Market By Dosages, Formulation And Geography | Forecast 2019-2027

A detailed analysis by Triton has found that the global hyperphosphatemia drugs market is expected to display a positive market trend over the forecast period of 2019-2027, exhibiting a CAGR of 16.61%. The market was assessed to be worth $2873.67 million in the year 2018 and is predicted to generate a revenue of approximately $11480.07 million by the year 2027.

Report scope can be customized per your requirements. Request For Customization

Hyperphosphatemia is a condition of electrolyte disturbance in the body, with an abnormal increase in the blood’s phosphate levels. Generally, calcium levels are reduced (hypocalcemia) because the phosphate precipitates with the calcium in the tissues. The average levels of phosphorus should ideally range from 0.81 mmol per liter to 1.45 mmol per liter.

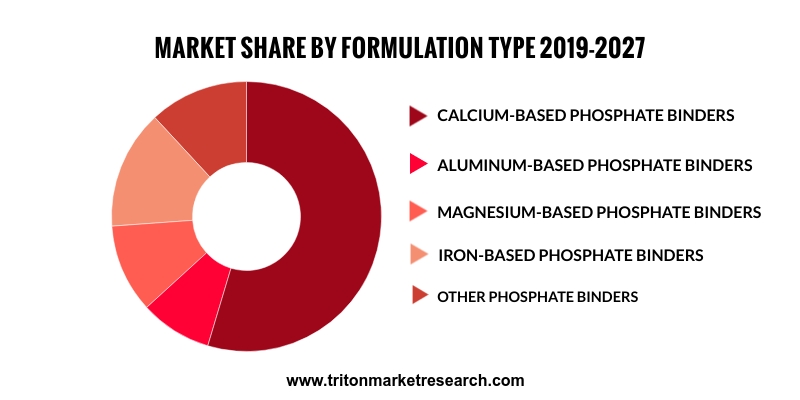

Hyperphosphatemia is diagnosed by the process of measuring the phosphate concentration in the blood. A phosphate concentration >1.46 mmol/L (4.5 mg/dL) indicates the presence of hyperphosphatemia. However, further tests may be necessary to identify the root cause of the elevated phosphate levels. The formulation of hyperphosphatemia drugs is applied extensively for different purposes. Calcium-based phosphate binders took the place of aluminum-based phosphate binders and have been used since the 1990s. Calcium-based phosphate binders are also used as calcium supplements. Aluminum-based phosphate binders have been used for a long time for treating hyperphosphatemia in dialysis patients. Also, the magnesium-based phosphorus binders are prominently used in the treatment of hyperphosphatemia conditions in all dialysis patients. Iron-based phosphate binders such as sevelamer are impactful in curing hyperphosphatemia and anemia. These binders are associated with an iron surplus in the body.

The global hyperphosphatemia drugs market report covers the present market situation and the growth prospects of the global hyperphosphatemia drugs market for the period of 2019-2027 and considers the revenue generated due to the sales of hyperphosphatemia drugs for the types as well as the applications to calculate the market size by considering 2017 as the base year.

Within this report from Triton on the global hyperphosphatemia drugs market, Porter’s five force model, key buying outlook, key insights, key market trends and guidance related to phosphate binders have been studied.

Market drivers like the growing prevalence of chronic diseases, increase in public cognizance and increase in the geriatric population have been analyzed. The industry is facing restraints like limitations levied by the Food and Drug Administration (FDA) and the growing side-effects of hyperphosphatemia drugs, which are obstructing the industry growth.

Key opportunities like the rising aging population can be leveraged by the industry to get towards the projected growth. However, non-adherence to treatment regiments, limited availability of drugs and the use of advanced dialysis techniques are the challenges facing the market at this moment.

To get detailed insights on segments, Download Sample Report

Geographies covered for the global hyperphosphatemia drugs market:

• North America: the United States and Canada

• Europe: the United Kingdom, Germany, France, Italy, Spain and Rest of Europe

• Asia-Pacific: China, Japan, India, South Korea, ASEAN countries, Australia and Rest of Asia-Pacific

• Latin America: Brazil, Mexico and Rest of Latin America

• The Middle East and Africa: the United Arab Emirates, Turkey, Saudi Arabia, South Africa and Rest of Middle East & Africa

The global hyperphosphatemia drugs market is segmented into:

• By dosages:

O Solid

• Tablet

• Powder

O Liquid

• Solution

• By formulation:

O Calcium-based phosphate binders

O Aluminum-based phosphate binders

O Magnesium-based phosphate binders

O Iron-based phosphate binders

O Other phosphate binders

The top key players in the hyperphosphatemia drugs market are Royal DSM N.V., Sanofi, Bio-Tech Pharmacal, Fresenius Medical Care, Keryx Biopharmaceuticals, Inc., Roche Diagnostics Corporation, Shire, Fermenta Biotech, Ltd., Sun Pharmaceutical Industries, Ltd., Cipla, Pfizer, Inc., AMAG Pharmaceuticals, Johnson and Johnson, Bruno Farmaceutici S.p.A., Ultragenyx Pharmaceutical, Inc. and Zeria Pharmaceutical.

