Market By Blood Type, Application, End-users And Geography | Forecast 2019-2027

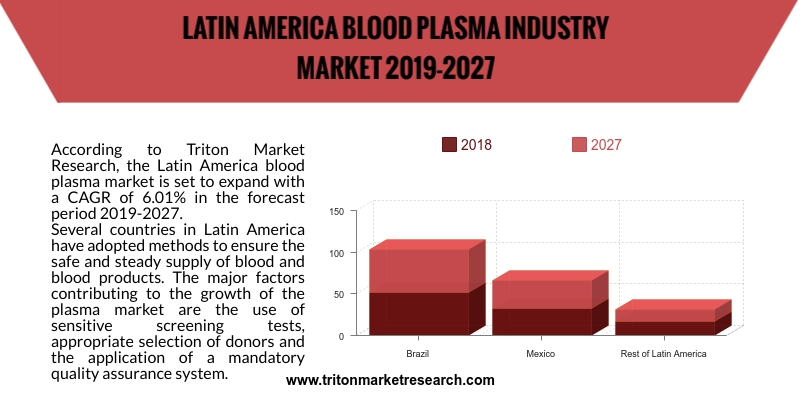

According to Triton Market Research, the Latin America blood plasma market is set to expand with a CAGR of 6.01% in the forecast period 2019-2027.

The countries that have been considered in the report on the blood plasma market in Latin America are:

• Brazil

• Mexico

• Rest of Latin America

Several countries in Latin America have adopted methods to ensure the safe and steady supply of blood and blood products. The major factors contributing to the growth of the plasma market are the use of sensitive screening tests, appropriate selection of donors and the application of a mandatory quality assurance system. Out of 17 countries, 16 are enforcing various laws and regulations to ensure safe blood transfusion. Additionally, the adoption of new technologies associated with blood plasma help in boosting the market growth. For example, Paraguay has recently become the latest country to perform the recycling of blood plasma in Latin America. Paraguay has since stopped wasting tons of plasma each year and instead recycles it for use in the production of medicines.

Blood plasma, which is used in medical therapies for treating life-threatening conditions, can help some donors to earn almost $300 a month. The US FDA regulates the practice of purchase and sale of plasma, which helps in protecting the body from infections and also clots blood for controlling bleeding. However, some expert medical practitioners forewarn donors that they are at risk of losing their own body’s defences if they donate blood so often. Still, blood product companies and blood recipients of these donations out the medicinal benefits of donating blood. Plasma can treat immune deficiencies, hemophilia and other blood disorders. In spite of the benefits represented by Mexico, the country hardly has an altruistic blood donation culture. Although in some of the countries in Europe, such as Switzerland, the rate of blood donation is almost 100%, in Latin American countries, it's just 33%, with only 2.7% in Mexico.

Shire Plc focuses on offering innovative solutions for the treatment of rare genetic, as well as chronic diseases. To achieve this, the company focuses on internal knowledge, research, collaborations with external partners, patients, doctors and advocacy groups. The company produces novel medicines in respective therapeutic areas and offers several therapeutic products in the areas of genetic diseases, hematology, immunology, neuroscience, oncology and ophthalmics.

1.

LATIN AMERICA BLOOD PLASMA MARKET - SUMMARY

2.

INDUSTRY OUTLOOK

2.1. MARKET DEFINITION

2.2. PORTER’S FIVE FORCES OUTLOOK

2.2.1.

THREAT OF NEW ENTRANTS

2.2.2.

THREAT OF SUBSTITUTES

2.2.3.

BARGAINING POWER OF BUYERS

2.2.4.

BARGAINING POWER OF SUPPLIERS

2.2.5.

THREAT OF RIVALRY

2.3. VENDOR SCORECARD

2.4. CLINICAL GUIDELINES

2.5. REGULATION IN THE PLASMA THERAPEUTICS

2.6. KEY INSIGHTS

2.7. MARKET TRENDS

2.8. MARKET DRIVERS

2.8.1.

