Market by Vehicle Type, Components, Level of Automation, Solutions, and Region | Forecast 2019-2027

The Latin America market for advanced driver assistance systems (ADAS) has been predicted to depict growth in revenue, while expanding with a CAGR of 18.04% in the forecast years 2019-2027, states a report by Triton Market Research. The market is also estimated to show a growth in volume at 16.60% CAGR in the forecasting years.

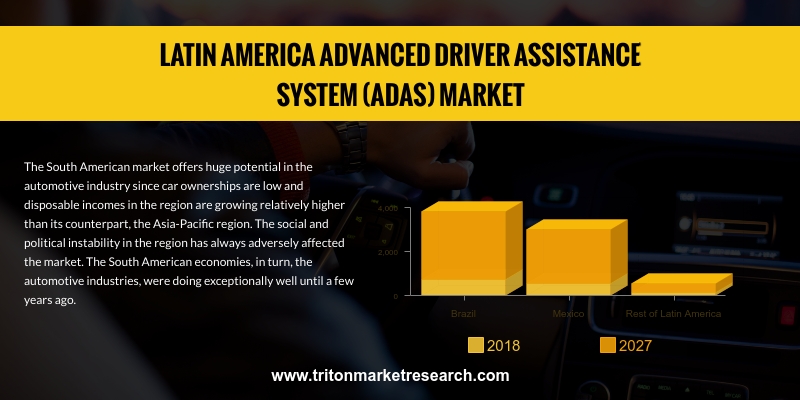

The countries reviewed in the report on the advanced driver assistance systems market in Latin America are:

• Brazil

• Mexico

• Rest of Latin America

Mexico is one of the leading automobile producers in Latin America and follows the United States and Brazil to be the third-largest in the western hemisphere. Around 75% of the vehicles produced in the country are exported to the US. The top ten of the world’s vehicle assembly companies in the world, such as General Motors, Chrysler, Ford, Nissan, Volkswagen, Honda, Toyota, BMW, Mercedes-Benz, and Volvo, are present in the country. The growing demand for advanced driver assistance systems from the United States is expected to raise the demand for Mexico’s ADAS market. Free trade between Mexico and Argentina has been restored owing to the relapse of the deal that imposed import-export restrictions between the two countries. This would help Mexico in gaining the market share from Brazil, which is currently the largest automobile exporter to Argentina. The market for luxury cars is fast progressing in the country, owing to rising disposable incomes. This factor is expected to significantly drive Mexico’s ADAS market.

Moreover, Mexico City is grappling with issues of traffic congestion. With the congestion levels reaching an unbearable high, a significant change was needed in the city. The authorities thus took initiatives to make transport reforms and tackle the issue of on-street parking. This move will raise the demand for parking assist systems, which will thereby raise the demand for ADA systems. The growing demand for advanced driver assistance systems fuels the growth of Mexico’s ADAS market.

Continental AG manufactures and supplies automotive parts, such as brake systems, tires, vehicle electronics, rubber & plastic-based products, chassis & safety parts, actuators, powertrain products, and interior products to vehicle manufacturers, assemblers, and suppliers. It markets its products under brands such as Phoenix, ATE, Barum, Benecke-Kaliko, Mabor, Euzkadi, ContiTech, VDO, General Tire, Paguag, Matador, Uniroyal, and Continental. The company operates across Latin America, Asia, Europe, and North America. Continental AG continues to take various strategic initiatives to make new acquisitions to expand its business and enhance its capabilities.

1. LATIN

AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. INTRODUCTION

TO ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

2.2. MARKET

DEFINITION

2.3. KEY

INSIGHTS

2.4. PORTER'S

FIVE FORCES ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. VENDOR

SCORECARD

2.7. INDUSTRY

PLAYER POSITIONING

2.8. MARKET

DRIVERS

2.8.1. RISING

VEHICULAR PRODUCTION ACROSS THE WORLD

2.8.2. GROWING

NUMBER OF AUTOMOBILES THEFTS

2.8.3. INCREASED

ADOPTION OF SAFETY STANDARDS IN NEW VEHICLES DUE TO ROAD ACCIDENTS

2.8.4. INCREASING

AWARENESS OF ADAS SYSTEMS

2.8.5. STRINGENT

CRASH TEST REGULATIONS BY NUMEROUS GOVERNMENTS

2.9. MARKET

RESTRAINTS

2.9.1. TECHNOLOGICAL

LIMITATIONS

2.9.2. HIGH

COST OF THE ADAS SYSTEMS

2.10.

MARKET OPPORTUNITIES

2.10.1. INCREASED

ADOPTION OF ADAS IN LOW-COST CARS

2.10.2. GROWING

CONCERNS ABOUT PASSENGER SAFETY

2.11.

