Market By Vehicle Type, Application, And Geography | Forecast 2019-2027

According to Triton Market Research, the market for automotive polycarbonate glazing in Latin America is set to proliferate with a CAGR of 6.37% over the forecast period from 2019-2027.

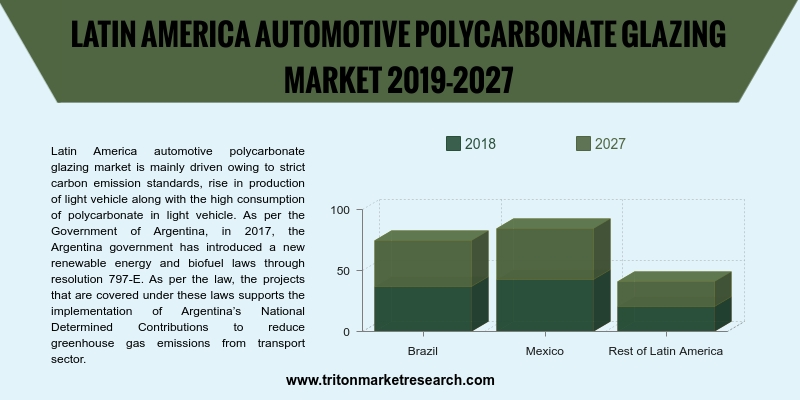

The countries examined in the report on the Latin American market for automotive polycarbonate glazing are:

• Brazil

• Mexico

• Rest of Latin America

Brazil is one of the largest markets for automotives in the world, being one of the few nations to have registered positive growth in the global market. Polycarbonate is one of the most widely used thermoplastic materials used for engineering processes in Brazil today. The sales of passenger vehicles in the country in 2018 accounted for approximately 2 million units, showing an increase of around 14% from 2017. The impact and efficiency of polycarbonate plastics make them beneficial for use in the automotive industry for glazing purposes.

The Brazilian Government, in 2012, launched ‘INNOVAR,’ a program aimed at boosting the production of fuel-efficient vehicles and encouraging international market players to invest in the Brazil market, with measures such as providing tax exemptions for these companies. Though the program expired in the following years, it did manage to bring in more investments, boost vehicle production, and thereby the sales, providing the Brazil market with more options of vehicles and models.

Besides, the Government in the country has also been taking several initiatives to decrease GHG emissions, which includes an increase in the utilization of renewable sources like wind and solar power, increasing the electric energy efficiency, and promoting clean technology in the industrial and transportation sectors. The above-mentioned factors lead to a rise in the demand for automotive polycarbonate glazing, thereby fueling the growth of Brazil’s automotive polycarbonate glazing market.

Established in 1901, Webasto SE specializes in the manufacture and commercialization of polycarbonate roof systems, including sunroofs, panorama roofs, and others. The company’s products are in compliance with various quality certificates, such as ISO 9001, KBA, ISO/TS, IATF 16949, ISO 14001, OHSAS 18001, OHRIS, which strengthen the company’s position in the global market. Webasto has a presence across Latin America, Europe, North America, Africa, Asia, and others. Since the past four years, the company hasn’t undertaken any strategic initiatives, including collaborations, partnerships, mergers & acquisitions, etc., which poses a threat to the company’s growth.

1. LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET – SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.2.1. SIDE

WINDOW IS A RAPIDLY GROWING APPLICATION OF THE AUTOMOTIVE POLYCARBONATE GLAZING

MARKET

2.2.2. PASSENGER

VEHICLE HAS THE MOST PROMINENT SHARE IN THE AUTOMOTIVE POLYCARBONATE GLAZING

MARKET

2.2.3. FRONT

WINDSHIELD IS THE LARGEST APPLICATION

2.3. PORTER’S

FIVE FORCES ANALYSIS

2.3.1. THREAT

OF NEW ENTRANTS

2.3.2. THREAT

OF SUBSTITUTE

2.3.3. BARGAINING

POWER OF SUPPLIERS

2.3.4. BARGAINING

POWER OF BUYERS

2.3.5. INTENSITY

OF COMPETITIVE RIVALRY

2.4. MARKET

ATTRACTIVENESS INDEX

2.5. VENDOR

SCORECARD

2.6. KEY

BUYING CRITERIA

2.7. MARKET

DRIVERS

2.7.1. RISING

POPULARITY OF LIGHTWEIGHT GLAZING

2.7.2. STRICT

CARBON EMISSION RULES & REGULATIONS DUE TO CLIMATE CHANGE

2.7.3. INCREASING

APPLICATION OF SUNROOFS IN CARS

2.8. MARKET

RESTRAINTS

2.8.1. REGULATIONS

RELATED TO THE USE OF POLYCARBONATE FOR WINDSCREENS

2.8.2. INCREASING

COST OF AUTOMOTIVE POLYCARBONATE GLAZING

2.9. MARKET

OPPORTUNITIES

2.9.1. RISING

TREND OF THE ELECTRIC VEHICLE MARKET

2.9.2. ADVANCEMENT

IN AUTOMOTIVE DESIGNS

2.10.

