Market By Type, End-users, Technology And Geography | Forecast 2019-2027

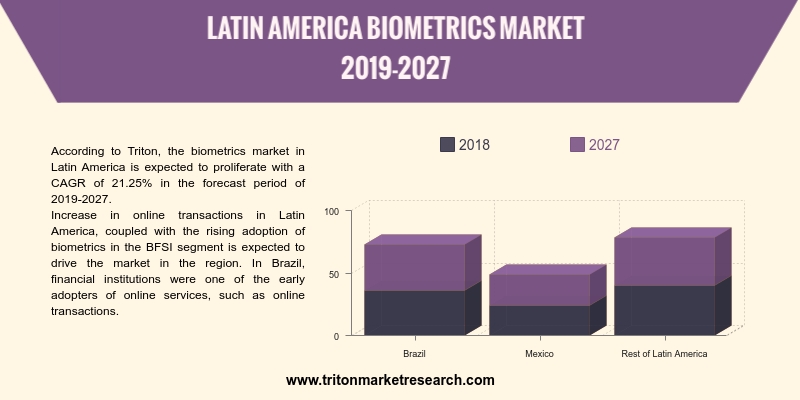

According to Triton, the biometrics market in Latin America is expected to proliferate with a CAGR of 21.25% in the forecast period of 2019-2027.

The countries scrutinized in Latin America’s biometrics market are:

• Brazil

• Mexico

• Rest of Latin America

Increase in online transactions in Latin America, coupled with the rising adoption of biometrics in the BFSI segment is expected to drive the market in the region. In Brazil, financial institutions were one of the early adopters of online services, such as online transactions. Moreover, identity theft and online fraud are major concerns in the country, with annual losses reaching nearly USD 1.21 billion, which is likely to boost the demand for advanced authentication solutions, such as biometrics.

In addition to this, Mexico is the one of the forerunner in the biometrics market as the National Banking and Security Commission (CNBV) of Mexico in August 2017, announced new regulations requiring every bank to integrate fingerprint scanners for the clients over the next twelve months, resulting in positive impact on the market growth in the country, during the forecast period. Besides, SITA has stationed 100 biometric Automated Border Control kiosks at Mexico’s three major airports for supporting the government’s efforts at strengthening border control. The kiosks are expected to process close to eight million arrivals in their first year. Further adoption at other airports is set to augment the biometrics market. Apart from this, HID Global has collaborated with the Government of Argentina to upgrade the country’s ICAO biometric passport. The next-generation passport aims to reduce costs and improve security. Thus, such potential initiatives in other countries in the region are poised to drive the biometrics market.

HID Global Corporation (HID), a subsidiary of ASSA ABLOY Group is engaged in providing secure identity (ID) solutions. The company serves markets including physical & logical access control, such as authentication & credential management; card printing & personalization; visitor management systems; secure government & citizen ID and RFID technologies used in animal ID and industry & logistics applications. It has a diversified geographical presence. The company operates in Latin America, North America, Asia and Europe. As a subsidiary of ASSA ABLOY Group, HID is not obliged to release its financials.

1.

LATIN AMERICA BIOMETRICS MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. COMPONENTS OF A BIOMETRIC ACCESS CONTROL SYSTEM

2.2.1.

INPUT EXTRACTION

2.2.2.

TRANSMISSION & SIGNAL PROCESSING

2.2.3.

QUALITY ASSESSMENT

2.2.4.

DATA STORAGE

2.3. KEY INSIGHTS

2.3.1.

FAVORABLE GOVERNMENT INITIATIVES

2.3.2.

INTRODUCTION OF MULTIMODAL BIOMETRIC TECHNOLOGY

2.3.3.

RAPID ADOPTION BY BANKING & FINANCIAL SERVICE INDUSTRIES

2.4. PORTER’S FIVE FORCE ANALYSIS

2.4.1.

BARGAINING POWER OF BUYERS

2.4.2.

BARGAINING POWER OF SUPPLIERS

2.4.3.

