Market by Type, Substrate Material, End User and Geography | Forecast 2019-2027

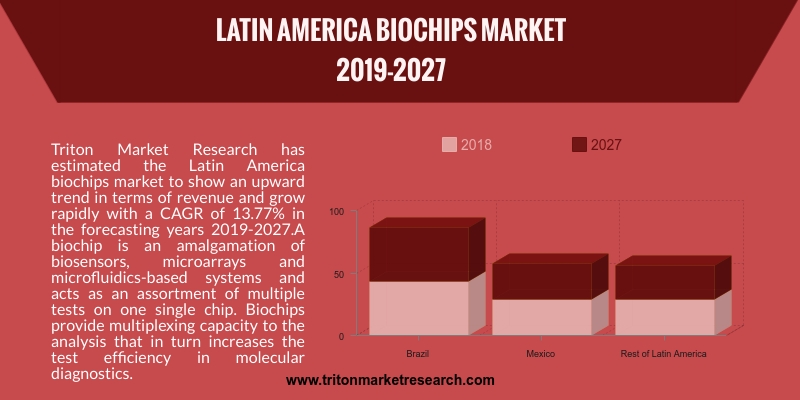

Triton Market Research has estimated the Latin America biochips market to show an upward trend in terms of revenue and grow rapidly with a CAGR of 13.77% in the forecasting years 2019-2027.

A biochip is an amalgamation of biosensors, microarrays and microfluidics-based systems and acts as an assortment of multiple tests on one single chip. Biochips provide multiplexing capacity to the analysis that in turn increases the test efficiency in molecular diagnostics.

The biochips market report includes key information about the key market strategies, regulatory framework, industry components, market opportunity insights, key insights, key impact analysis, Porter’s five force analysis, market definition, vendor scorecard, industry player positioning and the market attractiveness index.

The countries that have been analyzed for the Latin America biochips market are:

O Brazil

O Mexico

O Rest of Latin America

We provide additional customization based on your specific requirements. Request For Customization

The key funding received by biotechnology companies, private sector investments in biotechnology R&D activities and the increasing investments in the pharmaceutical sector for drug discovery are expected to boost the Latin America biochip market growth over the forecast period. The region is now targeting investment in bio-pharma and biotech industries specializing both in human health for the tropics, plant and animal husbandry for tropical agri-business.

Brazil is renowned globally for its research-related activities and investments in industrial biotechnology, particularly with respect to cellulosic sucrose and agriculture-based businesses. The Mexican pharmaceutical industry has constantly been transforming over the last few years, with the entry of international brands into the region. The country is the new cynosure for raising market share owing to the facilities it provides to organizations concerning the creation and protection of new formulae and/or technologies.

Newly-formed biotechnology trade federations in Latin America are increasing their membership base and rapidly gaining recognition on a global scale. In conjunction with the prosperity of commercial biotechnology in the region, arises the need to address a series of issues associated with public perception, regulatory framework and IP protection, financing mechanisms, workforce development among others. Government organizations and related public institutions are posed with the challenge of adjusting their policies and operations to address these changing demands.

1. LATIN

AMERICA BIOCHIPS MARKET - SUMMARY

2. INDUSTRY

OUTLOOK

2.1. MARKET

DEFINITION

2.2. KEY

INSIGHTS

2.3. EVOLUTION

& TRANSITION OF BIOCHIPS

2.4. PORTER'S

FIVE FORCE ANALYSIS

2.5. MARKET

ATTRACTIVENESS MATRIX

2.6. INDUSTRY

COMPONENTS

2.7. REGULATORY

FRAMEWORK

2.8. VENDOR

SCORECARD

2.9. KEY

IMPACT ANALYSIS

2.10.

MARKET OPPORTUNITY INSIGHTS

2.11.

INDUSTRY PLAYER POSITIONING

2.12.

KEY MARKET STRATEGIES

2.13.

MARKET DRIVERS

2.13.1.

GROWTH IN PERSONALIZED

MEDICINES

2.13.2.

