Market By Demographics, Products, Devices, Services And Geography | Forecast 2019-2027

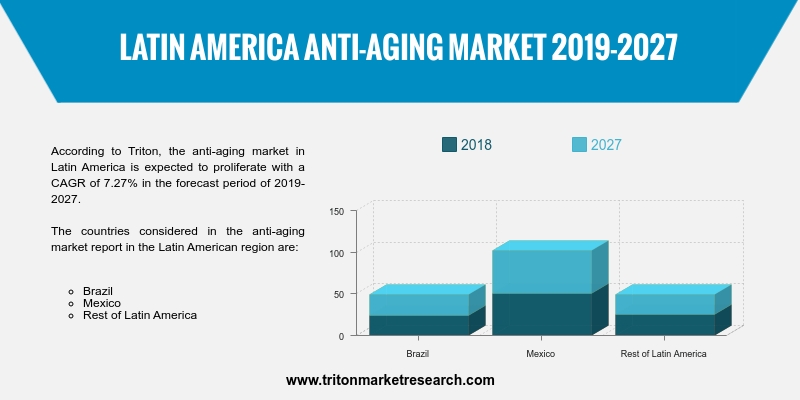

According to Triton, the anti-aging market in Latin America is expected to proliferate with a CAGR of 7.27% in the forecast period of 2019-2027.

The countries considered in the anti-aging market report in the Latin American region are:

• Mexico

• Brazil

• Rest of Latin America

The Latin America anti-aging market is mainly driven owing to the rise in aging population and growing awareness about aging signs, along with the rise in medical tourism. As per the World Bank Group (US), the geriatric population of Mexico was about 5.9% of the total population in 2010 that increased to 6.85% in 2017. Hence, the growing consciousness with the increase in the geriatric population regarding their physical appearance is boosting the demand for anti-aging products, services and devices, thereby driving the market growth in the region.

Healthcare in Mexico is as good as that in the United States and is available at a fraction of cost. The country has a huge market for medical tourism in cosmetic procedures. Since most of the cosmetic surgeries are not covered under insurance in most of the countries, patients coming to Mexico can save up a lot and most of the aged population here uses their pension for their treatment. Also, Mexico has a location advantage over a lot of medical tourist countries, owing to its proximity to the United States. Due to these factors, the Mexican anti-aging products & services market is expected to grow at a decent pace over the forecast period.

Beiersdorf is a personal-care company that manufactures pressure-sensitive adhesives and personal care products. It was acquired by Tchibo Holding AG in 2001. The company has been operating for more than 130 years with its specialities in skincare, FMCG, skin research, cosmetics and marketing. Beiersdorf has established a strong consumer base in various regions including North America, Europe, Asia, Latin America, Africa and Australia. It has some top brands in its product portfolio, including Nivea, Eucerin, La Prairie, Elastoplast, Florena, 8x4, Elastoplast, etc. In addition, the company generated $8.02 billion of revenue in 2017.

1.

