Market By Polymer, Film Type, Printing Technology, End-user And Geography | Forecast 2019-2027

After a detailed analysis, Triton has concluded that the global graphic films market is expected to display an upward trend in terms of revenue and estimated to grow at a CAGR of 5.67% from the forecasting years 2019 to 2027. The market was assessed to be worth $24155.68 million in the year 2018 and is predicted to generate a revenue of approximately $39199.90 million by the year 2027.

Graphic films can be defined as polymer films that have an aesthetic appeal to it. These films have emerged as a marketing innovation and are applied onto products to enhance their aesthetic appeal. They are also used as signage for various promotional activities. Automobiles, construction and e-commerce packaging are some of the major applications of graphic films.

Report scope can be customized per your requirements. Request For Customization

The global graphic films market report gives a detailed analysis of the market definition, key industry insights, market attractiveness matrix, regulatory framework, vendor scorecard, Porter’s five force analysis and key market strategies.

Market drivers like the demands from the e-commerce industry are going to push the market sales further. The e-commerce industry is ascending with a favorable pace, and the trends observed in this industry are primarily driving the graphic films market. These films have extensive applications in packaging and wrapping of products sold in the e-commerce market. The rising shares of personalized gifts involving the usage of Graphic films in digital printing and their growing demand have stimulated the market growth.

Variable data printing (VDP) is another trending feature that adds up in colorizing text or varnishing the text portion on or the background of the product. Personalization printing in e-commerce is boosting the adoption of graphic films. Thus, the proliferation of the global e-commerce industry stimulates the demand for graphic films. Key opportunities such as demand from the Asia-Pacific region and improvement in digital printing technology are leveraging the market growth over the projected period. However, unorganized market structure is the main challenge curbing the growth of the market globally.

To get detailed insights on segments, Download Sample Report

Geographies analyzed in the global Graphic films market are:

O North America: The United States and Canada

O Europe: The United Kingdom, Germany, France, Italy, Spain, Russia and rest of Europe

O Asia-Pacific: China, Japan, India, South Korea, ASEAN countries, Australia & New Zealand and rest of Asia-Pacific

O Latin America: Brazil, Mexico and rest of Latin America

o The Middle East & Africa: The United Arab Emirates, Turkey, Saudi Arabia, South Africa and rest of the Middle East & Africa

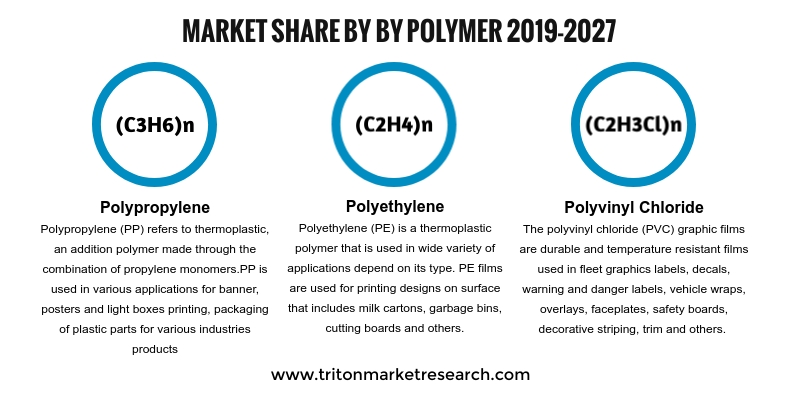

The Graphic films market has been segmented into polymers, film type, printing technology, and end-user.

