLE 7 GLOBAL BLOOD PLASMA

MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 8 GLOBAL BLOOD PLASMA

MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 9 GLOBAL BLOOD PLASMA

MARKET BY REGION 2019-2027 ($ MILLION)

TABLE 10 NORTH AMERICA BLOOD

PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 11 NORTH AMERICA BLOOD

PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 12 NORTH AMERICA BLOOD

PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 13 NORTH AMERICA BLOOD

PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 14 EUROPE BLOOD PLASMA

MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 15 EUROPE BLOOD PLASMA

MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 16 EUROPE BLOOD PLASMA

MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 17 EUROPE BLOOD PLASMA

MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 18 ASIA-PACIFIC BLOOD

PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 19 ASIA-PACIFIC BLOOD

PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 20 ASIA-PACIFIC BLOOD

PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 21 ASIA-PACIFIC BLOOD

PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 22 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 23 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 24 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 25 MIDDLE EAST AND

AFRICA BLOOD PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

TABLE 26 LATIN AMERICA BLOOD

PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 27 LATIN AMERICA BLOOD

PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 28 LATIN AMERICA BLOOD

PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 29 LATIN AMERICA BLOOD

PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 GLOBAL BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 2 BLOOD PLASMA PRODUCTS

PATENTS SHARES BY COUNTRY 2014-2016 (%)

FIGURE 3 IMMUNOGLOBULIN

INFUSIONS SIDE-EFFECTS

FIGURE 4 ROLE OF FIBRIN

SEALANT IN COAGULATION CASCADE

FIGURE 5 GLOBAL BLOOD PLASMA

MARKET IN ALBUMIN 2019-2027 ($ MILLION)

FIGURE 6 GLOBAL BLOOD PLASMA

MARKET IN IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 7 GLOBAL IMMUNOGLOBULIN

MARKET IN INTRAVENOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 8 GLOBAL IMMUNOGLOBULIN

MARKET IN SUBCUTANEOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 9 GLOBAL IMMUNOGLOBULIN

MARKET IN OTHER IMMUNOGLOBULIN TYPE 2019-2027 ($ MILLION)

FIGURE 10 GLOBAL BLOOD PLASMA MARKET

IN COAGULATION FACTOR CONCENTRATES 2019-2027 ($ MILLION)

FIGURE 11 HYPERIMMUNES ISOLATION

PROCESS

FIGURE 12 GLOBAL BLOOD PLASMA

MARKET IN HYPERIMMUNES 2019-2027 ($ MILLION)

FIGURE 13 GLOBAL BLOOD PLASMA

MARKET IN OTHER PLASMA FRACTIONATION PRODUCTS 2019-2027 ($ MILLION)

FIGURE 14 GLOBAL BLOOD PLASMA

MARKET IN ONCOLOGY 2019-2027 ($ MILLION)

FIGURE 15 GLOBAL BLOOD PLASMA

MARKET IN HEMATOLOGY 2019-2027 ($ MILLION)

FIGURE 16 GLOBAL BLOOD PLASMA

MARKET IN TRANSPLANTATION 2019-2027 ($ MILLION)

FIGURE 17 LUPUS INFECTION

SYMPTOMS

FIGURE 18 GLOBAL BLOOD PLASMA

MARKET IN RHEUMATOLOGY 2019-2027 ($ MILLION)

FIGURE 19 GLOBAL BLOOD PLASMA

MARKET IN NEUROLOGY 2019-2027 ($ MILLION)

FIGURE 20 GLOBAL BLOOD PLASMA

MARKET IN PULMONOLOGY 2019-2027 ($ MILLION)

FIGURE 21 GLOBAL BLOOD PLASMA

MARKET IN IMMUNOLOGY 2019-2027 ($ MILLION)

FIGURE 22 GLOBAL BLOOD PLASMA

MARKET IN OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 23 GLOBAL BLOOD PLASMA

MARKET IN ACADEMIC INSTITUTIONS 2019-2027 ($ MILLION)

FIGURE 24 GLOBAL BLOOD PLASMA MARKET

IN RESEARCH LABORATORIES 2019-2027 ($ MILLION)

FIGURE 25 GLOBAL BLOOD PLASMA

MARKET IN HOSPITALS AND CLINICS 2019-2027 ($ MILLION)

FIGURE 26 THE UNITED STATES BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 27 CANADA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 28 FRANCE BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 29 GERMANY BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 30 THE UNITED KINGDOM

BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 31 ITALY BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 32 SPAIN BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 33 RUSSIA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 34 REST OF EUROPE BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 35 JAPAN BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 36 CHINA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 37 AUSTRALIA & NEW

ZEALAND BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 38 INDIA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 39 SOUTH KOREA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 40 ASEAN COUNTRIES BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 41 REST OF ASIA-PACIFIC

BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 42 BRAZIL BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 43 MEXICO BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 44 REST OF LATIN AMERICA

BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 45 SAUDI ARABIA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 46 TURKEY BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 47 THE UNITED ARAB

EMIRATES BLOOD PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 48 SOUTH AFRICA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 49 REST OF MIDDLE EAST

& AFRICA BLOOD PLASMA MARKET 2019-2027 ($ MILLION)