LATIN AMERICA ANTI-AGING MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PARENT MARKET ANALYSIS: BEAUTY & PERSONAL

CARE MARKET

2.3. EVOLUTION & TRANSITION OF ANTI-AGING

PRODUCTS, SERVICES & DEVICES

2.4. KEY INSIGHTS

2.4.1. ADVENT OF MULTIFUNCTIONAL PRODUCTS AND UV

ABSORBERS

2.4.2. INCREASING DEMAND FOR ANTI-AGING HAIR CARE

PRODUCTS

2.4.3. HIGH NUMBER OF START-UPS

2.4.4. RISING AWARENESS TOWARDS THE AGING SIGNS

2.5. PORTER’S FIVE FORCE ANALYSIS

2.5.1. BARGAINING POWER OF BUYERS

2.5.2. BARGAINING POWER OF SUPPLIERS

2.5.3. THREAT OF NEW ENTRANTS

2.5.4. THREAT OF SUBSTITUTE

2.5.5. THREAT OF COMPETITIVE RIVALRY

2.6. KEY IMPACT ANALYSIS

2.6.1. BRAND VALUE

2.6.2. PRODUCTS REVIEWS

2.6.3. COST

2.6.4. FORMULATION

2.7. MARKET ATTRACTIVENESS INDEX

2.8. VENDOR SCORECARD

2.9. INDUSTRY COMPONENTS

2.9.1. SUPPLIERS

2.9.2. RESEARCH & DEVELOPMENT

2.9.3. MANUFACTURING/PRODUCTION

2.9.4. DISTRIBUTION & MARKETING

2.9.5. END-USERS

2.10. REGULATORY FRAMEWORK

2.11. MARKET DRIVERS

2.11.1. UPSURGE IN AGING POPULATION

2.11.2. GROWING POPULATION WITH OBESITY

2.11.3. AGGREGATED AWARENESS OF ANTI-AGING PRODUCTS

2.11.4. NOVEL INVENTIONS IN ANTI-AGING TREATMENTS

2.12. MARKET RESTRAINTS

2.12.1. SHIFTING CONSUMER PREFERENCE TOWARDS NATURAL

& ORGANIC PRODUCTS

2.12.2. LOGISTICS CONCERNS

2.12.3. SIDE-EFFECTS OF ANTI-AGING PRODUCTS

2.13. MARKET OPPORTUNITIES

2.13.1. RISING HOUSEHOLD DISPOSABLE INCOME PER CAPITA

2.13.2. ENHANCED MARKETING & PROMOTION TECHNIQUES

2.13.3. RAPID ADOPTION OF HAIR RESTORATION

TECHNOLOGIES

2.14. MARKET CHALLENGES

2.14.1. ADOPTION OF HOME REMEDIES BY MAJOR PORTION OF

CONSUMERS

2.14.2. STRINGENT GOVERNMENT REGULATIONS REGARDING

COSMETICS AND DEVICES

3.

LATIN AMERICA ANTI-AGING MARKET OUTLOOK - BY DEMOGRAPHICS

3.1. BABY BOOMERS

3.2. GENERATION X

3.3. GENERATION Y

4.

LATIN AMERICA ANTI-AGING MARKET OUTLOOK - BY PRODUCTS

4.1. UV ABSORBERS

4.2. ANTI-WRINKLE

4.3. ANTI-STRETCH MARKS

4.4. HAIR COLOR

5.

LATIN AMERICA ANTI-AGING MARKET OUTLOOK - BY DEVICES

5.1. ANTI-CELLULITE TREATMENT DEVICES

5.2. MICRODERM ABRASION DEVICES

5.3. AESTHETIC LASER DEVICES

5.4. RADIOFREQUENCY DEVICES

6.

LATIN AMERICA ANTI-AGING MARKET OUTLOOK - BY SERVICES

6.1. ANTI-PIGMENTATION THERAPY

6.2. ADULT ACNE THERAPY

6.3. BREAST AUGMENTATION

6.4. LIPOSUCTION SERVICES

6.5. ABDOMINOPLASTY

6.6. CHEMICAL PEEL

6.7. EYELID SURGERY

6.8. HAIR RESTORATION

6.9. SCLEROTHERAPY

6.10. OTHER SERVICES

7.

LATIN AMERICA ANTI-AGING MARKET - REGIONAL OUTLOOK

7.1. BRAZIL

7.2. MEXICO

7.3. REST OF LATIN AMERICA

8.

COMPETITIVE LANDSCAPE

8.1. LUMENIS LTD. (ACQUIRED BY XIO)

8.2. SOLTA MEDICAL (VALEANT PHARMACEUTICALS)

8.3. ALMA LASER, INC. (ACQUIRED BY FOSUN PHARMA)

8.4. LUTRONIC CORPORATION

8.5. OLAY (ACQUIRED BY PROCTER & GAMBLE)

8.6. BEIERSDORF (ACQUIRED BY TCHIBO HOLDING AG)

8.7. SYNERON CANDELA

8.8. AVON PRODUCTS, INC.

8.9. COTY, INC.

8.10. PERSONAL MICRODERM

8.11. ALLERGAN PLC

8.12. L’ORÉAL S.A.

8.13. PHOTOMEDEX, INC. (ACQUIRED BY RADIANCY, INC.)

8.14. REVLON

8.15. CYNOSURE (ACQUIRED BY HOLOGIC)

9.

RESEARCH METHODOLOGY & SCOPE

9.1. RESEARCH SCOPE & DELIVERABLES

9.2. SOURCES OF DATA

9.3. RESEARCH METHODOLOGY

TABLE 1: LATIN AMERICA ANTI-AGING MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: EVOLUTION & TRANSITION OF ANTI-AGING PRODUCTS, SERVICES

& DEVICES

TABLE 3: PROMINENT START-UPS IN ANTI-AGING MARKET

TABLE 4: VENDOR SCORECARD

TABLE 5: REGULATORY FRAMEWORK

TABLE 6: PRODUCERS GROWTH IN ANTI-AGING MARKET

TABLE 7: REGION WISE GROWTH IN AGING POPULATION, 2015-2050F

TABLE 8: LATIN AMERICA ANTI-AGING MARKET, BY DEMOGRAPHICS, 2019-2027 (IN

$ MILLION)

TABLE 9: LATIN AMERICA ANTI-AGING MARKET, BY PRODUCTS, DEVICES &

SERVICES, 2019-2027 (IN $ MILLION)