O Polymer is sub-segmented into:

• Polypropylene

• Polyethylene

• Polyvinyl Chloride

• Others

O Film Type is sub-segmented into:

• Opaque

• Reflective

• Transparent

• Translucent

O Printing Technology is sub-segmented into:

• Flexography

• Rotogravure

• Offset

• Digital

O End user is sub-segmented into:

• Automotive

• Promotional & Advertisement

• Industrial

• Others

Major players engaged in the graphic films market are Wiman Corporation, Hexis S.A., CCL Industries, Arlon Graphics LLC, Drytac Corporation, Avery Dennison Corporation (acquired by CCL Industries, Inc.), Agfa Graphics, Covestro AG, Kay Premium Marking Film, Dunmore, Amcor, Ltd., Achilles USA, Inc., E.I. Du Pont Nemours & Company, 3M Company, Constantia Flexibles and Jessup Manufacturing.

The strategic analysis for each of these companies in the graphic films market has been covered in detail. The company market share helps in diving into the information about the key market players and hold of each company on the market.

1. GRAPHIC

FILMS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. COMPARISON

OF TRADITIONAL VS DIGITAL BILLBOARDS

2.2.2. BIOPLASTIC

POLYMERS - A NEW TREND IN GRAPHIC FILMS MARKET

2.3. PORTER’S

FIVE FORCE ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTES

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. THREAT

OF COMPETITIVE RIVALRY

2.4. KEY

IMPACT ANALYSIS

2.4.1. COST

2.4.2. QUALITY

2.4.3. APPLICATION

2.5. MARKET

ATTRACTIVENESS INDEX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

COMPONENTS

2.7.1. SUPPLIERS

2.7.2. RESEARCH

& DEVELOPMENT

2.7.3. MANUFACTURING

& RETAILING

2.7.3.1. MANUFACTURING

2.7.3.2. RETAILING

2.7.3.3. END-USERS

2.8. REGULATORY

FRAMEWORK

2.9. KEY

MARKET STRATEGIES

2.9.1. PRIMARY

STRATEGY: PRODUCT LAUNCH & INNOVATION

2.9.2. SECONDARY

STRATEGY: MERGER & ACQUISITION

2.9.3. TERTIARY

STRATEGY: INVESTMENT

2.10. MARKET DRIVERS

2.10.1. COST EFFICIENCY OF GRAPHIC

FILMS FOR PROMOTION

2.10.2. GROWTH IN ADVERTISING AND MARKETING INDUSTRY

2.10.3. DEMAND FROM E-COMMERCE

INDUSTRY

2.11. MARKET RESTRAINTS

2.11.1. FLUCTUATIONS IN RAW MATERIAL

PRICES

2.12. MARKET OPPORTUNITIES

2.12.1. DEMAND FROM THE ASIA-PACIFIC

REGION

2.12.2. IMPROVEMENT IN DIGITAL

PRINTING TECHNOLOGY

2.13. MARKET CHALLENGES

2.13.1. UNORGANIZED STRUCTURE OF THE

MARKET

3. GRAPHIC

FILMS MARKET OUTLOOK - BY POLYMER

3.1. POLYPROPYLENE

3.2. POLYETHYLENE

3.3. POLYVINYL

CHLORIDE

3.4. OTHERS

4. GRAPHIC

FILMS MARKET OUTLOOK - BY FILM TYPE

4.1. OPAQUE

4.2. REFLECTIVE

4.3. TRANSPARENT

4.4. TRANSLUCENT