MARKET CHALLENGES

2.10.1.

UNSTABLE POLITICAL AND

TERRITORIAL SITUATION

3. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET OUTLOOK – BY VEHICLE TYPE

3.1. PASSENGER

VEHICLE

3.2. COMMERCIAL

VEHICLE

4. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET OUTLOOK – BY APPLICATION

4.1. SIDE

WINDOW

4.2. FRONT

WINDSHIELD

4.3. SUNROOF

4.4. REAR

WINDSHIELD

4.5. LARGE

WINDSCREEN

4.6. HYDROPHOBIC

GLAZING

4.7. HEAD-UP

DISPLAY

4.8. SWITCHABLE

GLAZING

5. AUTOMOTIVE

POLYCARBONATE GLAZING MARKET – LATIN AMERICA

5.1. BRAZIL

5.2. MEXICO

5.3. REST

OF LATIN AMERICA

6. COMPETITIVE

LANDSCAPE

6.1. CHI MEI CORPORATION

6.2. IDEMITSU KOSAN CO. LTD

6.3. SABIC

6.4. ENGEL AUSTRIA GMBH

6.5. TEIJIN LTD

6.6. WEBASTO SE

6.7. RENIAS CO., LTD.

6.8. SUMITOMO CHEMICAL CO. LTD

6.9. TRINSEO S.A.

6.10. MITSUBISHI CHEMICAL CORPORATION

6.11. COVESTRO AG

6.12. KRD SICHERHEITSTECHNIK GMBH

7. RESEARCH

METHODOLOGY & SCOPE

7.1. RESEARCH

SCOPE & DELIVERABLES

7.1.1. OBJECTIVES

OF STUDY

7.1.2. SCOPE

OF STUDY

7.2. SOURCES

OF DATA

7.2.1. PRIMARY

DATA SOURCES

7.2.2. SECONDARY

DATA SOURCES

7.3. RESEARCH

METHODOLOGY

7.3.1. EVALUATION

OF PROPOSED MARKET

7.3.2. IDENTIFICATION

OF DATA SOURCES

7.3.3. ASSESSMENT

OF MARKET DETERMINANTS

7.3.4. DATA

COLLECTION

7.3.5. DATA

VALIDATION & ANALYSIS

TABLE 1: LATIN AMERICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 2: VENDOR

SCORECARD

TABLE 3: LATIN AMERICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY VEHICLE TYPE, 2019-2027 (IN $

MILLION)

TABLE 4: LATIN AMERICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY APPLICATION, 2019-2027 (IN $

MILLION)

TABLE 5: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: LATIN AMERICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY APPLICATION, 2018 & 2027 (IN %)

FIGURE 2: SIDE WINDOW

MARKET, 2019 - 2027 (IN $ MILLION)

FIGURE 3: PASSENGER

VEHICLE MARKET, 2019 - 2027 (IN $ MILLION)

FIGURE 4: FRONT

WINDSHIELD MARKET, 2019 - 2027 (IN $ MILLION)

FIGURE 5: PORTER’S FIVE

FORCES ANALYSIS

FIGURE 6: MARKET

ATTRACTIVENESS INDEX

FIGURE 7: LATIN AMERICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY PASSENGER VEHICLE, 2019-2027 (IN $

MILLION)

FIGURE 8: LATIN AMERICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY COMMERCIAL VEHICLE, 2019-2027 (IN $

MILLION)

FIGURE 9: LATIN AMERICA

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SIDE WINDOW 2019-2027 (IN $

MILLION)

FIGURE 10: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY FRONT WINDSHIELD, 2019-2027

(IN $ MILLION)

FIGURE 11: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SUNROOF, 2019-2027 (IN $

MILLION)

FIGURE 12: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY REAR WINDSHIELD, 2019-2027

(IN $ MILLION)

FIGURE 13: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY LARGE WINDSCREEN, 2019-2027

(IN $ MILLION)

FIGURE 14: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY HYDROPHOBIC GLAZING,

2019-2027 (IN $ MILLION)

FIGURE 15: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY HEAD-UP DISPLAY, 2019-2027

(IN $ MILLION)

FIGURE 16: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, BY SWITCHABLE GLAZING,

2019-2027 (IN $ MILLION)

FIGURE 17: LATIN

AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, REGIONAL OUTLOOK, 2018 &

2027 (IN %)

FIGURE 18: BRAZIL

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: MEXICO

AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: REST OF

LATIN AMERICA AUTOMOTIVE POLYCARBONATE GLAZING MARKET, 2019-2027 (IN $ MILLION)