TABLE 10: LATIN AMERICA ANTI-AGING MARKET, BY PRODUCTS, 2019-2027 (IN $

MILLION)

TABLE 11: LATIN AMERICA ANTI-AGING MARKET, BY DEVICES, 2019-2027 (IN $

MILLION)

TABLE 12: LATIN AMERICA ANTI-AGING MARKET, BY SERVICES, 2019-2027 (IN $

MILLION)

TABLE 13: LATIN AMERICA ANTI-AGING MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: KEY BUYING IMPACT ANALYSIS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: WORLDWIDE GERIATRIC POPULATION (AGED 65 YEARS & ABOVE),

2014-2022 (IN MILLION)

FIGURE 5: COUNTRIES WITH MOST OBESE POPULATION (IN %)

FIGURE 6: PATENT APPLICATIONS RECEIVED FOR ANTI-AGING MOISTURIZERS WITH

NATURAL INGREDIENTS

FIGURE 7: HOUSEHOLD DISPOSABLE INCOME PER CAPITA OF OECD COUNTRIES IN

2017 (IN $)

FIGURE 8: LATIN AMERICA ANTI-AGING MARKET, BY BABY BOOMERS, 2019-2027

(IN $ MILLION)

FIGURE 9: LATIN AMERICA ANTI-AGING MARKET, BY GENERATION X, 2019-2027

(IN $ MILLION)

FIGURE 10: LATIN AMERICA ANTI-AGING MARKET, BY GENERATION Y, 2019-2027

(IN $ MILLION)

FIGURE 11: LATIN AMERICA ANTI-AGING MARKET, BY UV ABSORBERS, 2019-2027

(IN $ MILLION)

FIGURE 12: LATIN AMERICA ANTI-AGING MARKET, BY ANTI-WRINKLE, 2019-2027

(IN $ MILLION)

FIGURE 13: LATIN AMERICA ANTI-AGING MARKET, BY ANTI-STRETCH MARKS,

2019-2027 (IN $ MILLION)

FIGURE 14: LATIN AMERICA ANTI-AGING MARKET, BY HAIR COLOR, 2019-2027 (IN

$ MILLION)

FIGURE 15: LATIN AMERICA ANTI-AGING MARKET, BY ANTI-CELLULITE TREATMENT

DEVICES, 2019-2027 (IN $ MILLION)

FIGURE 16: LATIN AMERICA ANTI-AGING MARKET, BY MICRODERM ABRASION

DEVICES, 2019-2027 (IN $ MILLION)

FIGURE 17: LATIN AMERICA ANTI-AGING MARKET, BY AESTHETIC LASER DEVICES,

2019-2027 (IN $ MILLION)

FIGURE 18: LATIN AMERICA ANTI-AGING MARKET, BY RADIOFREQUENCY DEVICES,

2019-2027 (IN $ MILLION)

FIGURE 19: LATIN AMERICA ANTI-AGING MARKET, BY ANTI-PIGMENTATION

THERAPY, 2019-2027 (IN $ MILLION)

FIGURE 20: LATIN AMERICA ANTI-AGING MARKET, BY ADULT ACNE THERAPY,

2019-2027 (IN $ MILLION)

FIGURE 21: LATIN AMERICA ANTI-AGING MARKET, BY BREAST AUGMENTATION,

2019-2027 (IN $ MILLION)

FIGURE 22: LATIN AMERICA ANTI-AGING MARKET, BY LIPOSUCTION SERVICES,

2019-2027 (IN $ MILLION)

FIGURE 23: LATIN AMERICA ANTI-AGING MARKET, BY ABDOMINOPLASTY, 2019-2027

(IN $ MILLION)

FIGURE 24: LATIN AMERICA ANTI-AGING MARKET, BY CHEMICAL PEEL, 2019-2027

(IN $ MILLION)

FIGURE 25: LATIN AMERICA ANTI-AGING MARKET, BY EYELID SURGERY, 2019-2027

(IN $ MILLION)

FIGURE 26: LATIN AMERICA ANTI-AGING MARKET, BY HAIR RESTORATION,

2019-2027 (IN $ MILLION)

FIGURE 27: LATIN AMERICA ANTI-AGING MARKET, BY SCLEROTHERAPY, 2019-2027

(IN $ MILLION)

FIGURE 28: LATIN AMERICA ANTI-AGING MARKET, BY OTHER SERVICES, 2019-2027

(IN $ MILLION)

FIGURE 29: BRAZIL ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: MEXICO ANTI-AGING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: REST OF LATIN AMERICA ANTI-AGING MARKET, 2019-2027 (IN $

MILLION)