5. GRAPHIC

FILMS MARKET OUTLOOK - BY PRINTING TECHNOLOGY

5.1. FLEXOGRAPHY

5.2. ROTOGRAVURE

5.3. OFFSET

5.4. DIGITAL

6. GRAPHIC

FILMS MARKET OUTLOOK - BY END USER

6.1. AUTOMOTIVE

6.2. PROMOTIONAL

& ADVERTISEMENT

6.3. INDUSTRIAL

6.4. OTHERS

7. GRAPHIC

FILMS MARKET - REGIONAL OUTLOOK

7.1. NORTH

AMERICA

7.1.1. MARKET

BY POLYMER

7.1.2. MARKET

BY FILM TYPE

7.1.3. MARKET

BY PRINTING TECHNOLOGY

7.1.4. MARKET

BY END USER

7.1.5. COUNTRY

ANALYSIS

7.1.5.1. THE

UNITED STATES

7.1.5.2. CANADA

7.2. EUROPE

7.2.1. MARKET

BY POLYMER

7.2.2. MARKET

BY FILM TYPE

7.2.3. MARKET

BY PRINTING TECHNOLOGY

7.2.4. MARKET

BY END USER

7.2.5. COUNTRY

ANALYSIS

7.2.5.1. THE

UNITED KINGDOM

7.2.5.2. GERMANY

7.2.5.3. FRANCE

7.2.5.4. SPAIN

7.2.5.5. ITALY

7.2.5.6. RUSSIA

7.2.5.7. REST

OF EUROPE

7.3. ASIA-PACIFIC

7.3.1. MARKET

BY POLYMER

7.3.2. MARKET

BY FILM TYPE

7.3.3. MARKET

BY PRINTING TECHNOLOGY

7.3.4. MARKET

BY END USER

7.3.5. COUNTRY

ANALYSIS

7.3.5.1. CHINA

7.3.5.2. JAPAN

7.3.5.3. INDIA

7.3.5.4. SOUTH

KOREA

7.3.5.5. ASEAN

COUNTRIES

7.3.5.6. AUSTRALIA

& NEW ZEALAND

7.3.5.7. REST

OF ASIA-PACIFIC

7.4. LATIN

AMERICA

7.4.1. MARKET

BY POLYMER

7.4.2. MARKET

BY FILM TYPE

7.4.3. MARKET

BY PRINTING TECHNOLOGY

7.4.4. MARKET

BY END USER

7.4.5. COUNTRY

ANALYSIS

7.4.5.1. BRAZIL

7.4.5.2. MEXICO

7.4.5.3. REST

OF LATIN AMERICA

7.5. THE

MIDDLE EAST & AFRICA

7.5.1. MARKET

BY POLYMER

7.5.2. MARKET

BY FILM TYPE

7.5.3. MARKET

BY PRINTING TECHNOLOGY

7.5.4. MARKET

BY END USER

7.5.5. COUNTRY

ANALYSIS

7.5.5.1. THE

UNITED ARAB EMIRATES

7.5.5.2. TURKEY

7.5.5.3. SAUDI

ARABIA

7.5.5.4. SOUTH

AFRICA

7.5.5.5. REST

OF THE MIDDLE EAST & AFRICA

8. COMPETITIVE

LANDSCAPE

8.1. 3M

COMPANY

8.2. ACHILLES

USA, INC.

8.3. AGFA

GRAPHICS

8.4. AMCOR,

LTD.

8.5. ARLON

GRAPHICS LLC

8.6. AVERY

DENNISON CORPORATION (ACQUIRED BY CCL INDUSTRIES, INC.)

8.7. CCL

INDUSTRIES

8.8. CONSTANTIA

FLEXIBLES

8.9. COVESTRO

AG

8.10. DRYTAC CORPORATION

8.11. DUNMORE

8.12. E.I. DU PONT NEMOURS AND

COMPANY

8.13. HEXIS SA

8.14. JESSUP MANUFACTURING

8.15. KAY PREMIUM MARKING FILM, LTD.

8.16. WIMAN CORPORATION

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH

METHODOLOGY

TABLE 1: GLOBAL GRAPHIC

FILMS MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: MARKET

ATTRACTIVENESS INDEX

TABLE 3: VENDOR

SCORECARD

TABLE 4: REGULATORY

FRAMEWORK

TABLE 5: GLOBAL GRAPHIC

FILMS MARKET, BY POLYMER, 2019-2027, (IN $ MILLION)

TABLE 6: GLOBAL GRAPHIC

FILMS MARKET, BY FILM TYPE, 2019-2027, (IN $ MILLION)