EXPANSION IN INDICATION FOR NEW THERAPEUTIC AREAS

2.8.2.

APPROVAL OF IMMUNOGLOBULIN-CENTERED THERAPIES

2.8.3.

SURGE IN THE HEMOPHILIA TREATMENT

2.9. MARKET RESTRAINTS

2.9.1.

HIGH COSTS OF BLOOD PLASMA TREATMENTS

2.9.2.

EASY AVAILABILITY OF RECOMBINANT PLASMA

2.10.

MARKET OPPORTUNITIES

2.10.1.

INCREASING PUBLIC COGNIZANCE

2.10.2.

RISE IN THE PLASMA-DERIVED PRODUCTS OPPORTUNITIES

2.10.3.

INCREASING OCCURRENCE OF HEMOPHILIA

2.11.

MARKET CHALLENGES

2.11.1.

SPREAD OF PATHOGENIC CONTAMINANTS

2.11.2.

HIGH REGULATIONS IN THE MARKET

2.12.

BLOOD PLASMA INDUSTRY BY MODE OF DELIVERY

2.12.1.

INFUSION SOLUTIONS

2.12.2.

GELS

2.12.3.

SPRAYS

2.12.4.

BIOMEDICAL SEALANTS

3.

BLOOD PLASMA MARKET OUTLOOK - BY BLOOD TYPE

3.1. ALBUMIN

3.2. IMMUNOGLOBULIN

3.2.1.

INTRAVENOUS IMMUNOGLOBULIN

3.2.2.

SUBCUTANEOUS IMMUNOGLOBULIN

3.2.3.

OTHER IMMUNOGLOBULIN TYPE

3.3. COAGULATION FACTOR CONCENTRATES

3.4. HYPERIMMUNES

3.5. OTHER PLASMA FRACTIONATION PRODUCTS

4.

BLOOD PLASMA MARKET OUTLOOK - BY APPLICATION

4.1. ONCOLOGY

4.2. HEMATOLOGY

4.3. TRANSPLANTATION

4.4. RHEUMATOLOGY

4.5. NEUROLOGY

4.6. IMMUNOLOGY

4.7. PULMONOLOGY

4.8. OTHER APPLICATIONS

5.

BLOOD PLASMA MARKET OUTLOOK - BY END-USER

5.1. ACADEMIC INSTITUTIONS

5.2. RESEARCH LABORATORIES

5.3. HOSPITALS AND CLINICS

6.

BLOOD PLASMA MARKET - REGIONAL OUTLOOK

6.1. COUNTRY ANALYSIS

6.1.1.1.

BRAZIL

6.1.1.2.

MEXICO

6.1.1.3.

REST OF LATIN AMERICA

7.

COMPANY PROFILES

7.1. SHIRE PLC

7.2. ARTHREX

7.3. OCTAPHARMA AG

7.4. BAXTER INTERNATIONAL, INC.

7.5. GRIFOLS INTERNATIONAL S.A.

7.6. BIOTEST AG

7.7. CSL LTD.

7.8. ADMA BIOLOGICS, INC.

7.9. CHINA BIOLOGIC PRODUCTS, INC.

7.10.

GENERAL ELECTRIC CO.

7.11.

CERUS CORP.

8.

METHODOLOGY & SCOPE

8.1. RESEARCH SCOPE

8.2. SOURCES OF DATA

8.3. RESEARCH METHODOLOGY

TABLE 1 LATIN AMERICA BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

TABLE 2 BLOOD PLASMA

COMPONENTS

TABLE 3 LATIN AMERICA BLOOD

PLASMA MARKET BY BLOOD TYPE 2019-2027 ($ MILLION)

TABLE 4 LATIN AMERICA BLOOD

PLASMA MARKET IN IMMUNOGLOBULIN BY TYPES 2019-2027 ($ MILLION)

TABLE 5 PROTEASE INHIBITORS

USED IN THE HIV INFECTION TREATMENT

TABLE 6 LATIN AMERICA BLOOD

PLASMA MARKET BY APPLICATION 2019-2027 ($ MILLION)