RISING INCIDENCES &

TREATMENT OF CANCER

2.13.3.

CONSTANT RISE IN HEALTHCARE

SPENDING WORLDWIDE

2.13.4.

INCREASING NUMBER OF

INVESTMENTS IN BIOTECHNOLOGY R&D

2.14.

MARKET RESTRAINTS

2.14.1.

INEQUALITIES IN HEALTHCARE

ACCESS

2.14.2.

INADEQUATE TECHNICAL AWARENESS

RELATED TO BIOCHIPS

2.14.3.

COMPLEXITY OF BIOLOGICAL

SYSTEMS

2.15.

MARKET OPPORTUNITIES

2.15.1.

DEVELOPMENTS IN BIOCHIPS

TECHNOLOGY

2.15.2.

ASIA PACIFIC TO OFFER

LUCRATIVE GROWTH OPPORTUNITIES

2.15.3.

WIDENING APPLICATION AREAS OF

BIOCHIPS

2.16.

MARKET CHALLENGES

2.16.1.

AVAILABILITY OF SUBSTITUTE

TECHNOLOGIES

2.16.2.

UNCLEAR REGULATORY GUIDELINES

2.16.3.

COST CONSTRAINTS

3. LATIN

AMERICA BIOCHIPS MARKET OUTLOOK – BY TYPE

3.1. DNA

CHIPS

3.1.1. AGRICULTURAL

BIOTECHNOLOGY

3.1.2. CANCER

DIAGNOSTICS & TREATMENT

3.1.3. DRUG

DISCOVERY

3.1.4. GENE

EXPRESSION

3.1.5. GENOMICS

3.1.6. SINGLE

NUCLEOTIDE POLYMORPHISM (SNP) GENOTYPING

3.1.7. OTHER

DNA CHIPS

3.2. LAB

ON A CHIP

3.2.1. CLINICAL

DIAGNOSTICS

3.2.2. DRUG

DISCOVERY

3.2.3. GENOMICS

3.2.4. POINT

OF CARE & IN VITRO DIAGNOSIS

3.2.5. PROTEOMICS

3.2.6. OTHER

LAB ON A CHIP

3.3. PROTEIN

CHIPS

3.3.1. DIAGNOSTICS

3.3.2. DRUG

DISCOVERY

3.3.3. EXPRESSION

PROFILING

3.3.4. HIGH

THROUGHPUT SCREENING

3.3.5. PROTEOMICS

3.3.6. OTHER

PROTEIN CHIPS

3.4. OTHER

CHIPS

3.4.1. CELL

ARRAYS

3.4.2. TISSUE

ARRAYS

4. LATIN

AMERICA BIOCHIPS MARKET OUTLOOK - BY SUBSTRATE MATERIAL

4.1. GLASS

4.2. POLYMERS

4.3. SILICON

4.4. OTHER

SUBSTRATE MATERIALS

5. LATIN

AMERICA BIOCHIPS MARKET OUTLOOK - BY END USER

5.1. BIOTECHNOLOGY

AND PHARMACEUTICAL COMPANIES

5.2. HOSPITALS

AND DIAGNOSTICS CENTERS

5.3. ACADEMIC

AND RESEARCH INSTITUTE

6. LATIN

AMERICA BIOCHIPS MARKET - REGIONAL OUTLOOK

6.1. BRAZIL

6.2. MEXICO

6.3. REST

OF LATIN AMERICA

7. COMPETITIVE

LANDSCAPE

7.1. AGILENT

TECHNOLOGY INC.

7.2. BIOCHAIN

INSTITUTE INC.

7.3. BIOMERIEUX

SA

7.4. BIO-RAD

LABORATORIES INC.

7.5. CEPHEID

INC.

7.6. CYBRDI

INC.

7.7. FLUIDIGM

CORPORATION

7.8. GAMIDA

FOR LIFE GROUP

7.9. ILLUMINA

INC.

7.10.