THREAT OF NEW ENTRANTS

2.4.4.

THREAT OF SUBSTITUTE

2.4.5.

THREAT OF COMPETITIVE RIVALRY

2.5. MARKET ATTRACTIVENESS INDEX

2.6. VENDOR SCORECARD

2.7. INDUSTRY COMPONENTS

2.7.1.

CORE TECHNOLOGY

2.7.2.

PHYSICAL COMPONENTS MANUFACTURER

2.7.3.

INTEGRATED BIOMETRIC DEVICES

2.7.4.

MARKETING AND DISTRIBUTION

2.7.5.

END-USERS

2.8. MARKET DRIVERS

2.8.1.

INCREASED SAFETY & SECURITY CONCERNS

2.8.2.

RISE IN IDENTITY THREATS & RELATED COSTS

2.8.3.

IMMENSE PROLIFERATION OF SMARTPHONES & TABLETS WITH BIOMETRIC

CAPABILITIES

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COST OF TECHNOLOGY

2.9.2.

DIFFICULTIES IN INTEGRATING BIOMETRICS INTO EXISTING SOFTWARE

2.10. MARKET OPPORTUNITIES

2.10.1.

THRIVING E-COMMERCE INDUSTRY

2.10.2.

EMERGENCE OF E-PASSPORT

2.11. MARKET CHALLENGES

2.11.1.

TECHNICAL LIMITATIONS ASSOCIATED WITH BIOMETRIC TECHNOLOGY

2.11.2.

DATA SECURITY & PRIVACY ISSUES

3.

LATIN AMERICA BIOMETRICS MARKET Y OUTLOOK – BY TYPE

3.1. FIXED

3.2. MOBILE

4.

LATIN AMERICA BIOMETRICS MARKET OUTLOOK – BY END-USERS

4.1. GOVERNMENT

4.2. TRANSPORTATION

4.3. BFSI

4.4. HEALTHCARE

4.5. IT & TELECOMMUNICATION

4.6. RETAIL

4.7. OTHER END-USERS

5.

LATIN AMERICA BIOMETRICS MARKET OUTLOOK – BY TECHNOLOGY

5.1. FINGERPRINT RECOGNITION

5.2. IRIS RECOGNITION

5.3. FACIAL RECOGNITION

5.4. HAND GEOMETRY

5.5. VEIN ANALYSIS

5.6. VOICE RECOGNITION

5.7. DNA ANALYSIS

5.8. GAIT

5.9. EEG/ECG

5.10. OTHER TECHNOLOGIES

6.

LATIN AMERICA BIOMETRICS MARKET – REGIONAL OUTLOOK

6.1. BRAZIL

6.2. MEXICO

6.3. REST OF LATIN AMERICA

7.

COMPETITIVE LANDSCAPE

7.1. AWARE, INC.

7.2. BIO-KEY INTERNATIONAL, INC.

7.3. CROSSMATCH TECHNOLOGIES, INC.

7.4. FINGERPRINT CARDS AB

7.5. FUJITSU LIMITED

7.6. FULCRUM BIOMETRICS LLC

7.7. GEMALTO N.V.

7.8. HID GLOBAL CORPORATION

7.9. IMAGEWARE SYSTEMS

7.10. IRIS ID SYSTEMS, INC.

7.11. M2SYS TECHNOLOGIES, INC.

7.12. NEC CORPORATION

7.13. NUANCE COMMUNICATIONS, INC.

7.14. IDEMIA FRANCE S.A.S. (SAFRAN IDENTITY &

SECURITY S.A.S.)

7.15. PRECISE BIOMETRICS AB

7.16. SIEMENS AG

8.