TABLE 7 LATIN AMERICA BLOOD

PLASMA MARKET BY END-USER 2019-2027 ($ MILLION)

TABLE 8 LATIN AMERICA BLOOD

PLASMA MARKET BY COUNTRY 2019-2027 ($ MILLION)

FIGURE 1 LATIN AMERICA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)

FIGURE 2 IMMUNOGLOBULIN

INFUSIONS SIDE-EFFECTS

FIGURE 3 ROLE OF FIBRIN

SEALANT IN COAGULATION CASCADE

FIGURE 4 LATIN AMERICA BLOOD

PLASMA MARKET IN ALBUMIN 2019-2027 ($ MILLION)

FIGURE 5 LATIN AMERICA BLOOD

PLASMA MARKET IN IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 6 LATIN AMERICA

IMMUNOGLOBULIN MARKET IN INTRAVENOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 7 LATIN AMERICA

IMMUNOGLOBULIN MARKET IN SUBCUTANEOUS IMMUNOGLOBULIN 2019-2027 ($ MILLION)

FIGURE 8 LATIN AMERICA

IMMUNOGLOBULIN MARKET IN OTHER IMMUNOGLOBULIN TYPE 2019-2027 ($ MILLION)

FIGURE 9 LATIN AMERICA BLOOD

PLASMA MARKET IN COAGULATION FACTOR CONCENTRATES 2019-2027 ($ MILLION)

FIGURE 10 HYPERIMMUNES ISOLATION

PROCESS

FIGURE 11 LATIN AMERICA BLOOD

PLASMA MARKET IN HYPERIMMUNES 2019-2027 ($ MILLION)

FIGURE 12 LATIN AMERICA BLOOD

PLASMA MARKET IN OTHER PLASMA FRACTIONATION PRODUCTS 2019-2027 ($ MILLION)

FIGURE 13 LATIN AMERICA BLOOD

PLASMA MARKET IN ONCOLOGY 2019-2027 ($ MILLION)

FIGURE 14 LATIN AMERICA BLOOD

PLASMA MARKET IN HEMATOLOGY 2019-2027 ($ MILLION)

FIGURE 15 LATIN AMERICA BLOOD

PLASMA MARKET IN TRANSPLANTATION 2019-2027 ($ MILLION)

FIGURE 16 LUPUS INFECTION

SYMPTOMS

FIGURE 17 LATIN AMERICA BLOOD

PLASMA MARKET IN RHEUMATOLOGY 2019-2027 ($ MILLION)

FIGURE 18 LATIN AMERICA BLOOD

PLASMA MARKET IN NEUROLOGY 2019-2027 ($ MILLION)

FIGURE 19 LATIN AMERICA BLOOD

PLASMA MARKET IN PULMONOLOGY 2019-2027 ($ MILLION)

FIGURE 20 LATIN AMERICA BLOOD PLASMA

MARKET IN IMMUNOLOGY 2019-2027 ($ MILLION)

FIGURE 21 LATIN AMERICA BLOOD

PLASMA MARKET IN OTHER APPLICATIONS 2019-2027 ($ MILLION)

FIGURE 22 LATIN AMERICA BLOOD

PLASMA MARKET IN ACADEMIC INSTITUTIONS 2019-2027 ($ MILLION)

FIGURE 23 LATIN AMERICA BLOOD

PLASMA MARKET IN RESEARCH LABORATORIES 2019-2027 ($ MILLION)

FIGURE 24 LATIN AMERICA BLOOD

PLASMA MARKET IN HOSPITALS AND CLINICS 2019-2027 ($ MILLION)

FIGURE 25 BRAZIL BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 26 MEXICO BLOOD PLASMA

MARKET 2019-2027 ($ MILLION)

FIGURE 27 REST OF LATIN AMERICA BLOOD

PLASMA MARKET 2019-2027 ($ MILLION)