IMGENEX

7.11.

MERCK GMBH

7.12.

ORIGENE TECHNOLOGIES INC.

7.13.

PERKINELMER INC.

7.14.

SAMSUNG ELECTRONICS INC.

7.15.

THERMO FISHER SCIENTIFIC INC.

8. METHODOLOGY

& SCOPE

8.1. RESEARCH

SCOPE

8.2. SOURCES

OF DATA

8.3. RESEARCH

METHODOLOGY

TABLE 1. MARKET

ATTRACTIVENESS MATRIX FOR BIOCHIPS MARKET

TABLE 2. VENDOR

SCORECARD OF BIOCHIPS MARKET

TABLE 3. REGULATORY

FRAMEWORK OF BIOCHIPS MARKET

TABLE 4. KEY STRATEGIC

DEVELOPMENTS IN BIOCHIPS MARKET

TABLE 5. NOTABLE

INVESTMENTS MADE IN BIOTECHNOLOGY INDUSTRY IN 2017

TABLE 6. LATIN AMERICA

BIOCHIPS MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

TABLE 7. LATIN AMERICA

BIOCHIPS MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 8. LATIN AMERICA BIOCHIPS

MARKET, BY SUBSTRATE MATERIAL, 2019-2027 (IN $ MILLION)

TABLE 9. LATIN AMERICA

BIOCHIPS MARKET, BY END USER, 2019-2027 (IN $ MILLION)

TABLE 10. LATIN AMERICA

BIOCHIPS MARKET, COUNTRY OUTLOOK, 2019-2027 (IN $ MILLION)

FIGURE 1. LATIN AMERICA

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 2. PORTER’S FIVE

FORCE ANALYSIS OF BIOCHIPS MARKET

FIGURE 3. KEY IMPACT

ANALYSIS

FIGURE 4. TIMELINE OF

BIOCHIPS

FIGURE 5. MARKET

OPPORTUNITY INSIGHTS, BY TYPE, 2018

FIGURE 6. MARKET

OPPORTUNITY INSIGHTS, BY END USER, 2018

FIGURE 7. INDUSTRY

COMPONENTS OF BIOCHIPS MARKET

FIGURE 8. KEY PLAYERS

POSITIONING IN 2018 (%)

FIGURE 9. WORLDWIDE

HEALTHCARE SPENDING, BY REGIONS, 2014-2015 (% OF GDP)

FIGURE 10. COMPARISON

OF HEALTHCARE SPENDING PER CAPITA AND OUT OF THE POCKET HEALTH EXPENDITURE

FIGURE 11. LATIN

AMERICA BIOCHIPS MARKET, BY DNA CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 12. LATIN

AMERICA DNA CHIPS MARKET, BY AGRICULTURAL BIOTECHNOLOGY, 2019-2027 (IN $

MILLION)

FIGURE 13. LATIN

AMERICA DNA CHIPS MARKET, BY CANCER DIAGNOSTICS & TREATMENT, 2019-2027 (IN

$ MILLION)

FIGURE 14. LATIN

AMERICA DNA CHIPS MARKET, BY DRUG DISCOVERY, 2019-2027 (IN $ MILLION)

FIGURE 15. LATIN

AMERICA DNA CHIPS MARKET, BY GENE EXPRESSION, 2019-2027 (IN $ MILLION)

FIGURE 16. LATIN

AMERICA DNA CHIPS MARKET, BY GENOMICS, 2019-2027 (IN $ MILLION)

FIGURE 17. LATIN

AMERICA DNA CHIPS MARKET, BY SINGLE NUCLEOTIDE POLYMORPHISM (SNP) GENOTYPING,

2019-2027 (IN $ MILLION)

FIGURE 18. LATIN

AMERICA DNA CHIPS MARKET, BY OTHER CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 19. LATIN

AMERICA BIOCHIPS MARKET, BY LAB ON A CHIP, 2019-2027 (IN $ MILLION)