TABLE 7: GLOBAL GRAPHIC

FILMS MARKET, BY PRINTING TECHNOLOGY, 2019-2027, (IN $ MILLION)

TABLE 8: GLOBAL GRAPHIC

FILMS MARKET, BY END USER 2019-2027, (IN $ MILLION)

TABLE 9: GLOBAL GRAPHIC

FILMS MARKET, BY GEOGRAPHY, 2019-2027, (IN $ MILLION)

TABLE 10: NORTH

AMERICA GRAPHIC FILMS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 11: NORTH

AMERICA GRAPHIC FILMS MARKET, BY POLYMER, 2019-2027 (IN $ MILLION)

TABLE 12: NORTH

AMERICA GRAPHIC FILMS MARKET, BY FILM TYPE, 2019-2027 (IN $ MILLION)

TABLE 13: NORTH

AMERICA GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 14: NORTH

AMERICA GRAPHIC FILMS MARKET, BY END USER, 2019-2027 (IN $ MILLION)

TABLE 15: EUROPE GRAPHIC

FILMS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 16: EUROPE GRAPHIC

FILMS MARKET, BY POLYMER, 2019-2027 (IN $ MILLION)

TABLE 17: EUROPE GRAPHIC

FILMS MARKET, BY FILM TYPE, 2019-2027 (IN $ MILLION)

TABLE 18: EUROPE GRAPHIC

FILMS MARKET, BY PRINTING TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 19: EUROPE GRAPHIC

FILMS MARKET, BY END USER, 2019-2027 (IN $ MILLION)

TABLE 20: ASIA-PACIFIC

GRAPHIC FILMS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 21: ASIA-PACIFIC

GRAPHIC FILMS MARKET, BY POLYMER, 2019-2027 (IN $ MILLION)

TABLE 22: ASIA-PACIFIC

GRAPHIC FILMS MARKET, BY FILM TYPE, 2019-2027 (IN $ MILLION)

TABLE 23: ASIA-PACIFIC

GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 24: ASIA-PACIFIC

GRAPHIC FILMS MARKET, BY END USER, 2019-2027 (IN $ MILLION)

TABLE 25: LATIN

AMERICA GRAPHIC FILMS MARKET, 2019-2027 (IN $ MILLION)

TABLE 26: LATIN

AMERICA GRAPHIC FILMS MARKET, BY POLYMER, 2019-2027 (IN $ MILLION)

TABLE 27: LATIN

AMERICA GRAPHIC FILMS MARKET, BY FILM TYPE, 2019-2027 (IN $ MILLION)

TABLE 28: LATIN

AMERICA GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 29: LATIN

AMERICA GRAPHIC FILMS MARKET, BY END USER, 2019-2027 (IN $ MILLION)

TABLE 30: THE MIDDLE

EAST & AFRICA GRAPHIC FILMS MARKET, 2019-2027 (IN $ MILLION)

TABLE 31: THE MIDDLE

EAST & AFRICA GRAPHIC FILMS MARKET, BY POLYMER, 2019-2027 (IN $ MILLION)

TABLE 32: THE MIDDLE

EAST & AFRICA GRAPHIC FILMS MARKET, BY FILM TYPE, 2019-2027 (IN $ MILLION)

TABLE 33: THE MIDDLE

EAST & AFRICA GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2019-2027 (IN $

MILLION)

TABLE 34: THE MIDDLE

EAST & AFRICA GRAPHIC FILMS MARKET, BY END USER, 2019-2027 (IN $ MILLION)

FIGURE 1: GLOBAL GRAPHIC FILMS MARKET, BY PRINTING

TECHNOLOGY, 2018 & 2027 (IN %)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: KEY BUYING IMPACT ANALYSIS

FIGURE 4: INDUSTRY COMPONENTS

FIGURE 5: GLOBAL GRAPHIC FILMS MARKET, BY POLYPROPYLENE,

2019-2027 (IN $ MILLION)