The strategic analysis for each of these companies has been covered in detail in the report. The company market share helps to dive into the information about the key market players in the industry and their corresponding hold in the market.

1. GLOBAL

HYPERPHOSPHATEMIA DRUGS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. PORTER’S

FIVE FORCE MODEL

2.2.1. THREAT

OF NEW ENTRANTS

2.2.2. BARGAINING

POWER OF BUYERS

2.2.3. BARGAINING

POWER OF SUPPLIERS

2.2.4. THREAT

OF SUBSTITUTE PRODUCT

2.2.5. INTENSITY

OF COMPETITIVE RIVALRY

2.3. VENDOR

SCORECARD

2.4. KEY

BUYING OUTLOOK

2.5. KEY

INSIGHTS

2.6. KEY

MARKET TRENDS

2.7. GUIDELINES

RELATED TO THE PHOSPHATE BINDERS

2.8. MARKET

DRIVERS

2.8.1. CHRONIC

DISORDERS ARE INCREASING RAPIDLY

2.8.2. INCREASE

IN PUBLIC COGNIZANCE

2.8.3. INCREASE

IN GERIATRIC POPULATION

2.9. MARKET

RESTRAINTS

2.9.1. SIDE-EFFECTS

RELATED TO THE USAGE OF HYPERPHOSPHATEMIA DRUGS

2.9.2. STRICT

FOOD AND DRUG ADMINISTRATION (FDA) REGULATIONS

2.10.

MARKET OPPORTUNITIES

2.10.1.

RISE IN THE AGING POPULATION

2.11.

MARKET CHALLENGES

2.11.1.

ALTERNATIVE DIALYSIS

TECHNIQUES

2.11.2.

ACCESSIBILITY OF DRUGS IS

LIMITED

2.11.3.

NON-ADHERENCE TO TREATMENT

REGIMES

3. HYPERPHOSPHATEMIA

DRUGS MARKET OUTLOOK - BY DOSAGES

3.1. SOLID

3.1.1. TABLET

3.1.2. POWDER

3.2. LIQUID

3.2.1. SOLUTION

4. HYPERPHOSPHATEMIA

DRUGS MARKET OUTLOOK - BY FORMULATION

4.1.1. CALCIUM-BASED

PHOSPHATE BINDERS

4.1.2. ALUMINUM-BASED PHOSPHATE BINDERS

4.1.3. MAGNESIUM-BASED

PHOSPHATE BINDERS

4.1.4. IRON-BASED

PHOSPHATE BINDERS

4.1.5. OTHER

PHOSPHATE BINDERS

5. HYPERPHOSPHATEMIA

DRUGS INDUSTRY – REGIONAL OUTLOOK

5.1. NORTH

AMERICA

5.1.1. MARKET

BY FORMULATION

5.1.2. COUNTRY

ANALYSIS

5.1.2.1. UNITED

STATES

5.1.2.2. CANADA

5.2. EUROPE

5.2.1. MARKET

BY FORMULATION

5.2.2. COUNTRY

ANALYSIS

5.2.2.1. UNITED

KINGDOM

5.2.2.2. FRANCE

5.2.2.3. GERMANY

5.2.2.4. SPAIN

5.2.2.5. ITALY

5.2.2.6. RUSSIA

5.2.2.7. REST

OF EUROPE (ROE)

5.3. ASIA

PACIFIC

5.3.1. MARKET

BY FORMULATION

5.3.2. COUNTRY

ANALYSIS

5.3.2.1. INDIA

5.3.2.2. CHINA

5.3.2.3. JAPAN

5.3.2.4. AUSTRALIA

5.3.2.5. REST

OF APAC

5.4. LATIN

AMERICA

5.4.1. MARKET

BY FORMULATION

5.4.2. COUNTRY

ANALYSIS

5.4.2.1. BRAZIL

5.4.2.2. MEXICO

5.4.2.3. REST

OF LATIN AMERICA

5.5. MIDDLE

EAST AND AFRICA (MEA)

5.5.1. MARKET

BY FORMULATION

5.5.2. COUNTRY

ANALYSIS

5.5.2.1. SAUDI

ARABIA

5.5.2.2. TURKEY

5.5.2.3. UNITED

ARAB EMIRATES

5.5.2.4. SOUTH

AFRICA

5.5.2.5. REST

OF MIDDLE EAST AND AFRICA

6. COMPETITIVE

LANDSCAPE

6.1. JOHNSON

AND JOHNSON

6.2. ZERIA

PHARMACEUTICAL

6.3. AMAG

PHARMACEUTICALS

6.4. SANOFI

6.5. BRUNO

FARMACEUTICI S.P.A.

6.6. ROCHE

DIAGNOSTICS CORPORATION

6.7. ROYAL

DSM N.V.

6.8. SHIRE

6.9. CIPLA

6.10.

ULTRAGENYX PHARMACEUTICAL,

INC.

6.11.

FERMENTA BIOTECH, LTD.

6.12.

BIOTECH PHARMACAL

6.13.

SUN PHARMACEUTICAL INDUSTRIES,

LTD.

6.14.

KERYX BIOPHARMACEUTICALS, INC.

6.15.