MARKET CHALLENGES

2.11.1. DEPENDENCY

ON HUMANS

2.11.2. INTENSE

COMPETITION

3. LATIN

AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET OUTLOOK – BY VEHICLE

TYPE (IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME: MILLION UNITS)

3.1. PASSENGER

CARS

3.2. LIGHT

COMMERCIAL VEHICLES

3.3. HEAVY

COMMERCIAL VEHICLES

4. LATIN

AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET OUTLOOK – BY COMPONENTS

(IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME: MILLION UNITS)

4.1. PROCESSOR

4.2. SENSORS

4.2.1. IMAGE

4.2.2. ULTRASONIC

4.2.3. LASER

4.2.4. RADAR

4.2.5. INFRARED

4.2.6. LIDAR

4.3. SOFTWARE

4.4. OTHER

COMPONENTS

5.

LATIN AMERICA ADVANCED

DRIVER ASSISTANCE SYSTEM (ADAS) MARKET OUTLOOK – BY LEVEL OF AUTOMATION (IN

TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME: MILLION UNITS)

5.1. LEVEL

1 (ADVANCED DRIVING ASSIST SYSTEMS-ADAS)

5.2. LEVEL

2 (PARTIAL AUTOMATION)

5.3. LEVEL

3 (CONDITIONAL AUTOMATION)

5.4. LEVEL

4 (HIGH AUTOMATION)

5.5. LEVEL

5 (FULL AUTOMATION)

6. LATIN

AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET OUTLOOK – BY SOLUTIONS

(IN TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME: MILLION UNITS)

6.1. PARKING

ASSISTANCE SYSTEM

6.2. TIRE

PRESSURE MONITORING SYSTEM

6.3. ADAPTIVE

FRONT LIGHTING SYSTEMS

6.4. LANE

DEPARTURE WARNING SYSTEMS

6.5. COLLISION

WARNING SYSTEMS

6.6. BLIND

SPOT DETECTION

6.7. ELECTRONIC

STABILITY CONTROL

6.8. ADAPTIVE

CRUISE CONTROL

6.9. ADVANCED

EMERGENCY BRAKING SYSTEM

6.10.

TRAFFIC SIGN RECOGNITION

SYSTEMS

6.11.

DRIVER DROWSINESS DETECTION

6.12.

OTHER SOLUTIONS

7. LATIN

AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET – REGIONAL OUTLOOK (IN

TERMS OF VALUE: $ MILLION & IN TERMS OF VOLUME: MILLION UNITS)

7.1. BRAZIL

7.2. MEXICO

7.3. REST

OF LATIN AMERICA

8. COMPETITIVE

LANDSCAPE

8.1. AISIN

SEIKI CO., LTD.

8.2. APTIV

(DELPHI AUTOMOTIVE PLC)

8.3. AUTOLIV,

INC.

8.4. CONTINENTAL

AG

8.5. DENSO

CORPORATION

8.6. HELLA

KGAA HUECK & CO.

8.7. HYUNDAI

MOBIS

8.8. INFINEON

TECHNOLOGIES AG

8.9. MAGNA

INTERNATIONAL, INC.

8.10.

MOBILEYE N.V.

8.11.

NXP SEMICONDUCTOR

8.12.

PANASONIC CORPORATION

8.13.

RENESAS ELECTRONICS

CORPORATION

8.14.

ROBERT BOSCH GMBH

8.15.

SAMVARDHANA MOTHERSON (SMR)

8.16.

TAKATA

8.17.

TEXAS INSTRUMENTS

8.18.

VALEO S.A.

8.19.

WABCO HOLDINGS, INC.

8.20.

ZF TRW

9. METHODOLOGY

& SCOPE

9.1. RESEARCH

SCOPE

9.2. SOURCES

OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1: MARKET ATTRACTIVENESS

MATRIX

TABLE 2: VENDOR SCORECARD

TABLE 3: COMPARISON BETWEEN

LIDAR, CAMERA AND RADAR IN AUTOMOTIVE APPLICATIONS

TABLE 4: AN OVERVIEW OF

ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

TABLE 5: DEFINITIONS &

CLASSIFICATION OF AUTOMATED DRIVING LEVELS

TABLE 6: DEVELOPMENTS IN

PARKING ASSISTANCE SYSTEM

TABLE 7: DEVELOPMENTS IN LANE

DEPARTURE WARNING SYSTEM

TABLE 8: DEVELOPMENTS IN

COLLISION WARNING SYSTEM

TABLE 9: DEVELOPMENTS IN

ELECTRONIC STABILITY CONTROL

TABLE 10: DEVELOPMENTS IN

ADAPTIVE CRUISE CONTROL

TABLE 11: COMPANY WISE NOMENCLATURE

OF DIFFERENT DRIVER DROWSINESS ALERT SYSTEMS

TABLE 12: COMPARATIVE ANALYSIS

OF LIDAR WITH OTHER SENSOR TECHNOLOGIES USED IN AUTOMOTIVE APPLICATIONS

TABLE 13: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, COUNTRY OUTLOOK, 2019-2027 (IN

$ MILLION)

TABLE 14: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, COUNTRY OUTLOOK, 2019-2027 (IN

MILLION UNITS)

TABLE 15: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY VEHICLE TYPE, 2019-2027 (IN

$ MILLION)

TABLE 16: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY VEHICLE TYPE, 2019-2027 (IN

MILLION UNITS)

TABLE 17: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COMPONENTS, 2019-2027 (IN $

MILLION)