RESEARCH METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE & DELIVERABLES

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1: LATIN AMERICA BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

TABLE 2: GOVERNMENT INITIATIVES & POLICIES RELATED TO BIOMETRICS

TABLE 3: VENDOR SCORECARD

TABLE 4: INSTANCES OF IDENTITY THEFTS IN KEY GEOGRAPHIES, 2017

TABLE 5: SOME OF THE PROMISING E-PASSPORT PROJECTS

TABLE 6: LATIN AMERICA BIOMETRICS MARKET, BY TYPE, 2019-2027 (IN $

MILLION)

TABLE 7: LATIN AMERICA BIOMETRICS MARKET, BY END-USERS, 2019-2027 (IN $

MILLION)

TABLE 8: LATIN AMERICA BIOMETRICS MARKET, BY TECHNOLOGY, 2019-2027 (IN $

MILLION)

TABLE 9: LATIN AMERICA BIOMETRICS MARKET, BY COUNTRY, 2019-2027 (IN $

MILLION)

FIGURE 1: BASIC COMPONENTS OF BIOMETRIC AUTHENTICATION SYSTEMS

FIGURE 2: MARKET ATTRACTIVENESS INDEX

FIGURE 3: INDUSTRY COMPONENTS

FIGURE 4: INTERNAL PROCESS FOR IDENTIFICATION BY BIOMETRIC TECHNOLOGY

FIGURE 5: AVERAGE CYBERCRIME COST IN KEY GEOGRAPHIES, AUGUST 2017 (IN $

MILLION)

FIGURE 6: LATIN AMERICA BIOMETRICS MARKET, BY FIXED, 2019-2027 (IN $

MILLION)

FIGURE 7: LATIN AMERICA BIOMETRICS MARKET, BY MOBILE, 2019-2027 (IN $

MILLION)

FIGURE 8: LATIN AMERICA BIOMETRICS MARKET, BY GOVERNMENT, 2019-2027 (IN

$ MILLION)

FIGURE 9: LATIN AMERICA BIOMETRICS MARKET, BY TRANSPORTATION, 2019-2027

(IN $ MILLION)

FIGURE 10: LATIN AMERICA BIOMETRICS MARKET, BY BFSI, 2019-2027 (IN $

MILLION)

FIGURE 11: LATIN AMERICA BIOMETRICS MARKET, BY HEALTHCARE, 2019-2027 (IN

$ MILLION)

FIGURE 12: LATIN AMERICA BIOMETRICS MARKET, BY IT &

TELECOMMUNICATION, 2019-2027 (IN $ MILLION)

FIGURE 13: LATIN AMERICA BIOMETRICS MARKET, BY RETAIL, 2019-2027 (IN $

MILLION)

FIGURE 14: LATIN AMERICA BIOMETRICS MARKET, BY OTHER END-USERS,

2019-2027 (IN $ MILLION)

FIGURE 15: LATIN AMERICA BIOMETRICS MARKET, BY FINGERPRINT RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 16: LATIN AMERICA BIOMETRICS MARKET, BY IRIS RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 17: LATIN AMERICA BIOMETRICS MARKET, BY FACIAL RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 18: LATIN AMERICA BIOMETRICS MARKET, BY HAND GEOMETRY, 2019-2027

(IN $ MILLION)

FIGURE 19: LATIN AMERICA BIOMETRICS MARKET, BY VEIN ANALYSIS, 2019-2027

(IN $ MILLION)

FIGURE 20: LATIN AMERICA BIOMETRICS MARKET, BY VOICE RECOGNITION,

2019-2027 (IN $ MILLION)

FIGURE 21: LATIN AMERICA BIOMETRICS MARKET, BY DNA ANALYSIS, 2019-2027

(IN $ MILLION)

FIGURE 22: LATIN AMERICA BIOMETRICS MARKET, BY GAIT, 2019-2027 (IN $

MILLION)

FIGURE 23: LATIN AMERICA BIOMETRICS MARKET, BY EEG/ECG, 2019-2027 (IN $

MILLION)

FIGURE 24: LATIN AMERICA BIOMETRICS MARKET, BY OTHER TECHNOLOGIES,

2019-2027 (IN $ MILLION)

FIGURE 25: BRAZIL BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: MEXICO BIOMETRICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: REST OF LATIN AMERICA BIOMETRICS MARKET, 2019-2027 (IN $

MILLION)