FIGURE 6: GLOBAL GRAPHIC FILMS MARKET, BY

POLYETHYLENE, 2019-2027 (IN $ MILLION)

FIGURE 7: GLOBAL GRAPHIC FILMS MARKET, BY POLYVINYL

CHLORIDE, 2019-2027 (IN $ MILLION)

FIGURE 8: GLOBAL GRAPHIC FILMS MARKET, BY OTHERS,

2019-2027 (IN $ MILLION)

FIGURE 9: GLOBAL GRAPHIC FILMS MARKET, BY OPAQUE,

2019-2027 (IN $ MILLION)

FIGURE 10: GLOBAL GRAPHIC FILMS MARKET, BY REFLECTIVE,

2019-2027 (IN $ MILLION)

FIGURE 11: GLOBAL GRAPHIC FILMS MARKET, BY TRANSPARENT,

2019-2027 (IN $ MILLION)

FIGURE 12: GLOBAL GRAPHIC FILMS MARKET, BY TRANSLUCENT,

2019-2027 (IN $ MILLION)

FIGURE 13: GLOBAL GRAPHIC FILMS MARKET, BY FLEXOGRAPHY,

2019-2027 (IN $ MILLION)

FIGURE 14: GLOBAL GRAPHIC FILMS MARKET, BY ROTOGRAVURE,

2019-2027 (IN $ MILLION)

FIGURE 15: GLOBAL GRAPHIC FILMS MARKET, BY OFFSET,

2019-2027 (IN $ MILLION)

FIGURE 16: GLOBAL GRAPHIC FILMS MARKET, BY DIGITAL,

2019-2027 (IN $ MILLION)

FIGURE 17: GLOBAL GRAPHIC FILMS MARKET, BY AUTOMOTIVE,

2019-2027 (IN $ MILLION)

FIGURE 18: GLOBAL GRAPHIC FILMS MARKET, BY PROMOTIONAL

& ADVERTISEMENT, 2019-2027 (IN $ MILLION)

FIGURE 19: GLOBAL GRAPHIC FILMS MARKET, BY INDUSTRIAL,

2019-2027 (IN $ MILLION)

FIGURE 20: GLOBAL GRAPHIC FILMS MARKET, BY OTHERS,

2019-2027 (IN $ MILLION)

FIGURE 21: GLOBAL GRAPHIC FILMS MARKET, REGIONAL OUTLOOK,

2018 & 2027 (IN %)

FIGURE 22: THE UNITED STATES GRAPHIC FILMS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 23: CANADA GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 24: UNITED KINGDOM GRAPHIC FILMS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 25: GERMANY GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 26: FRANCE GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 27: SPAIN GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 28: ITALY GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 29: RUSSIA GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 30: REST OF EUROPE GRAPHIC FILMS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 31: CHINA GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 32: JAPAN GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 33: INDIA GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 34: SOUTH KOREA GRAPHIC FILMS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 35: ASEAN COUNTRIES GRAPHIC FILMS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 36: AUSTRALIA & NEW ZEALAND GRAPHIC FILMS

MARKET, 2019-2027 (IN $ MILLION)

FIGURE 37: REST OF ASIA-PACIFIC GRAPHIC FILMS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 38: BRAZIL GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 39: MEXICO GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 40: REST OF LATIN AMERICA GRAPHIC FILMS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 41: UNITED ARAB EMIRATES GRAPHIC FILMS MARKET,

2019-2027 (IN $ MILLION)

FIGURE 42: TURKEY GRAPHIC FILMS MARKET, 2019-2027 (IN $

MILLION)

FIGURE 43: SAUDI ARABIA GRAPHIC FILMS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 44: SOUTH AFRICA GRAPHIC FILMS MARKET, 2019-2027

(IN $ MILLION)

FIGURE 45: REST OF THE MIDDLE EAST & AFRICA GRAPHIC

FILMS MARKET, 2019-2027 (IN $ MILLION)