TABLE 18: LATIN AMERICA ADVANCED

DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COMPONENTS, 2019-2027 (IN MILLION

UNITS)

TABLE 19: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SENSOR, 2019-2027 (IN $

MILLION)

TABLE 20: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SENSOR, 2019-2027 (IN

MILLION UNITS)

TABLE 21: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL OF AUTOMATION,

2019-2027 (IN $ MILLION)

TABLE 22: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL OF AUTOMATION,

2019-2027 (IN MILLION UNITS)

TABLE 23: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SOLUTIONS, 2019-2027 (IN $

MILLION)

TABLE 24: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SOLUTIONS, 2019-2027 (IN

MILLION UNITS)

FIGURE 1: PORTER’S FIVE FORCES

ANALYSIS

FIGURE 2: KEY PLAYER

POSITIONING IN 2018 (%)

FIGURE 3: WORLDWIDE AUTOMOTIVE

(CARS & COMMERCIAL VEHICLES) PRODUCTION, 2015-2020 (IN MILLION)

FIGURE 4: LIST OF IMPORTANT UN

VEHICLE SAFETY REGULATIONS

FIGURE 5: NEW REGULATIONS AND

NCAP RATINGS FOR ADAS

FIGURE 6: ADAS FEATURES,

ACTUAL PRICE VERSUS CUSTOMER WILLINGNESS TO PAY (IN USD)

FIGURE 7: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY PASSENGER CARS, 2019-2027

(IN $ MILLION)

FIGURE 8: WORLDWIDE SALES OF

PASSENGER CARS, 2005-2016 (IN MILLION UNITS)

FIGURE 9: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LIGHT COMMERCIAL VEHICLES,

2019-2027 (IN $ MILLION)

FIGURE 10: WORLDWIDE SALES OF

COMMERCIAL VEHICLES, 2005-2016 (IN MILLION UNITS)

FIGURE 11: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY HEAVY COMMERCIAL VEHICLES,

2019-2027 (IN $ MILLION)

FIGURE 12: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY PROCESSORS, 2019-2027 (IN $

MILLION)

FIGURE 13: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SENSORS, 2019-2027 (IN $

MILLION)

FIGURE 14: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY IMAGE SENSORS, 2019-2027

(IN $ MILLION)

FIGURE 15: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ULTRASONIC SENSORS,

2019-2027 (IN $ MILLION)

FIGURE 16: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LASER SENSORS, 2019-2027

(IN $ MILLION)

FIGURE 17: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY RADAR SENSORS, 2019-2027

(IN $ MILLION)

FIGURE 18: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY INFRARED SENSORS, 2019-2027

(IN $ MILLION)

FIGURE 19: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LIDAR, 2019-2027 (IN $

MILLION)

FIGURE 20: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SOFTWARE, 2019-2027 (IN $

MILLION)

FIGURE 21: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY OTHER COMPONENTS, 2019-2027

(IN $ MILLION)

FIGURE 22: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 1, 2019-2027 (IN $

MILLION)

FIGURE 23: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 2, 2019-2027 (IN $

MILLION)

FIGURE 24: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 3, 2019-2027 (IN $

MILLION)

FIGURE 25: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 4, 2019-2027 (IN $

MILLION)

FIGURE 26: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 5, 2019-2027 (IN $

MILLION)

FIGURE 27: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY PARKING ASSISTANCE SYSTEM,

2019-2027 (IN $ MILLION)

FIGURE 28: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY TIRE PRESSURE MONITORING

SYSTEM, 2019-2027 (IN $ MILLION)

FIGURE 29: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ADAPTIVE FRONT LIGHTING

SYSTEMS, 2019-2027 (IN $ MILLION)

FIGURE 30: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LANE DEPARTURE WARNING

SYSTEMS, 2019-2027 (IN $ MILLION)

FIGURE 31: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COLLISION WARNING SYSTEMS,

2019-2027 (IN $ MILLION)

FIGURE 32: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY BLIND SPOT DETECTION,

2019-2027 (IN $ MILLION)

FIGURE 33: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ELECTRONIC STABILITY

CONTROL, 2019-2027 (IN $ MILLION)

FIGURE 34: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ADAPTIVE CRUISE CONTROL,

2019-2027 (IN $ MILLION)

FIGURE 35: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ADVANCED EMERGENCY BRAKING

SYSTEM, 2019-2027 (IN $ MILLION)

FIGURE 36: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY TRAFFIC SIGN RECOGNITION

SYSTEMS, 2019-2027 (IN $ MILLION)

FIGURE 37: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY DRIVER DROWSINESS

DETECTION, 2019-2027 (IN $ MILLION)

FIGURE 38: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY OTHER SOLUTIONS, 2019-2027

(IN $ MILLION)

FIGURE 39: LATIN AMERICA

ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, REGIONAL OUTLOOK, 2018 &

2027 (IN %)

FIGURE 40: BRAZIL ADVANCED

DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41: MEXICO ADVANCED

DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2019-2027 (IN $ MILLION)

FIGURE 42: REST OF LATIN

AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2019-2027 (IN $

MILLION)