FIGURE 20. LATIN

AMERICA LAB ON A CHIP MARKET, BY CLINICAL DIAGNOSTICS, 2019-2027 (IN $ MILLION)

FIGURE 21. LATIN

AMERICA LAB ON A CHIP MARKET, BY DRUG DISCOVERY, 2019-2027 (IN $ MILLION)

FIGURE 22. LATIN

AMERICA LAB ON A CHIP MARKET, BY GENOMICS, 2019-2027 (IN $ MILLION)

FIGURE 23. LATIN

AMERICA LAB ON A CHIP MARKET, BY POINT OF CARE & IN VITRO DIAGNOSIS, 2019-2027

(IN $ MILLION)

FIGURE 24. LATIN

AMERICA LAB ON A CHIP MARKET, BY PROTEOMICS, 2019-2027 (IN $ MILLION)

FIGURE 25. LATIN

AMERICA LAB ON A CHIP MARKET, BY OTHER LAB ON A CHIP, 2019-2027 (IN $ MILLION)

FIGURE 26. LATIN

AMERICA BIOCHIPS MARKET, BY PROTEIN CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 27. LATIN

AMERICA PROTEIN CHIPS MARKET, BY DIAGNOSTICS, 2019-2027 (IN $ MILLION)

FIGURE 28. LATIN

AMERICA PROTEIN CHIPS MARKET, BY DRUG DISCOVERY, 2019-2027 (IN $ MILLION)

FIGURE 29. LATIN

AMERICA PROTEIN CHIPS MARKET, BY EXPRESSION PROFILING, 2019-2027 (IN $ MILLION)

FIGURE 30. LATIN

AMERICA PROTEIN CHIPS MARKET, BY HIGH THROUGHPUT SCREENING, 2019-2027 (IN $

MILLION)

FIGURE 31. LATIN

AMERICA PROTEIN CHIPS MARKET, BY PROTEOMICS, 2019-2027 (IN $ MILLION)

FIGURE 32. LATIN

AMERICA PROTEIN CHIPS MARKET, BY OTHER PROTEIN CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 33. LATIN

AMERICA BIOCHIPS MARKET, BY OTHER CHIPS, 2019-2027 (IN $ MILLION)

FIGURE 34. LATIN

AMERICA OTHER BIOCHIPS MARKET, BY CELL ARRAYS, 2019-2027 (IN $ MILLION)

FIGURE 35. LATIN

AMERICA OTHER BIOCHIPS MARKET, BY TISSUE ARRAYS, 2019-2027 (IN $ MILLION)

FIGURE 36. LATIN

AMERICA BIOCHIPS MARKET, BY GLASS, 2019-2027 (IN $ MILLIONS)

FIGURE 37. LATIN

AMERICA BIOCHIPS MARKET, BY POLYMERS, 2019-2027 (IN $ MILLIONS)

FIGURE 38. LATIN

AMERICA BIOCHIPS MARKET, BY SILICON, 2019-2027 (IN $ MILLIONS)

FIGURE 39. LATIN

AMERICA BIOCHIPS MARKET, BY OTHER SUBSTRATE MATERIALS, 2019-2027 (IN $

MILLIONS)

FIGURE 40. LATIN

AMERICA BIOCHIPS MARKET, BY BIOTECHNOLOGY AND PHARMACEUTICAL COMPANIES,

2019-2027 (IN $ MILLIONS)

FIGURE 41. LATIN

AMERICA BIOCHIPS MARKET, BY HOSPITALS AND DIAGNOSTICS CENTERS, 2019-2027 (IN $

MILLIONS)

FIGURE 42. LATIN

AMERICA BIOCHIPS MARKET, BY ACADEMIC AND RESEARCH INSTITUTE, 2019-2027 (IN $

MILLIONS)

FIGURE 43. LATIN

AMERICA BIOCHIPS MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 44. BRAZIL

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 45. MEXICO

BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 46. REST OF

LATIN AMERICA BIOCHIPS MARKET, 2019-2027 (IN $ MILLION)