FRESENIUS MEDICAL CARE

6.16.

PFIZER, INC.

7. METHODOLOGY

& SCOPE

7.1. RESEARCH

SCOPE

7.2. SOURCES

OF DATA

7.3. RESEARCH

METHODOLOGY

TABLE 1 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET BY

REGION 2019-2027 ($ MILLION)

TABLE 2 PHOSPHOROUS LEVELS IN SELECT FOODS

TABLE 3 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET BY

FORMULATION 2019-2027 ($ MILLION)

TABLE 4 DIAGNOSIS AND CLINICAL INDICATORS OF

CHRONIC KIDNEY DISEASE

TABLE 5 NORTH AMERICA HYPERPHOSPHATEMIA DRUGS

MARKET BY FORMULATION 2019-2027 ($ MILLION)

TABLE 6 NORTH AMERICA HYPERPHOSPHATEMIA DRUGS MARKET

COUNTRY ANALYSIS 2019-2027 ($ MILLION)

TABLE 7 EUROPE HYPERPHOSPHATEMIA DRUGS MARKET BY

FORMULATION 2019-2027 ($ MILLION)

TABLE 8 EUROPE HYPERPHOSPHATEMIA DRUGS MARKET

COUNTRY ANALYSIS 2019-2027 ($ MILLION)

TABLE 9 ASIA-PACIFIC HYPERPHOSPHATEMIA DRUGS

MARKET BY FORMULATION 2019-2027 ($ MILLION)

TABLE 10 ASIA-PACIFIC HYPERPHOSPHATEMIA DRUGS

MARKET COUNTRY ANALYSIS 2019-2027 ($ MILLION)

TABLE 11 PER CAPITA CONSUMPTION OF DAIRY PRODUCTS

IN AUSTRALIA

TABLE 12 LATIN AMERICA HYPERPHOSPHATEMIA DRUGS

MARKET BY FORMULATION 2019-2027 ($ MILLION)

TABLE 13 LATIN AMERICA HYPERPHOSPHATEMIA DRUGS

MARKET COUNTRY ANALYSIS 2019-2027 ($ MILLION)

TABLE 14 MIDDLE EAST AND AFRICA HYPERPHOSPHATEMIA

DRUGS MARKET BY FORMULATION 2019-2027 ($ MILLION)

TABLE 15 MIDDLE EAST AND AFRICA HYPERPHOSPHATEMIA

DRUGS MARKET COUNTRY ANALYSIS 2019-2027 ($ MILLION)

FIGURE 1 PORTER’S FIVE FORCE MODEL OF

HYPERPHOSPHATEMIA MARKET

FIGURE 2 IRON-BASED HYPERPHOSPHATEMIA DRUG APPROVAL

STATUS 2014-2017

FIGURE 3 GLOBAL POPULATION AGED 80 AND ABOVE

1950-2050 (MILLION)

FIGURE 4 RATE OF ADHERENCE TO PHOSPHATE BINDERS

FIGURE 5 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET IN

CALCIUM-BASED PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 6 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET IN

ALUMINUM-BASED PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 7 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET IN

MAGNESIUM-BASED PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 8 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET IN

IRON-BASED PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 9 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET IN

OTHER PHOSPHATE BINDERS 2019-2027 ($ MILLION)

FIGURE 10 GLOBAL HYPERPHOSPHATEMIA DRUGS MARKET SHARE

BY REGION 2018 & 2027 (%)

FIGURE 11 NORTH AMERICA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 12 UNITED STATES HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 13 CANADA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 14 EUROPE HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 15 UNITED KINGDOM HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 16 FRANCE HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 17 GERMANY HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 18 SPAIN HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 19 ITALY HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 20 RUSSIA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 21 REST OF EUROPE HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 22 ASIA-PACIFIC HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 23 AGEWISE DISTRIBUTION OF ELDERLY POPULATION IN

INDIA

FIGURE 24 INDIA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 25 CHINA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 26 JAPAN HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 27 NUMBER OF FRACTURES DUE TO OSTEOPOROSIS AND

OSTEOPENIA

FIGURE 28 SOUTH KOREA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 29 ASEAN COUNTRIESHYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 30 AUSTRALIA & NEW ZEALAND HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 31 ROAPAC HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 32 LATIN AMERICA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 33 BRAZIL HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 34 MEXICO HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 35 REST OF LATIN AMERICA HYPERPHOSPHATEMIA DRUGS

MARKET 2019-2027 ($ MILLION)

FIGURE 36 MIDDLE EAST AND AFRICA HYPERPHOSPHATEMIA

DRUGS MARKET 2019-2027 ($ MILLION)

FIGURE 37 SAUDI ARABIA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 38 TURKEY HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 39 UNITED ARAB EMIRATES HYPERPHOSPHATEMIA DRUGS

MARKET 2019-2027 ($ MILLION)

FIGURE 40 SOUTH AFRICA HYPERPHOSPHATEMIA DRUGS MARKET

2019-2027 ($ MILLION)

FIGURE 41 REST OF MIDDLE EAST & AFRICA

HYPERPHOSPHATEMIA DRUGS MARKET 2019-2027 ($ MILLION)